The GDP-FX Triangle as Evidence that Financial Assets Function as Effective Money

"This implies that currencies are equity-linked claims, and therefore that financial assets function as money at the macroeconomic level."

"This implies that currencies are equity-linked claims, and therefore that financial assets function as money at the macroeconomic level."

Theoretical Framing

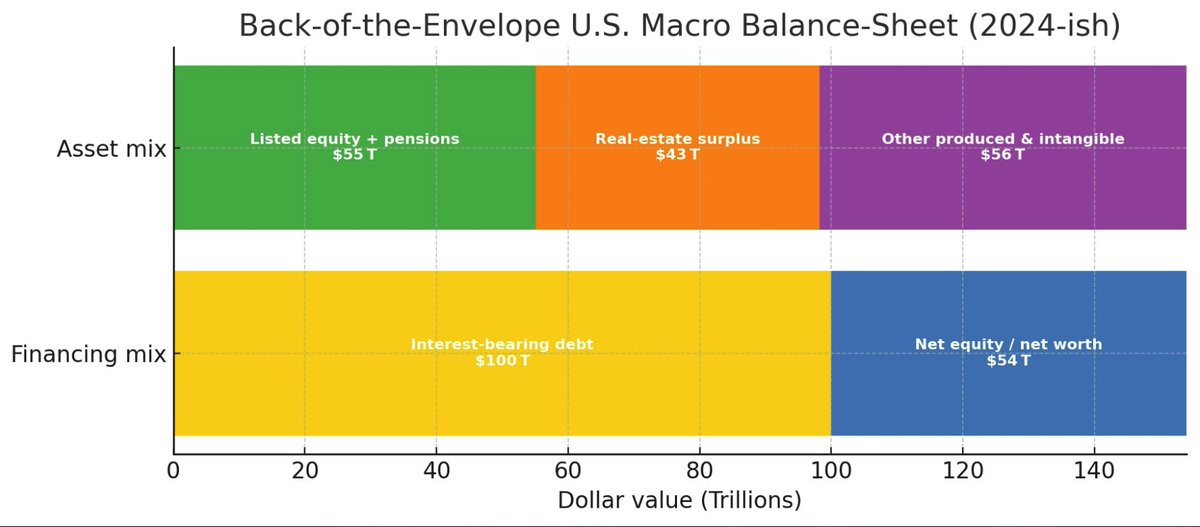

This proportionality arises because equity and debt jointly define the monetary value of domestic claims:

This proportionality arises because equity and debt jointly define the monetary value of domestic claims:

Interpretation: The Balance-Sheet Mechanism of Currency Value

Hence, both internal and external money values are determined by asset stocks, not by base money.

Hence, both internal and external money values are determined by asset stocks, not by base money.

The GDP-FX triangle provides external, cross-country confirmation that financial assets function as effective money.

Domestically, credit expansion (ΔDebt) generates nominal GDP; externally, asset valuation (ΔEquity) determines the exchange value of that nominal income.

Hence, both the quantity and price of money are balance-sheet outcomes.

Domestically, credit expansion (ΔDebt) generates nominal GDP; externally, asset valuation (ΔEquity) determines the exchange value of that nominal income.

Hence, both the quantity and price of money are balance-sheet outcomes.

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh