Kruti Shah || SEBI Research Analyst ||

INH000017666 || Discovering and Sharing Knowledge, Not Investment Advice

https://t.co/fmLRnTYr66

How to get URL link on X (Twitter) App

Today is D-Day. January 6, 2026. The APTEL court hears the case. 🏛️

Today is D-Day. January 6, 2026. The APTEL court hears the case. 🏛️

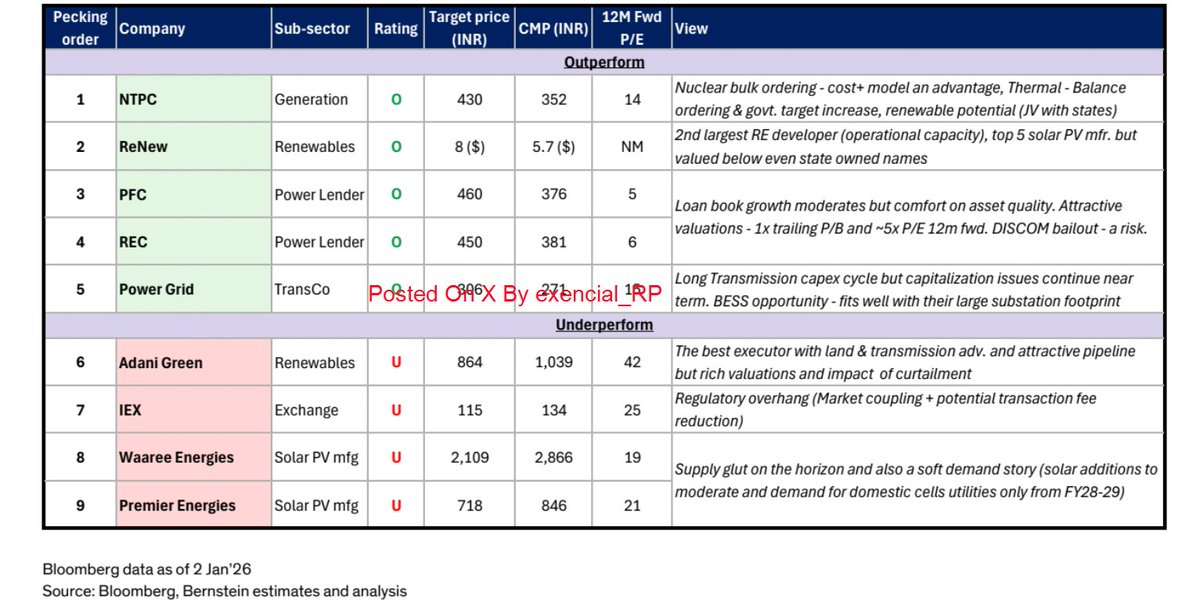

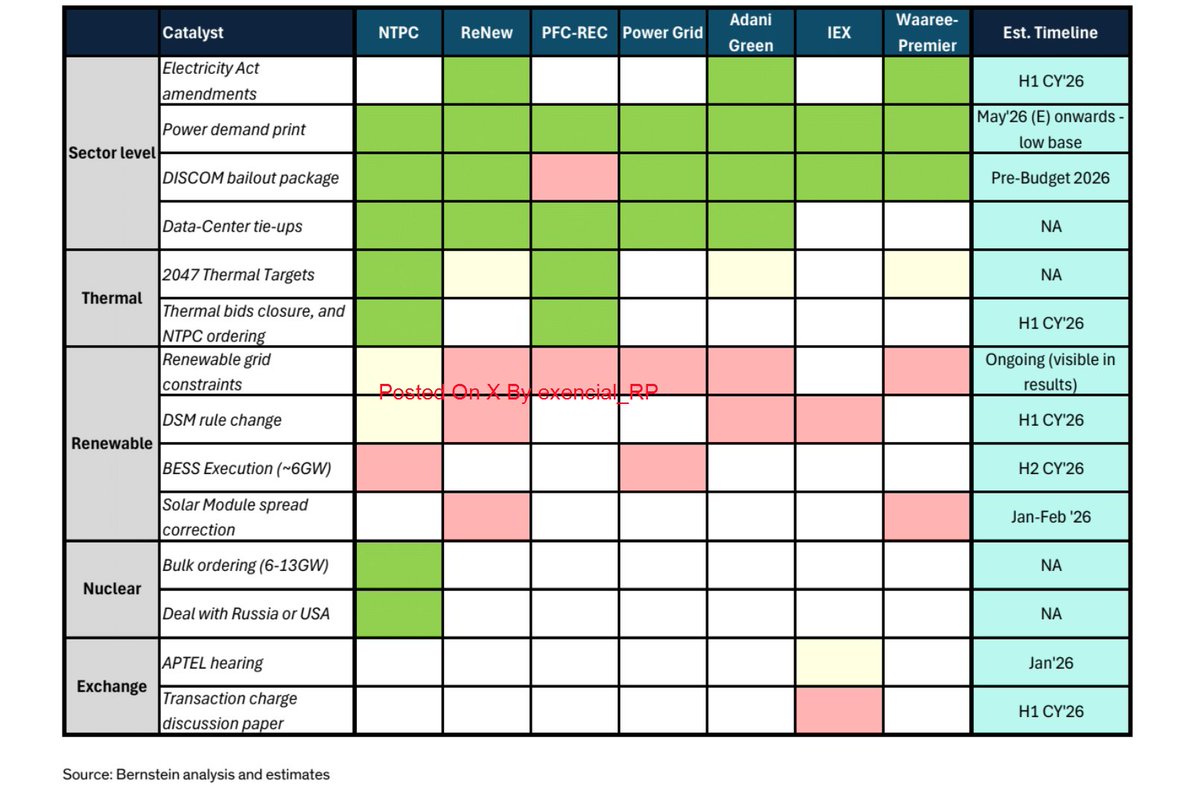

Power sector coverage universe pecking order

Power sector coverage universe pecking order

BCCL is opening its IPO on January 9, 2026.

BCCL is opening its IPO on January 9, 2026.

First, ignore the stock price for a second.

First, ignore the stock price for a second.

1) Japan’s long bonds are the foundation of global fixed income

1) Japan’s long bonds are the foundation of global fixed income

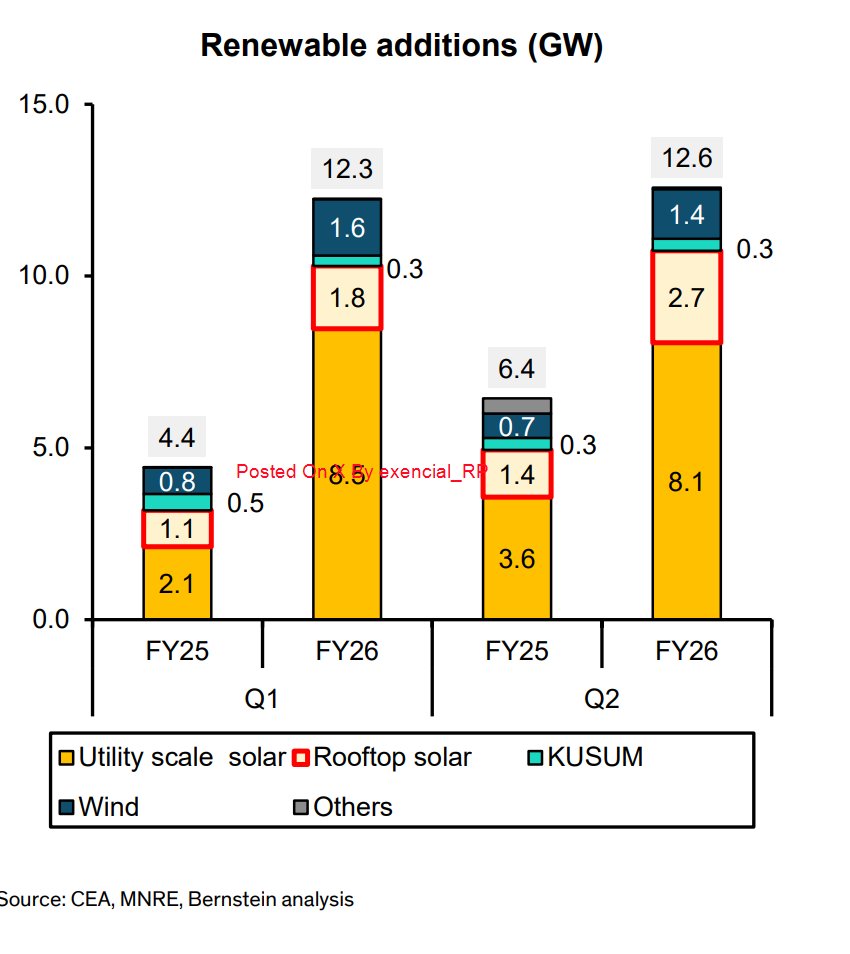

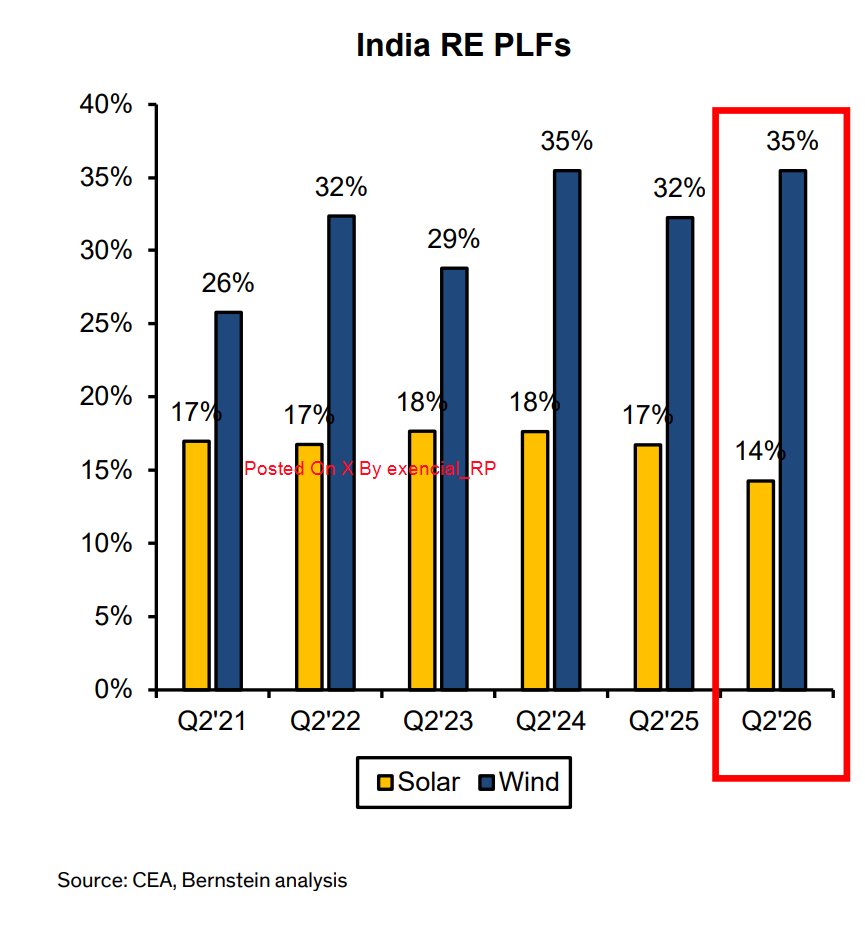

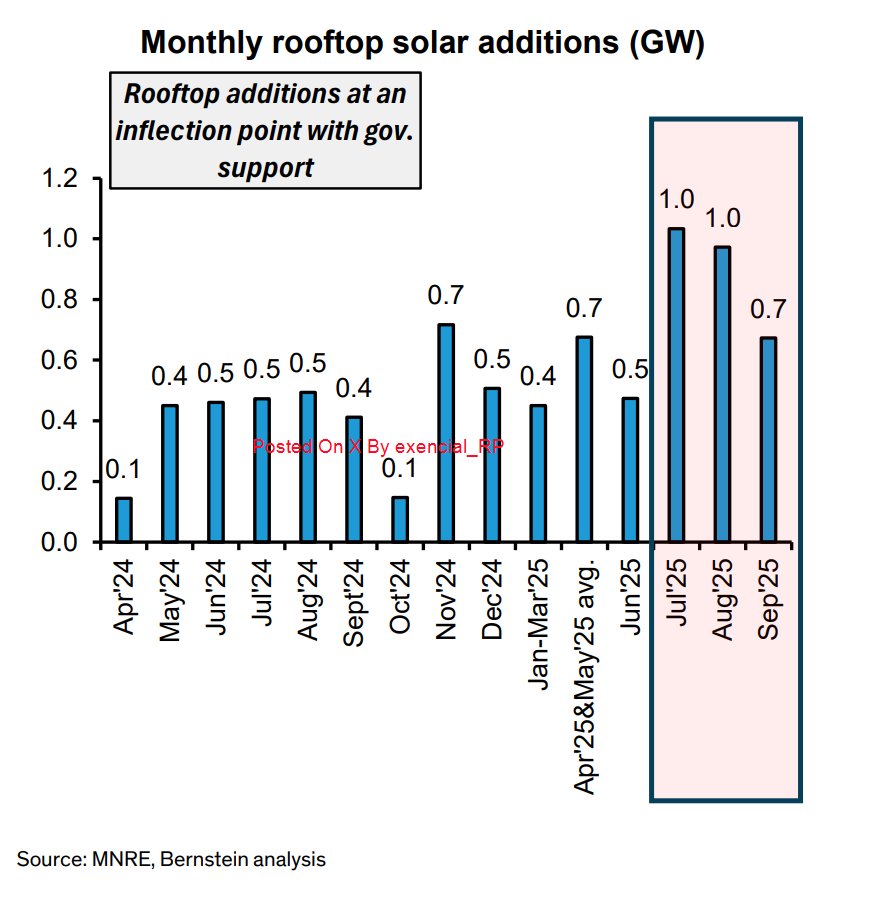

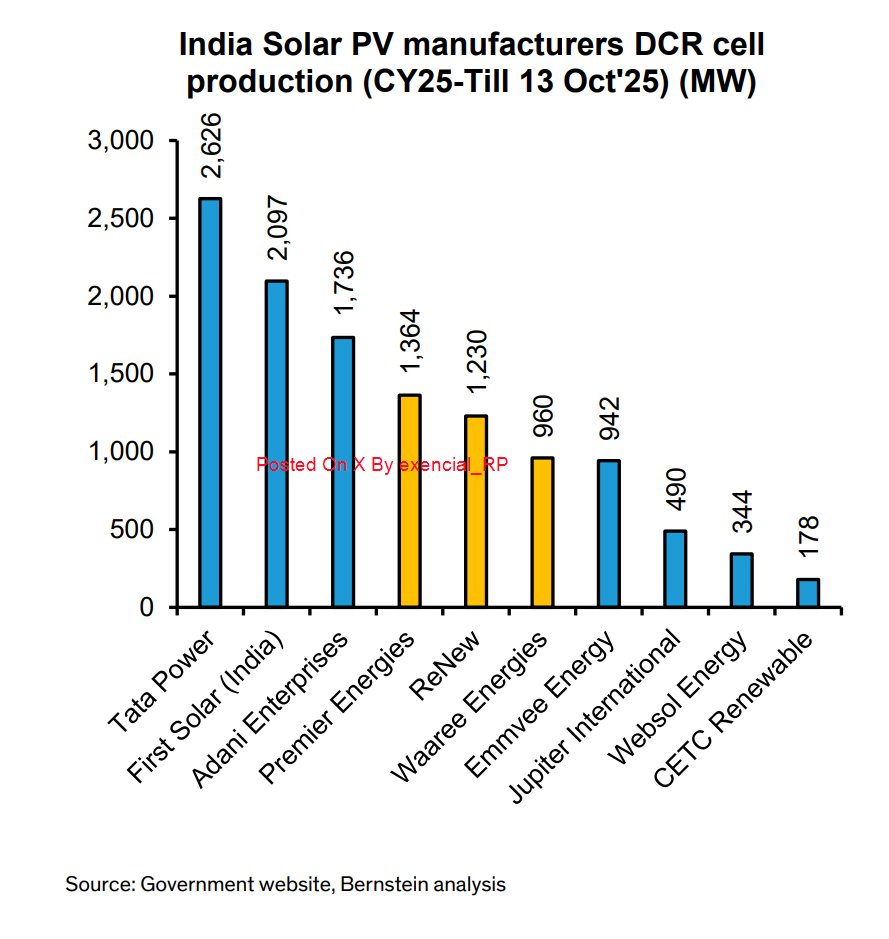

3. RENEWABLE ADDITIONS ON A ROLL, BUT PLFS DISAPPOINT

3. RENEWABLE ADDITIONS ON A ROLL, BUT PLFS DISAPPOINT

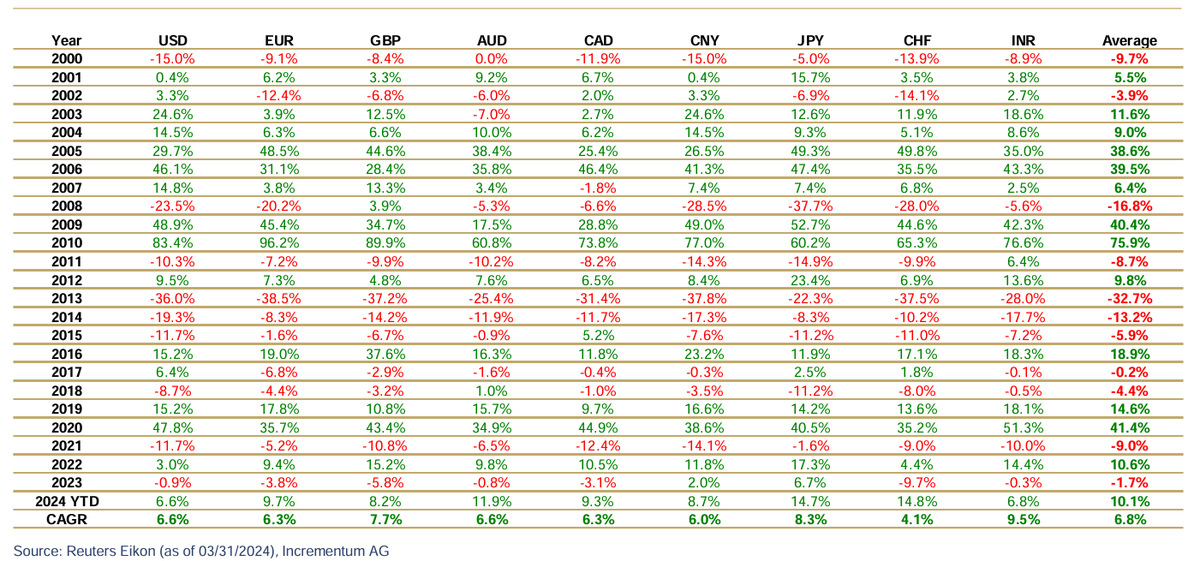

Silver Performance in Major Currencies, 2000-2024 YTD

Silver Performance in Major Currencies, 2000-2024 YTD