🛢️ Russia Gives Cheap Oil. The U.S. Gives Pressure. What Should India Choose?

🛢️India imports 36% oil from Russia, but if India reduces Russian oil due to global pressure, what happens to:

✅ Our FX reserves?

✅ Import bill & inflation?

✅ Rupee stability?

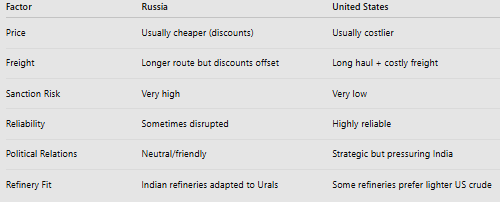

✅ U.S. vs Russia pricing power?

Let’s break it down in detail… 👇

🛢️India imports 36% oil from Russia, but if India reduces Russian oil due to global pressure, what happens to:

✅ Our FX reserves?

✅ Import bill & inflation?

✅ Rupee stability?

✅ U.S. vs Russia pricing power?

Let’s break it down in detail… 👇

India is the world’s 3rd largest oil consumer and 2nd largest importer of crude. Because domestic production covers only 15% of its needs, India is heavily dependent on global suppliers.

1️⃣ HOW MUCH CRUDE OIL DOES INDIA IMPORT?

🔹FY 2024-25 average: ~4.9 million barrels per day (mbpd)

🔹Year-on-year growth: +5%

Crude Oil forms ~25% of India’s total import bill

🔹FY 2024-25 average: ~4.9 million barrels per day (mbpd)

🔹Year-on-year growth: +5%

Crude Oil forms ~25% of India’s total import bill

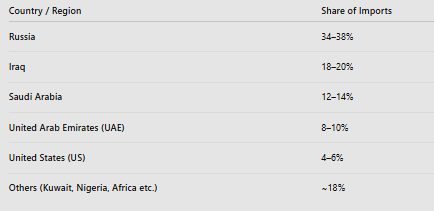

2️⃣ COUNTRY-WISE BREAKDOWN OF INDIA’S CRUDE IMPORTS

📌Russia has been the 1 supplier for 3 consecutive years

📌Russia has been the 1 supplier for 3 consecutive years

3️⃣ WHY DID INDIA SHIFT TOWARD RUSSIA?

✅After the Russia-Ukraine war, Western countries banned or capped Russian oil.

Russia suddenly needed new buyers → India became the perfect customer.

🔹Typical Brent price: $85–90 per barrel

🔹Russian Urals price: $70–78 per barrel

✅After the Russia-Ukraine war, Western countries banned or capped Russian oil.

Russia suddenly needed new buyers → India became the perfect customer.

🔹Typical Brent price: $85–90 per barrel

🔹Russian Urals price: $70–78 per barrel

🔹India saved $7–10 per barrel at peak times.

🔹Even with higher shipping, net savings = $2–5 per barrel. Annual savings ≈ $2–3 billion.

📌This alone made Russia the cheapest large-scale supplier in the world.

🔹Even with higher shipping, net savings = $2–5 per barrel. Annual savings ≈ $2–3 billion.

📌This alone made Russia the cheapest large-scale supplier in the world.

✅Flexible Payment Methods Saved India’s Dollars

Due to sanctions, Russia accepted:

🔹Indian Rupees

🔹UAE Dirhams

🔹Chinese Yuan

🔹Barter/credit terms

Due to sanctions, Russia accepted:

🔹Indian Rupees

🔹UAE Dirhams

🔹Chinese Yuan

🔹Barter/credit terms

✅ Perfect Crude Quality for Indian Refineries

Russian Urals crude = medium sour, similar to the Middle East grade.

Indian refineries are already designed to handle this type.

Benefits:

🔹No new infrastructure needed

🔹High refinery efficiency

🔹Higher refining margins (profit per barrel)

📌In some cases, Russian crude actually gave better refinery profits than Gulf crude.

Russian Urals crude = medium sour, similar to the Middle East grade.

Indian refineries are already designed to handle this type.

Benefits:

🔹No new infrastructure needed

🔹High refinery efficiency

🔹Higher refining margins (profit per barrel)

📌In some cases, Russian crude actually gave better refinery profits than Gulf crude.

✅Geo-Political Neutrality = FREEDOM TO BUY

India maintained a neutral stance in the Russia-Ukraine conflict.

Unlike the West, India did NOT sanction Russia.

Russia did not threaten India.

India did not face retaliation from anyone.

So India had:

🔹 No legal barrier

🔹No security concern

🔹Full diplomatic support from Moscow

India maintained a neutral stance in the Russia-Ukraine conflict.

Unlike the West, India did NOT sanction Russia.

Russia did not threaten India.

India did not face retaliation from anyone.

So India had:

🔹 No legal barrier

🔹No security concern

🔹Full diplomatic support from Moscow

✅Reducing Dependence on OPEC Monopoly

Earlier, OPEC supplied 80–85% of India’s crude.

This was dangerous because OPEC:

❌ Cuts production to increase global prices

❌ Controls supply

❌ Dictates terms

By buying from Russia:

✅ OPEC share fell below 50% (first time in history)

✅ India increased competition among suppliers

✅ Negotiated better terms from Gulf countries

Earlier, OPEC supplied 80–85% of India’s crude.

This was dangerous because OPEC:

❌ Cuts production to increase global prices

❌ Controls supply

❌ Dictates terms

By buying from Russia:

✅ OPEC share fell below 50% (first time in history)

✅ India increased competition among suppliers

✅ Negotiated better terms from Gulf countries

✅Buy Cheap ➡️ Refine ➡️ Export High

India is one of the world’s largest refiners and fuel exporters.

Here’s the smart hack India used:

1️⃣ Buy discounted Russian crude

2️⃣ Refine it into petrol, diesel, and jet fuel

3️⃣ Export to Europe at full international price!

India is one of the world’s largest refiners and fuel exporters.

Here’s the smart hack India used:

1️⃣ Buy discounted Russian crude

2️⃣ Refine it into petrol, diesel, and jet fuel

3️⃣ Export to Europe at full international price!

📌Europe bans Russian crude…

But Europe buys Indian petroleum products made from Russian crude! India became a refining & arbitrage powerhouse.

But Europe buys Indian petroleum products made from Russian crude! India became a refining & arbitrage powerhouse.

4️⃣ WHAT IF INDIA REDUCES IMPORTS FROM RUSSIA?

🔹The import bill increases sharply because Russian crude is the cheapest in India’s basket.

🔹India will pay $2–5 more per barrel from alternative suppliers like Saudi Arabia, Iraq, US.

🔹Higher crude cost directly worsens India’s trade deficit and current account deficit.

🔹The import bill increases sharply because Russian crude is the cheapest in India’s basket.

🔹India will pay $2–5 more per barrel from alternative suppliers like Saudi Arabia, Iraq, US.

🔹Higher crude cost directly worsens India’s trade deficit and current account deficit.

🔹The rupee comes under pressure due to higher dollar outflow for oil payments.

🔹Fuel prices in India may rise, or the government may cut taxes; both have economic costs.

🔹Inflation increases across the economy (transport, manufacturing).

🔹Refinery profit margins fall because Russian crude gives higher refining spreads.

🔹Fuel prices in India may rise, or the government may cut taxes; both have economic costs.

🔹Inflation increases across the economy (transport, manufacturing).

🔹Refinery profit margins fall because Russian crude gives higher refining spreads.

🔹India’s fuel export profits shrink, especially exports to Europe.

🔹OPEC regains dominance over India and can raise prices more easily.

🔹Dependency on the Middle East increases, reducing energy security.

🔹Shifting to U.S. oil improves relations but increases economic burden.

🔹OPEC regains dominance over India and can raise prices more easily.

🔹Dependency on the Middle East increases, reducing energy security.

🔹Shifting to U.S. oil improves relations but increases economic burden.

5⃣WILL INDIA COMPLETELY STOP BUYING RUSSIAN OIL?

Highly unlikely.

India has clearly stated:

👉 “We will buy from wherever we get the best price.”

What India will do:

✅ Reduce dependence gradually, not abruptly

✅ Increase buying from the US, Iraq, Saudi Arabia, UAE, and Africa.

Highly unlikely.

India has clearly stated:

👉 “We will buy from wherever we get the best price.”

What India will do:

✅ Reduce dependence gradually, not abruptly

✅ Increase buying from the US, Iraq, Saudi Arabia, UAE, and Africa.

✅ Negotiate long-term contracts at stable prices ✅ Build Strategic Petroleum Reserves (SPR)

✅ Accelerate renewable energy & ethanol blending

✅ Accelerate renewable energy & ethanol blending

⚡️Disclaimer: The above data should not be considered as a Buy or Sell recommendation. The analysis has been done for educational and learning purpose only.

✅Follow <@raghavwadhwa> for more insights on micro-cap companies and various sectors.

✅Like & Retweet

✅Subscribe to our YouTube Channel youtube.com/@raghav.wadhwa

✅Subscribe to our Telegram Channel

t.me/samarwealth

✅ Explore our new website legaciscapital.com

✅Like & Retweet

✅Subscribe to our YouTube Channel youtube.com/@raghav.wadhwa

✅Subscribe to our Telegram Channel

t.me/samarwealth

✅ Explore our new website legaciscapital.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh