Can't stop, won't stop.

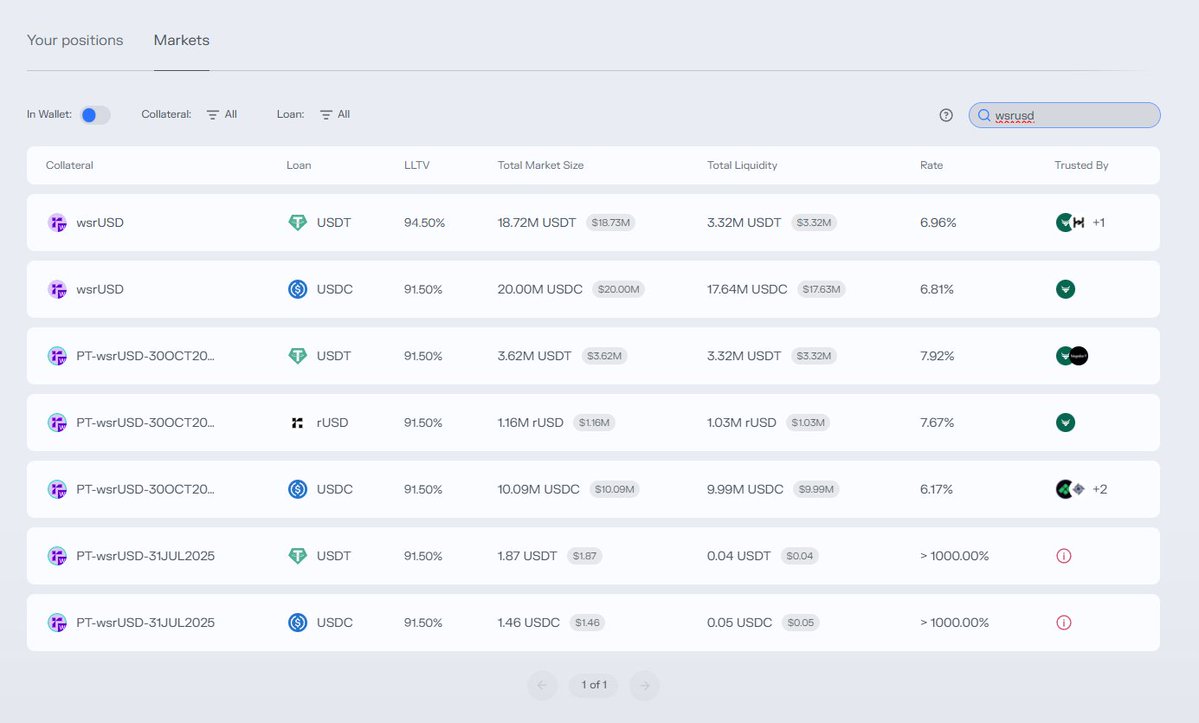

🚨TOP FIVE 20%+ APY STABLE FARMS🚨

CBB has some size, so I'll try to find some good ones.

🧵👇

🚨TOP FIVE 20%+ APY STABLE FARMS🚨

CBB has some size, so I'll try to find some good ones.

🧵👇

https://x.com/phtevenstrong/status/1978844261794631697

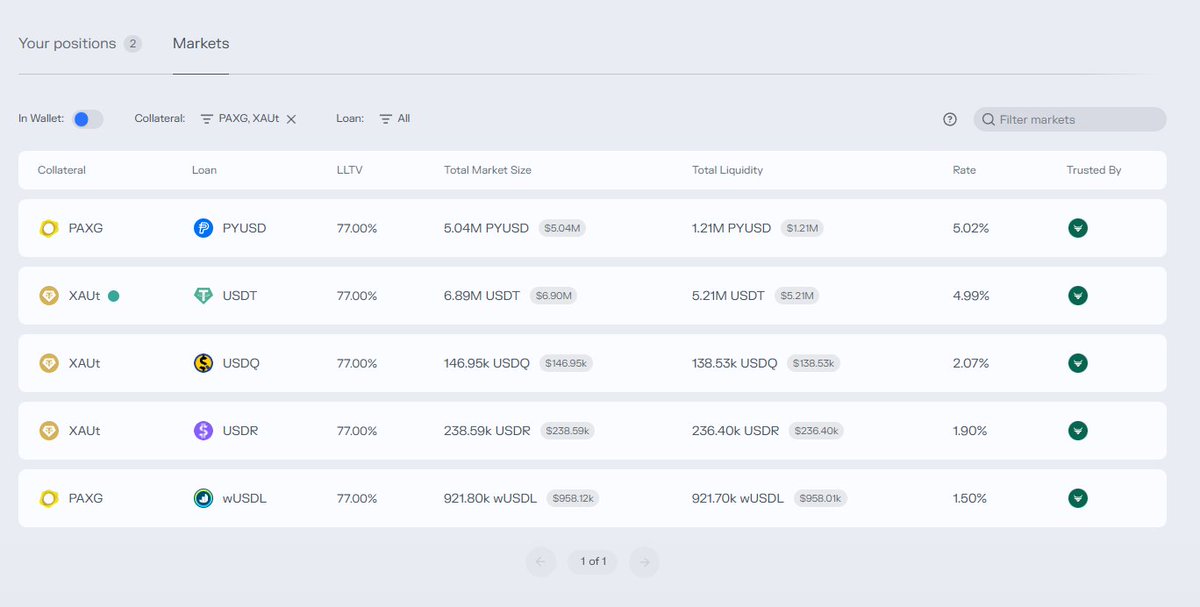

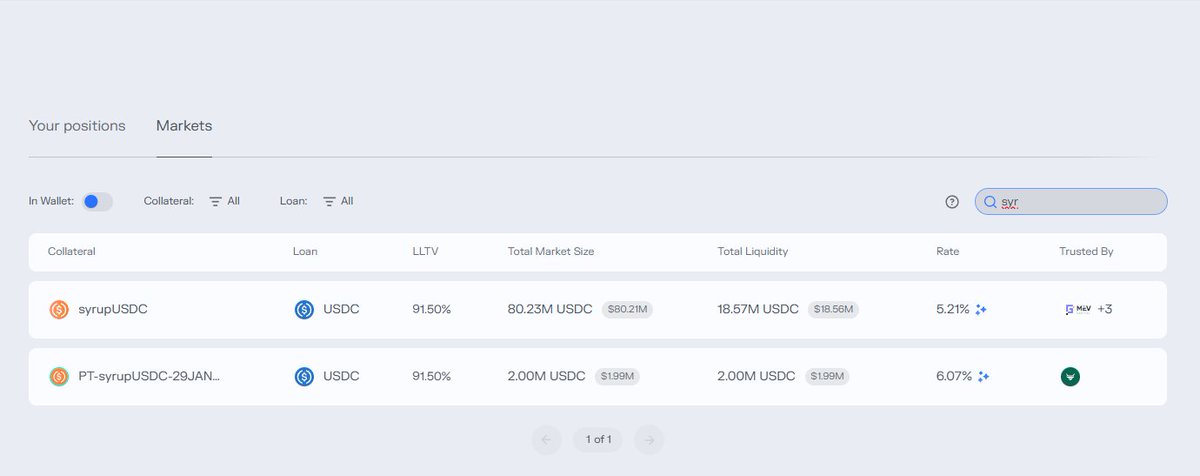

1) @reservoir_xyz wsrUSD/USDC loop on @MorphoLabs

► 8.25% APY collateral yield

► 6.81% APY borrow cost

► 17.64M to borrow

= 21.21% Net (+ s2 points)

► 8.25% APY collateral yield

► 6.81% APY borrow cost

► 17.64M to borrow

= 21.21% Net (+ s2 points)

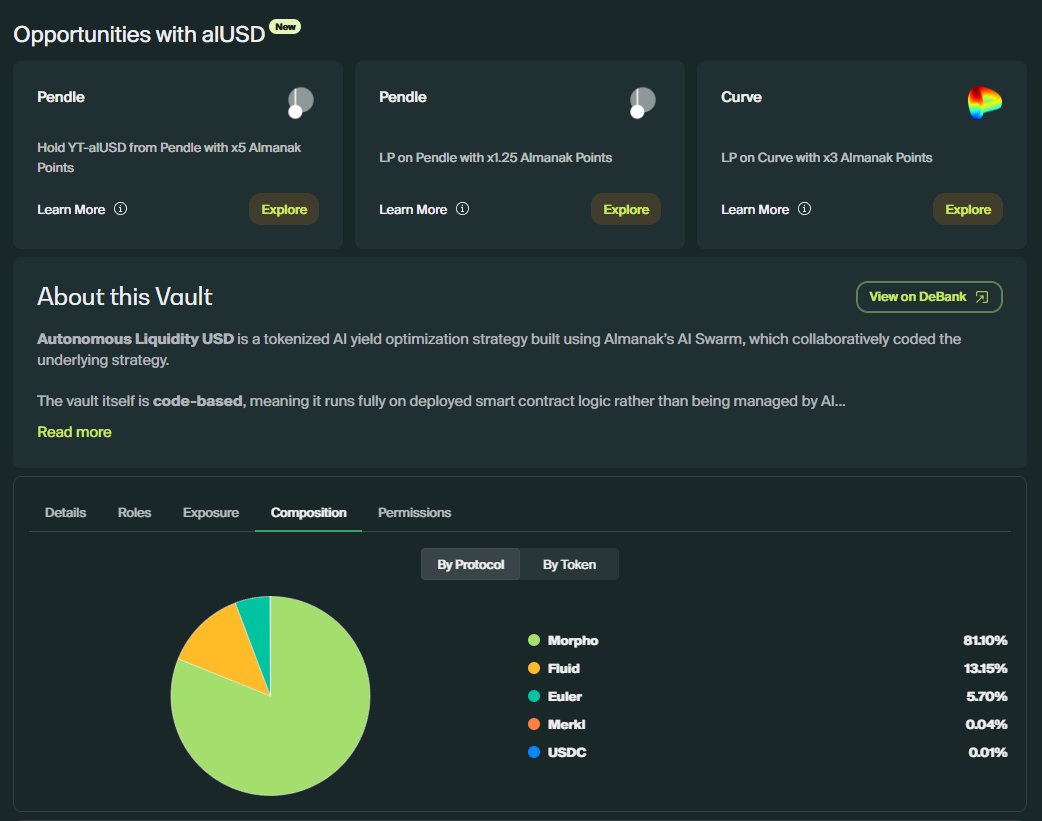

2) @maplefinance on @arbitrum (DRIP farming)

► 6.73% APY collateral yield

► 5.2% APY borrow cost

► 18.57M to borrow

= 20.5% Net (+ drips)

► 6.73% APY collateral yield

► 5.2% APY borrow cost

► 18.57M to borrow

= 20.5% Net (+ drips)

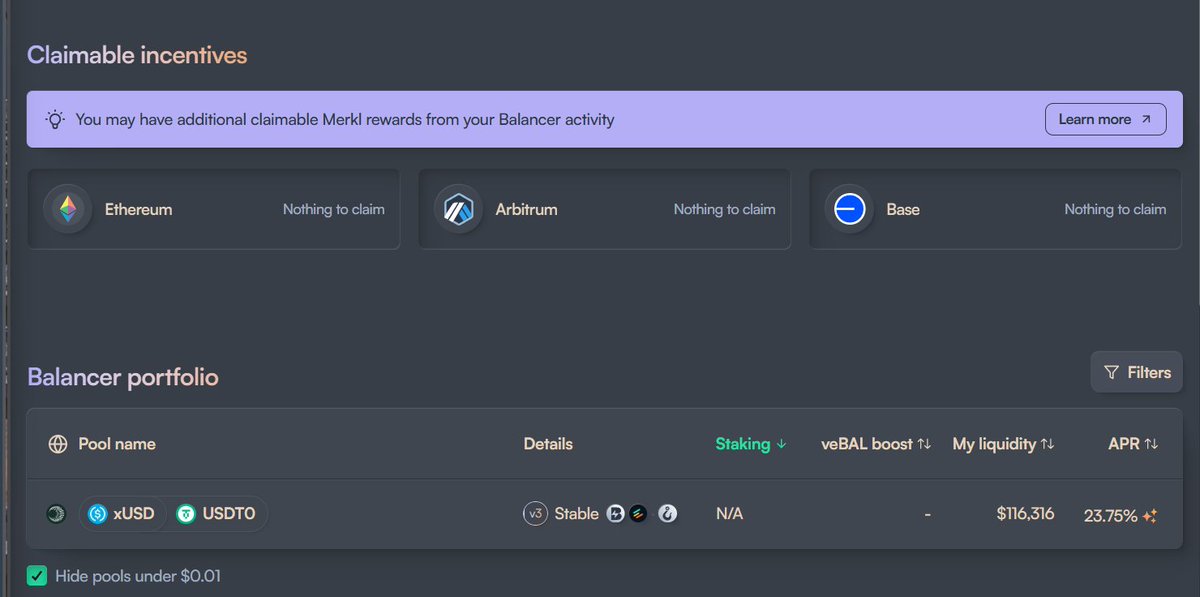

3) @StreamDefi with @Balancer on @Plasma

This may not be able to handle millions, but I'm rather bullish on these points.

This is LPing xUSD with Euler-Lent USDT for a 23% APR + Stream Points.

No leverage, just liquidity.

h/t @0xlawlol

This may not be able to handle millions, but I'm rather bullish on these points.

This is LPing xUSD with Euler-Lent USDT for a 23% APR + Stream Points.

No leverage, just liquidity.

h/t @0xlawlol

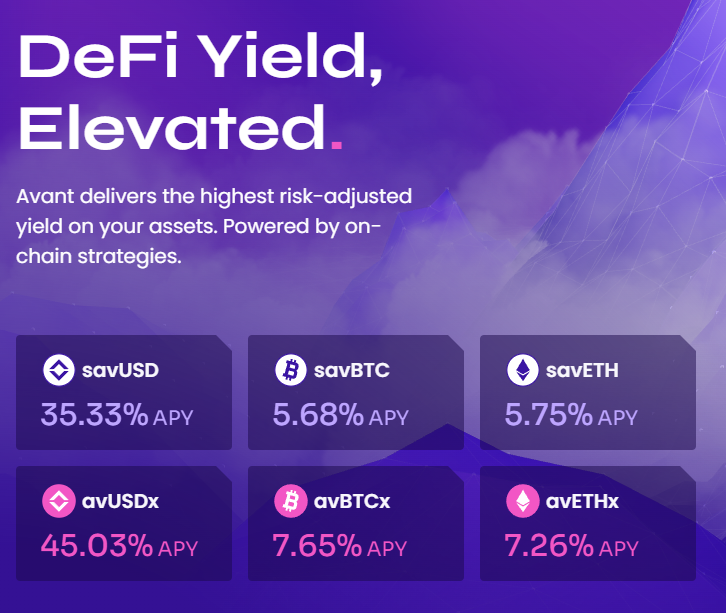

4) @avantprotocol on @avax

Look guys, I finally tagged the right one

Hat tip to the avant lads for having a senior tranche doing over 20%.

You can leverage on Euler for insane APR.

But to just break 20% and not expose yourself to leverage, this is pretty spicy.

Look guys, I finally tagged the right one

Hat tip to the avant lads for having a senior tranche doing over 20%.

You can leverage on Euler for insane APR.

But to just break 20% and not expose yourself to leverage, this is pretty spicy.

5) @pendle_fi, obviously.

I don't typically do short-dated PTs, but I'm learning to love them.

@gaib_ai's AIDaUSDC is nice. The cap is hit, but you can buy a fair amount around peg.

30% actual APR at 100K deposit just yeeting USDC into the pendle market direct (1% ROI).

I don't typically do short-dated PTs, but I'm learning to love them.

@gaib_ai's AIDaUSDC is nice. The cap is hit, but you can buy a fair amount around peg.

30% actual APR at 100K deposit just yeeting USDC into the pendle market direct (1% ROI).

There are tons more, surely. There are actually a handful of interesting tradfi/defi yields like gold futures backwardation (short on HL, long on CME) plays over 20% APR too.

ANYWHO, if you want to talk yields all day, join us:

defidojo.vip

ANYWHO, if you want to talk yields all day, join us:

defidojo.vip

• • •

Missing some Tweet in this thread? You can try to

force a refresh