🧵 The Mother of All Silver Covering Rallies — 2025 Edition

1️⃣ Remember February 2024?

Funds (Managed Money) sat on a $1 billion net short in silver futures.

Swap Dealers quietly flipped long.

Fast-forward to October 2025 → India sold out. London panicking.

That setup just detonated. 🥈⚡

Thanks to @profitsplusid

1️⃣ Remember February 2024?

Funds (Managed Money) sat on a $1 billion net short in silver futures.

Swap Dealers quietly flipped long.

Fast-forward to October 2025 → India sold out. London panicking.

That setup just detonated. 🥈⚡

Thanks to @profitsplusid

2️⃣ India breaks first 🇮🇳

MMTC-PAMP — the country’s largest refiner — ran completely out of silver for the first time ever.

Festive demand + industrial pull = retail shelves empty, premiums surging, ETFs restricting new subscriptions.

When India runs dry, global flows shake.

MMTC-PAMP — the country’s largest refiner — ran completely out of silver for the first time ever.

Festive demand + industrial pull = retail shelves empty, premiums surging, ETFs restricting new subscriptions.

When India runs dry, global flows shake.

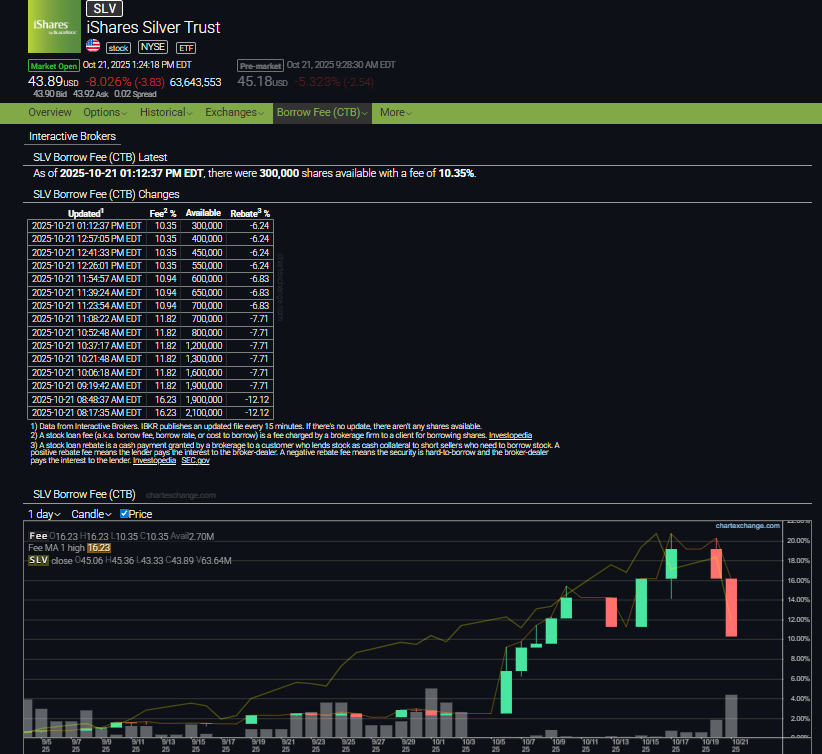

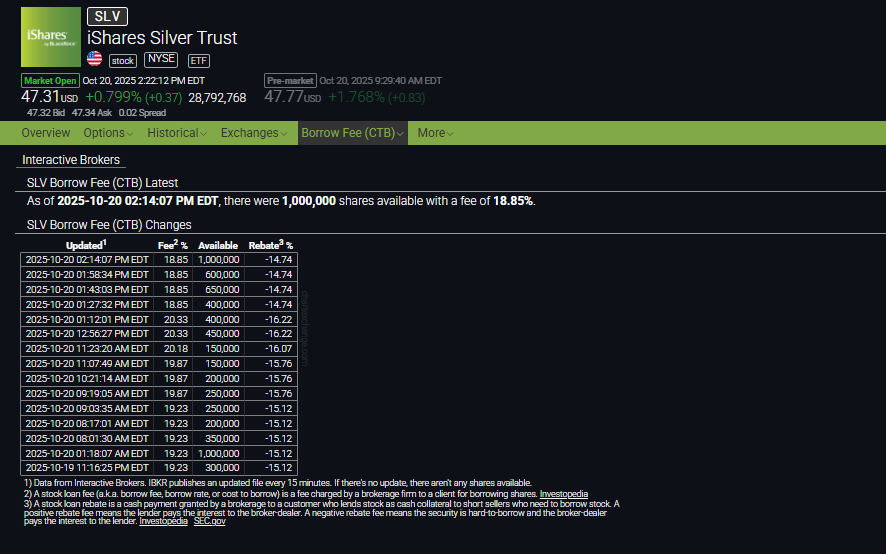

3️⃣ London dislocation 🇬🇧

The 1 000 oz bar market seized up.

Lease rates spiked to > 30 % (some reports show intraday > 100 %).

NY futures traded below London spot — pure backwardation.

Physical supply is tight where it matters most.

The 1 000 oz bar market seized up.

Lease rates spiked to > 30 % (some reports show intraday > 100 %).

NY futures traded below London spot — pure backwardation.

Physical supply is tight where it matters most.

4️⃣ Why supply can’t respond

~70 % of silver is a by-product metal → price spikes don’t trigger new mines.

Meanwhile, solar and electronics demand hit records.

The structural deficit is in its 5th year (Silver Institute 2025 report).

~70 % of silver is a by-product metal → price spikes don’t trigger new mines.

Meanwhile, solar and electronics demand hit records.

The structural deficit is in its 5th year (Silver Institute 2025 report).

5️⃣ The old setup (Feb 2024)

• Managed Money: ≈ 9 000 net shorts (≈ 45 Moz ≈ $1 B).

• Swap Dealers: slightly net long.

It was a time bomb waiting for a spark.

• Managed Money: ≈ 9 000 net shorts (≈ 45 Moz ≈ $1 B).

• Swap Dealers: slightly net long.

It was a time bomb waiting for a spark.

6️⃣ The COT reversal (Sept 2025)

✅ Managed Money → from −45 Moz short to +185 Moz long.

❌ Swap Dealers → from slightly long to −220 Moz short.

The entire market flipped polarity.

Now banks hold the short bag — and funds are long with stackers.

✅ Managed Money → from −45 Moz short to +185 Moz long.

❌ Swap Dealers → from slightly long to −220 Moz short.

The entire market flipped polarity.

Now banks hold the short bag — and funds are long with stackers.

7️⃣ Who’s under pressure now?

Swap Dealers (BB banks) sit on massive shorts while physical metal is disappearing.

If prices rise further, they must cover — buy back contracts — fueling a vertical move.

That’s the essence of a short squeeze.

Swap Dealers (BB banks) sit on massive shorts while physical metal is disappearing.

If prices rise further, they must cover — buy back contracts — fueling a vertical move.

That’s the essence of a short squeeze.

8️⃣ Asia vs West

Shanghai and Indian premiums positive again (+2–3 USD/oz).

London discount deepens.

When metal flows east and paper trades west, price discovery moves with the bars.

Shanghai and Indian premiums positive again (+2–3 USD/oz).

London discount deepens.

When metal flows east and paper trades west, price discovery moves with the bars.

9️⃣ Real signals to watch

• Lease rates (1M) holding above 20 %, with intraday spikes > 30 % (a few reports even > 100 % overnight).

• London–NY spread (EFP) remains inverted — paper trades cheaper than physical.

• Asia/LBMA premium > $2/oz sustained.

• India retail & import flow stays tight.

If these conditions persist together → the squeeze is still alive —and accelerating. ⚡🥈

• Lease rates (1M) holding above 20 %, with intraday spikes > 30 % (a few reports even > 100 % overnight).

• London–NY spread (EFP) remains inverted — paper trades cheaper than physical.

• Asia/LBMA premium > $2/oz sustained.

• India retail & import flow stays tight.

If these conditions persist together → the squeeze is still alive —and accelerating. ⚡🥈

🔟 Why this matters for stackers

Futures markets finally mirror what we’ve felt for years:

Paper shortages and physical scarcity colliding.

The banks are short, stackers are long, and the world’s real silver is vanishing from the float.

The rot has flipped — and that’s our signal. ⚡🥈

Futures markets finally mirror what we’ve felt for years:

Paper shortages and physical scarcity colliding.

The banks are short, stackers are long, and the world’s real silver is vanishing from the float.

The rot has flipped — and that’s our signal. ⚡🥈

🏁 1⃣1️⃣ Final thought

“Knowledge is power. But action is where power becomes real.”

Stackers saw the rotation before the crowd.

Now even hedge funds are joining the long side.

That’s what a new bull leg looks like.

#Silver #SilverSqueeze #StackerLogic

“Knowledge is power. But action is where power becomes real.”

Stackers saw the rotation before the crowd.

Now even hedge funds are joining the long side.

That’s what a new bull leg looks like.

#Silver #SilverSqueeze #StackerLogic

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh