Crypto is out, Gold is in🪙

🚨BEST GOLD YIELD GUIDE EVER MADE🚨

I'm only half-joking. But definitely bookmark.

🧵👇

🚨BEST GOLD YIELD GUIDE EVER MADE🚨

I'm only half-joking. But definitely bookmark.

🧵👇

Gold is difficult to get a native yield on. Virtually all gold yields involve collateralizing a gold derivative and farming against borrowed stables.

That said, you can deposit smart XAUT/PAXG collateral on @0xfluid for ~4.5%

Next, we'll look at where to borrow against Gold...

That said, you can deposit smart XAUT/PAXG collateral on @0xfluid for ~4.5%

Next, we'll look at where to borrow against Gold...

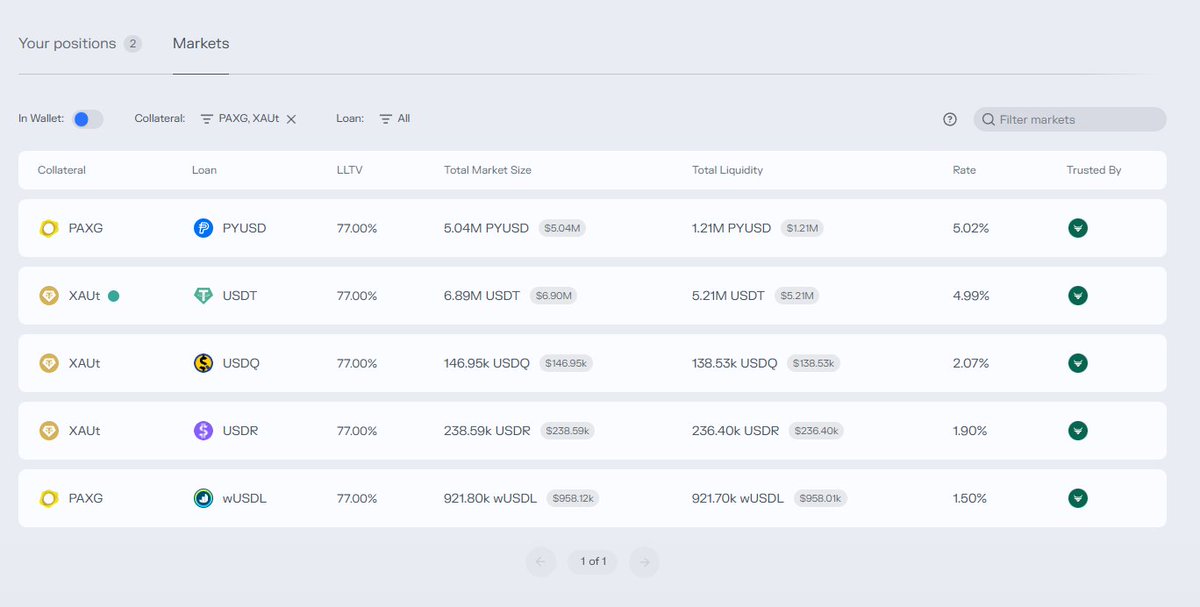

1) @MorphoLabs

I love morpho and am currently using it for my own gold farming.

Pros:

⇒ Highest LLTV at 77%

⇒ 5% borrow cost

⇒ Only large EVM market with both PAXG and XAUT

Cons:

➢ Thin liquidity compared to Aave

➢ Isolated margin (could be a pro?)

I love morpho and am currently using it for my own gold farming.

Pros:

⇒ Highest LLTV at 77%

⇒ 5% borrow cost

⇒ Only large EVM market with both PAXG and XAUT

Cons:

➢ Thin liquidity compared to Aave

➢ Isolated margin (could be a pro?)

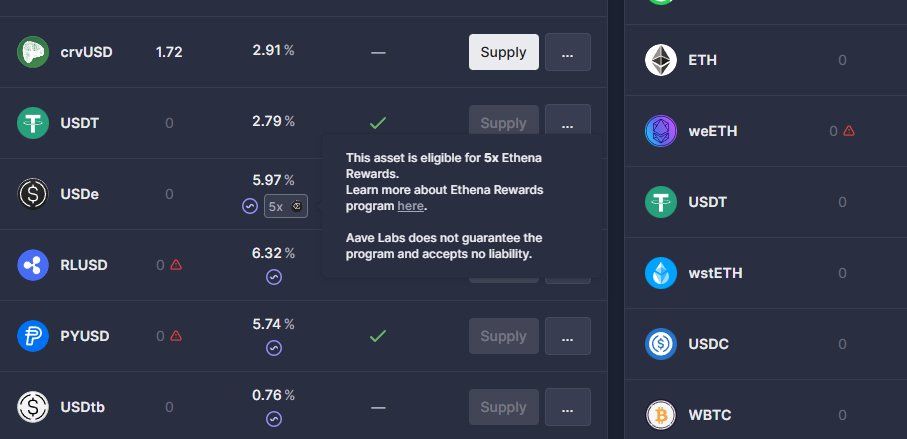

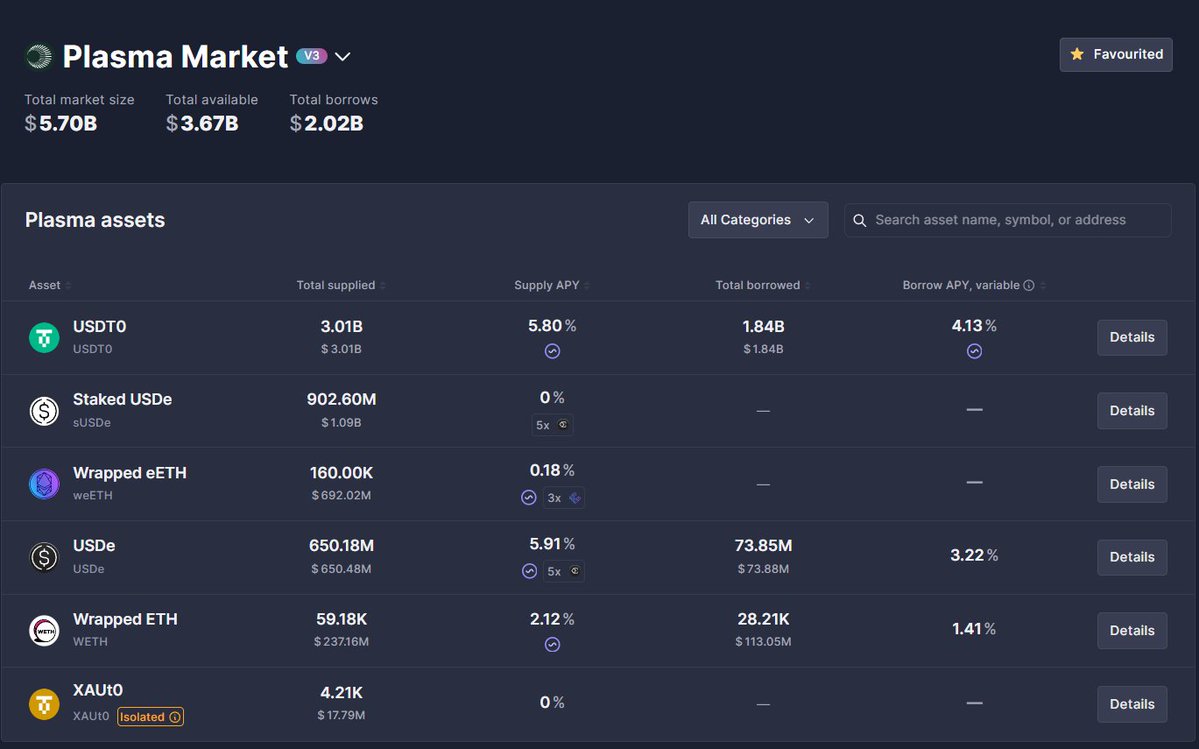

2) @aave

Aave has XAUT

Pros:

➢ Borrow USDC, USDT, USDe between 3-6%

➢ Billions to borrow on mainnet

(no one else compares)

➢ It's Aave

➢ Deep liquidity on Plasma and Ethereum

➢ Cross margin

Con:

➢ 75% LLTV slightly lower than Morpho

➢ No PAXG unless I'm blind

Aave has XAUT

Pros:

➢ Borrow USDC, USDT, USDe between 3-6%

➢ Billions to borrow on mainnet

(no one else compares)

➢ It's Aave

➢ Deep liquidity on Plasma and Ethereum

➢ Cross margin

Con:

➢ 75% LLTV slightly lower than Morpho

➢ No PAXG unless I'm blind

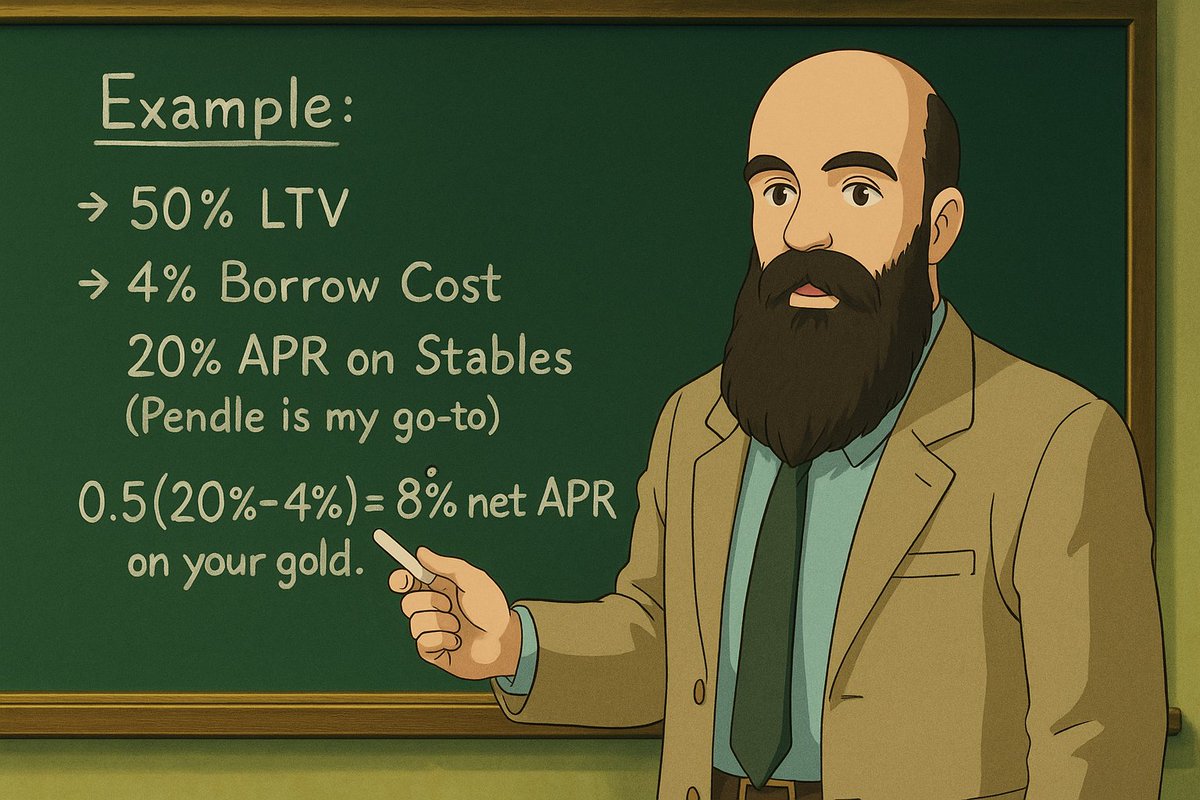

NOW, for yields, the math is simple.

LTV * (stablecoinYield - borrowCost)

Example:

➢ 50% LTV

➢ 4% Borrow Cost

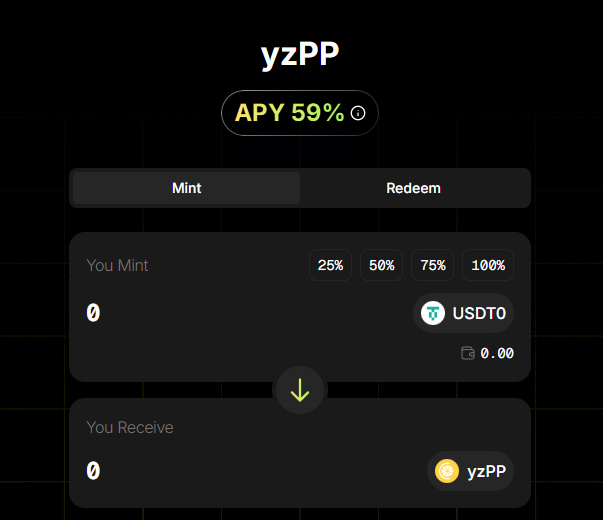

➢ 20% APR on Stables (Pendle is my go-to)

0.5(20%-4%) = 8% net APR on your gold.

Pretty dang good for a gold yield

LTV * (stablecoinYield - borrowCost)

Example:

➢ 50% LTV

➢ 4% Borrow Cost

➢ 20% APR on Stables (Pendle is my go-to)

0.5(20%-4%) = 8% net APR on your gold.

Pretty dang good for a gold yield

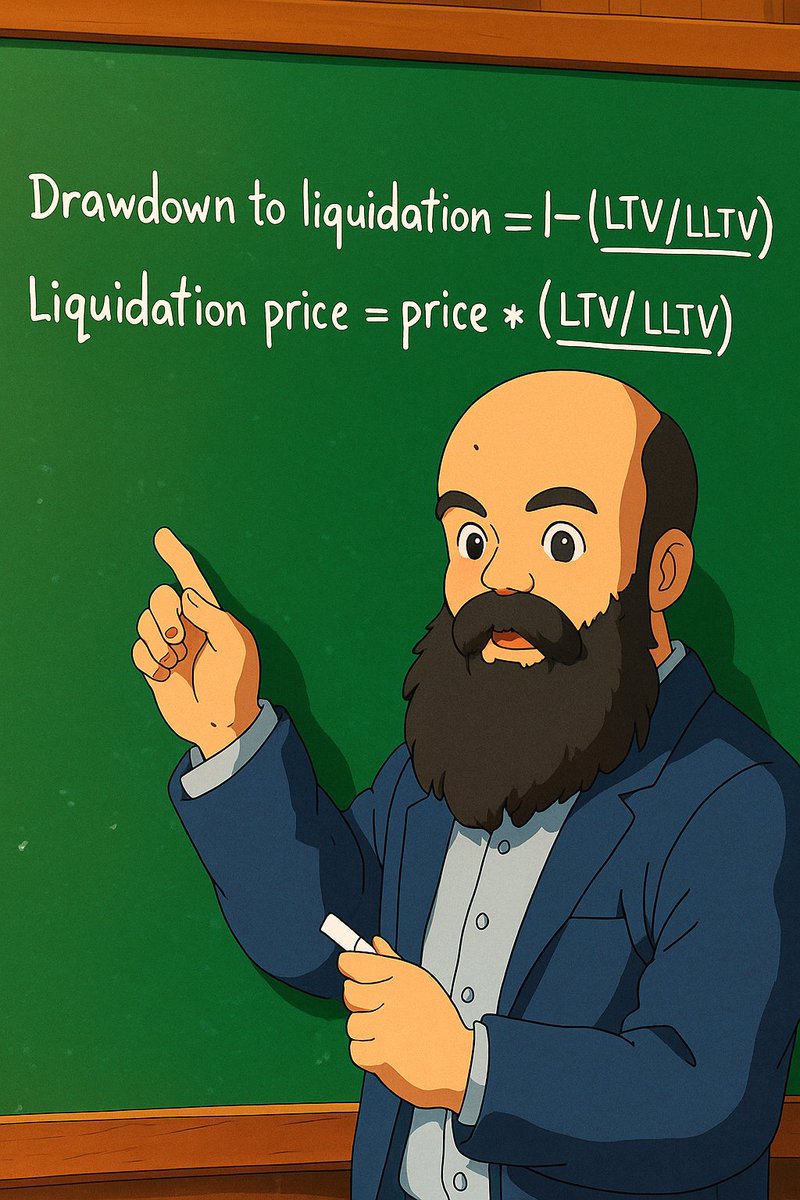

Don't forget liquidations!

► Drawdown to liquidation = 1-(LTV/LLTV)

► Liquidation price = price*(LTV/LLTV)

Ex:

• Gold: $4200

• LTV: 50%

• LLTV: 75%

Drawdown to liquidation = 1-(.5/.75)

= 33%

Liquidation price = $4200*(0.5/0.75)

= $2800

► Drawdown to liquidation = 1-(LTV/LLTV)

► Liquidation price = price*(LTV/LLTV)

Ex:

• Gold: $4200

• LTV: 50%

• LLTV: 75%

Drawdown to liquidation = 1-(.5/.75)

= 33%

Liquidation price = $4200*(0.5/0.75)

= $2800

SO, what are some good ways to farm this and their net APRs?

Assume borrow at 5% and 50% LTV.

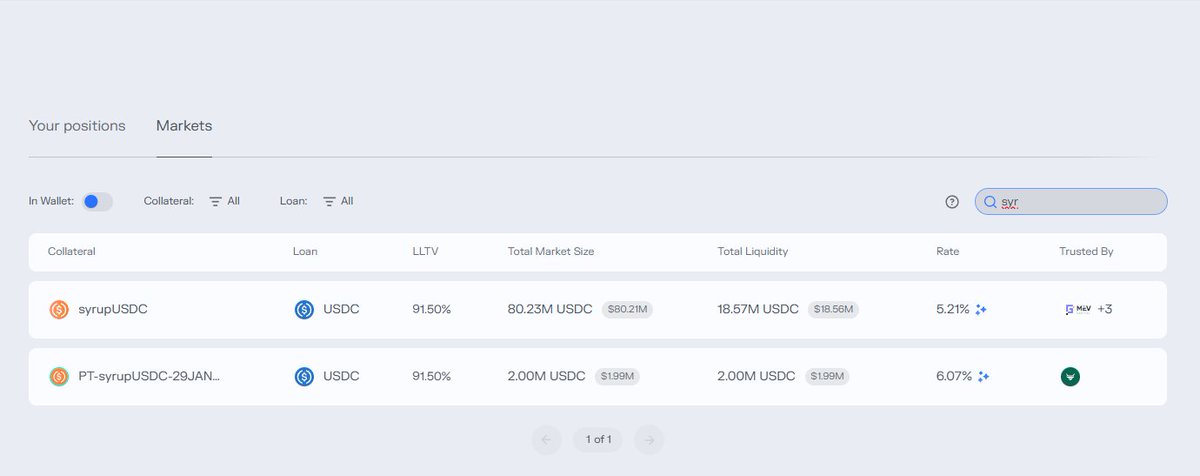

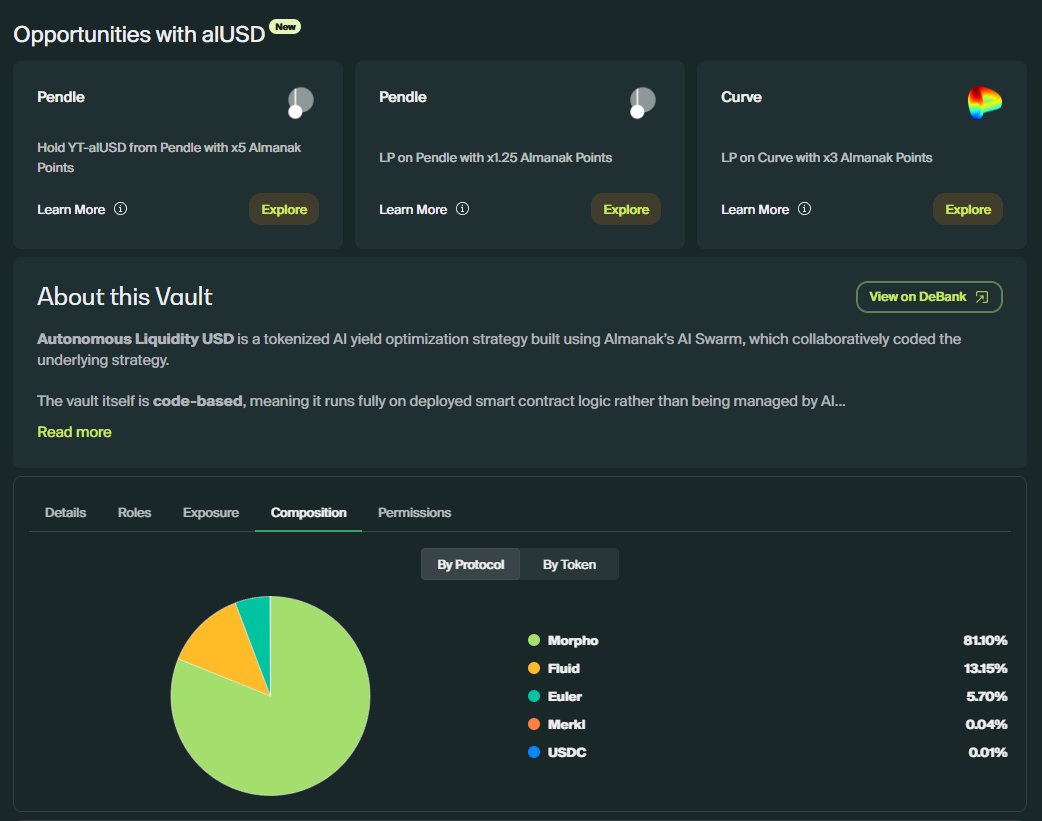

1) XAUT | PT-AIDaUSDC: 12.5% (med risk)

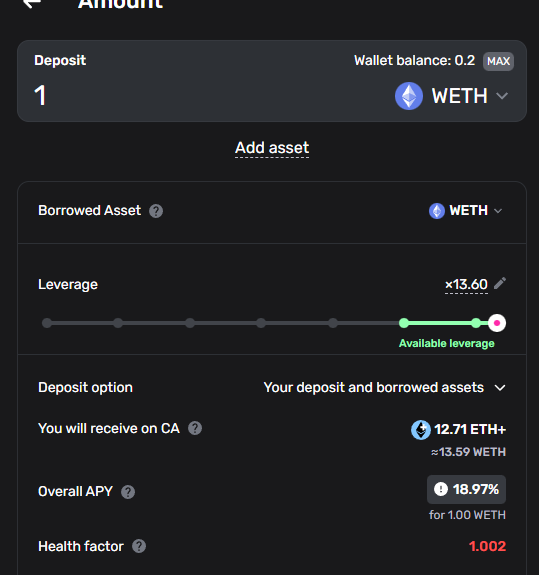

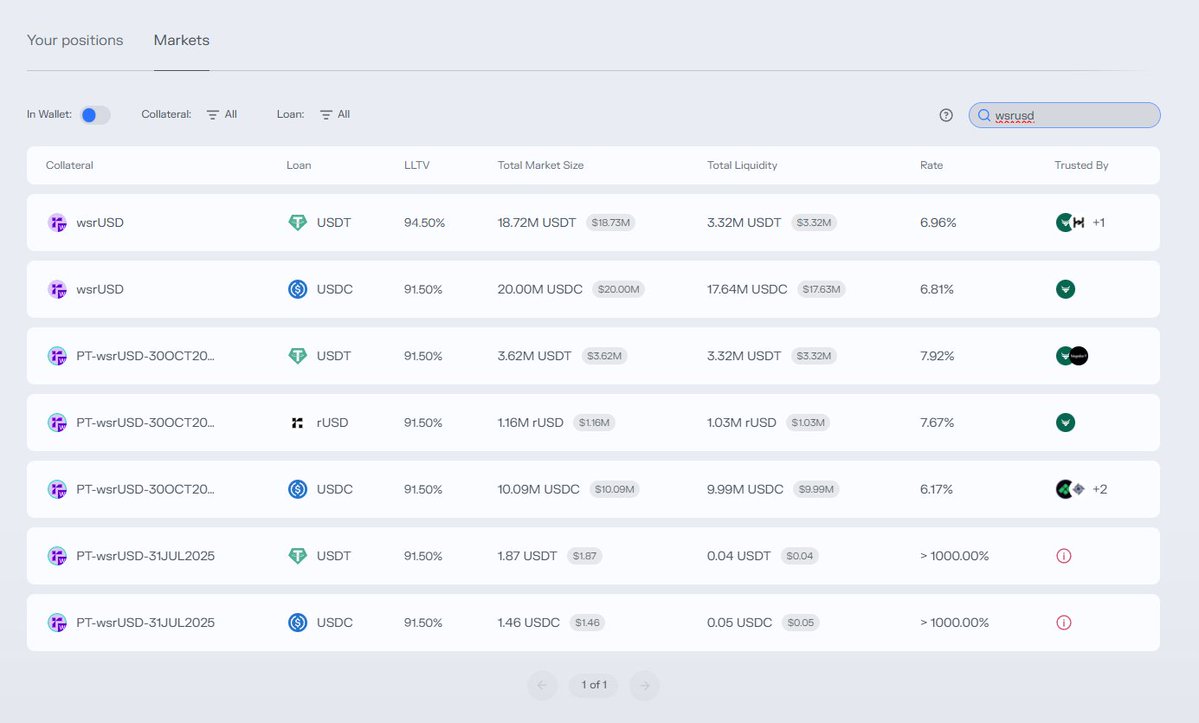

2) XAUT | syrupUSDT Loop: 13.5% (higher risk)

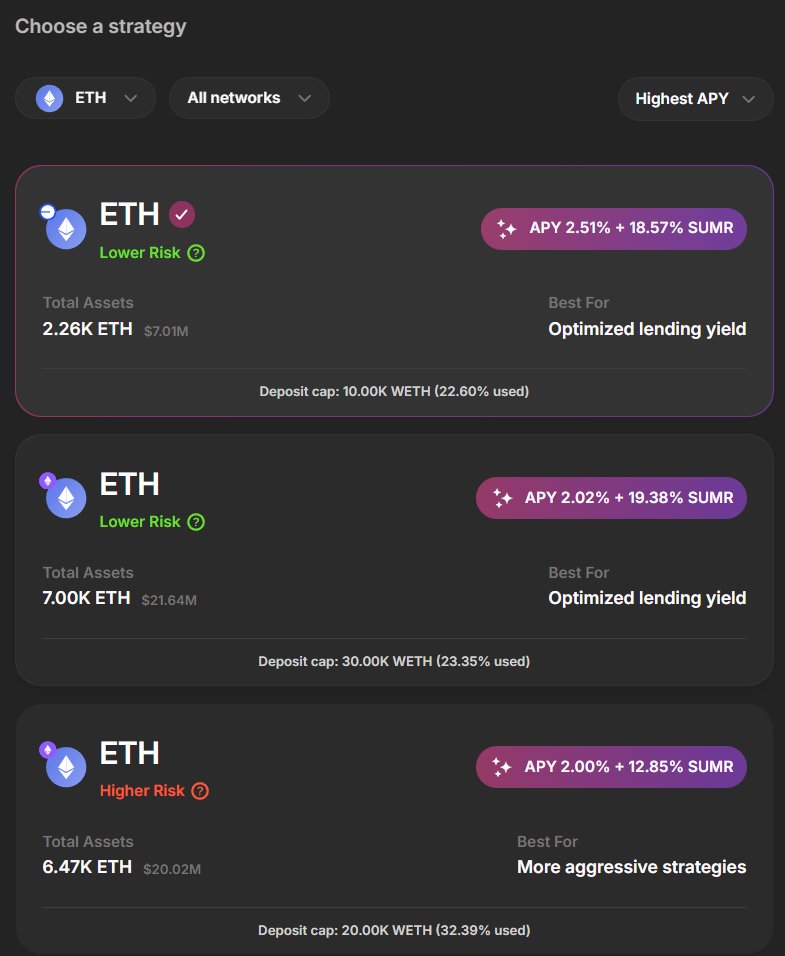

3) XAUT | Simple Lend-Agg SummerFi: 3% (low risk)

Assume borrow at 5% and 50% LTV.

1) XAUT | PT-AIDaUSDC: 12.5% (med risk)

2) XAUT | syrupUSDT Loop: 13.5% (higher risk)

3) XAUT | Simple Lend-Agg SummerFi: 3% (low risk)

That's it!

There is $GOLD on @solana, but I'm not sure I trust it yet, it gets a decent native yield by allowing your gold to be lent to jewelers for 3-4% net.

Feels like it needs more lindy.

Anywho, join us: defidojo.vip

There is $GOLD on @solana, but I'm not sure I trust it yet, it gets a decent native yield by allowing your gold to be lent to jewelers for 3-4% net.

Feels like it needs more lindy.

Anywho, join us: defidojo.vip

• • •

Missing some Tweet in this thread? You can try to

force a refresh