In preparation for my appearance at #BattleFest on Saturday, I've written a new article on Why is My Energy Bill So High? A thread 🧵(1/n)

First off, we have the highest industrial electricity prices in the developed world and the second highest domestic prices. Prices like this represent an existential threat to the economy (2/n)

Gas plays a part in setting the wholesale price of electricity, and the cost of gas used in electricity generation in 2024 was about £5.5bn (3/n)

But we add on carbon taxes to the cost of gas-fired electricity in the form of Carbon Price Support and the Emissions Trading Scheme that at today's prices cost about £2bn per year. So, carbon taxes now make up about a third of the wholesale price (4/n)

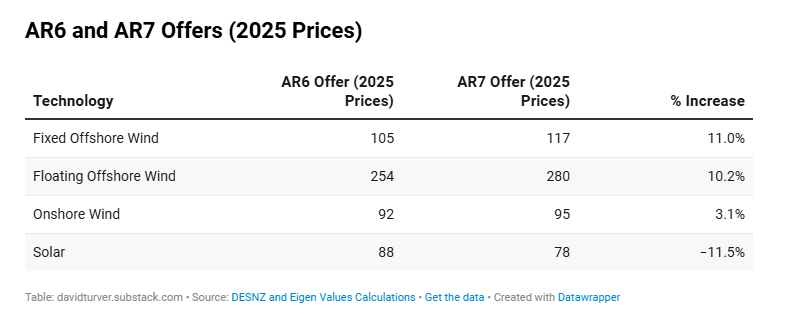

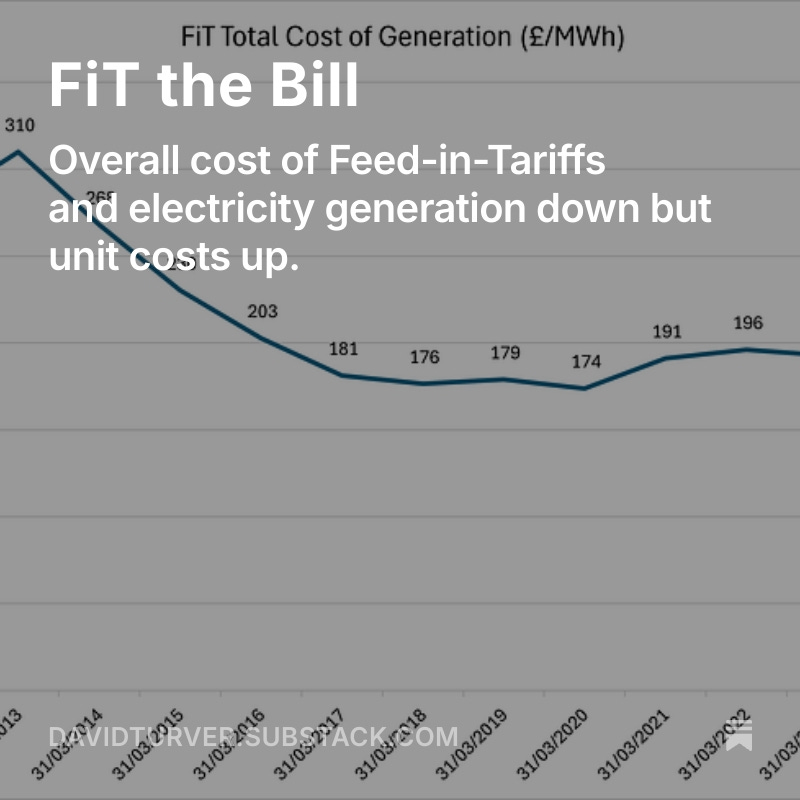

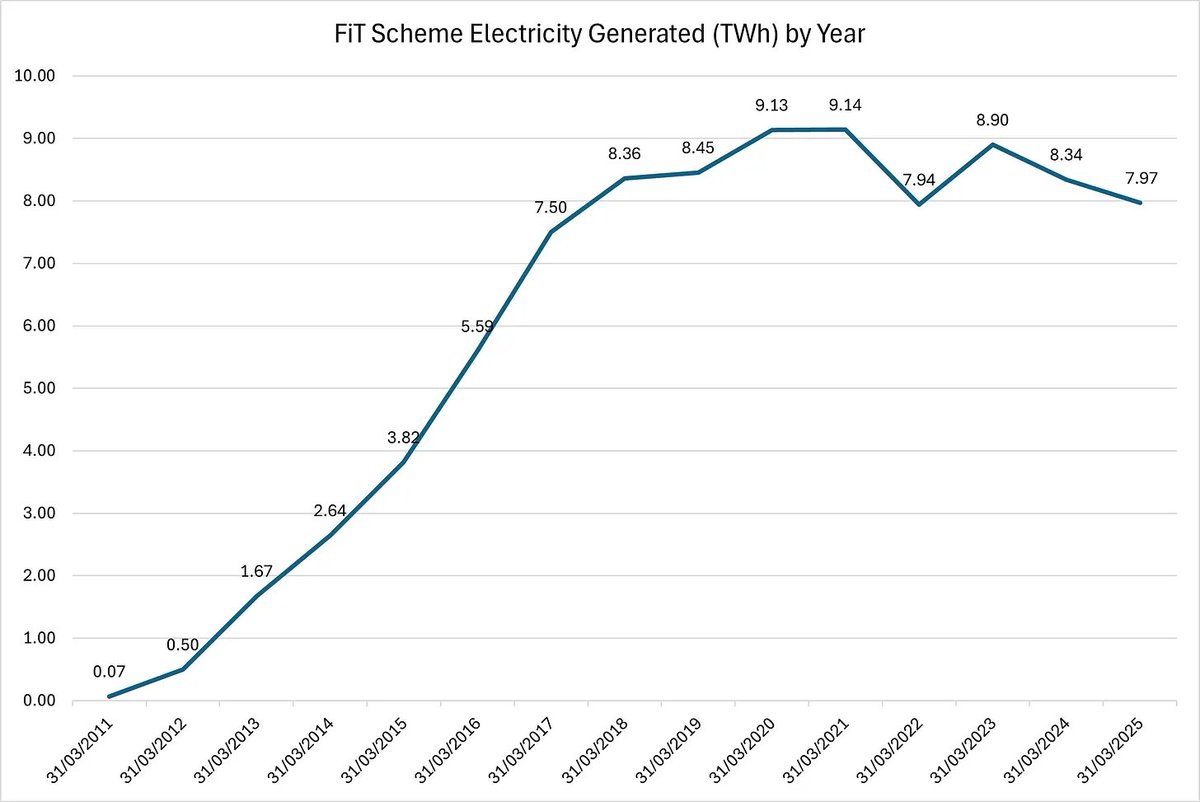

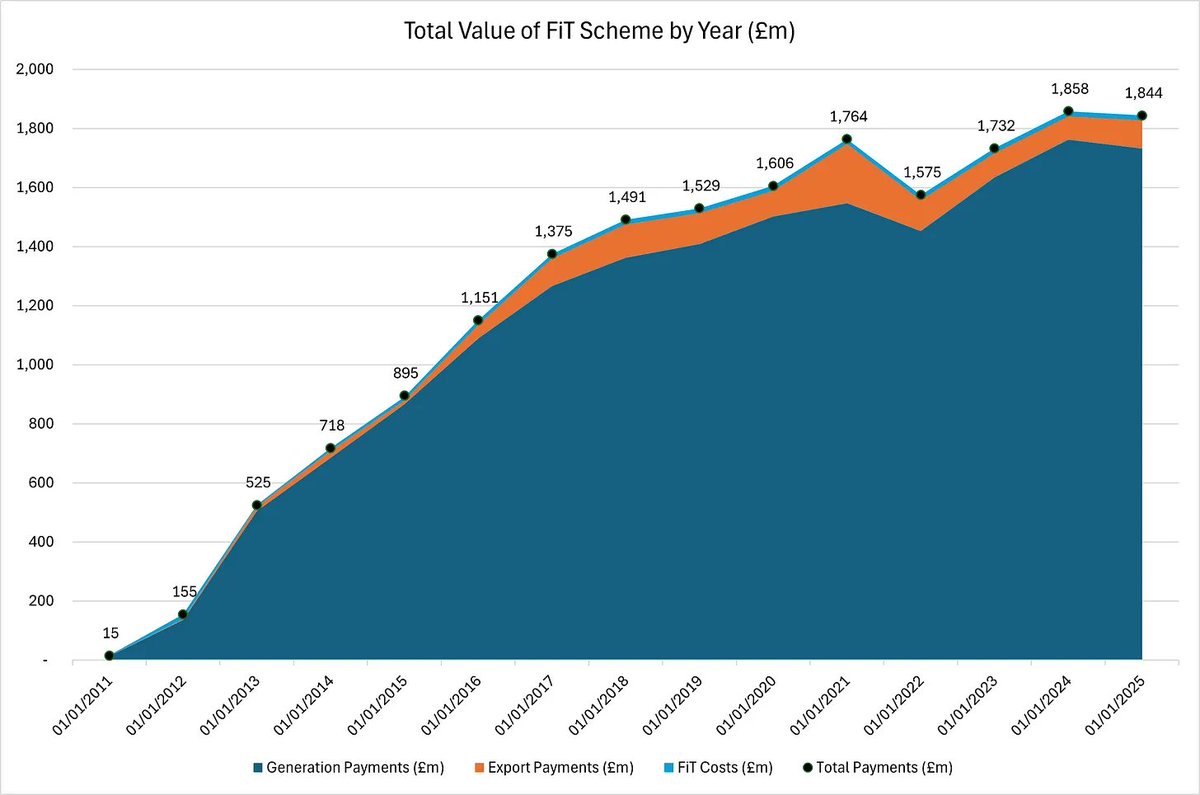

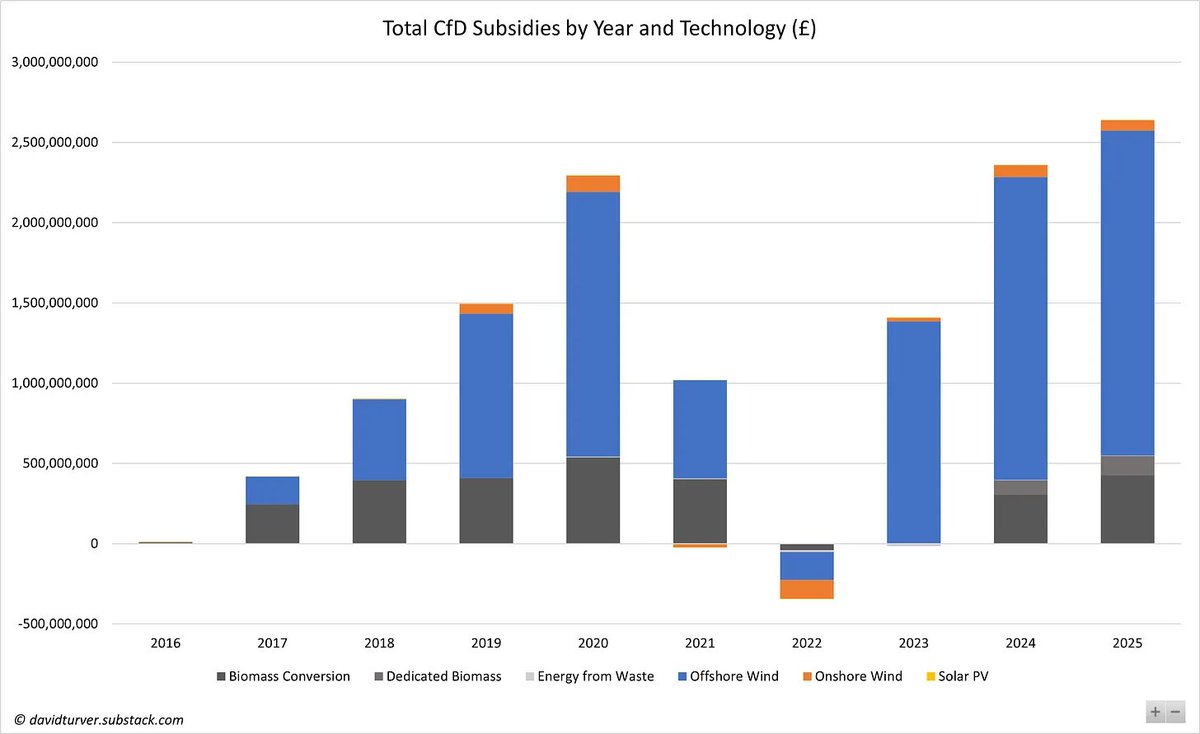

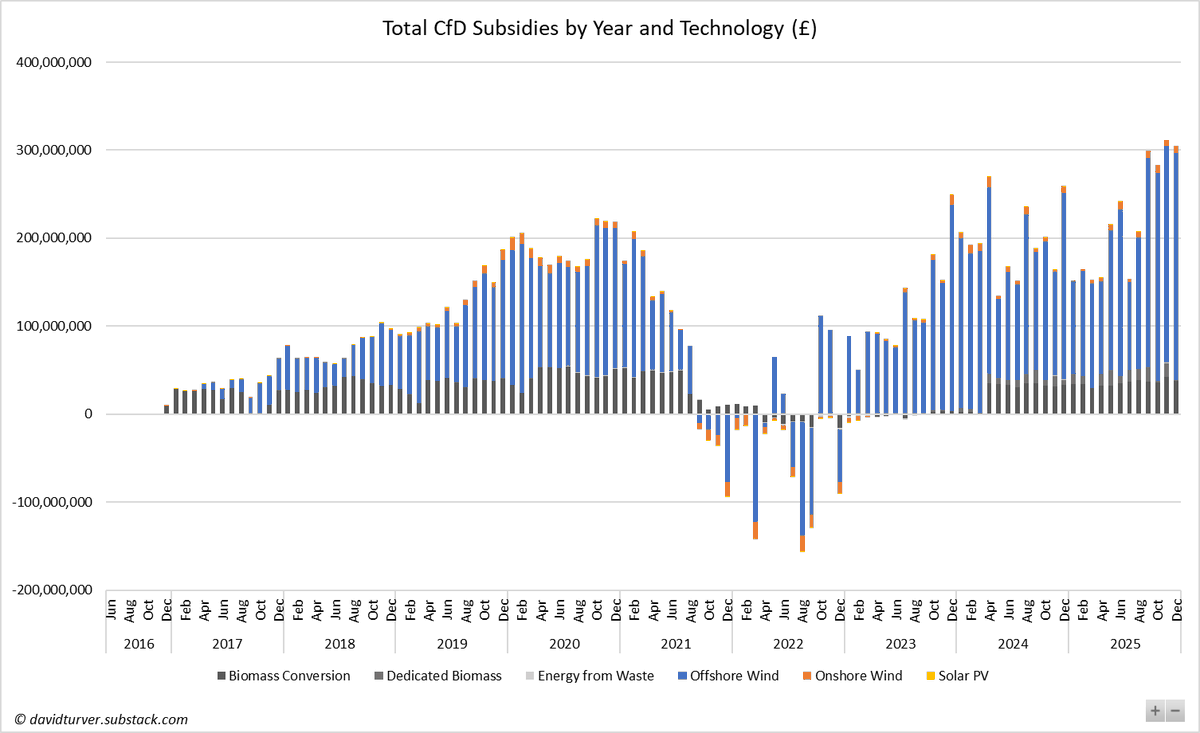

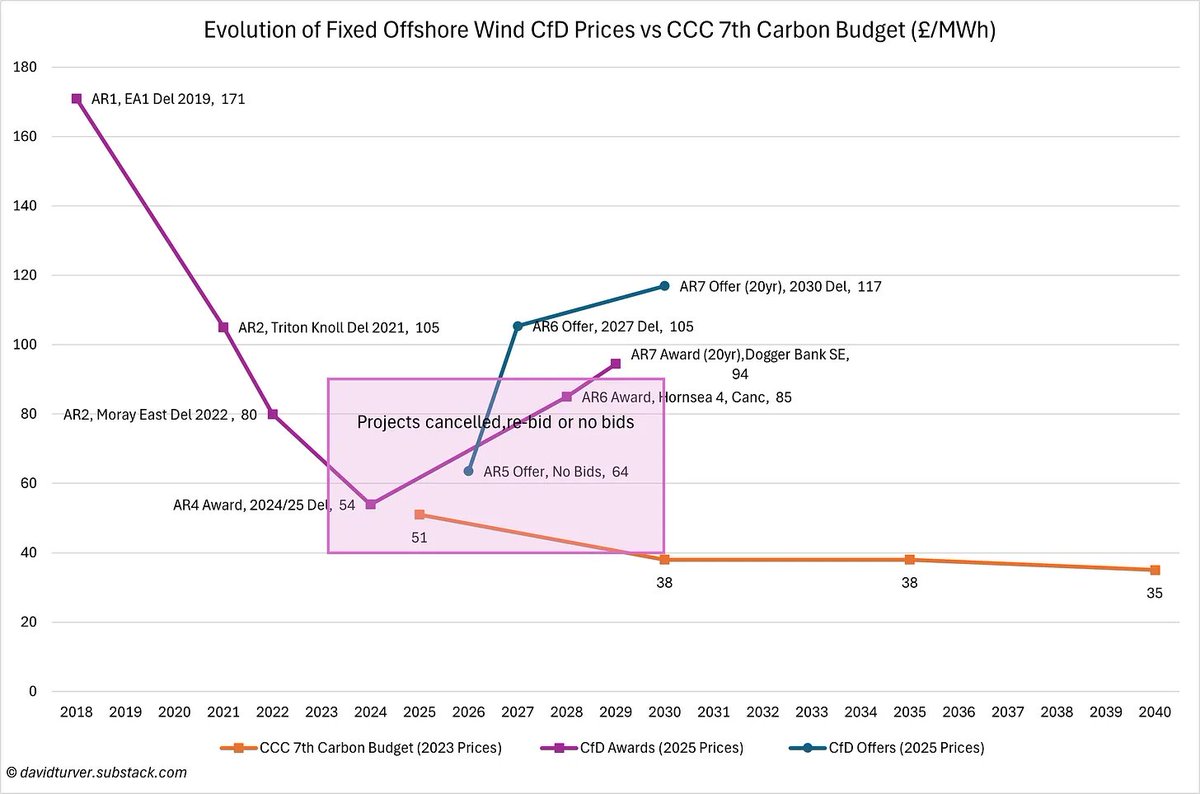

Then there's Renewables Obligations, Feed in Tariffs and Contracts for Difference subsidies that together add a further £12bn to our bills. Renewables subsidies cost >2X the cost of gas for electricity (5/n)

Then there's extra costs of renewables for grid balancing and backup that together add another £4bn to bills and are forecast to cost £10-12bn by 2030. These extra costs are forecast to cost twice as much as gas used for electricity (7/n)

Then to compensate for high prices, there's extra costs on our bills like Warm Homes Discount and Energy Company Obligation (8/n)

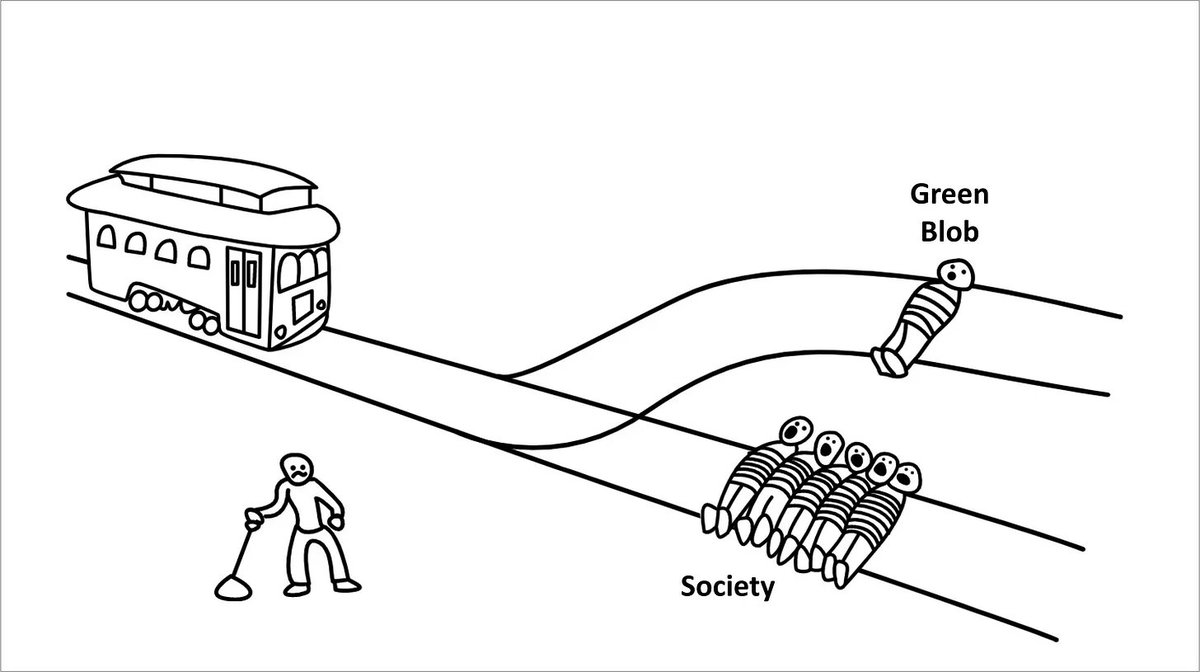

To fix this, we need to recognise that we face a trolley problem. We either save society or the green blob, not both. The green blob must be dismantled to cut energy prices (9/n)

If you enjoyed this thread please like and share. You can sign up for free to read the full article on the link below (10/10).

open.substack.com/pub/davidturve…

open.substack.com/pub/davidturve…

Hi @threadreaderapp unroll please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh