Good morning ☕

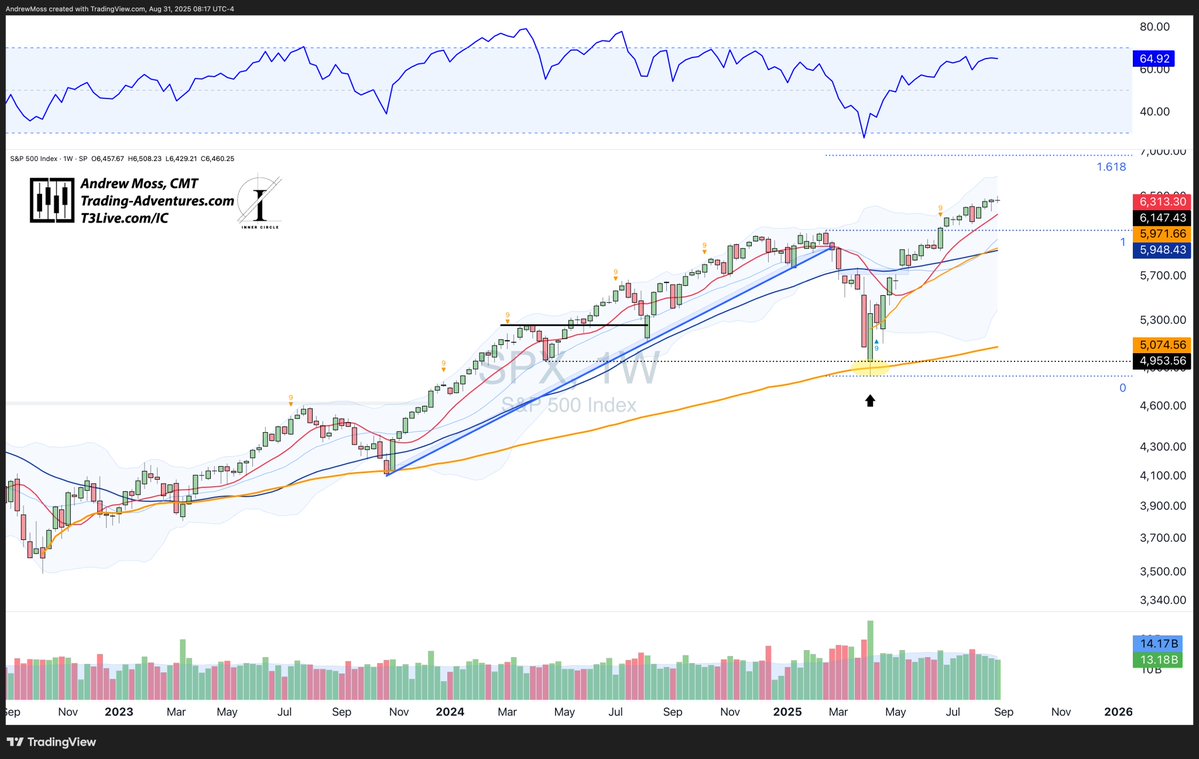

Another busy week of price discovery as indices tried to recover and find direction.

Time to zoom out and get perspective with the 📈Weekly Charts📉

Another busy week of price discovery as indices tried to recover and find direction.

Time to zoom out and get perspective with the 📈Weekly Charts📉

$SPX - tapped the 10-week MA early, bounced, and closed above both the new 4-week MA and the AVWAP🟠 from its last 10-week test.

🔸Still mid-range but holding firm.

🔸Volume right in line with the 20-week average.

🔸Still mid-range but holding firm.

🔸Volume right in line with the 20-week average.

$DIA

🔹More of the same — steady but uninspiring.

🔹Still hugging the 4- and 10-week MAs.

🔹Volume was very heavy this week.

🔹More of the same — steady but uninspiring.

🔹Still hugging the 4- and 10-week MAs.

🔹Volume was very heavy this week.

$IWM

🔹Led early, made a new high, but couldn’t hold it.

🔹Closed right on the 4-week MA.

🔹Volume slightly above average — leadership attempt faded into Friday.

🔹Led early, made a new high, but couldn’t hold it.

🔹Closed right on the 4-week MA.

🔹Volume slightly above average — leadership attempt faded into Friday.

$QQQ

🔹Closed the week at a new all-time high by 75¢.

🔹Traded higher early, reversed, then finished strong.

🔹Volume slightly heavier than average.

🔹Closed the week at a new all-time high by 75¢.

🔹Traded higher early, reversed, then finished strong.

🔹Volume slightly heavier than average.

Quick note - yes, the 4-week MA is a new addition to the charts. 4-week = 20-days. It's the thin black line.

$ACWX

The Rest of the World repaired much of last week’s damage, moving back near recent highs on rising volume back above its 20-week average.

The Rest of the World repaired much of last week’s damage, moving back near recent highs on rising volume back above its 20-week average.

$FXI

Printed a spinning-top doji (indecision) between the 4- and 10-week MAs — right in the middle of last week’s selloff range.

Volume roughly 2× average.

Printed a spinning-top doji (indecision) between the 4- and 10-week MAs — right in the middle of last week’s selloff range.

Volume roughly 2× average.

Bonds

$AGG broke higher from consolidation.

$TLT followed — up and out, though not as far.

$HYG recovered most of last week’s losses but finished just under the 10-week MA.

$AGG broke higher from consolidation.

$TLT followed — up and out, though not as far.

$HYG recovered most of last week’s losses but finished just under the 10-week MA.

$DXY / U.S. Dollar

Spent another week testing resistance at 99.25, while also visiting its 10-week MA below.

Spent another week testing resistance at 99.25, while also visiting its 10-week MA below.

Crypto

$BTC hit its 40-week MA and Fib extension near 103K, bounced to $107K

$ETH retesting pivot-low anchored VWAP — bull flag is still there, but getting old and weak.

$SOL testing trendline support near 187.

$BTC hit its 40-week MA and Fib extension near 103K, bounced to $107K

$ETH retesting pivot-low anchored VWAP — bull flag is still there, but getting old and weak.

$SOL testing trendline support near 187.

Gold and Silver were headliners at the commodity concert.

$GLD put in its 7th week of 'gap and go' action. Yes, since the breakout near $319, this ETF has gapped up and moved higher every week so far. 😮

And it's done so on MASSIVE volume. That's power.💪

$GLD put in its 7th week of 'gap and go' action. Yes, since the breakout near $319, this ETF has gapped up and moved higher every week so far. 😮

And it's done so on MASSIVE volume. That's power.💪

But, to say it is now very extended could be the understatement of the year.

🔹Weekly RSI > 85

🔹15% above the 10-week MA

🔹4-week MA and price parabolic

🔹DeMark 9 sell setup

All of those factors suggest some rest and pullback for the shiny metal. Doesn't have to be THE top. But this pace can't continue forever.

🔹Weekly RSI > 85

🔹15% above the 10-week MA

🔹4-week MA and price parabolic

🔹DeMark 9 sell setup

All of those factors suggest some rest and pullback for the shiny metal. Doesn't have to be THE top. But this pace can't continue forever.

$SLV is in the same boat.

Potential topping/reversal candle with all the other factors mentioned on $GLD too.

Potential topping/reversal candle with all the other factors mentioned on $GLD too.

And, just in case you want to see the two combined, the usual $DBP chart.

Same picture. Potential pullback for Precious Metals.

Same picture. Potential pullback for Precious Metals.

$XLY / $XLP – Inside week near 10-week MA and the lower end of last week's range.

$SPHB / $SPLV – Still choppy and widening, but holding up well.

$SPHB / $SPLV – Still choppy and widening, but holding up well.

Bullish Percent Indices all added to the columns of Os and are all in 'Bear Confirmed' status.

$BPSPX

$BPNDX

$BPNYA

$BPSPX

$BPNDX

$BPNYA

🧭 Now What?

Last week’s selloff met decent repair this week, even with a volatility spike.

The key, that volatility also crashed quickly.

$VIX daily

Last week’s selloff met decent repair this week, even with a volatility spike.

The key, that volatility also crashed quickly.

$VIX daily

Seasonally, $SPX tends to dip mid-October before the year-end rally.

The 2025 line (blue) sits right on that seasonal trough — the sharp drop in the dotted white line, the average of recent years.

Maybe we front-ran that seasonal dip.

Maybe not.

The 2025 line (blue) sits right on that seasonal trough — the sharp drop in the dotted white line, the average of recent years.

Maybe we front-ran that seasonal dip.

Maybe not.

• • •

Missing some Tweet in this thread? You can try to

force a refresh