Bernstein On India Power: 5 developments... heading into Q2'26 results

1. TRANSMISSION LINE ADDITION CONTINUES TO DRAG, ALTHOUGH SOME MOMENTUM IN SUBSTATION ADDITION

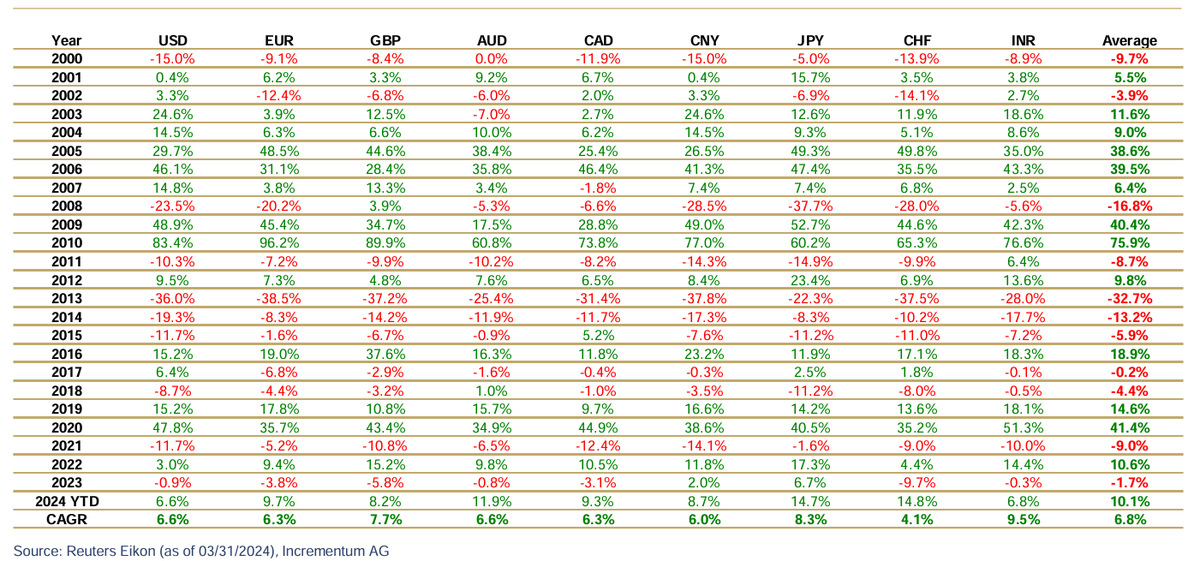

While commissioning has picked up slightly compared to last quarter, against a target of 1,475 ckm by Power Grid in Q2FY26 only 28% got completed. On the substation additions as well, only 70% of the target was achieved. It appears that RoW issues continue to impact transmission commissioning timelines.

Only 28% of the planned transmisison lines were laid out by the central govt during Q2 - one of the lowest in the last few years likely due to RoW issues

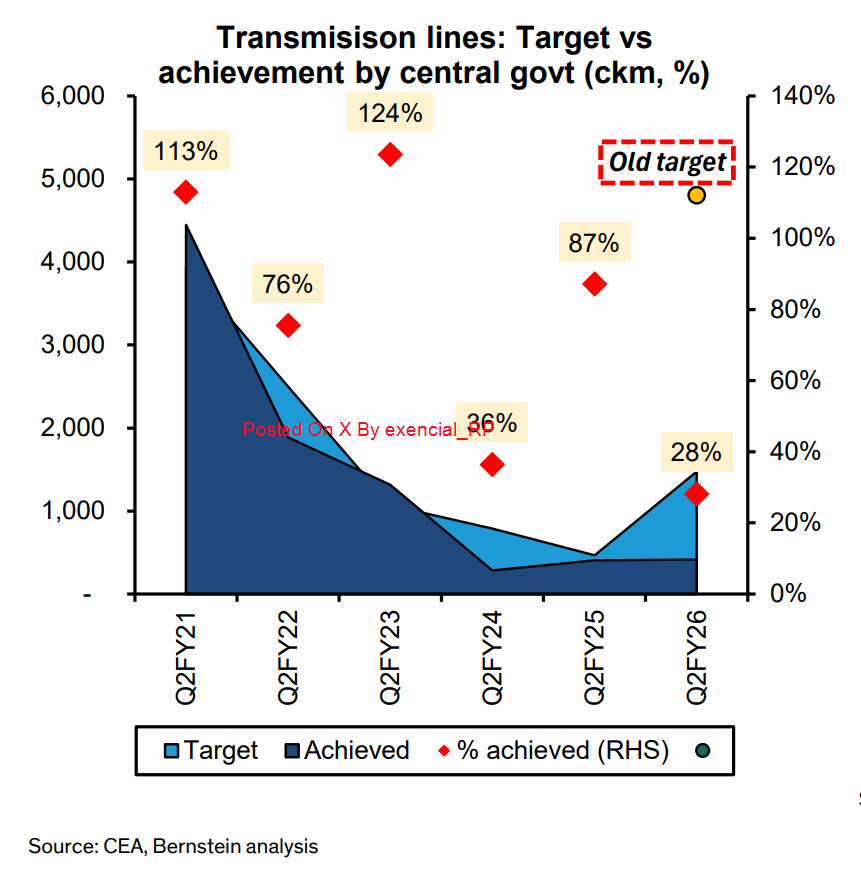

Substation addition improved, though still missing target

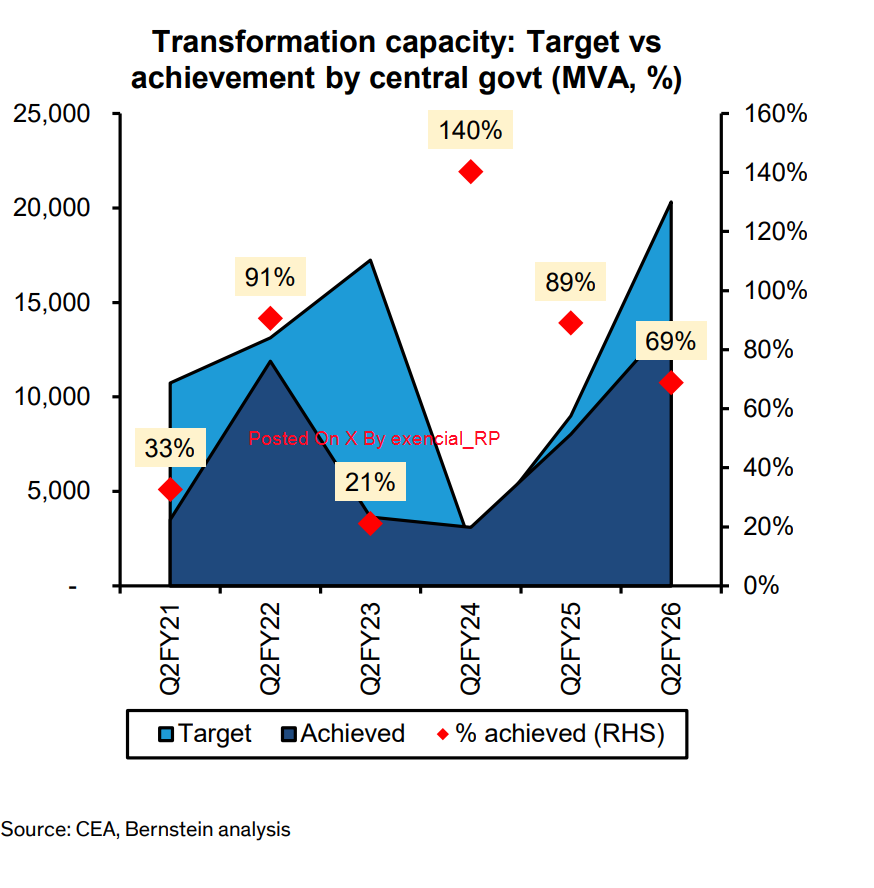

2. TRANSMISSION CAPEX OPTIMIZATION AND RISING ROLE OF BESS

There is no doubt on the long capex story that will be there for transmission in India and globally, however BESS can help optimize the demand (unless India puts in import restrictions).

1. TRANSMISSION LINE ADDITION CONTINUES TO DRAG, ALTHOUGH SOME MOMENTUM IN SUBSTATION ADDITION

While commissioning has picked up slightly compared to last quarter, against a target of 1,475 ckm by Power Grid in Q2FY26 only 28% got completed. On the substation additions as well, only 70% of the target was achieved. It appears that RoW issues continue to impact transmission commissioning timelines.

Only 28% of the planned transmisison lines were laid out by the central govt during Q2 - one of the lowest in the last few years likely due to RoW issues

Substation addition improved, though still missing target

2. TRANSMISSION CAPEX OPTIMIZATION AND RISING ROLE OF BESS

There is no doubt on the long capex story that will be there for transmission in India and globally, however BESS can help optimize the demand (unless India puts in import restrictions).

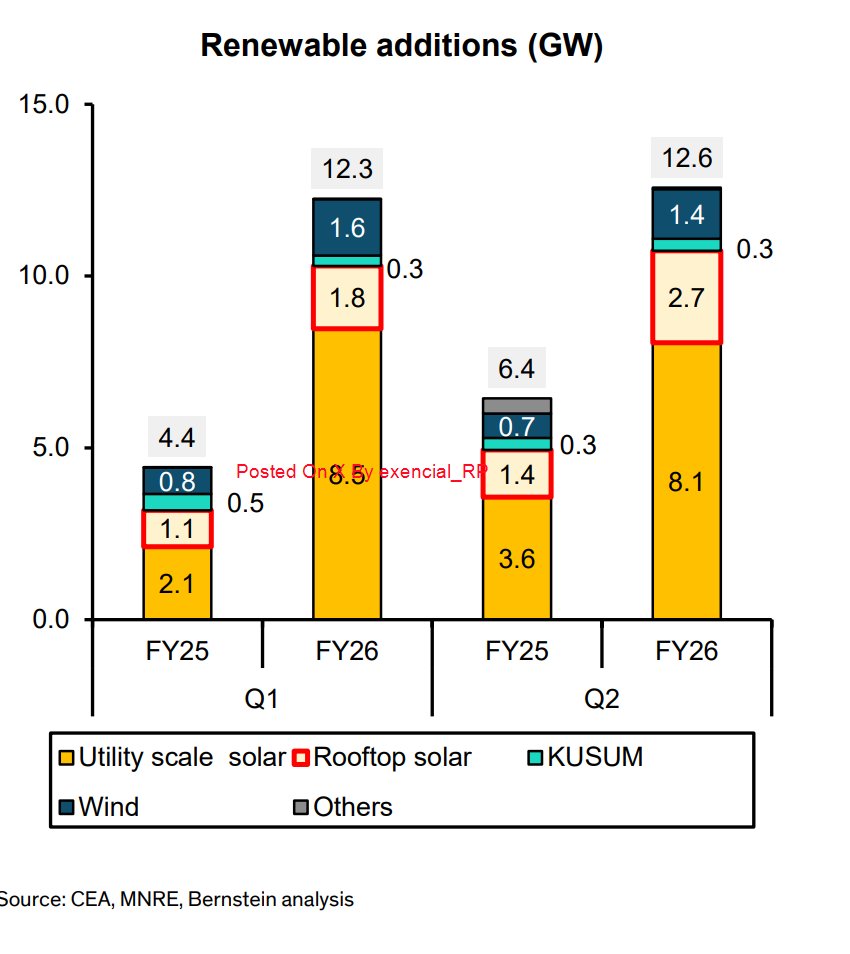

3. RENEWABLE ADDITIONS ON A ROLL, BUT PLFS DISAPPOINT

i) Capacity additions and PLFs

Capacity addition for developers clearly good, but earnings could disappoint given low PLFs, rising curtailment and low prices on solar hours on spot market.

Strong renewable addition in FY26 till now

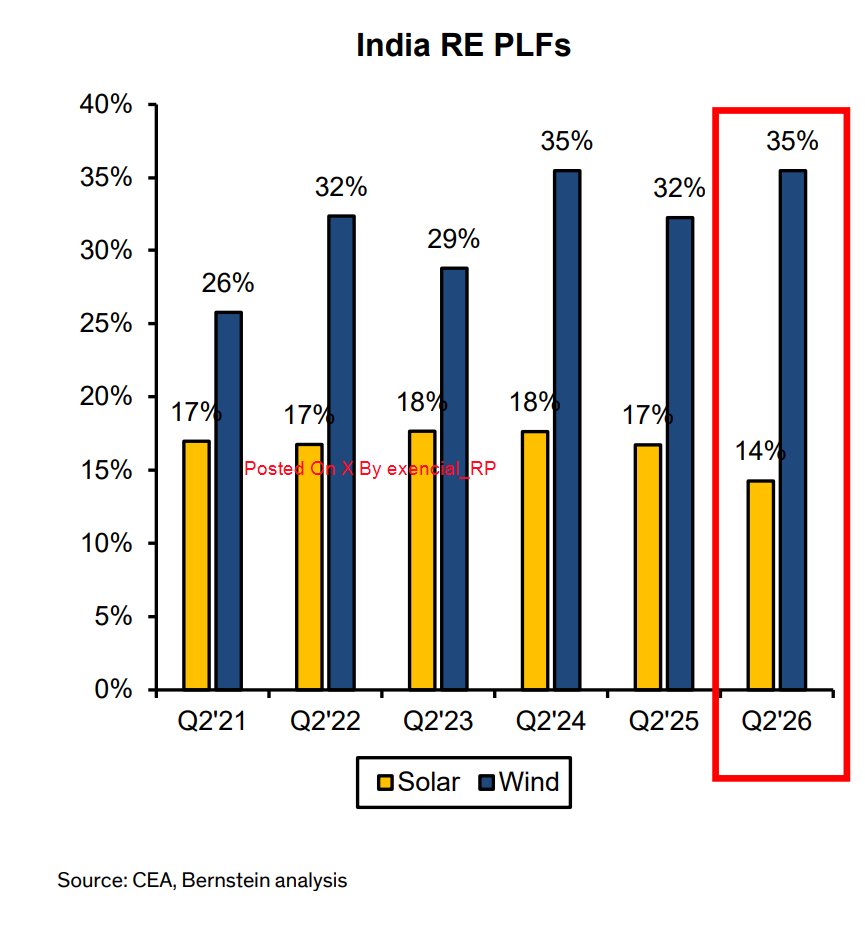

Solar PLF quite soft, wind slightly better in Q2

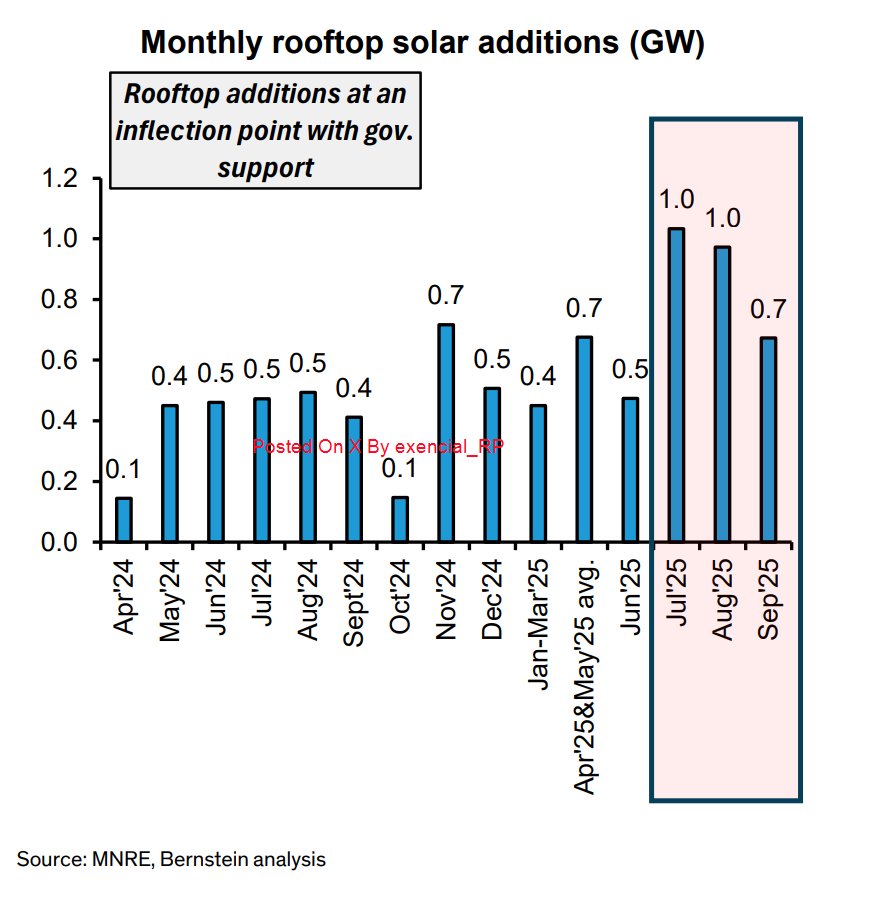

ii) Rooftop solar (RTS) additions and solar PV market

A very strong quarter for most solar PV players, though we would keep an eye out for commentary on prices and exports to US

Monthly rooftop solar capacity additions have almost doubled in the recent months

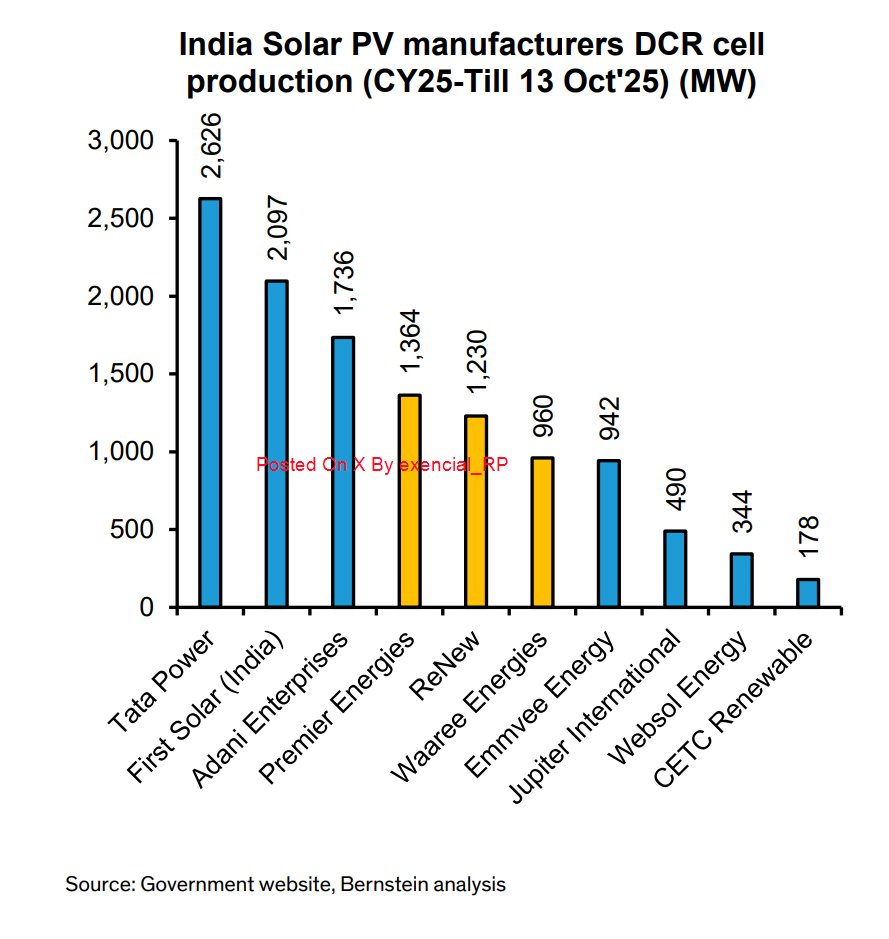

Domestic cell producers to benefit the most from the rooftop solar additions

i) Capacity additions and PLFs

Capacity addition for developers clearly good, but earnings could disappoint given low PLFs, rising curtailment and low prices on solar hours on spot market.

Strong renewable addition in FY26 till now

Solar PLF quite soft, wind slightly better in Q2

ii) Rooftop solar (RTS) additions and solar PV market

A very strong quarter for most solar PV players, though we would keep an eye out for commentary on prices and exports to US

Monthly rooftop solar capacity additions have almost doubled in the recent months

Domestic cell producers to benefit the most from the rooftop solar additions

4. THERMAL PLANT PERFORMANCE

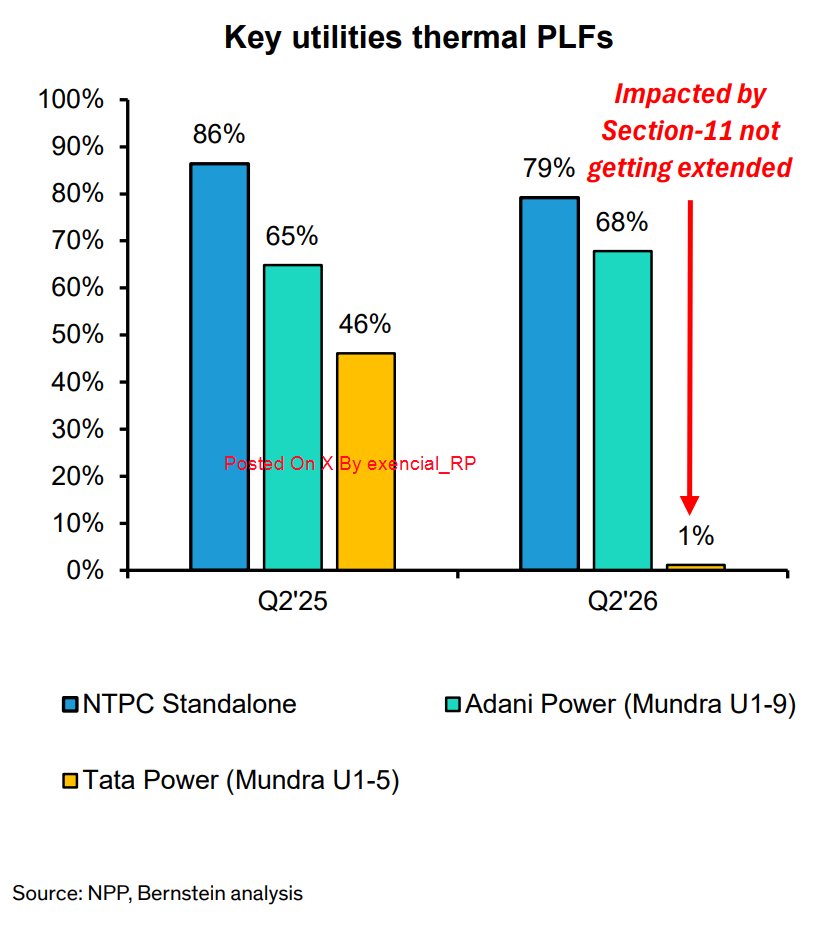

While it shouldn't impact NTPC earnings much other than a bit of incentives given plants are cost+, we should see reasonable impact on other thermal power plant operators this quarter. Even for Adani Ports, this might impact coal imports at Mundra in coming months as well.

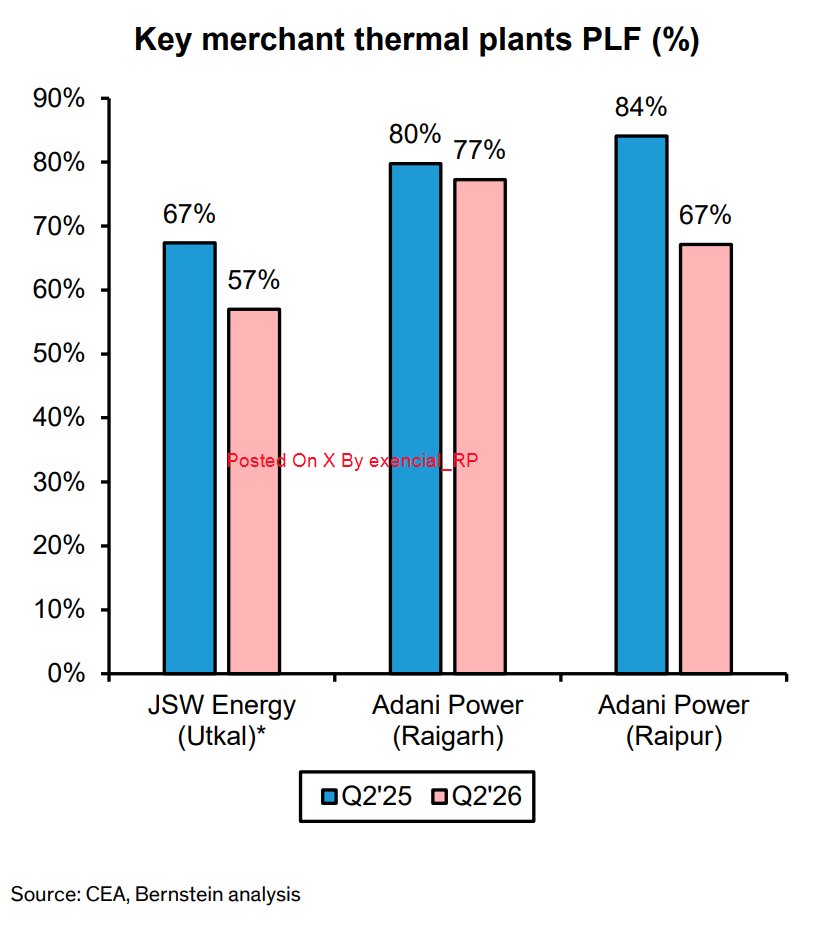

Lower PLFs for select merchant players

Thermal PLF summary

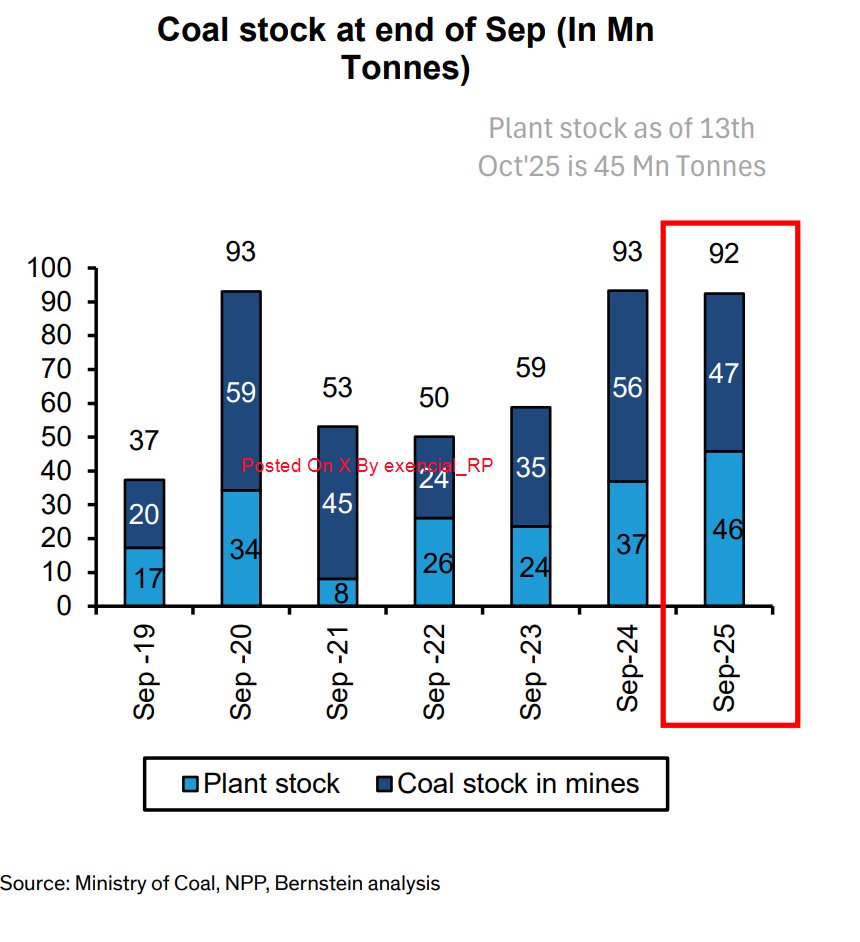

Coal stock levels continue to be healthy

While it shouldn't impact NTPC earnings much other than a bit of incentives given plants are cost+, we should see reasonable impact on other thermal power plant operators this quarter. Even for Adani Ports, this might impact coal imports at Mundra in coming months as well.

Lower PLFs for select merchant players

Thermal PLF summary

Coal stock levels continue to be healthy

5. POWER DEMAND AND MERCHANT PRICES

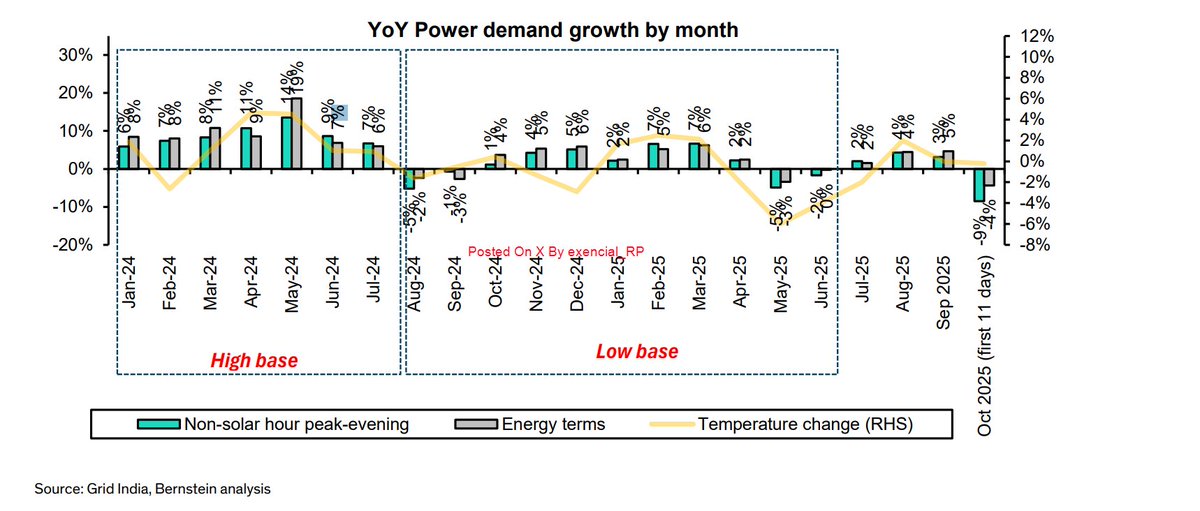

With a small uptick in August and September, power demand growth dipped again in the first 11 days of October. However, going forward, IMD expects colder winters this year due to the effect of La-Nina, which should aid power demand.

Power demand continues to remain soft

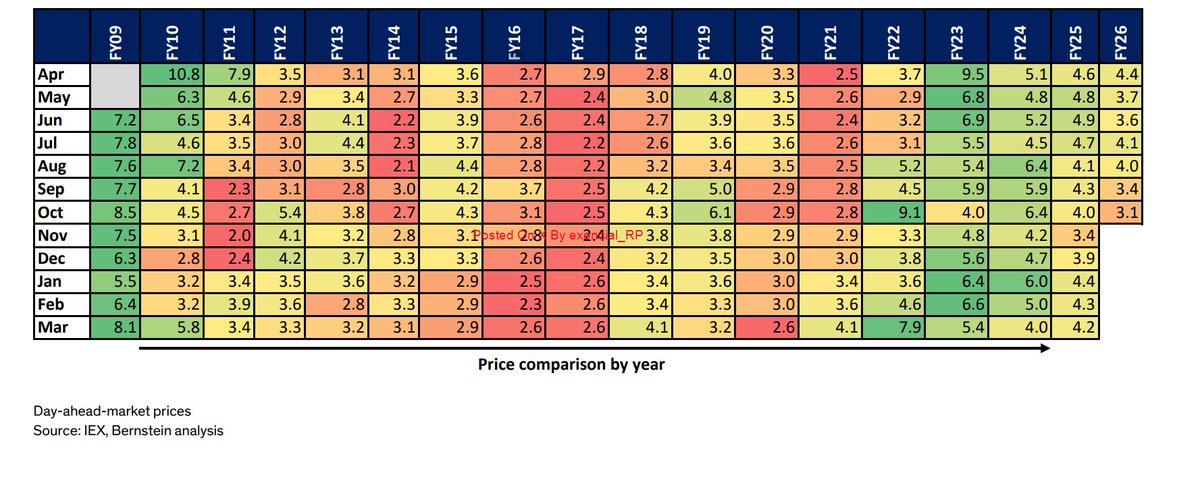

Spot prices summary

With a small uptick in August and September, power demand growth dipped again in the first 11 days of October. However, going forward, IMD expects colder winters this year due to the effect of La-Nina, which should aid power demand.

Power demand continues to remain soft

Spot prices summary

• • •

Missing some Tweet in this thread? You can try to

force a refresh