🇨🇳 Both SGE (Shanghai Gold Exchange) and SHFE (Shanghai Futures Exchange) just hit ALL-TIME HIGHS in silver and gold.

Silver closed at ¥11,970/kg ≈ $52.2/oz, higher than COMEX.

➡️ Physical price leads. Paper follows.

Silver closed at ¥11,970/kg ≈ $52.2/oz, higher than COMEX.

➡️ Physical price leads. Paper follows.

https://twitter.com/oriental_ghost/status/1978366046701555980

2️⃣

Daily data confirms it:

China SGE/SFE vaults are draining fast.

32,643 kg silver left in one day.

29,650 kg lost this week.

Physical is leaving the vaults — and not coming back.

Daily data confirms it:

China SGE/SFE vaults are draining fast.

32,643 kg silver left in one day.

29,650 kg lost this week.

Physical is leaving the vaults — and not coming back.

3️⃣

Volume exploded on both exchanges.

This isn’t retail FOMO — it’s industrial and institutional accumulation.

The East is absorbing physical, while the West is still playing with IOUs.

Volume exploded on both exchanges.

This isn’t retail FOMO — it’s industrial and institutional accumulation.

The East is absorbing physical, while the West is still playing with IOUs.

4️⃣

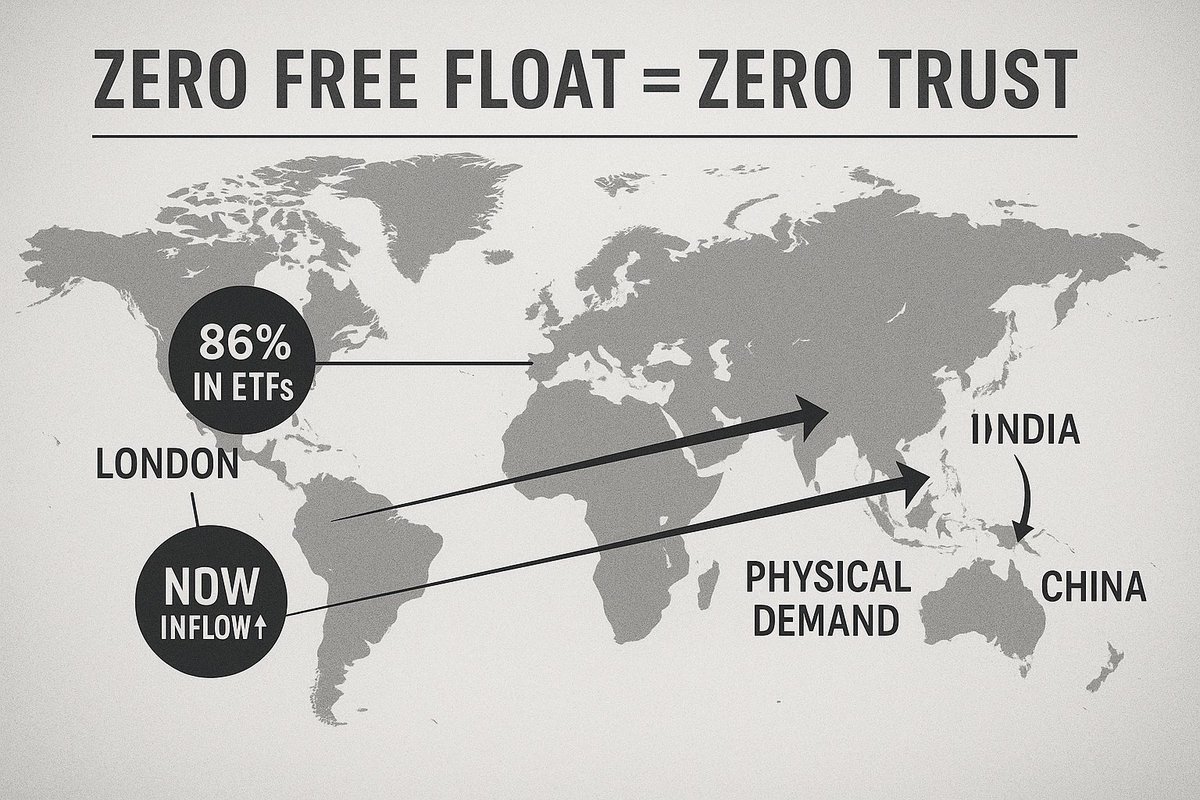

For decades, London and New York dictated the silver price.

Now Shanghai is quietly taking that power.

SGE and SHFE are building the real benchmark — backed by metal, not promises.

For decades, London and New York dictated the silver price.

Now Shanghai is quietly taking that power.

SGE and SHFE are building the real benchmark — backed by metal, not promises.

5️⃣

COMEX trades “silver” on paper.

SGE/SHFE trade silver itself.

That’s the difference.

And right now, the physical world is setting the new price reality.

COMEX trades “silver” on paper.

SGE/SHFE trade silver itself.

That’s the difference.

And right now, the physical world is setting the new price reality.

6️⃣

This isn’t a divergence anymore.

It’s a global decoupling between paper and physical.

And it’s happening in real time.

#SilverSqueeze ⚡ #StackerLogic 💪 #China #Gold #Silver #COMEX #SGE #SHFE

This isn’t a divergence anymore.

It’s a global decoupling between paper and physical.

And it’s happening in real time.

#SilverSqueeze ⚡ #StackerLogic 💪 #China #Gold #Silver #COMEX #SGE #SHFE

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh