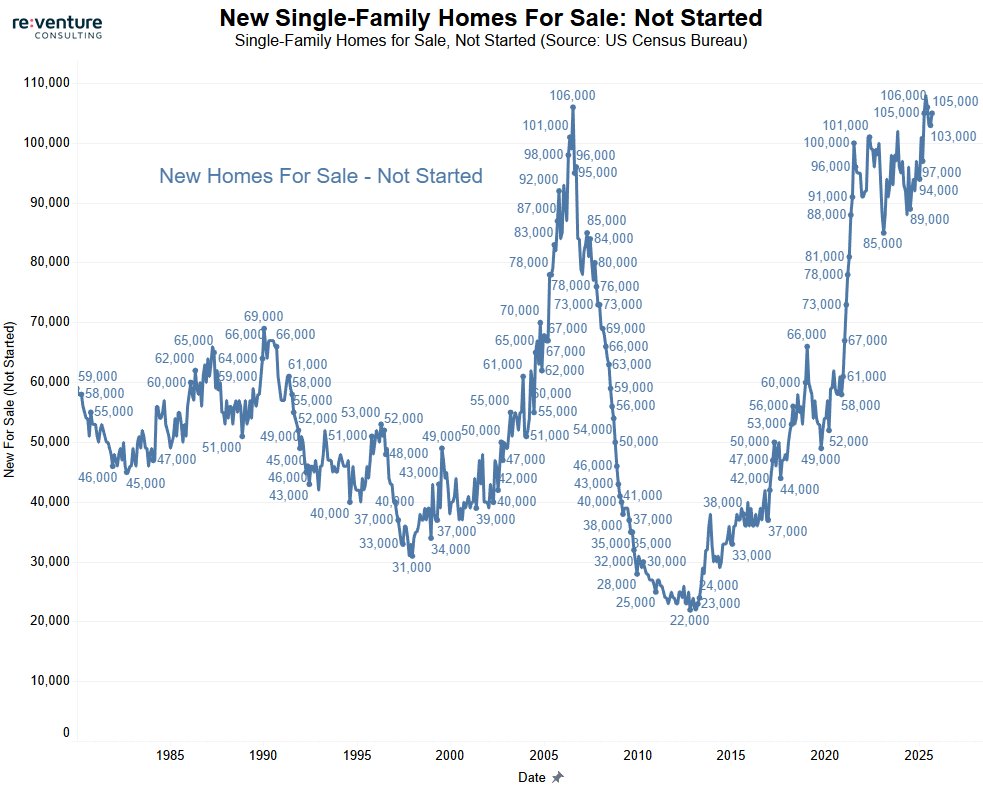

It would be fair to say that builders have a higher-than-normal number of "empty lots they are sitting on".

According to Census Bureau, there are 105,000 homes listed for sale from builders that they haven't started construction on.

There's also 134,000 homes permitted by builders that haven't been started.

Both are near records.

According to Census Bureau, there are 105,000 homes listed for sale from builders that they haven't started construction on.

There's also 134,000 homes permitted by builders that haven't been started.

Both are near records.

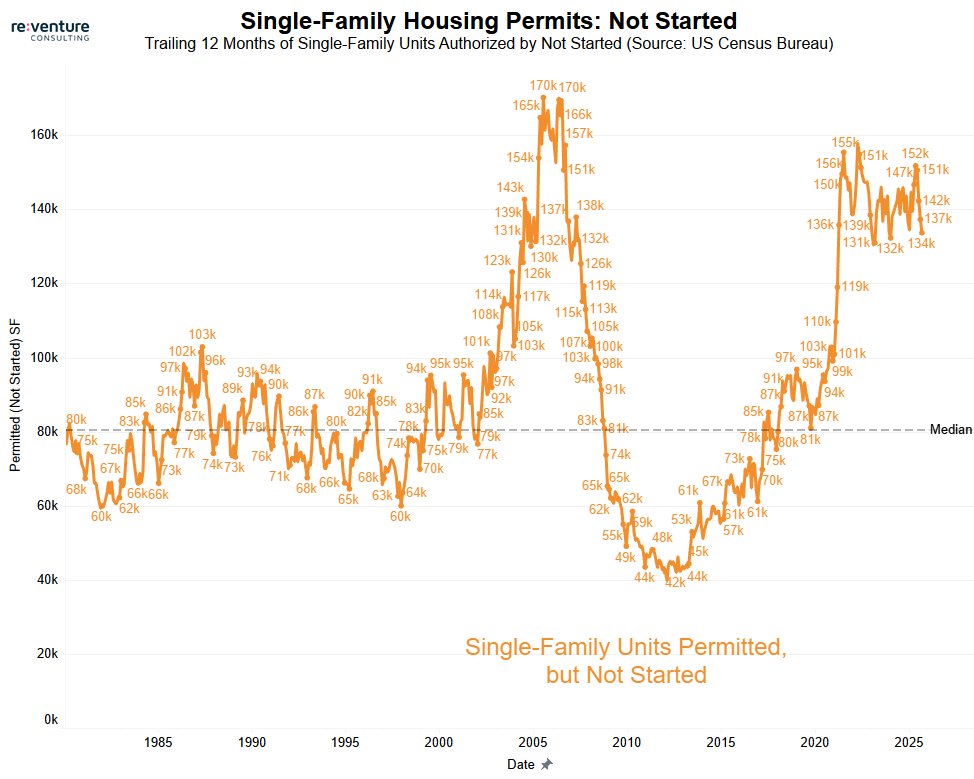

1) The permitted but not yet started metric looks similar.

There's 134,000 single-family units that builders have pulled a permit for, but haven't started.

This is down slightly from the cycle peak and is off from the 2006 high.

But is still about 70% above the long-term average.

There's 134,000 single-family units that builders have pulled a permit for, but haven't started.

This is down slightly from the cycle peak and is off from the 2006 high.

But is still about 70% above the long-term average.

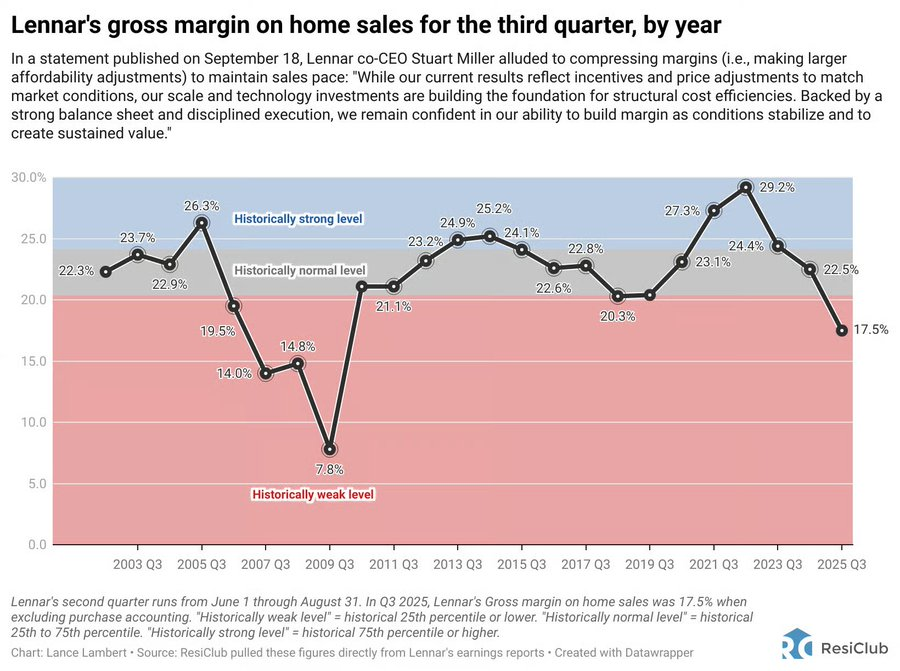

2) But the reason builders are balking at building these homes is because they aren't going to make as much selling them.

According to a graph from @NewsLambert, builder margins are being compressed, particularly Lennar, whose gross margin on selling houses is down to a 16-year low.

According to a graph from @NewsLambert, builder margins are being compressed, particularly Lennar, whose gross margin on selling houses is down to a 16-year low.

• • •

Missing some Tweet in this thread? You can try to

force a refresh