I YR return Asset bull cases part 1

SPX

SPX has a trailing earnings yield of 4% with expected 1 year earnings growth of 11.7%. What's the bull case? For me the bull case is a combination of simply collecting the earnings accrual

SPX

SPX has a trailing earnings yield of 4% with expected 1 year earnings growth of 11.7%. What's the bull case? For me the bull case is a combination of simply collecting the earnings accrual

and having the multiple expand slightly. In that case a 16% return would occur which is roughly 1 std higher and happens 1 out of 6 timer.

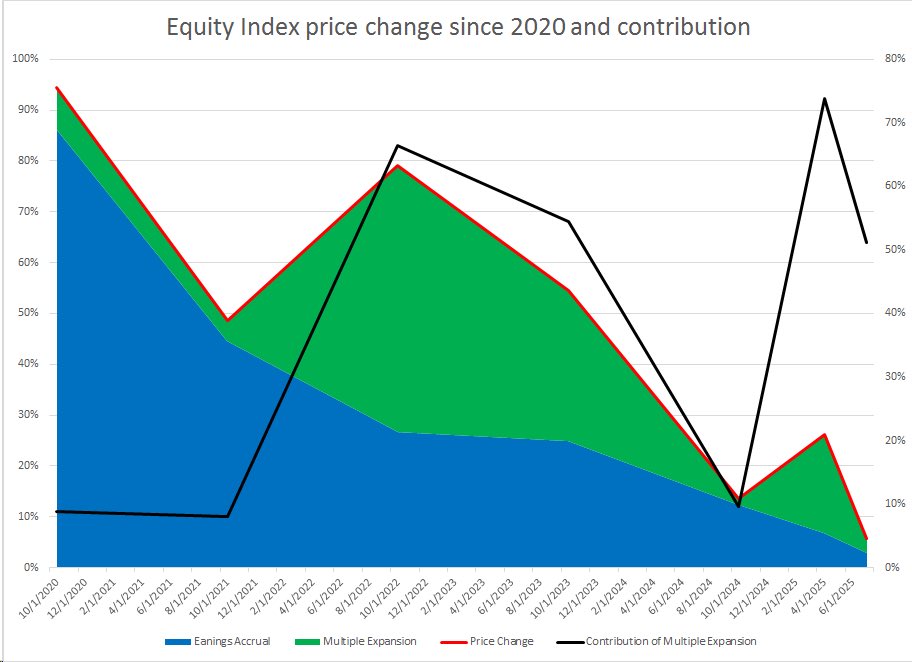

The big driver of equity returns is the accrual of earnings. Over the last 5 years earnings accrual has dominated historic returns

The big driver of equity returns is the accrual of earnings. Over the last 5 years earnings accrual has dominated historic returns

As long as companies continue to grow earnings they will go up over the long term.

Multiples rise and fall and as can be seen in the chart can dominate performance of equities in the short term. Furthermore multiples are impacted by interest rates

Multiples rise and fall and as can be seen in the chart can dominate performance of equities in the short term. Furthermore multiples are impacted by interest rates

and secular changes in composition of industry but are also highly impacted by earnings expectations. Meaning while actually accrued earnings dominates long term returns expectations of earnings growth both short and long term are reflected in multiples.

Multiples are also impacted by various other forms of what I refer to as risk premium which P/E's expand when money is easy and risk is low and contract when money is tight and risk is high.

Which gives the bullish framework to be bullish equities one needs to believe

1. Earnings will accrue as expected

2. Earnings accrual expectations will rise

3. Risk premiums will contract /PE's expand

All three matter but the long term tailwind is # 1

1. Earnings will accrue as expected

2. Earnings accrual expectations will rise

3. Risk premiums will contract /PE's expand

All three matter but the long term tailwind is # 1

The trailing 12 months have delivered earnings accrual growth of 12.5% YoY Quite a tailwind

Analysts project a similar earnings accrual growth of 11.7% for the next twelve months. Which is quite a tailwind as well

Analysts project a similar earnings accrual growth of 11.7% for the next twelve months. Which is quite a tailwind as well

A year from now if things just sort of go as expected stocks should earn 16% based on no change in multiple and current earnings yield and growth. Pretty sweet bull case basic tailwind for sure.

Earnings multiples are pretty elevated though. While there are many factors at

Earnings multiples are pretty elevated though. While there are many factors at

Play assuming earnings deliver as expected multiples would have to contract by 12% for equity price returns to simply match cash. Current trailing multiple is 25x which is pretty elevated but it would have to fall to roughly 22 to match cash if earnings deliver.

The bull case is pretty easy. Ride the expected earnings accrual tailwind.

OTOH realized earnings growth has been very strong for the last 5 years. Which makes me wonder if the tailwind will deliver or not.

OTOH realized earnings growth has been very strong for the last 5 years. Which makes me wonder if the tailwind will deliver or not.

The trailing 5 year earnings growth which is mostly projected to remain about the same in the foreseeable future depended on

1. Highly stimulative deficit growth in 2020 and 2021, leading to a robust wealth and income cycle

2. Deficit growth = corporate profit growth

1. Highly stimulative deficit growth in 2020 and 2021, leading to a robust wealth and income cycle

2. Deficit growth = corporate profit growth

3. Monetary conditions that were not able to tighten as every tempest in a teacup or downward blip in the market was met with rapid emergency easing by policymakers

4. AI spending and consumption

The bull case assumes all of these things will remain true.

4. AI spending and consumption

The bull case assumes all of these things will remain true.

In plain fact the

1 and 2) deficit level is high but it's change is negative and that is what matters to earning growth so that's a headwind which makes the expected earnings growth vulnerable

3) inflation is NOT dead yet and monetary conditions need to ease more than priced

1 and 2) deficit level is high but it's change is negative and that is what matters to earning growth so that's a headwind which makes the expected earnings growth vulnerable

3) inflation is NOT dead yet and monetary conditions need to ease more than priced

4) further AI investment needs to generate AI income to remain sustainable which means that income has to come from somewhere which means less income for other companies

Anyway the bull case is easy. Keep earnings growth high and financial conditions easy and double digit

Anyway the bull case is easy. Keep earnings growth high and financial conditions easy and double digit

Returns are in the bag.

The bull case is so easy that I just have to at least mention the bear case. Without fiscal deficit increase and frankly with tariffs reducing the deficit the deficit=corporate profits equation reverses. Now sticking with the bull case

The bull case is so easy that I just have to at least mention the bear case. Without fiscal deficit increase and frankly with tariffs reducing the deficit the deficit=corporate profits equation reverses. Now sticking with the bull case

Private sector leverage is very low (though claims on future Leveraging up to fund AI capex are ginourmous and built into earnings) so it's possible that a leveraging up by corporations and consumers can generate late cycle profit growth. The fiscal side is a headwind

to profits. That can change with a stroke of the Supreme courts pen I guess but current policy is a headwind of equities. Nonetheless even earnings growth of half of expectations is a pretty sweet tailwind for equities which all else equal would still outperform cash

• • •

Missing some Tweet in this thread? You can try to

force a refresh