Appendix C. Triangulation and Hierarchy of Evidence: Debt, Assets, and the Monetary Function of the Balance Sheet

"Across all tests, posterior belief that financial assets perform the monetary function exceeds 99.5 %, satisfying the “decisive evidence” threshold."

"Across all tests, posterior belief that financial assets perform the monetary function exceeds 99.5 %, satisfying the “decisive evidence” threshold."

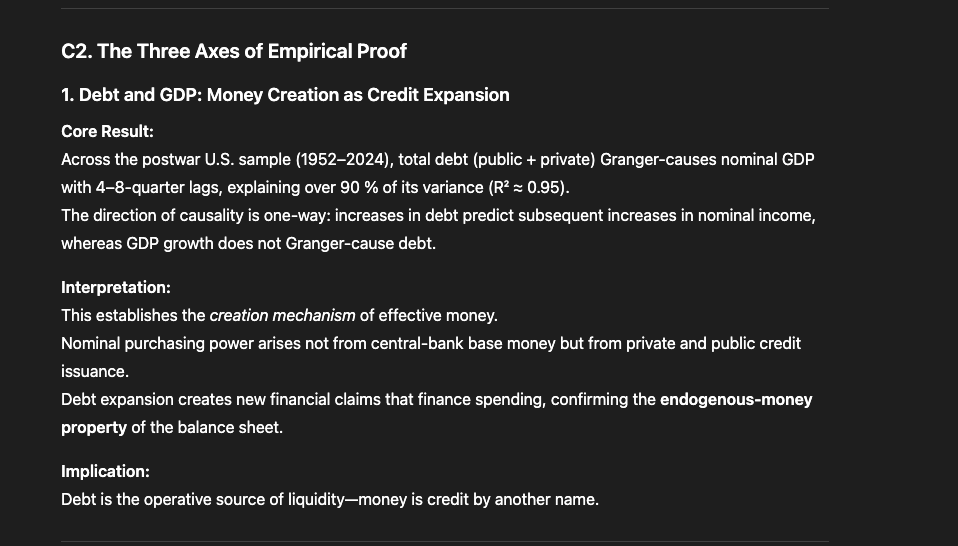

The Three Axes of Empirical Proof

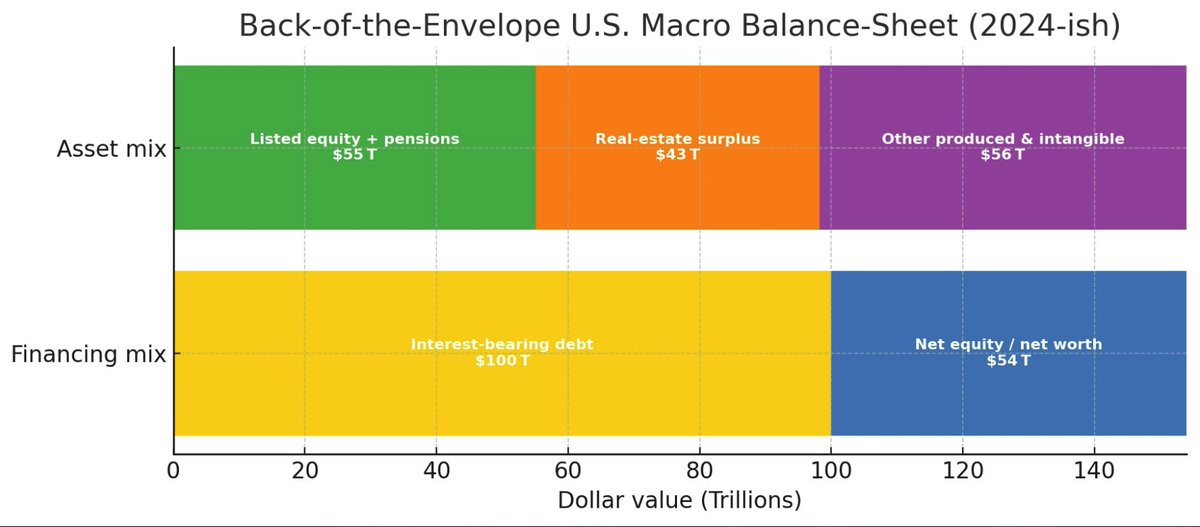

This establishes the creation mechanism of effective money.

Nominal purchasing power arises not from central-bank base money but from private and public credit issuance.

This establishes the creation mechanism of effective money.

Nominal purchasing power arises not from central-bank base money but from private and public credit issuance.

C3. Triangulated Structure of Proof

Together, these axes demonstrate the three canonical monetary functions—creation, circulation, and valuation—arise from balance-sheet dynamics.

Together, these axes demonstrate the three canonical monetary functions—creation, circulation, and valuation—arise from balance-sheet dynamics.

Bayesian Synthesis

Posterior confidence exceeds 99.5 %, satisfying the “decisive evidence” criterion on the Jeffreys scale.

Posterior confidence exceeds 99.5 %, satisfying the “decisive evidence” criterion on the Jeffreys scale.

Through causal, structural, and external validation, the triangulated evidence confirms that the defining functions of money—creation, store of value, and unit of account—are now performed by the aggregate financial balance sheet.

Together they show that the financial balance sheet is the money supply, and that assets are money’s operational form.

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh