🧵 THREAD:

“No COT? No problem. The Silver War doesn’t need their numbers anymore.”

1️⃣

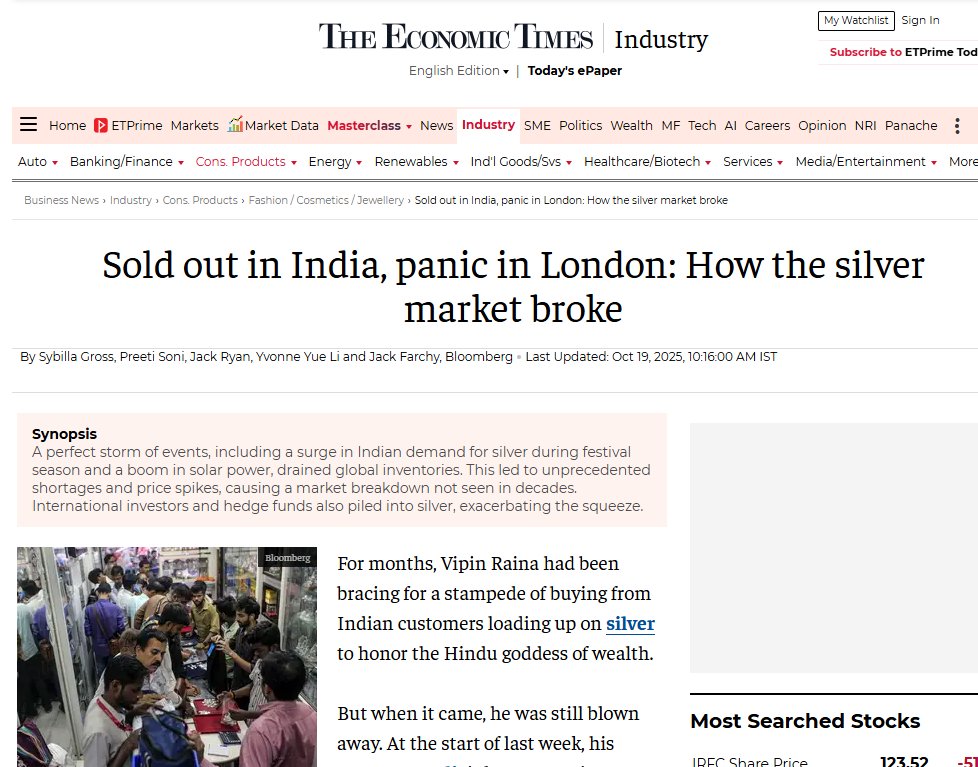

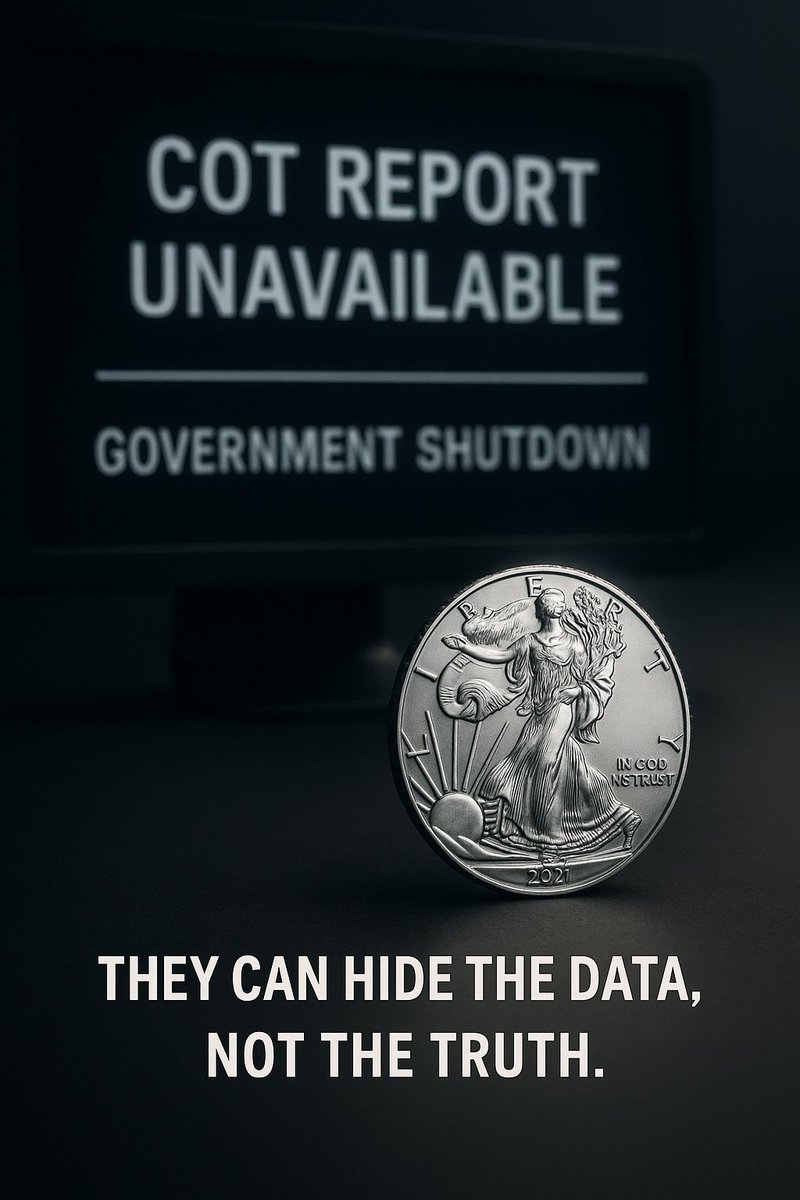

The U.S. government is in shutdown.

CFTC reports are frozen.

No COT. No Bank Participation. No transparency.

The paper world just went blind. 👀

“No COT? No problem. The Silver War doesn’t need their numbers anymore.”

1️⃣

The U.S. government is in shutdown.

CFTC reports are frozen.

No COT. No Bank Participation. No transparency.

The paper world just went blind. 👀

2️⃣

But here’s the thing — stackers don’t need their data.

We see what’s happening every day:

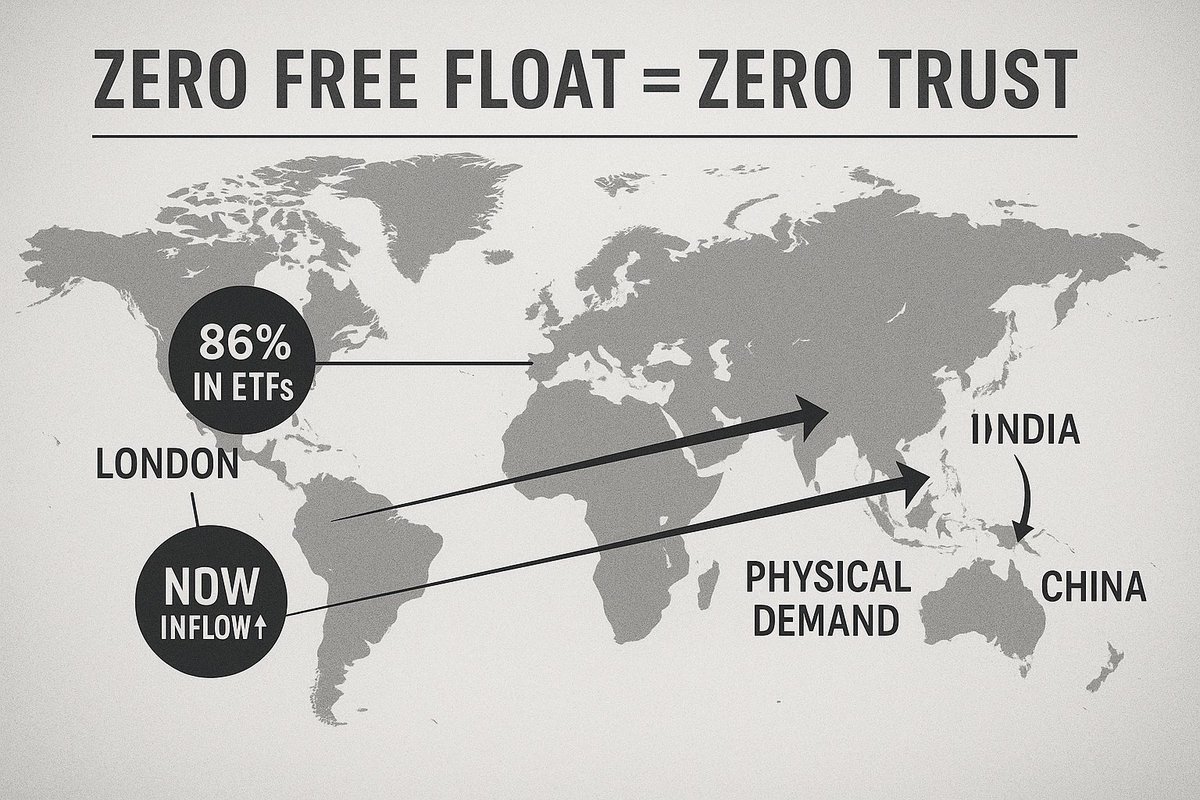

Vaults draining.

ETF inflows.

Registered bars disappearing.

Premiums rising.

👉 The battlefield speaks louder than the reports.

But here’s the thing — stackers don’t need their data.

We see what’s happening every day:

Vaults draining.

ETF inflows.

Registered bars disappearing.

Premiums rising.

👉 The battlefield speaks louder than the reports.

3️⃣

When the numbers go dark, the truth comes to light.

And that truth is silver leaving the system — one real ounce at a time. 🪙⚡

When the numbers go dark, the truth comes to light.

And that truth is silver leaving the system — one real ounce at a time. 🪙⚡

4️⃣

They can pause the reports, but they can’t pause the math:

LBMA vaults down again.

SLV keeps swallowing ounces.

COMEX deliverables shrinking.

Backwards spreads screaming: “Give me the metal NOW.”

They can pause the reports, but they can’t pause the math:

LBMA vaults down again.

SLV keeps swallowing ounces.

COMEX deliverables shrinking.

Backwards spreads screaming: “Give me the metal NOW.”

5️⃣

Stackers already read between the lines.

Because we are the data they don’t want to publish.

We are the physical drain.

We are the ones shortening their fuse. ⏳🔥

Stackers already read between the lines.

Because we are the data they don’t want to publish.

We are the physical drain.

We are the ones shortening their fuse. ⏳🔥

6️⃣

Remember: when the system hides the truth, you’re closer than ever to it.

Each missing report is another confirmation that we’re hitting a nerve. 🧠💥

Remember: when the system hides the truth, you’re closer than ever to it.

Each missing report is another confirmation that we’re hitting a nerve. 🧠💥

7️⃣

No COT? Fine.

We’ll trust the only metric that can’t be manipulated — the sound of real silver hitting the table.

Clink. Clink. Victory loading.

No COT? Fine.

We’ll trust the only metric that can’t be manipulated — the sound of real silver hitting the table.

Clink. Clink. Victory loading.

8️⃣

Stay calm. Stay focused.

The shutdown won’t last forever.

But the awakening it caused… will.

#SilverSqueeze #StackerLogic #PhysicalOnly #SilverGonnaPrevail

Stay calm. Stay focused.

The shutdown won’t last forever.

But the awakening it caused… will.

#SilverSqueeze #StackerLogic #PhysicalOnly #SilverGonnaPrevail

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh