Trader & CMT | Sharing charts, trades & structure at https://t.co/r1aJbu28hf

How to get URL link on X (Twitter) App

Starting with the standout: $IWM

Starting with the standout: $IWM

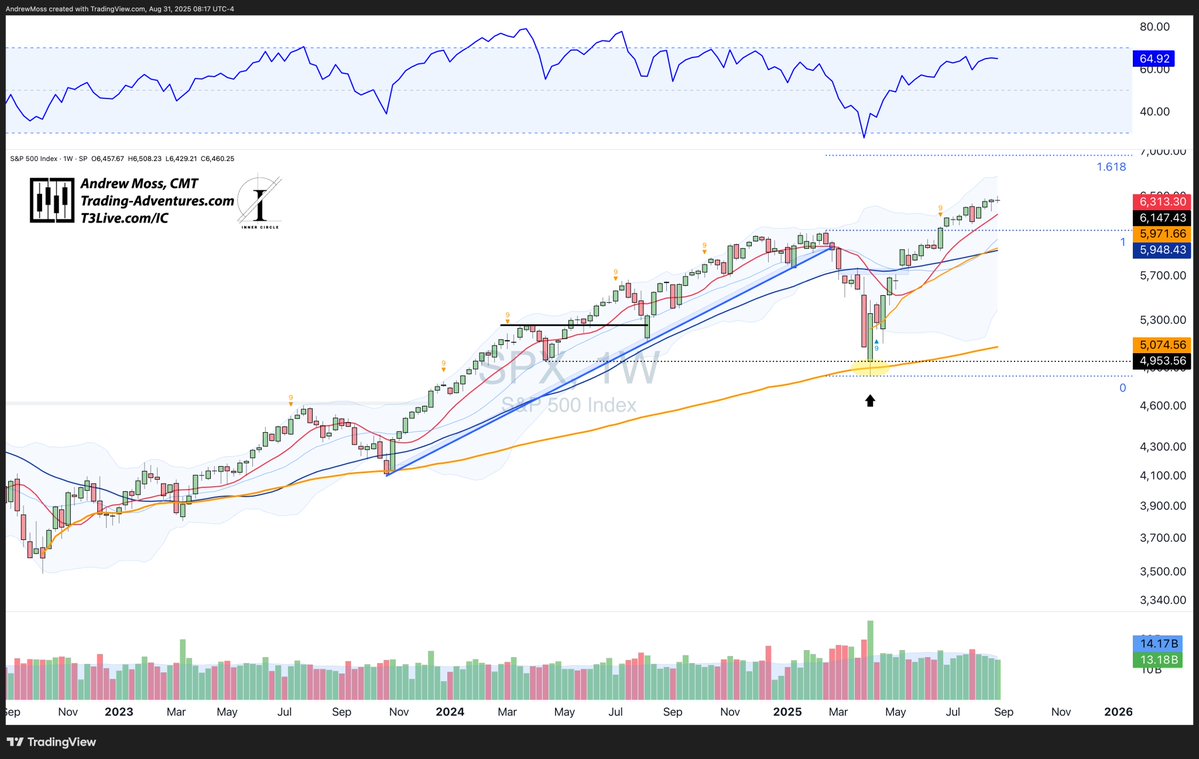

$SPX

$SPX

$SPX finished the week flat—open matched close—printing a weekly doji just under the 1.618 extension.

$SPX finished the week flat—open matched close—printing a weekly doji just under the 1.618 extension.

$SPX - tapped the 10-week MA early, bounced, and closed above both the new 4-week MA and the AVWAP🟠 from its last 10-week test.

$SPX - tapped the 10-week MA early, bounced, and closed above both the new 4-week MA and the AVWAP🟠 from its last 10-week test.

$SPX with a big outside reversal candle taking it from new highs to down nearly to the 10-week MA -- a level we haven't been close to for about 60 days, and haven't traded below since April.

$SPX with a big outside reversal candle taking it from new highs to down nearly to the 10-week MA -- a level we haven't been close to for about 60 days, and haven't traded below since April.

$SPX with an inside week near the highs on good volume while bringing RSI back below 70.

$SPX with an inside week near the highs on good volume while bringing RSI back below 70.

$IWM gets the starting spot this week with a new all-time high weekly close.

$IWM gets the starting spot this week with a new all-time high weekly close.

$SPX

$SPX

$SPX starts it off with a small range and indecisive action.

$SPX starts it off with a small range and indecisive action.

$DIA gets the starting spot today as it flirts with a new weekly all-time closing high. Missed by half a point.

$DIA gets the starting spot today as it flirts with a new weekly all-time closing high. Missed by half a point.

$QQQ spent another week testing the 40-week MA, but could not move above.

$QQQ spent another week testing the 40-week MA, but could not move above.

$QQQ has exceeded the -20% drawdown mark (~$432), closing the week very close to the August pivot low.

$QQQ has exceeded the -20% drawdown mark (~$432), closing the week very close to the August pivot low.

$QQQ bounced from the 10-week MA up to a new closing high $1 below the pivot high from mid-December.

$QQQ bounced from the 10-week MA up to a new closing high $1 below the pivot high from mid-December.

$SPX with a strong bounce from the Aug. low AVWAP🟠and the trendline.

$SPX with a strong bounce from the Aug. low AVWAP🟠and the trendline.

$SPX moved into the lower half of the Bollinger Bands, nearly touching the August low AVWAP🟠

$SPX moved into the lower half of the Bollinger Bands, nearly touching the August low AVWAP🟠

$SPX has an inside week, resting on the 10-week MA. RSI remains bullish, while the weekly volume was about half the average.

$SPX has an inside week, resting on the 10-week MA. RSI remains bullish, while the weekly volume was about half the average.

Now moving to $QQQ

Now moving to $QQQ