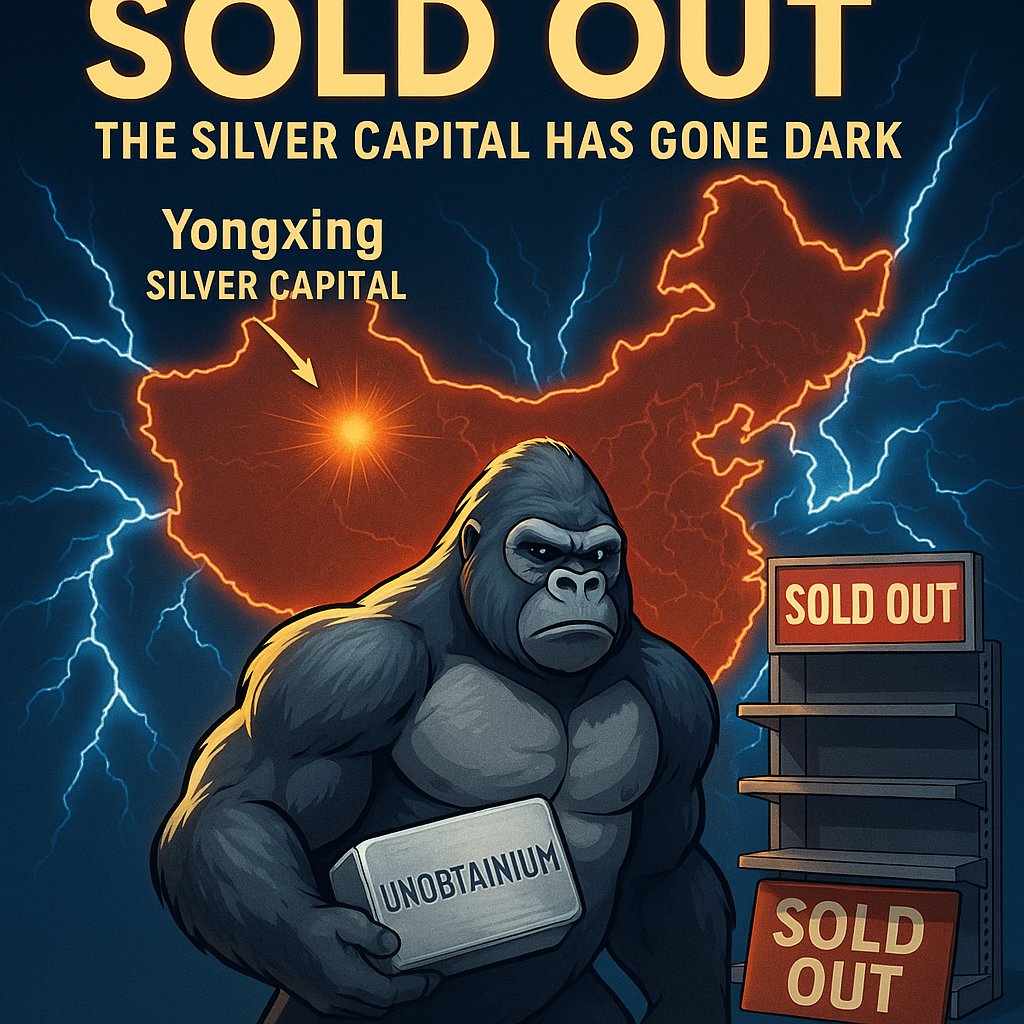

1️⃣ China is SOLD OUT.

In Yongxing, Hunan — the “Silver Capital” of China, producing ~¼ of the nation’s silver — most shops are completely out of investment silver.

Price per kilo jumped from 8,000 RMB → 13,000+ RMB.

That’s nearly +70% YTD. 🥈🇨🇳

In Yongxing, Hunan — the “Silver Capital” of China, producing ~¼ of the nation’s silver — most shops are completely out of investment silver.

Price per kilo jumped from 8,000 RMB → 13,000+ RMB.

That’s nearly +70% YTD. 🥈🇨🇳

2️⃣ This isn’t some local rumor.

Yongxing is the hub of China’s silver mining, refining, and trading.

When the source region itself reports empty shelves, it means one thing —⚠️ pressure across the entire chain from the mine to the final buyer.

Yongxing is the hub of China’s silver mining, refining, and trading.

When the source region itself reports empty shelves, it means one thing —⚠️ pressure across the entire chain from the mine to the final buyer.

https://x.com/oriental_ghost/status/1979871631876243559

3️⃣ Step-by-step logic:

Mining → Refining → Allocation (industry vs. retail).

When industry (solar, electronics) pulls harder,

👉 retail dries up

👉 premiums rise

👉 and the paper price stops reflecting reality.

Mining → Refining → Allocation (industry vs. retail).

When industry (solar, electronics) pulls harder,

👉 retail dries up

👉 premiums rise

👉 and the paper price stops reflecting reality.

4️⃣ That jump from 8k to 13k RMB/kg isn’t “market mood.”

It’s a signal of shortage.

At this stage, having metal in your hand matters more than watching charts on your screen.

#Unobtainium

It’s a signal of shortage.

At this stage, having metal in your hand matters more than watching charts on your screen.

#Unobtainium

5️⃣ China is the canary in the mine.

If the producer itself struggles to meet domestic demand,what happens to importers and the rest of the world?

This is where price discovery starts — from physical to paper, not the other way around.

If the producer itself struggles to meet domestic demand,what happens to importers and the rest of the world?

This is where price discovery starts — from physical to paper, not the other way around.

6️⃣ “But that’s just retail...”

Wrong.

If retail can’t get silver in the very place it’s mined and refined,that means the metal is being rerouted to industry — where the margins and contracts are bigger.

Retail is last in line, and it’s the first to vanish.

Wrong.

If retail can’t get silver in the very place it’s mined and refined,that means the metal is being rerouted to industry — where the margins and contracts are bigger.

Retail is last in line, and it’s the first to vanish.

7️⃣ What this tells stackers:

🔹 Focus on availability, not chasing the last dollar.

🔹 Kilo bars and standard sizes could be the first to disappear.

🔹 When physical runs out, paper won’t save anyone.

🔹 Focus on availability, not chasing the last dollar.

🔹 Kilo bars and standard sizes could be the first to disappear.

🔹 When physical runs out, paper won’t save anyone.

8️⃣ The 2025 setup:

A massive rotation from overleveraged paper to hard assets.

Once big players realize you can’t “click” deliveries into existence, the scramble begins.

That’s a world where every ounce speaks.

A massive rotation from overleveraged paper to hard assets.

Once big players realize you can’t “click” deliveries into existence, the scramble begins.

That’s a world where every ounce speaks.

9️⃣ Stacker discipline:

– Only physical.

– DCA & patience.

– Trusted dealers only.

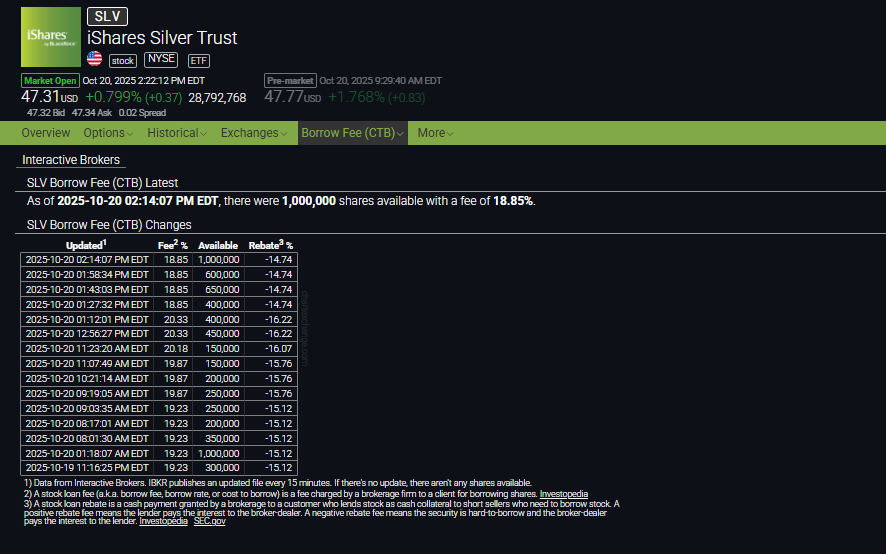

– React fast — availability changes by the hour, not by the quarter.

– And never kneel. Cheap words don’t buy expensive metal. 🦍

– Only physical.

– DCA & patience.

– Trusted dealers only.

– React fast — availability changes by the hour, not by the quarter.

– And never kneel. Cheap words don’t buy expensive metal. 🦍

🔟 Market psychology:

Price can swing.

But shortage is binary — either metal exists, or it doesn’t.

If it’s disappearing in the Silver Capital of China, the world just got the loudest wake-up call of the year. ⏰🥈

Price can swing.

But shortage is binary — either metal exists, or it doesn’t.

If it’s disappearing in the Silver Capital of China, the world just got the loudest wake-up call of the year. ⏰🥈

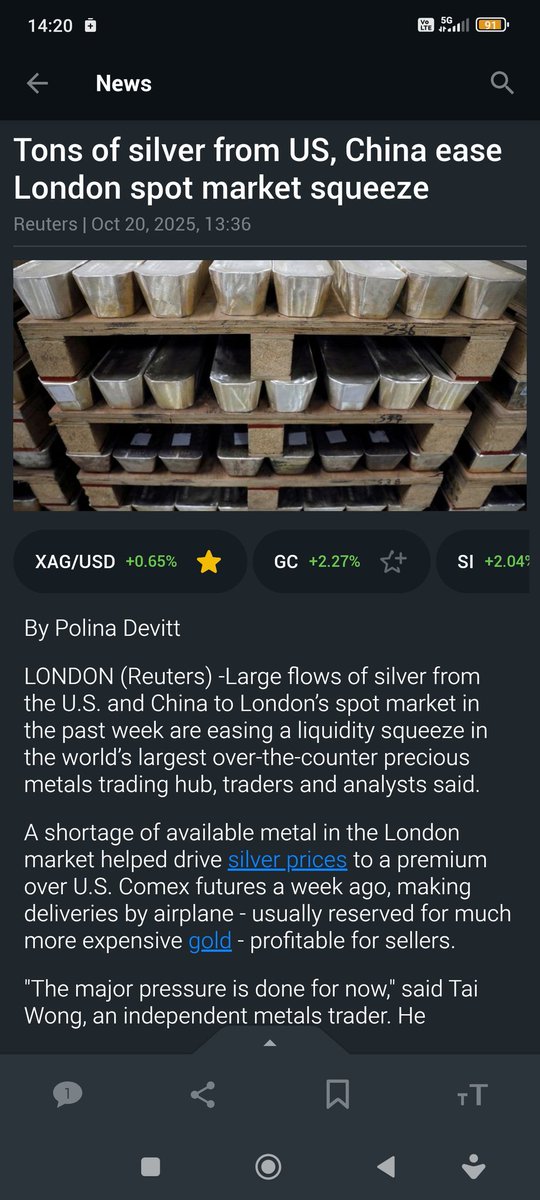

1⃣1⃣ Why it matters for the West:

Supply crunch at the source = export pressure, delivery delays, and soaring premiums.

The physical market will force its truth, no matter what the paper traders believe.

Supply crunch at the source = export pressure, delivery delays, and soaring premiums.

The physical market will force its truth, no matter what the paper traders believe.

1⃣2️⃣ Final thought:

This isn’t panic.

It’s warehouse reality.

You don’t hedge your future with tweets — you hedge it with ounces.

Hold the line. Build the wall of metal.

Price discovery is coming. ⚡️🥈

#Silver #SilverSqueeze #StackerLogic #PhysicalOverPaper #China #Unobtainium

This isn’t panic.

It’s warehouse reality.

You don’t hedge your future with tweets — you hedge it with ounces.

Hold the line. Build the wall of metal.

Price discovery is coming. ⚡️🥈

#Silver #SilverSqueeze #StackerLogic #PhysicalOverPaper #China #Unobtainium

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh