🧵 Thread: How the silver market broke (2025 edition)

1. The calm before the storm

The global silver market had already been under strain for years. According to one analysis, from 2021 onward demand exceeded supply by ~678 million ounces.

Silver is unlike gold: much of its supply comes as a by-product of mining other metals. So it doesn’t respond as quickly to price signals.

On the demand side: industrial uses (especially solar power) are growing. Silver is used in photovoltaic cells, electronics etc.

On the investor side: With global uncertainty, inflation, weak dollar talk, precious metals were increasingly in focus.

So we had a market that was already stretched — then the spark hit.

1. The calm before the storm

The global silver market had already been under strain for years. According to one analysis, from 2021 onward demand exceeded supply by ~678 million ounces.

Silver is unlike gold: much of its supply comes as a by-product of mining other metals. So it doesn’t respond as quickly to price signals.

On the demand side: industrial uses (especially solar power) are growing. Silver is used in photovoltaic cells, electronics etc.

On the investor side: With global uncertainty, inflation, weak dollar talk, precious metals were increasingly in focus.

So we had a market that was already stretched — then the spark hit.

2. India says: “Let’s load up on silver for the goddess”

In India, investors and consumers shifted part of their traditional festival buying away from gold → silver. Why? Because gold had run up so high, and people were looking for the next leg (and the social-media push on silver was strong).

One quoted dealer in India said: “I have never seen these kind of premiums … people who are dealing silver and silver coins, they’re literally out of stock.”

Premiums in India on silver above international rates, which are normally minimal, started climbing. Indian imports of silver fell ~42% in 2025 through August, even as demand surged.

Brown-note sarcasm: Yes, you heard it right — instead of “I’ll buy gold this festive season,” many went “Hmm, silver’s the under-dog, let’s go silver.” The under-dog turned into the scarce-dog.

In India, investors and consumers shifted part of their traditional festival buying away from gold → silver. Why? Because gold had run up so high, and people were looking for the next leg (and the social-media push on silver was strong).

One quoted dealer in India said: “I have never seen these kind of premiums … people who are dealing silver and silver coins, they’re literally out of stock.”

Premiums in India on silver above international rates, which are normally minimal, started climbing. Indian imports of silver fell ~42% in 2025 through August, even as demand surged.

Brown-note sarcasm: Yes, you heard it right — instead of “I’ll buy gold this festive season,” many went “Hmm, silver’s the under-dog, let’s go silver.” The under-dog turned into the scarce-dog.

3. The supply-chain & global arbitrage got squeezed

As India and others clambered for physical metal, supply chains began creaking. One big point: physical inventories in the global hubs (particularly London) fell dangerously.

One key condition: Although large amounts of silver exist in warehouses (e.g., in New York), not all of it is immediately deliverable to the points of demand (London, India).

So you could have “tons of silver” but still a shortage of usable supply.

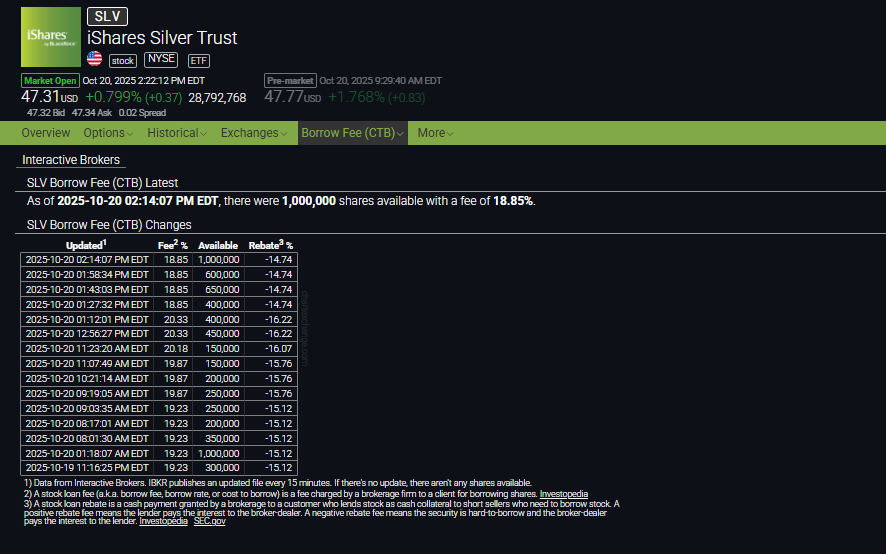

Example: Leasing or borrowing silver in London became wildly expensive because metal was simply not available to lend. One commentator says overnight borrowing rates spiked. Business Standard+1

The perfect storm ingredients:

Festival demand in India

Industrial demand (solar etc)

Investment demand (ETFs, hedge funds)

Limited physical supply + logistical delays → large premiums and shortages

As India and others clambered for physical metal, supply chains began creaking. One big point: physical inventories in the global hubs (particularly London) fell dangerously.

One key condition: Although large amounts of silver exist in warehouses (e.g., in New York), not all of it is immediately deliverable to the points of demand (London, India).

So you could have “tons of silver” but still a shortage of usable supply.

Example: Leasing or borrowing silver in London became wildly expensive because metal was simply not available to lend. One commentator says overnight borrowing rates spiked. Business Standard+1

The perfect storm ingredients:

Festival demand in India

Industrial demand (solar etc)

Investment demand (ETFs, hedge funds)

Limited physical supply + logistical delays → large premiums and shortages

4. Global markets: The stress reveals itself

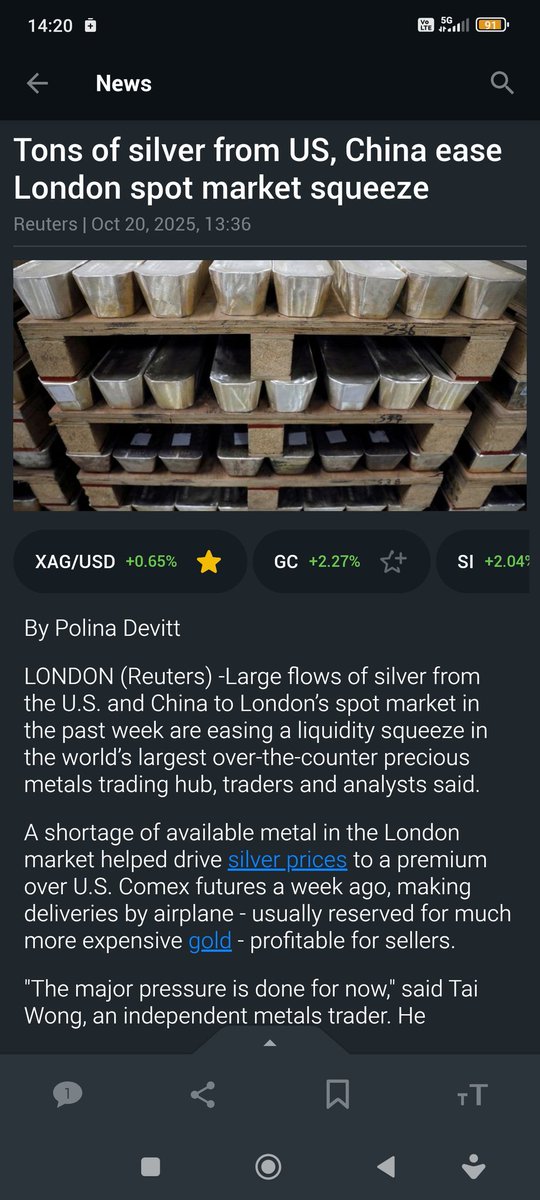

According to reports: The hub of the global price-setting market for silver, London, was described as “all but broken”.

Even major banks started stepping back from quoting prices/facilitating trades.

Spot silver pricing: Reports indicate prices in London reached highs above US$53–54 per ounce in mid-October 2025.

Premiums: In India, physical premiums rose dramatically. Some silver inventories dried up. Some ETFs in India even paused new subscriptions because they couldn’t get physical silver to back them.

According to reports: The hub of the global price-setting market for silver, London, was described as “all but broken”.

Even major banks started stepping back from quoting prices/facilitating trades.

Spot silver pricing: Reports indicate prices in London reached highs above US$53–54 per ounce in mid-October 2025.

Premiums: In India, physical premiums rose dramatically. Some silver inventories dried up. Some ETFs in India even paused new subscriptions because they couldn’t get physical silver to back them.

5. Why “it broke” (and yes, that’s dramatic)

With supply so tight, the mismatch between “paper silver” (futures, ETFs) and “physical silver” (bars, coins, deliverables) widened.

That’s dangerous because futures/settlement assume physical deliverability.

When borrowing/leasing costs go haywire (because lenders have little to lend), and when physical supply is constrained, the whole market structure can become stressed.

This is analogous to past squeezes (e.g., the 1980 Hunt brothers) though the triggers

The fact that new subscriptions to silver ETFs were halted in India signals a market that recognized physical supply was constrained. (You can’t promise “backed by physical metal” if you can’t get the metal.)

“There is more or less little to no liquidity actually available … we have basically stopped all silver intake that is not committed contractually.” — market participant.

With supply so tight, the mismatch between “paper silver” (futures, ETFs) and “physical silver” (bars, coins, deliverables) widened.

That’s dangerous because futures/settlement assume physical deliverability.

When borrowing/leasing costs go haywire (because lenders have little to lend), and when physical supply is constrained, the whole market structure can become stressed.

This is analogous to past squeezes (e.g., the 1980 Hunt brothers) though the triggers

The fact that new subscriptions to silver ETFs were halted in India signals a market that recognized physical supply was constrained. (You can’t promise “backed by physical metal” if you can’t get the metal.)

“There is more or less little to no liquidity actually available … we have basically stopped all silver intake that is not committed contractually.” — market participant.

6. Key numbers & signals (for the record)

Silver price touched ~$53.55 per ounce in mid-October 2025. Business Insider+2Yahoo Finance+2

India’s imports of silver fell ~42% through August 2025 vs prior year, even while domestic demand surged.

Supply deficit: According to one analysis, the 2025 silver supply-demand deficit is projected at ~118–149 million ounces.

Lease/borrowing rates and premiums: Overnight and short-term borrowing of silver reportedly soared, signaling physical stress.

Indian ETF houses halting new subscriptions to silver funds.

Silver price touched ~$53.55 per ounce in mid-October 2025. Business Insider+2Yahoo Finance+2

India’s imports of silver fell ~42% through August 2025 vs prior year, even while domestic demand surged.

Supply deficit: According to one analysis, the 2025 silver supply-demand deficit is projected at ~118–149 million ounces.

Lease/borrowing rates and premiums: Overnight and short-term borrowing of silver reportedly soared, signaling physical stress.

Indian ETF houses halting new subscriptions to silver funds.

7. Why does this matter (and why should you care)

For investors: It shows that physical supply constraints matter. It’s one thing for prices to rise because demand is up; but when supply cannot deliver, you get structural strains and higher risk.

For consumers/jewellers (especially in India): Traditional buying patterns (coins, jewellery for festivals) got disrupted. Price premiums, availability issues, all came into play.

For markets: The separation between “paper” and “physical” incommodities is dangerous.

If deliverability becomes constrained, the system can experience stress (liquidity issues, wide bid-ask spreads, banks stepping back).

For regulators/industry watchers: Sit-ups. The market conditions resemble squeeze-like behavior not seen in decades. Researchers are issuing warnings.

For investors: It shows that physical supply constraints matter. It’s one thing for prices to rise because demand is up; but when supply cannot deliver, you get structural strains and higher risk.

For consumers/jewellers (especially in India): Traditional buying patterns (coins, jewellery for festivals) got disrupted. Price premiums, availability issues, all came into play.

For markets: The separation between “paper” and “physical” incommodities is dangerous.

If deliverability becomes constrained, the system can experience stress (liquidity issues, wide bid-ask spreads, banks stepping back).

For regulators/industry watchers: Sit-ups. The market conditions resemble squeeze-like behavior not seen in decades. Researchers are issuing warnings.

8. A little sarcasm & caveats

So yes, next time someone says “silver is cheap because it’s $50 and gold is $4,000”, you can respond: “Sure — *provided you can find any physical silver to buy.”

No — it’s not just about speculative raving. The fundamentals (industrial demand, supply deficits) are real. But the surprise comes from how tight things became so quickly.

Caveat: Just because supply is tight now doesn’t guarantee perpetual price-rise. Markets can adjust: new mine output, recycling, substitution, policy interventions.

The “squeeze” may ease (and the premiums fall). In fact, one article says the physical tightness in London may not last long.

So yes, next time someone says “silver is cheap because it’s $50 and gold is $4,000”, you can respond: “Sure — *provided you can find any physical silver to buy.”

No — it’s not just about speculative raving. The fundamentals (industrial demand, supply deficits) are real. But the surprise comes from how tight things became so quickly.

Caveat: Just because supply is tight now doesn’t guarantee perpetual price-rise. Markets can adjust: new mine output, recycling, substitution, policy interventions.

The “squeeze” may ease (and the premiums fall). In fact, one article says the physical tightness in London may not last long.

9. So what happens next?

Some analysts (e.g., Bank of America) see silver target ~$65/oz next year (from ~$53) given the conditions.

Others caution: When physical supply is constrained and premiums big, volatility rises — risk of sharp falls if expectations don’t pan out. (Think: what if demand softens or supply loosens.)

For India: If the festival buying passes its peak, if silver becomes “less special” than gold again, or if imports rise, we might see the physical shortage part ease.

For global markets: Watch delivery data, lease-rates, inventories in London & COMEX, premiums vs spot, splits between “investment” demand vs “industrial / jewellery” demand.

Some analysts (e.g., Bank of America) see silver target ~$65/oz next year (from ~$53) given the conditions.

Others caution: When physical supply is constrained and premiums big, volatility rises — risk of sharp falls if expectations don’t pan out. (Think: what if demand softens or supply loosens.)

For India: If the festival buying passes its peak, if silver becomes “less special” than gold again, or if imports rise, we might see the physical shortage part ease.

For global markets: Watch delivery data, lease-rates, inventories in London & COMEX, premiums vs spot, splits between “investment” demand vs “industrial / jewellery” demand.

10.

In short:

A cocktail of factors (festival buying in India, industrial use, investor demand, supply constraints) created a perfect storm in the silver market.

Physical supply became so tight that the structure of the market (borrowing, deliverability, inventory) was stressed.

Prices spiked, premiums widened, ETFs paused new inflows, and dealers/jewellers faced shortages.

The situation resembles major “squeeze” events in commodity history — only difference: this one appears more structural (industrial + investment driven) rather than just speculative cornering.

Whether this upward trajectory will continue depends on supply, demand, and deliverability adjustments.

#SilverSqueeze #SilverCrisis #SilverShortage

In short:

A cocktail of factors (festival buying in India, industrial use, investor demand, supply constraints) created a perfect storm in the silver market.

Physical supply became so tight that the structure of the market (borrowing, deliverability, inventory) was stressed.

Prices spiked, premiums widened, ETFs paused new inflows, and dealers/jewellers faced shortages.

The situation resembles major “squeeze” events in commodity history — only difference: this one appears more structural (industrial + investment driven) rather than just speculative cornering.

Whether this upward trajectory will continue depends on supply, demand, and deliverability adjustments.

#SilverSqueeze #SilverCrisis #SilverShortage

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh