🧵 SILVER MARKET CRISIS 2025 — “THE UNRAVELING”

1️⃣

London is out of silver.

Even Metals Focus (LBMA consultancy) admits:

“Short-term lease rates surged to 200%...

backwardation at record highs... shortage of unallocated metal in London.”

Unprecedented.

1️⃣

London is out of silver.

Even Metals Focus (LBMA consultancy) admits:

“Short-term lease rates surged to 200%...

backwardation at record highs... shortage of unallocated metal in London.”

Unprecedented.

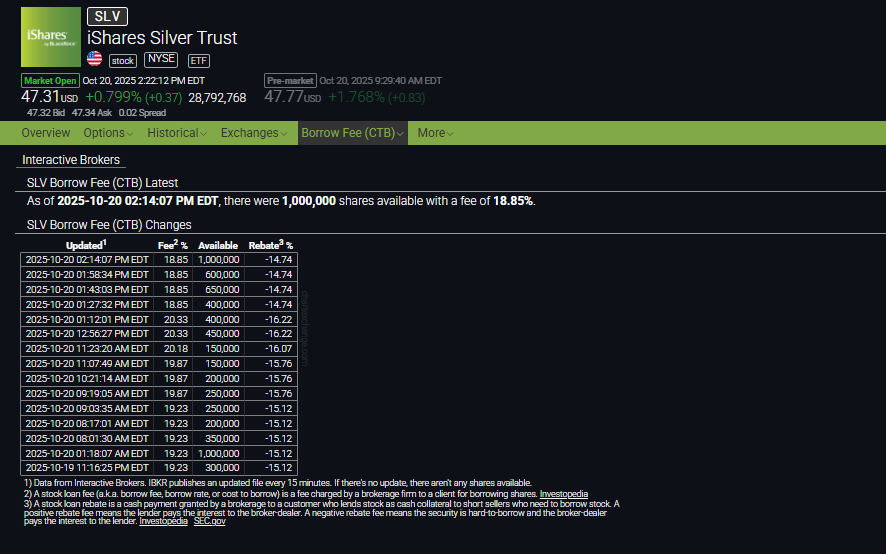

2️⃣

83% of all silver in London vaults is now locked inside ETFs.

Fully allocated.

➡️ Meaning: it can’t be leased, traded, or used to settle industrial or COMEX obligations.

Paper silver can’t find metal.

83% of all silver in London vaults is now locked inside ETFs.

Fully allocated.

➡️ Meaning: it can’t be leased, traded, or used to settle industrial or COMEX obligations.

Paper silver can’t find metal.

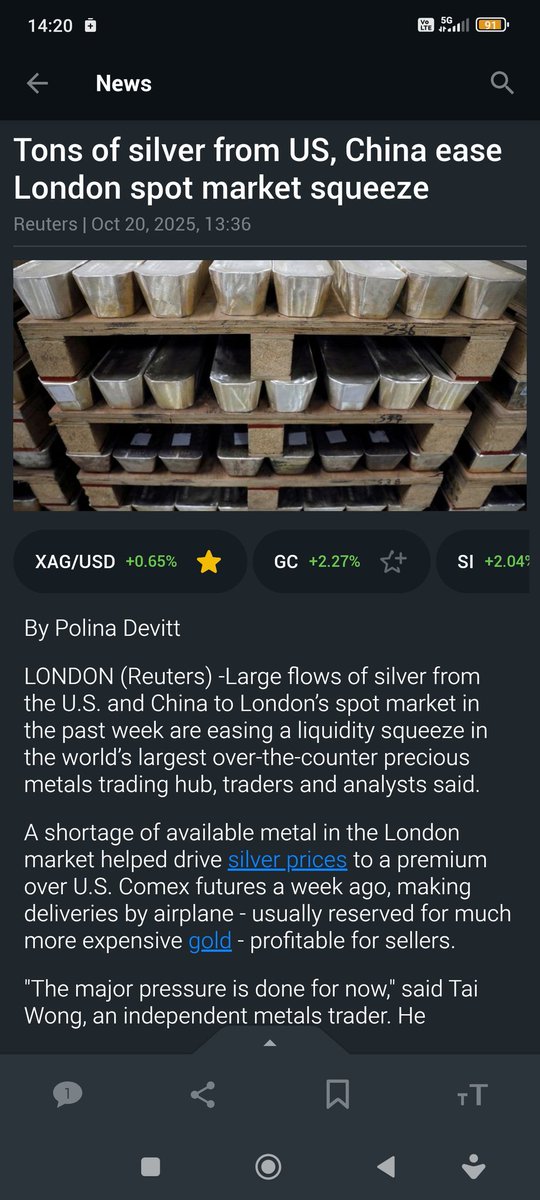

3️⃣

LBMA needs 150 million oz to restore “normality.”

That’s 88% of the entire COMEX registered vault silver.

Let that sink in.

To defend sub-$60 silver, London must airlift U.S. silver — by chartered planes.

LBMA needs 150 million oz to restore “normality.”

That’s 88% of the entire COMEX registered vault silver.

Let that sink in.

To defend sub-$60 silver, London must airlift U.S. silver — by chartered planes.

4️⃣

The squeeze is global:

🇮🇳 India’s festival season triggered a buying stampede.

Refineries ran out of stock.

Premiums hit record highs.

26 million oz imported in September — with more coming.

Silver is vanishing.

The squeeze is global:

🇮🇳 India’s festival season triggered a buying stampede.

Refineries ran out of stock.

Premiums hit record highs.

26 million oz imported in September — with more coming.

Silver is vanishing.

5️⃣

Meanwhile, U.S. COMEX vaults are drained.

CME stocks down 19 million oz from peak.

Tariff fears, refinery bottlenecks, and lack of high-grade recycling keep inventories tight.

This is not a one-off event. It’s structural.

Meanwhile, U.S. COMEX vaults are drained.

CME stocks down 19 million oz from peak.

Tariff fears, refinery bottlenecks, and lack of high-grade recycling keep inventories tight.

This is not a one-off event. It’s structural.

6️⃣

Deficit since 2021.

780 million oz already drawn down from above-ground stocks.

No rebuilding in sight.

Metals Focus predicts another deficit for 2026.

The system is bleeding ounces.

Deficit since 2021.

780 million oz already drawn down from above-ground stocks.

No rebuilding in sight.

Metals Focus predicts another deficit for 2026.

The system is bleeding ounces.

7️⃣

James Anderson (SD Bullion):

“Silver has been systemically suppressed.

We’re witnessing the unraveling of that old pricing system.

$50 silver will become support for triple-digit silver.”

James Anderson (SD Bullion):

“Silver has been systemically suppressed.

We’re witnessing the unraveling of that old pricing system.

$50 silver will become support for triple-digit silver.”

8️⃣

He predicts:

💥 $60–70/oz by end of year possible.

💥 $100+ within 1–2 years likely.

Silver will follow gold’s rerating — and shock the world.

He predicts:

💥 $60–70/oz by end of year possible.

💥 $100+ within 1–2 years likely.

Silver will follow gold’s rerating — and shock the world.

9️⃣

“London created this mess.

For decades it was an insider club.

Now it’s unraveling in real time.

When this blows up, the world will finally see how fake the ‘free market’ really was.” — J. Anderson

“London created this mess.

For decades it was an insider club.

Now it’s unraveling in real time.

When this blows up, the world will finally see how fake the ‘free market’ really was.” — J. Anderson

1⃣0️⃣

Fear of missing out is spreading.

Global bullion dealers report one of the strongest buying months in history.

People are moving from digital illusions to physical truth.

Fear of missing out is spreading.

Global bullion dealers report one of the strongest buying months in history.

People are moving from digital illusions to physical truth.

1⃣1️⃣

Gold already doubled since 2020.

Jamie Dimon now mentions $10 000 gold as “reasonable.”

If gold rerates, silver follows — fast.

Ratio 79:1 won’t last.

Gold already doubled since 2020.

Jamie Dimon now mentions $10 000 gold as “reasonable.”

If gold rerates, silver follows — fast.

Ratio 79:1 won’t last.

1⃣2️⃣

“A kilo of silver costs like an iPhone.

Everyone can afford one.

In 5 years, its value will shock you.”

— J. Anderson

“A kilo of silver costs like an iPhone.

Everyone can afford one.

In 5 years, its value will shock you.”

— J. Anderson

1⃣3️⃣

Silver has broken records in 158 of 163 currencies.

Only five fiat “bosses” remain — CHF among them.

Physical stackers are winning the long game.

Silver has broken records in 158 of 163 currencies.

Only five fiat “bosses” remain — CHF among them.

Physical stackers are winning the long game.

1⃣4️⃣

We are in the 5th consecutive year of deficit.

Shorts are running out of time.

Industry is competing with investors for the same ounces.

Tick… tock…

We are in the 5th consecutive year of deficit.

Shorts are running out of time.

Industry is competing with investors for the same ounces.

Tick… tock…

1⃣5️⃣

Silver is no longer just a monetary metal.

It’s critical infrastructure — powering EVs, solar, AI, defense, and medical tech.

This time, the shortage isn’t speculative. It’s existential.

Silver is no longer just a monetary metal.

It’s critical infrastructure — powering EVs, solar, AI, defense, and medical tech.

This time, the shortage isn’t speculative. It’s existential.

1⃣

“Silver’s rocket fuel is ready.

We’re sitting on a launch pad.”

And the countdown has begun. ⏳

#SilverSqueeze #SilverCrisis2025 #StackerLogic #PhysicalOnly #SilverStackers #Gold #COMEX #LBMA #India #CriticalMineral #EndGame

“Silver’s rocket fuel is ready.

We’re sitting on a launch pad.”

And the countdown has begun. ⏳

#SilverSqueeze #SilverCrisis2025 #StackerLogic #PhysicalOnly #SilverStackers #Gold #COMEX #LBMA #India #CriticalMineral #EndGame

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh