Last month, I was opportune to moderate the power sector panel session at the Northern Nigeria Investment and Industrialisation Summit 2025 at Ladi Conference centre Abuja. @NNIIS25

The summit theme is around unlocking opportunities in mining, power and agriculture.

Thread!!!

The summit theme is around unlocking opportunities in mining, power and agriculture.

Thread!!!

We had a series of panel discussions around power, agriculture and mining and some very interesting presentations from key industry stakeholders focusing on challenges and opportunities around the power sector.

Ahmed Rufai Zakari (Rep. of Future Energies Africa, owners of Kano Disco) delivered a presentation around Charting an achievable vision for Energy Security and Electricity Access in Northern Nigeria.

Highlights from the presentation.

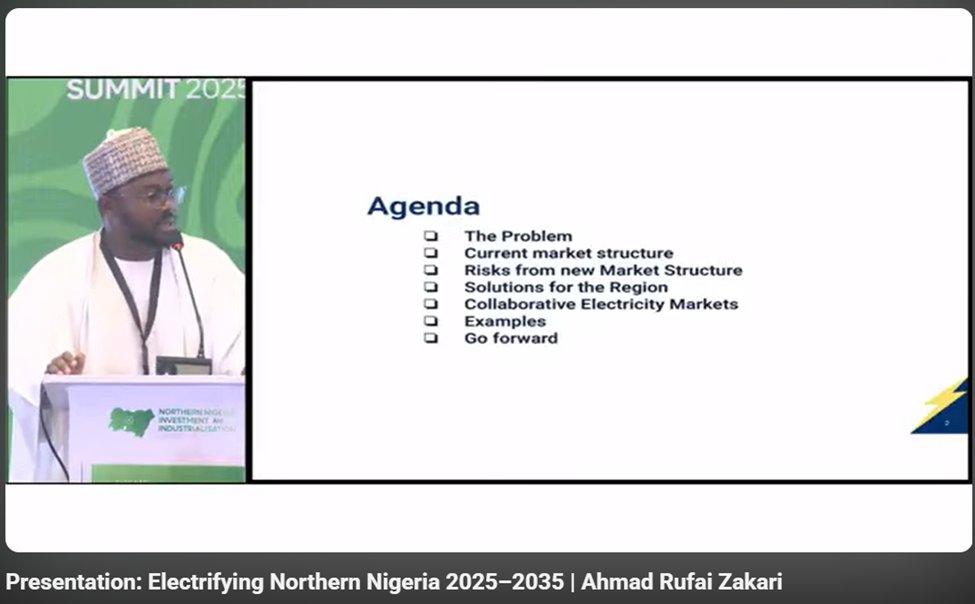

Lack of generation capacity in NW and NE. No states amongst the 2 region mentioned with over 100MW in generation capacity.

NC is slightly better due to availability of generation plans in Niger and Kogi.

Lack of generation capacity in NW and NE. No states amongst the 2 region mentioned with over 100MW in generation capacity.

NC is slightly better due to availability of generation plans in Niger and Kogi.

The north also harbours the largest populations of unelectrified citizens anywhere in the world.

This challenge also presents an opportunity in the region.

Absence of sufficient generation also leads to weak transmission coverage in the region.

This challenge also presents an opportunity in the region.

Absence of sufficient generation also leads to weak transmission coverage in the region.

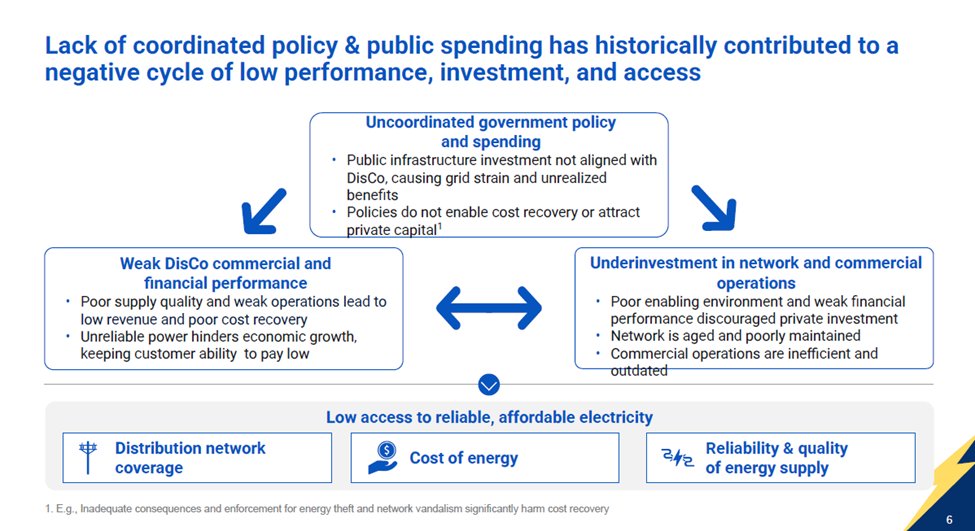

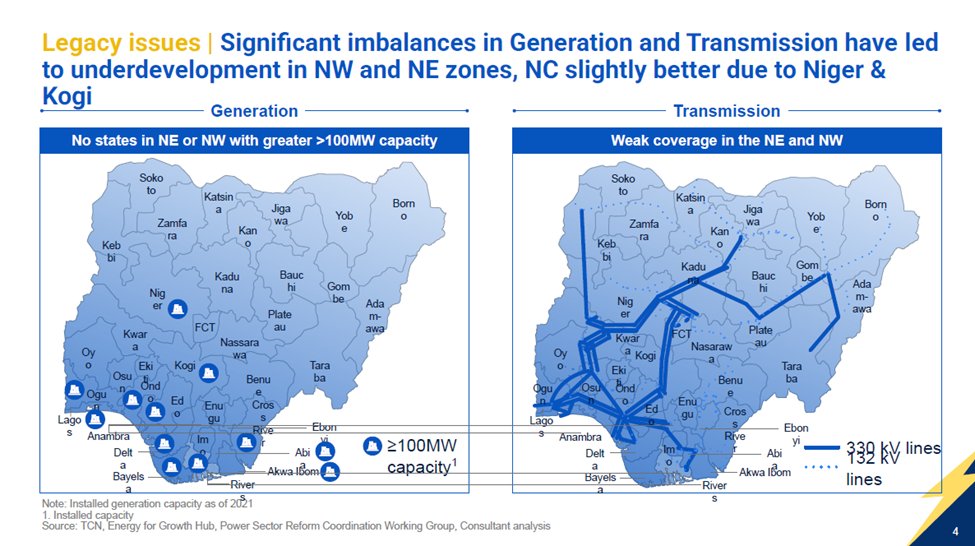

Some of the most obvious challenges are:

> Underinvestment

> Low commercial performance &

> Poor service quality

> Underinvestment

> Low commercial performance &

> Poor service quality

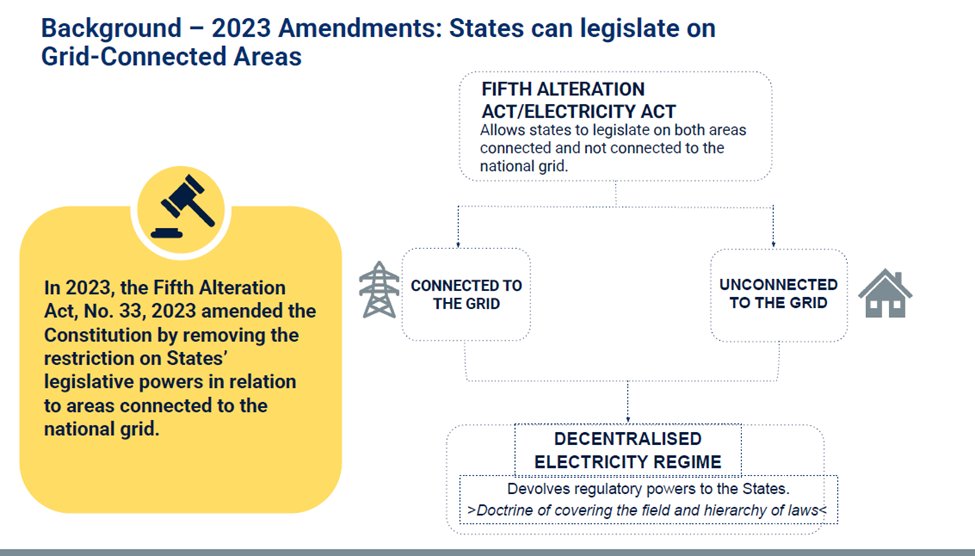

Another opportunity for state participation is the constitutional amendment that allows the state to regulate the activities of electricity in its region.

Ahmed also highlighted the risk and benefits associated with decentralization.

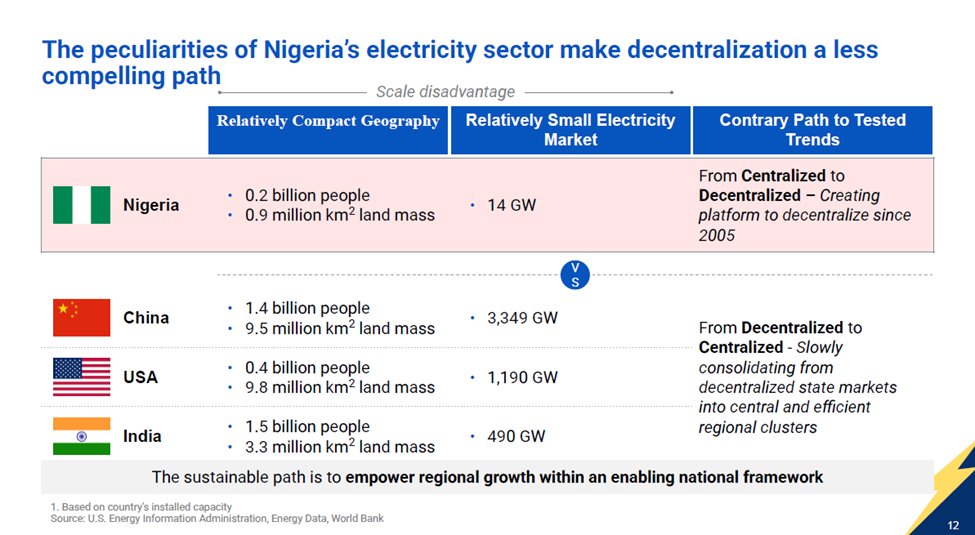

For electricity access = decentralization is good and perfect.

For industrialization purpose = centralization is good and more fit.

For electricity access = decentralization is good and perfect.

For industrialization purpose = centralization is good and more fit.

No country in the world industrialise on the backbone of small mini grid or solar home systems.

Economies of scale is very important in trying to achieve industrialization.

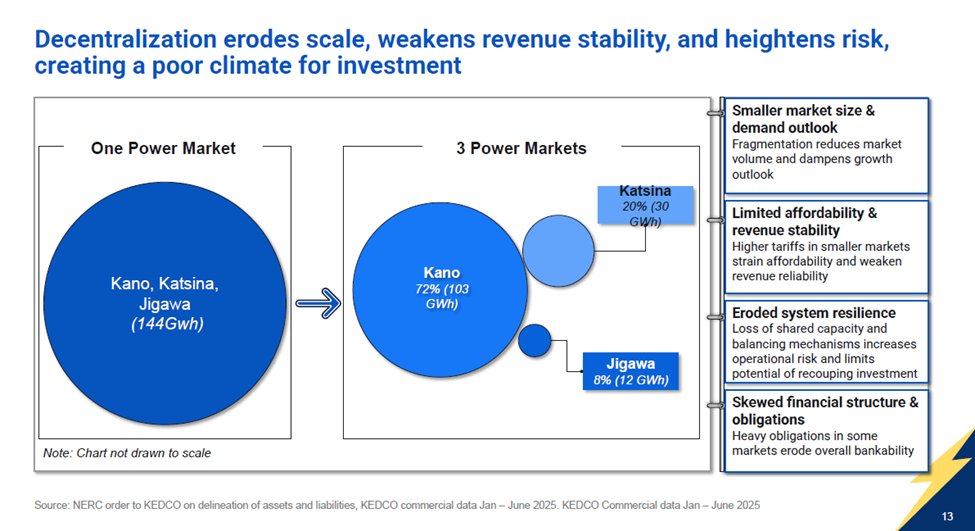

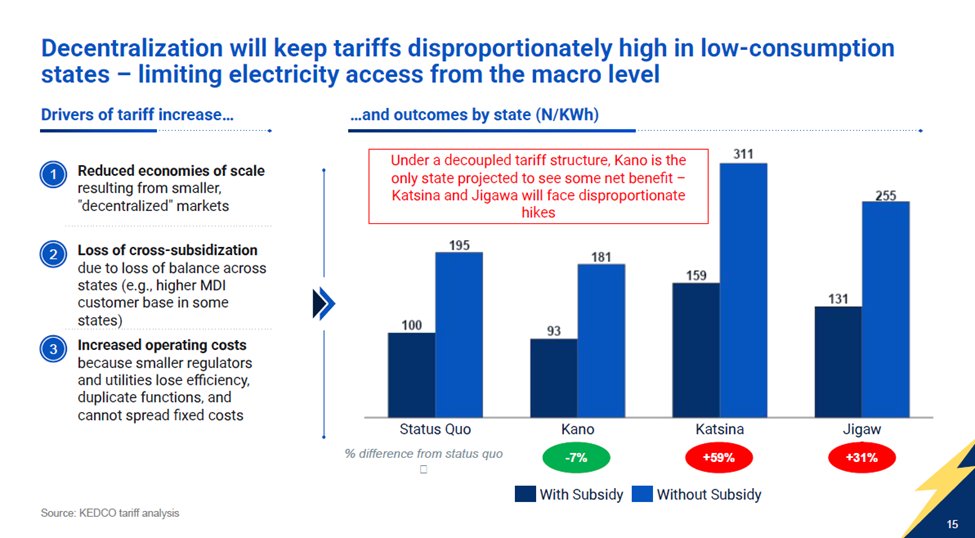

Another key risks with respect to decentralization, with specific focus on northern market.

Economies of scale is very important in trying to achieve industrialization.

Another key risks with respect to decentralization, with specific focus on northern market.

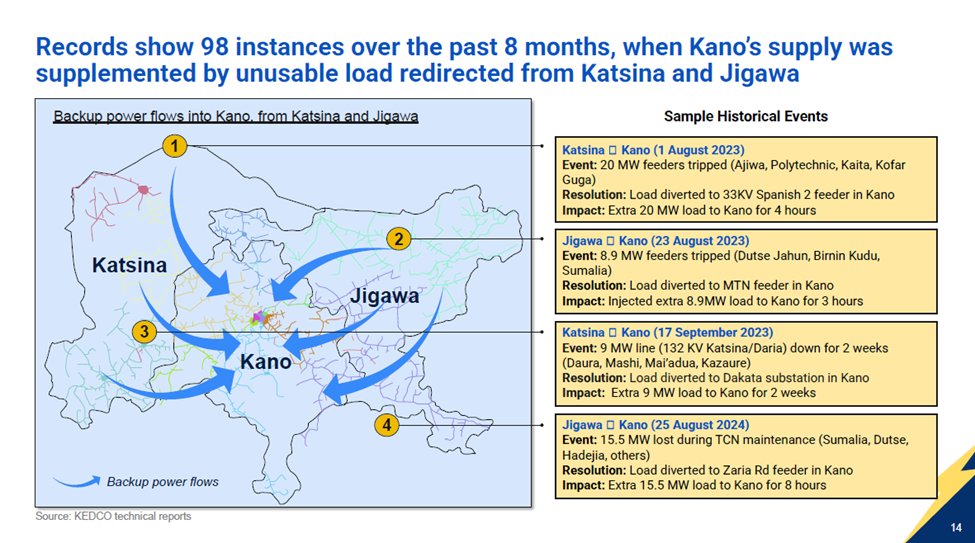

Ahmed presented historical events that show the importance of having a centralized or regionalized market.

Records show 98 instances in the past 8 months where katsina and Jigawa has assisted kano in ensuring steady supply.

Records show 98 instances in the past 8 months where katsina and Jigawa has assisted kano in ensuring steady supply.

Kano also helps katsina and Jigawa in terms of pricing because without Kano, electricity would be too expensive in Jigawa and katsina.

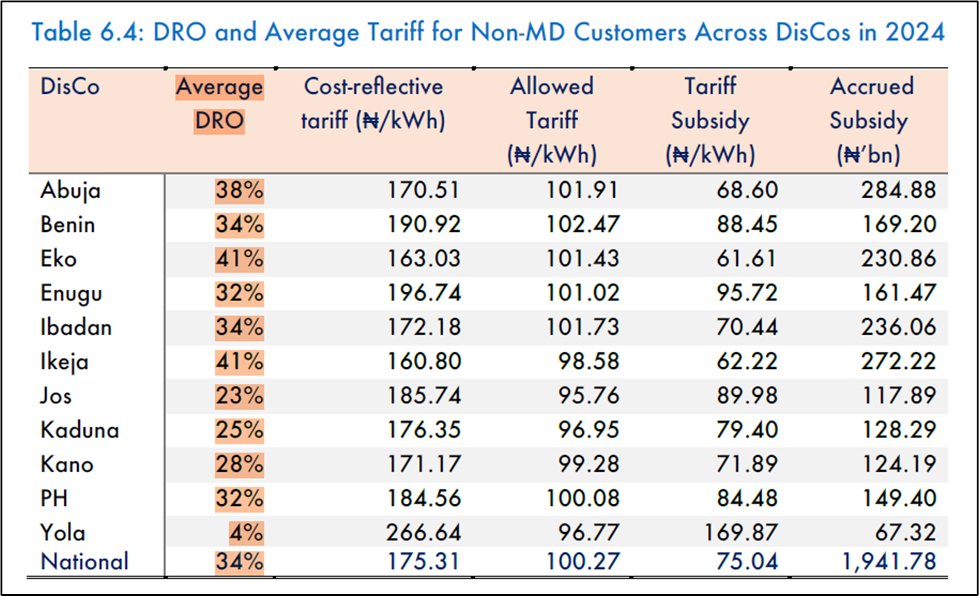

Without subsidy and in a decentralized market, the tariff in those 3 states would be:

Kano – N181/kwh

Katsina – N311/Kwh

Jigawa – N255/Kwh

Average – N195/Kwh

This data shows Kano is better off alone in terms of pricing but its needs katsina and Jigawa in terms of

Kano – N181/kwh

Katsina – N311/Kwh

Jigawa – N255/Kwh

Average – N195/Kwh

This data shows Kano is better off alone in terms of pricing but its needs katsina and Jigawa in terms of

network resilience to ensure availability of supply.

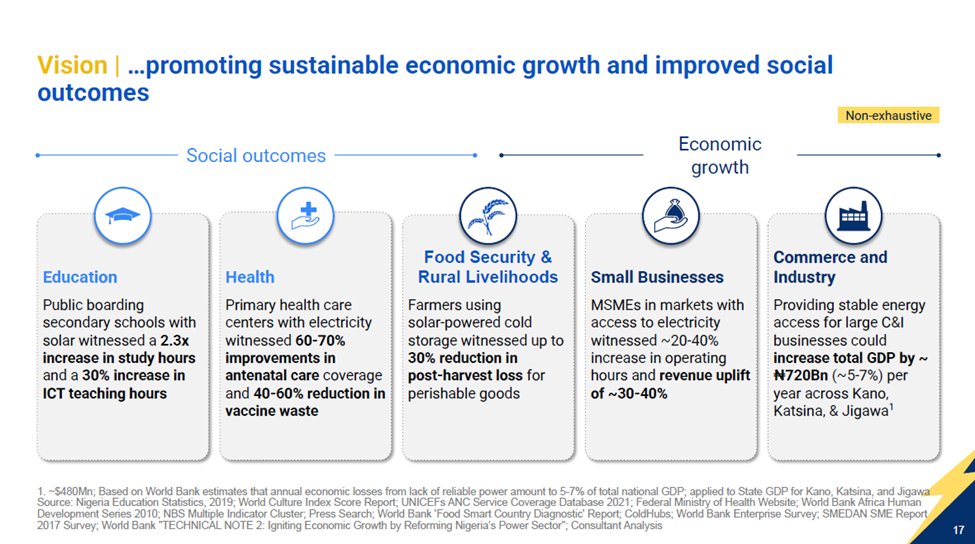

He separated the need for electrification in two aspect:

Social outcomes = Good for solar home system, solar mini grid, etc

Economic growth = Cheap energy to power businesses and industries by centralized grid structure

He separated the need for electrification in two aspect:

Social outcomes = Good for solar home system, solar mini grid, etc

Economic growth = Cheap energy to power businesses and industries by centralized grid structure

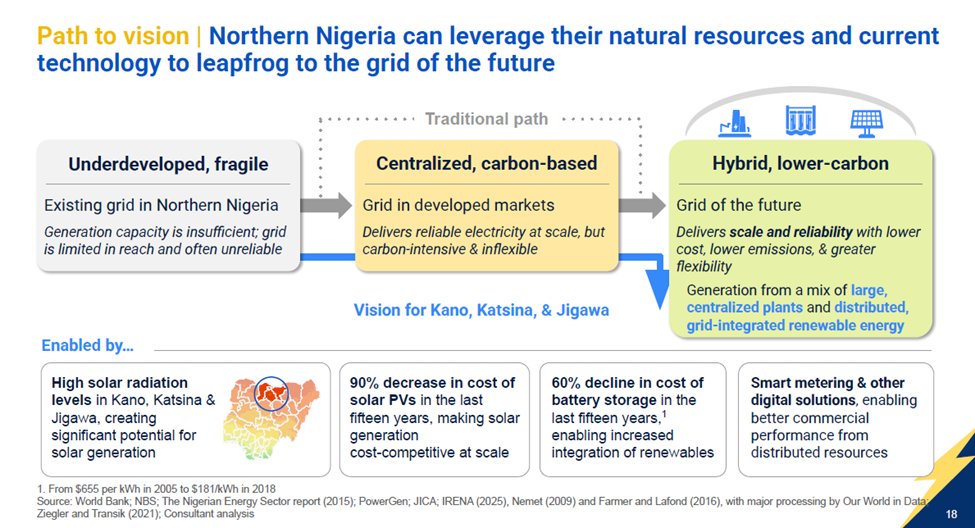

This slide describes why we need all source of energy to create a hybrid, lower-carbon structure where accessibility and affordability is considered.

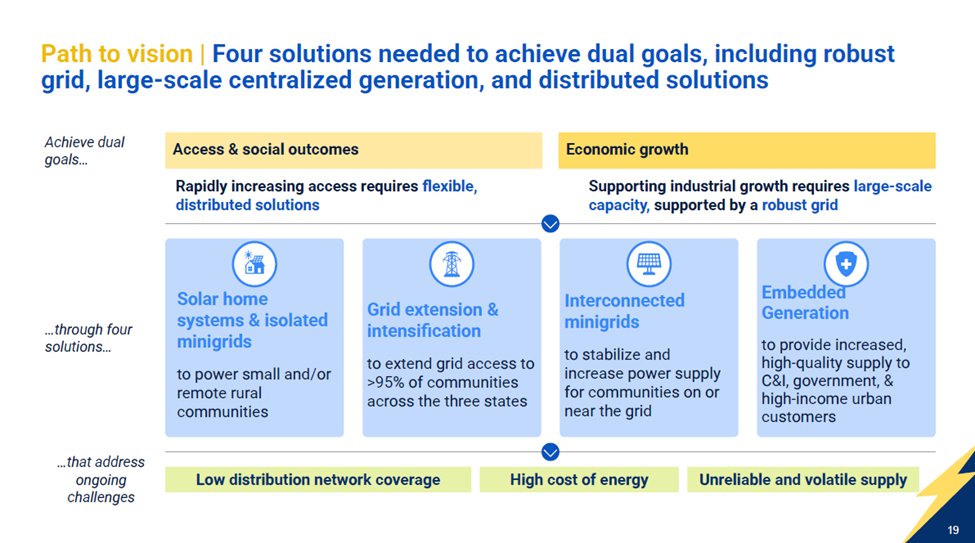

Also four (4) solutions needed to achieve the above dual goals of social outcomes and economic growth.

Also four (4) solutions needed to achieve the above dual goals of social outcomes and economic growth.

Jigawa state acquires 2.5% equity stake in KEDCO for N4 billion and invested the whole money in Jigawa state to improve its network and electricity access.

In conclusions:

1. North is battling with structural disadvantage.

2. Regulation does not bring investment.

3. Electricity is a scale game.

4. Decentralization is a good solution for access.

5. Billions of dollars are needed.

Ahmed Zakari Presentation:

1. North is battling with structural disadvantage.

2. Regulation does not bring investment.

3. Electricity is a scale game.

4. Decentralization is a good solution for access.

5. Billions of dollars are needed.

Ahmed Zakari Presentation:

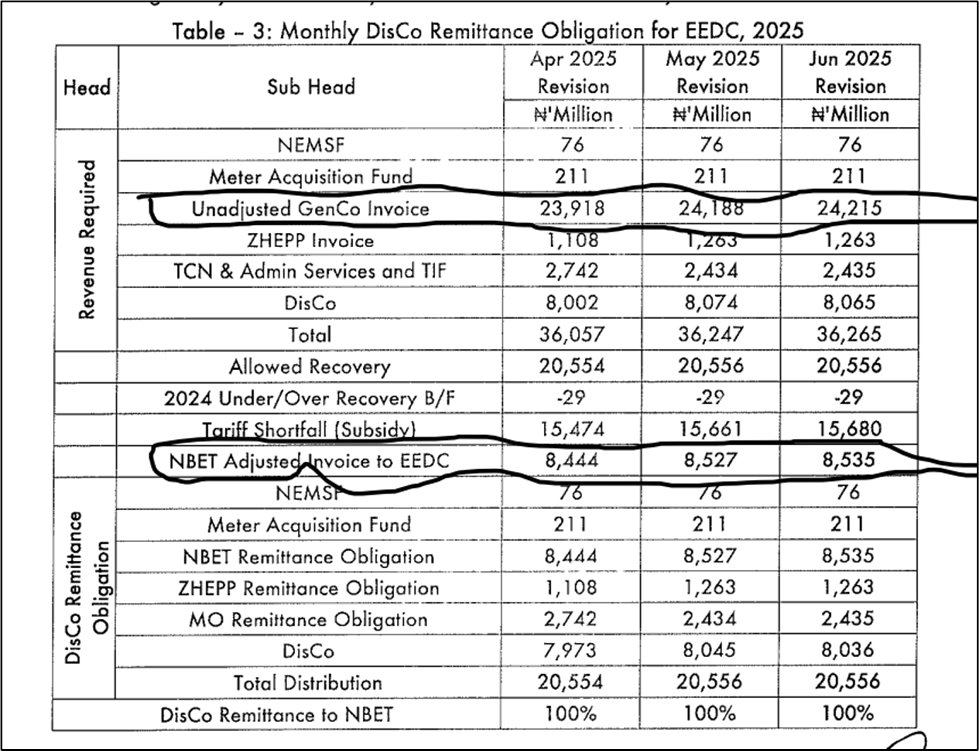

The panel conversation also focuses around different areas of commercial, financing, regulatory and governance, tariff and energy policy and liquidity crisis of the sector.

On the panel, Ahmed discusses and answers questions around energy deficit and decentralized system.

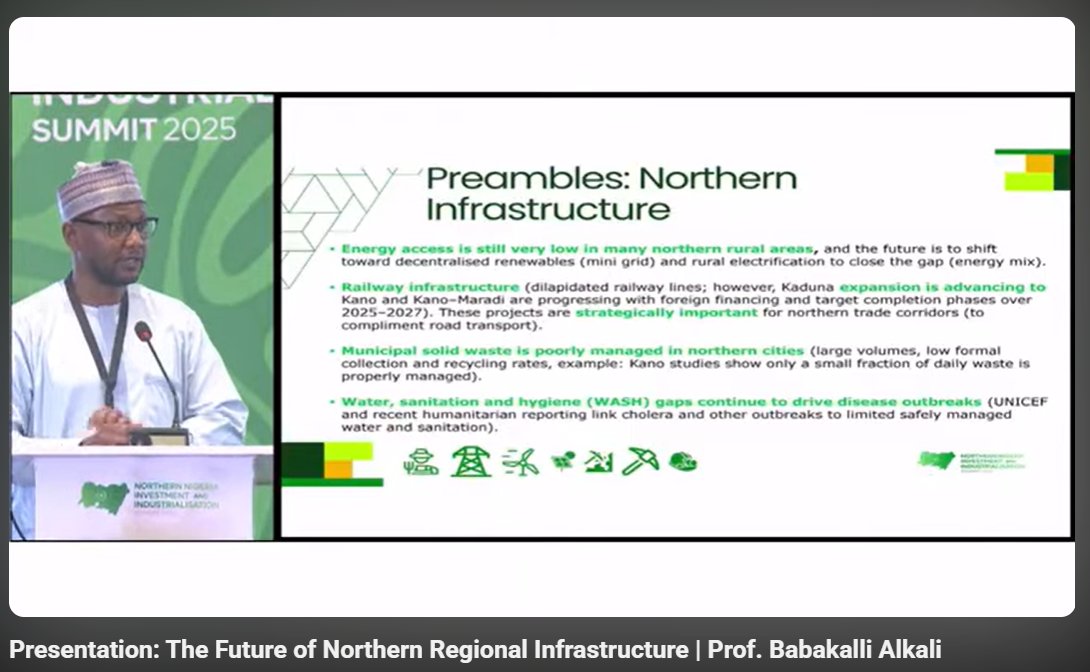

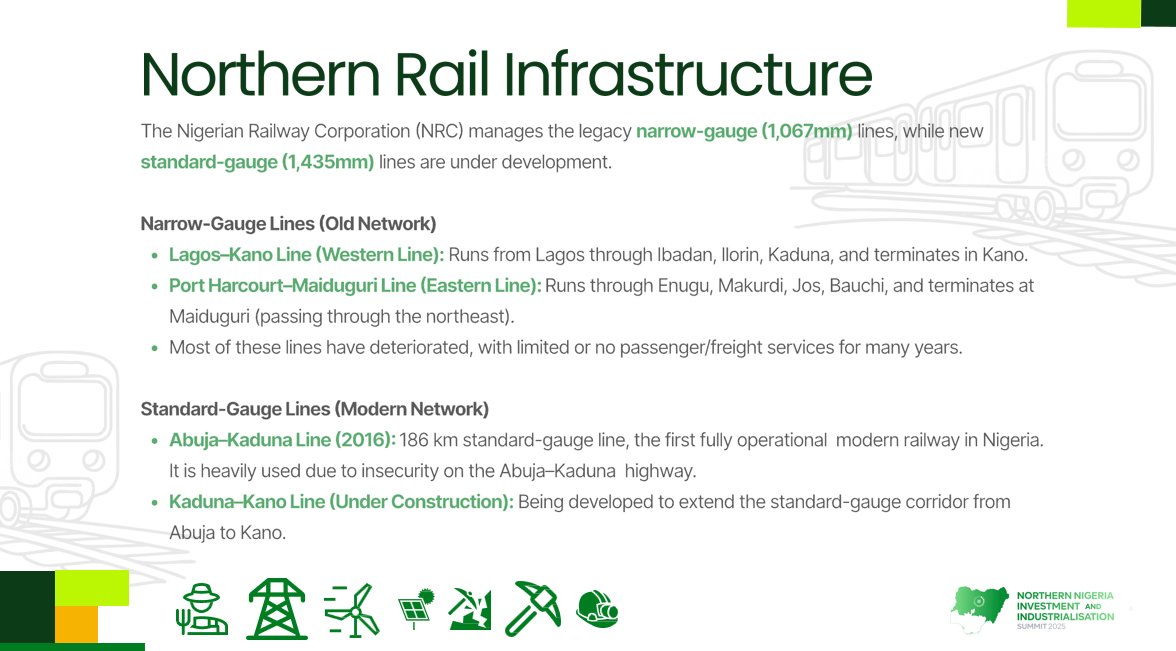

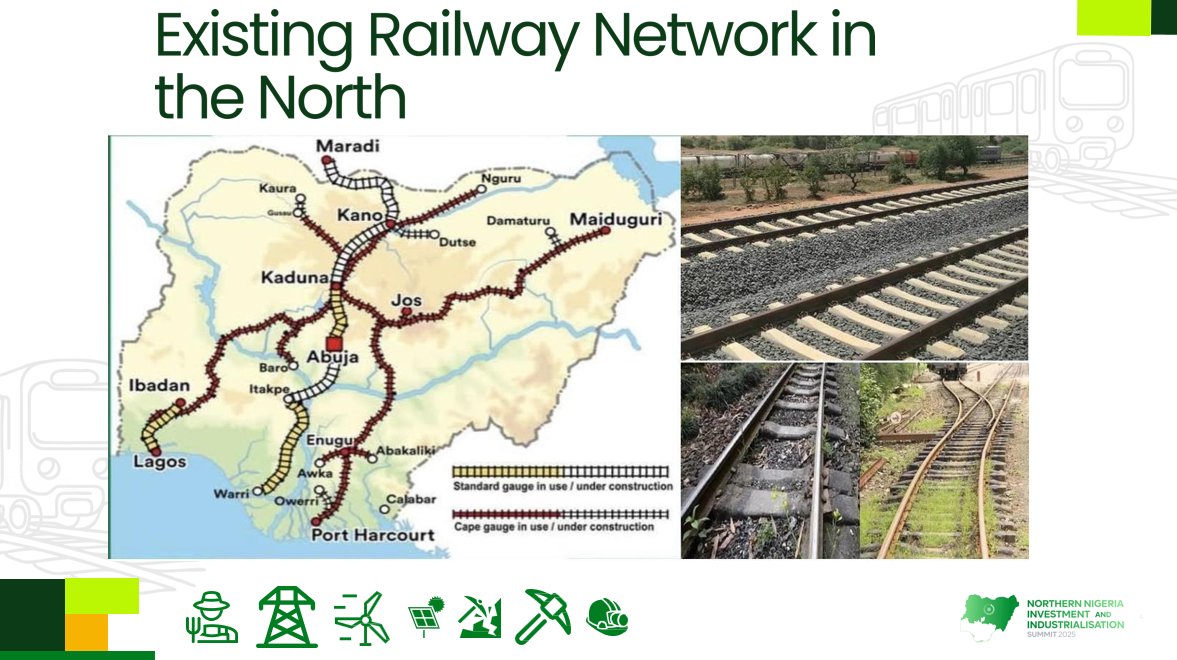

Professor Alkali (Glasgow university) discusses issues around security and investment risk and electricity tariff pricing.

Abdul Oladapo (Managing Partner Murty Int’l) also provides a compelling issue around policy and governance in the sector with specificity to northern Nigeria.

Rahila Thomas (Country Director EMRC) focuses on issues relating to technical, commercial and liquidity crisis in the Nigeria Electricity Supply Industry (NESI) with specific focus on northern discos.

Engr Yusuf Usman (Former MD, Kaduna Electric) also talk vandalism, liquidity and what the investors / government need to push for resilient electricity access.

At the end, all the panelists shared a personal opinion on what they think about band A pricing.

Find the link to the panel session:

youtu.be/ENXS3NisAI4?t=…

Professor Alkali (Glasgow university) discusses issues around security and investment risk and electricity tariff pricing.

Abdul Oladapo (Managing Partner Murty Int’l) also provides a compelling issue around policy and governance in the sector with specificity to northern Nigeria.

Rahila Thomas (Country Director EMRC) focuses on issues relating to technical, commercial and liquidity crisis in the Nigeria Electricity Supply Industry (NESI) with specific focus on northern discos.

Engr Yusuf Usman (Former MD, Kaduna Electric) also talk vandalism, liquidity and what the investors / government need to push for resilient electricity access.

At the end, all the panelists shared a personal opinion on what they think about band A pricing.

Find the link to the panel session:

youtu.be/ENXS3NisAI4?t=…

Prof Alkali also touch around inland dry port and waste management.

Prof Alkali Presentation

youtube.com/watch?v=iH6ZYm…

Habiba Suleiman (Strategy lead, TGI Group) presentation on the North Agricultural Industrialization:

youtube.com/watch?v=TUSERF…

Prof Alkali Presentation

youtube.com/watch?v=iH6ZYm…

Habiba Suleiman (Strategy lead, TGI Group) presentation on the North Agricultural Industrialization:

youtube.com/watch?v=TUSERF…

• • •

Missing some Tweet in this thread? You can try to

force a refresh