This year, ICONIQ led Anthropic’s $5bn Series F, ElevenLabs $180M Series C, Legora’s $80M Series B and TinyFish’s $47M Series A..

They are a media shy Wealth Mgt firm with $90bn+ of AUM who put their money where their pen is (quite literally)

Earlier this yr, they published their “State of AI 2025” report - now they’ve topped it up with several updates in a 73 page analysis of their portfolio companies.

Sharing a few takeaways ⤵️

They are a media shy Wealth Mgt firm with $90bn+ of AUM who put their money where their pen is (quite literally)

Earlier this yr, they published their “State of AI 2025” report - now they’ve topped it up with several updates in a 73 page analysis of their portfolio companies.

Sharing a few takeaways ⤵️

(1) “AI” has changed what “best in class” means for Software

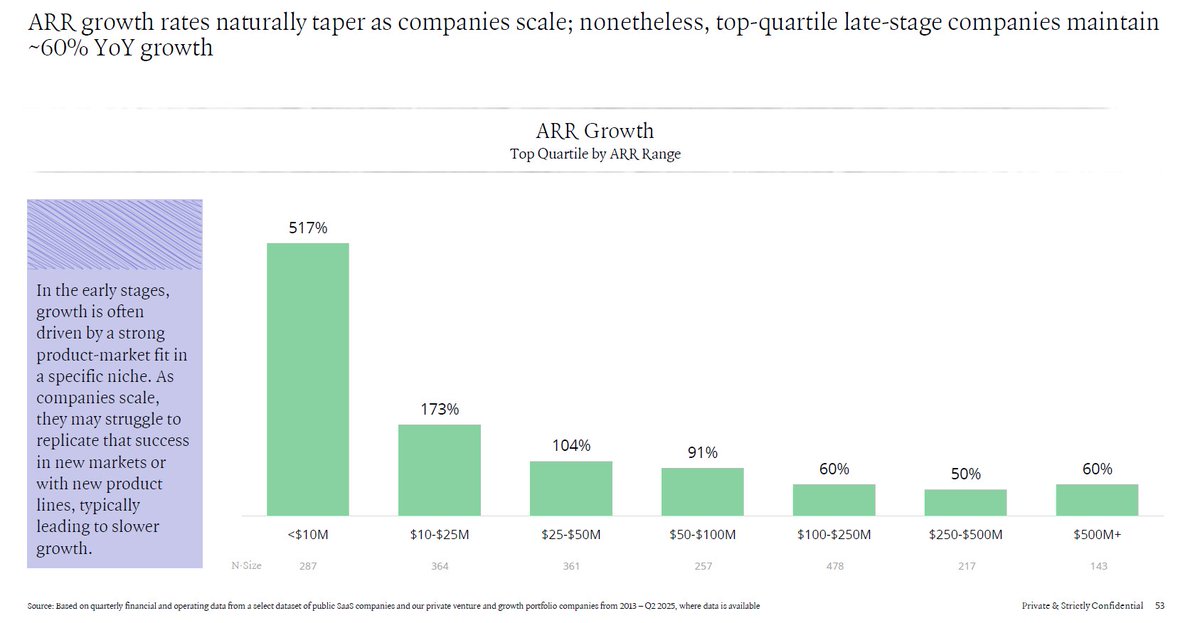

(a) OPEX leverage: ARR per FTE has increased 65% from ~$200K Pre-AI (2020) to $331K now; touching $390K for co’s with $500M+ ARR

(b) The goalpost “Rule of 40%” is now the “Rule of 60%” - BUT, there is ONE nuance: FCF margins are taking a hit - but growth rates are MUCH higher (even for “AI adjacent” SaaS co’s)

(c) NDRs (net dollar retention) also takes a hit - gold standard was ~135% in 2020; it is now down to ~115%. Elevated churn (experimental ARR, hype etc), competition & pricing pressure is hurting.

The change doesn’t impact Seed investors (like me) - but is VERY relevant for Growth & Public market investors.

Btw, ICONIQ’s Enterprise Five - ARR, NDR, Rule of 60%, Net Magic Number & ARR per FTE provides an excellent scorecard for Growth investors!

(a) OPEX leverage: ARR per FTE has increased 65% from ~$200K Pre-AI (2020) to $331K now; touching $390K for co’s with $500M+ ARR

(b) The goalpost “Rule of 40%” is now the “Rule of 60%” - BUT, there is ONE nuance: FCF margins are taking a hit - but growth rates are MUCH higher (even for “AI adjacent” SaaS co’s)

(c) NDRs (net dollar retention) also takes a hit - gold standard was ~135% in 2020; it is now down to ~115%. Elevated churn (experimental ARR, hype etc), competition & pricing pressure is hurting.

The change doesn’t impact Seed investors (like me) - but is VERY relevant for Growth & Public market investors.

Btw, ICONIQ’s Enterprise Five - ARR, NDR, Rule of 60%, Net Magic Number & ARR per FTE provides an excellent scorecard for Growth investors!

(2) The mere presence of “AI” revives growth (not joking)

(a) The one pint comment is that every VC has an “AI heavy” portfolio because all SaaS co’s have pivoted into AI co’s

(b) There is some data to support why this might help - it reinvigorates innovation (EPD teams), outbound (Sales morale) & inbound demand (FOMO)

(c) I’ve seen at least one of our portfolio co’s come back from extinction to growth mode because of AI - even SMBs can now be targeted profitably (CS cost is down, Sales can be automated & outcomes can be sold)

Example from ICONIQ: Palantir went from 15% YoY growth in Q2 ‘23 to ~35% growth in Q4 ‘24 - driven by “AI”

(a) The one pint comment is that every VC has an “AI heavy” portfolio because all SaaS co’s have pivoted into AI co’s

(b) There is some data to support why this might help - it reinvigorates innovation (EPD teams), outbound (Sales morale) & inbound demand (FOMO)

(c) I’ve seen at least one of our portfolio co’s come back from extinction to growth mode because of AI - even SMBs can now be targeted profitably (CS cost is down, Sales can be automated & outcomes can be sold)

Example from ICONIQ: Palantir went from 15% YoY growth in Q2 ‘23 to ~35% growth in Q4 ‘24 - driven by “AI”

(3) ERR is the new buzzword - “Experimental Random Revenue” - elevated Churn haunts

(a) ICONIQ totally didn’t come up with that - I added it to an internal doc last week for one of our partners (who totally glossed over it)

(b) There is a dual headwind for revenue retention in PLG companies - logo churn (competition driven) and contraction (price negotiation during Enterprise signing)

(c) This is the counterbalance to $100M ARR in 3 years - revenue is low(er) quality esp. because Enterprises & Prosumers are in the “discovery” mode with tooling (not deployment mode)

(a) ICONIQ totally didn’t come up with that - I added it to an internal doc last week for one of our partners (who totally glossed over it)

(b) There is a dual headwind for revenue retention in PLG companies - logo churn (competition driven) and contraction (price negotiation during Enterprise signing)

(c) This is the counterbalance to $100M ARR in 3 years - revenue is low(er) quality esp. because Enterprises & Prosumers are in the “discovery” mode with tooling (not deployment mode)

(4) AI native v/s AI enabled v/s AI adjacent

(a) AI native co’s see 3x faster revenue addition v/s AI adjacent co’s

(b) $100M ARR in 2 yrs is possible & proven (albeit subject to the FCF margin & churn dynamics mentioned earlier)

(c) You will see AI native companies with < 20 employees when at $100M ARR

(d) AI native co’s have pipeline acceleration with 2x converts from trial to subscription

But, like I pointed out above - faster revenue growth ≠ better business 😊

Downward pricing pressure remains painful (more notes below):

x.com/Rahul_J_Mathur…

(a) AI native co’s see 3x faster revenue addition v/s AI adjacent co’s

(b) $100M ARR in 2 yrs is possible & proven (albeit subject to the FCF margin & churn dynamics mentioned earlier)

(c) You will see AI native companies with < 20 employees when at $100M ARR

(d) AI native co’s have pipeline acceleration with 2x converts from trial to subscription

But, like I pointed out above - faster revenue growth ≠ better business 😊

Downward pricing pressure remains painful (more notes below):

x.com/Rahul_J_Mathur…

(5) GC’s Hemant Taneja got roasted but he’s right - (1)3322 has become (5)5322

If you read this and said :”WTF is this?” - here’s the simple explainer:

(a) Pre-AI (2020) - the gold standard of Software was to do $1M ARR in Y1 - and then triple, triple, double & double again i.e. get to $36M in ARR by Y5 and therefore to ~$100M by Y8

(b) Latest data from a16z suggests that gold standard in Enterprise AI is to do $5M ARR in Y1 (driven by FOMO & everything else)

(c) Per ICONIQ, in a post AI era (2023+) - the gold standard trajectory in AI is to x5 in Y2, x3 in Y3, and X2 for 2 subsequent years i.e. $300M in ARR by Y5

Btw, despite our reservations on AI ARR - Harvey has hit $100M in Y3, Cursor (Anysphere) crossed $500M in Y4 etc. Ballistic growth (if you get the joke)

If you read this and said :”WTF is this?” - here’s the simple explainer:

(a) Pre-AI (2020) - the gold standard of Software was to do $1M ARR in Y1 - and then triple, triple, double & double again i.e. get to $36M in ARR by Y5 and therefore to ~$100M by Y8

(b) Latest data from a16z suggests that gold standard in Enterprise AI is to do $5M ARR in Y1 (driven by FOMO & everything else)

(c) Per ICONIQ, in a post AI era (2023+) - the gold standard trajectory in AI is to x5 in Y2, x3 in Y3, and X2 for 2 subsequent years i.e. $300M in ARR by Y5

Btw, despite our reservations on AI ARR - Harvey has hit $100M in Y3, Cursor (Anysphere) crossed $500M in Y4 etc. Ballistic growth (if you get the joke)

Those of you who have read several of my posts might wonder why I frequently cite ICONIQ - they have a unique structure (given their Tech founder centric LP base) and an incredible portfolio (Glean, Databricks, Snowflake etc)

While most valley VCs have pivoted to video “marketing” - ICONIQ has stuck to long form writing with independent research (see the footnotes on methodology etc in their publications)

One can only aspire to match their level of diligence, discipline & foresight! This post is (at best) an average summary of their work - you’d do yourself a favor reading it first hand 😄

➡️ ICONIQ’s State of Software report can be downloaded here: iconiqcapital.com/growth/reports…

While most valley VCs have pivoted to video “marketing” - ICONIQ has stuck to long form writing with independent research (see the footnotes on methodology etc in their publications)

One can only aspire to match their level of diligence, discipline & foresight! This post is (at best) an average summary of their work - you’d do yourself a favor reading it first hand 😄

➡️ ICONIQ’s State of Software report can be downloaded here: iconiqcapital.com/growth/reports…

• • •

Missing some Tweet in this thread? You can try to

force a refresh