$SERV 🔥Serve Robotics: The AI Robotics Platform Powering the Future of Drones, Couriers, Logistics, and Sidewalk Autonomy🔥

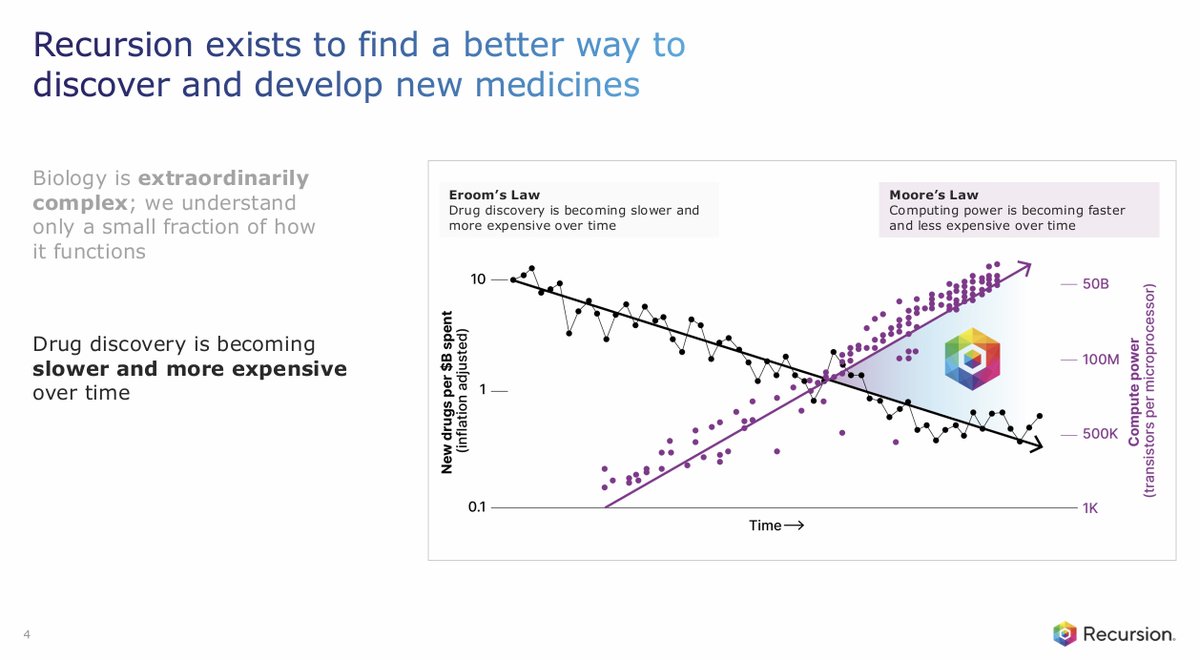

The next addition to my Speculative AI portfolio is $SERV, Serve Robotics. So far I’ve added $ASAN, $RXRX, and $PATH, each representing a different layer of applied AI. Now I’m adding Serve because the next frontier isn’t digital AI in the cloud, it’s physical, ROBOTIC AI in the real world. And I'm feeling SUPER bullish!

Serve builds autonomous, AI-powered delivery robots that move at walking speed through real city environments. Each robot runs NVIDIA Jetson Orin edge compute fused with Ouster LiDAR, operating at Level 4 autonomy. $NVDA NVIDIA is not just a technology supplier, it is also an investor and strategic partner that provided capital and simulation tools that help train Serve’s autonomy stack.

The company spun out of $UBER Uber in 2021, with Uber still the largest shareholder and commercial partner. The robots already run in Los Angeles, Miami, Dallas, Atlanta, and Chicago, integrated directly into Uber Eats, logging over 100,000 deliveries with up to 99.8 percent reliability.

I’m adding it because AI-powered robotics is about to explode, and it’s almost impossible to find a small-cap name that combines real technical leadership, proven deployments, and a team that understands the bigger picture.

That's why I like Serve: $SERV Serve isn’t just delivering food; it’s building an autonomy OS that could power sidewalk robots, drones, warehouse movers, sanitation robots, or any form of short-range logistics. With partners like Uber, NVIDIA, Vinod Khosla, and Magna International, it’s positioned to become the platform layer for urban robotics. Let's dive in 🧵

The next addition to my Speculative AI portfolio is $SERV, Serve Robotics. So far I’ve added $ASAN, $RXRX, and $PATH, each representing a different layer of applied AI. Now I’m adding Serve because the next frontier isn’t digital AI in the cloud, it’s physical, ROBOTIC AI in the real world. And I'm feeling SUPER bullish!

Serve builds autonomous, AI-powered delivery robots that move at walking speed through real city environments. Each robot runs NVIDIA Jetson Orin edge compute fused with Ouster LiDAR, operating at Level 4 autonomy. $NVDA NVIDIA is not just a technology supplier, it is also an investor and strategic partner that provided capital and simulation tools that help train Serve’s autonomy stack.

The company spun out of $UBER Uber in 2021, with Uber still the largest shareholder and commercial partner. The robots already run in Los Angeles, Miami, Dallas, Atlanta, and Chicago, integrated directly into Uber Eats, logging over 100,000 deliveries with up to 99.8 percent reliability.

I’m adding it because AI-powered robotics is about to explode, and it’s almost impossible to find a small-cap name that combines real technical leadership, proven deployments, and a team that understands the bigger picture.

That's why I like Serve: $SERV Serve isn’t just delivering food; it’s building an autonomy OS that could power sidewalk robots, drones, warehouse movers, sanitation robots, or any form of short-range logistics. With partners like Uber, NVIDIA, Vinod Khosla, and Magna International, it’s positioned to become the platform layer for urban robotics. Let's dive in 🧵

$SERV The story behind $SERV shows how real this platform already is.

Serve started inside Postmates as its internal robotics division, Postmates X. When $UBER Uber acquired Postmates in 2020, CEO Ali Kashani negotiated to spin the robotics unit out as an independent company in 2021. Uber remained a major shareholder and became Serve’s first commercial partner, integrating its autonomous sidewalk robots directly into Uber Eats.

The spin-off gave Serve freedom to partner beyond Uber, opening doors to trials with DoorDash, Walmart, and 7-Eleven. It also kept Uber financially aligned while giving Serve full control of its roadmap, autonomy in both name and structure.

Then came NVIDIA. In 2023 filings with the SEC, Serve disclosed that NVIDIA had taken a multi-million-share equity stake, about 3.6 million shares, and received convertible notes that were later exchanged for additional stock. NVIDIA provided not only capital but also technical support through its Jetson Orin edge platform and Isaac robotics simulation stack. This partnership helped Serve reach Level 4 autonomy in real-world environments.

By late 2024, NVIDIA had exited its stake, locking in early gains, but the collaboration had already given Serve the compute architecture and AI infrastructure it still runs today.

Uber gave Serve the demand and distribution engine. NVIDIA gave it the brain. Together they accelerated Serve’s leap from concept to commercial autonomy, a rare feat for any small-cap robotics company.

Serve started inside Postmates as its internal robotics division, Postmates X. When $UBER Uber acquired Postmates in 2020, CEO Ali Kashani negotiated to spin the robotics unit out as an independent company in 2021. Uber remained a major shareholder and became Serve’s first commercial partner, integrating its autonomous sidewalk robots directly into Uber Eats.

The spin-off gave Serve freedom to partner beyond Uber, opening doors to trials with DoorDash, Walmart, and 7-Eleven. It also kept Uber financially aligned while giving Serve full control of its roadmap, autonomy in both name and structure.

Then came NVIDIA. In 2023 filings with the SEC, Serve disclosed that NVIDIA had taken a multi-million-share equity stake, about 3.6 million shares, and received convertible notes that were later exchanged for additional stock. NVIDIA provided not only capital but also technical support through its Jetson Orin edge platform and Isaac robotics simulation stack. This partnership helped Serve reach Level 4 autonomy in real-world environments.

By late 2024, NVIDIA had exited its stake, locking in early gains, but the collaboration had already given Serve the compute architecture and AI infrastructure it still runs today.

Uber gave Serve the demand and distribution engine. NVIDIA gave it the brain. Together they accelerated Serve’s leap from concept to commercial autonomy, a rare feat for any small-cap robotics company.

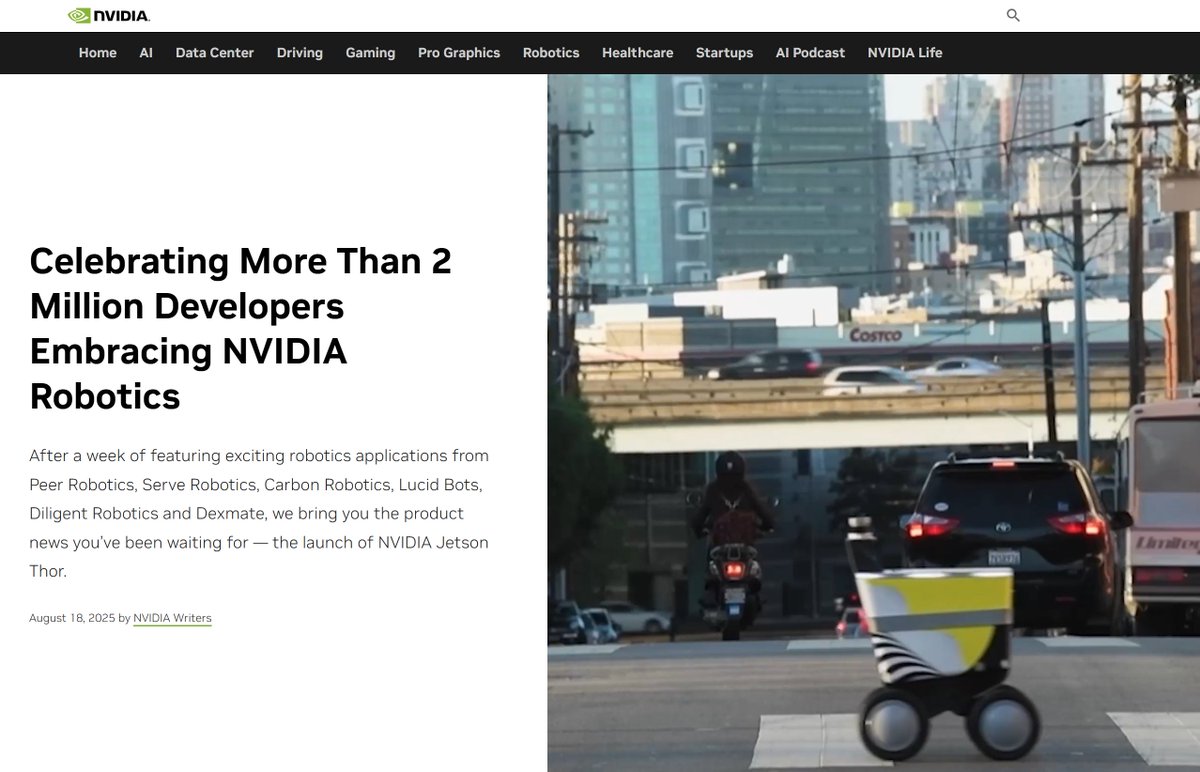

$NVDA NVIDIA just featured $SERV as a showcase for physical AI on its own website.

In NVIDIA’s article “Serve Robotics Is Ushering Food Delivery Into the Mainstream,” the company highlights how Serve’s delivery robots rely on three NVIDIA GPUs, including one Orin AGX, for real-time processing of camera and LiDAR data during navigation through city streets.

NVIDIA notes that Serve’s autonomy depends on its Isaac SDK and Isaac Sim, which allow the company to model real-world edge cases and retrain its AI in simulation before redeployment. CEO Ali Kashani explains, “When you’re out in the real world and you see those edge cases, it’s really valuable to model those and then try them again in simulation. A lot of testing and validation happens in Isaac Sim.”

The article also mentions Serve’s acquisition of Vayu Robotics, integrating foundation-model training with simulation-based learning to make its robots safer and more intelligent.

When NVIDIA publicly writes about a partner this way, it signals real validation. Serve’s fleet doesn’t just use NVIDIA hardware; it helps define how NVIDIA’s robotics ecosystem performs in the real world.

In NVIDIA’s article “Serve Robotics Is Ushering Food Delivery Into the Mainstream,” the company highlights how Serve’s delivery robots rely on three NVIDIA GPUs, including one Orin AGX, for real-time processing of camera and LiDAR data during navigation through city streets.

NVIDIA notes that Serve’s autonomy depends on its Isaac SDK and Isaac Sim, which allow the company to model real-world edge cases and retrain its AI in simulation before redeployment. CEO Ali Kashani explains, “When you’re out in the real world and you see those edge cases, it’s really valuable to model those and then try them again in simulation. A lot of testing and validation happens in Isaac Sim.”

The article also mentions Serve’s acquisition of Vayu Robotics, integrating foundation-model training with simulation-based learning to make its robots safer and more intelligent.

When NVIDIA publicly writes about a partner this way, it signals real validation. Serve’s fleet doesn’t just use NVIDIA hardware; it helps define how NVIDIA’s robotics ecosystem performs in the real world.

$SERV $UBER Uber still owns nearly 5 million shares of $SERV and its vision for the company is clear.

According to Uber’s latest 13F filing, the company holds roughly 4.9 million shares of Serve Robotics, maintaining a major minority stake after spinning the division out in 2021. Uber did not just incubate Serve; it remains deeply invested in its success because robotic delivery fits perfectly into Uber’s long-term logistics vision.

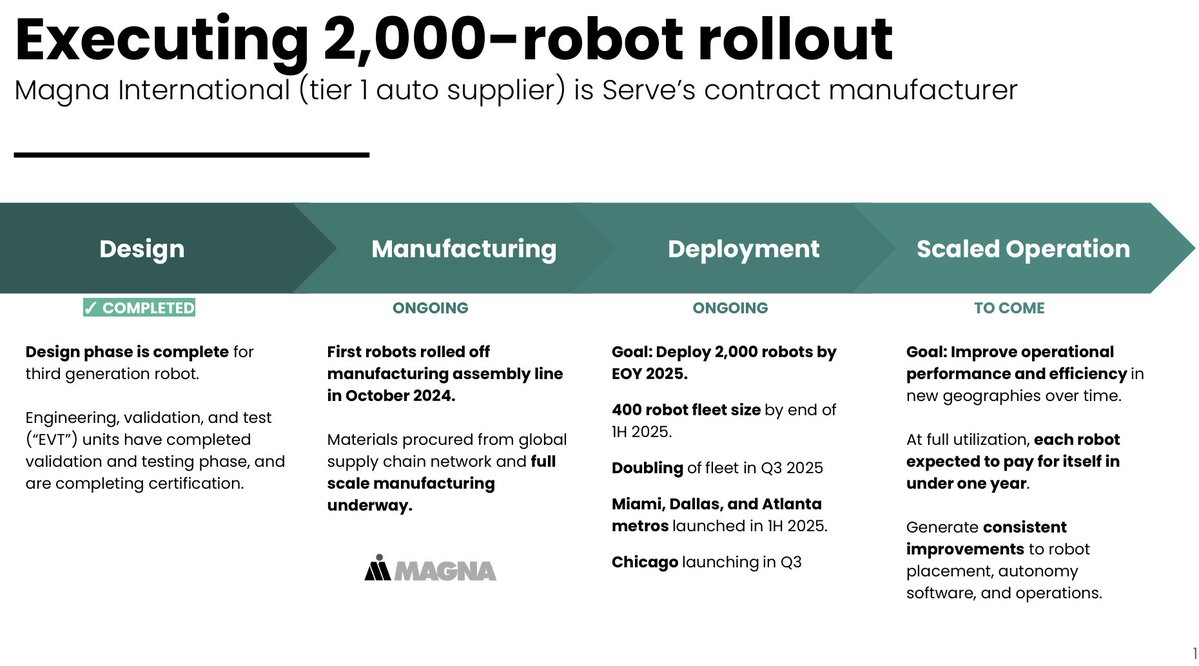

Serve’s robots already complete deliveries for Uber Eats in Los Angeles, Miami, and other markets. The companies have a multi-year agreement to deploy up to 2,000 autonomous robots, part of Uber’s plan to expand delivery without scaling labor or emissions.

Uber has described autonomous delivery as a cornerstone of its future logistics stack, pairing AI dispatch with zero-emission mobility to cut costs and improve urban efficiency. Uber’s continued ownership and partnership serve as powerful validation from one of the most proven innovators in modern logistics technology.

It is not just NVIDIA that sees Serve as a crucial part of its early AI robotics ecosystem. Uber’s investment and integration show that two of the world’s most advanced technology companies are betting on Serve’s platform as the bridge between artificial intelligence and real-world autonomy.

According to Uber’s latest 13F filing, the company holds roughly 4.9 million shares of Serve Robotics, maintaining a major minority stake after spinning the division out in 2021. Uber did not just incubate Serve; it remains deeply invested in its success because robotic delivery fits perfectly into Uber’s long-term logistics vision.

Serve’s robots already complete deliveries for Uber Eats in Los Angeles, Miami, and other markets. The companies have a multi-year agreement to deploy up to 2,000 autonomous robots, part of Uber’s plan to expand delivery without scaling labor or emissions.

Uber has described autonomous delivery as a cornerstone of its future logistics stack, pairing AI dispatch with zero-emission mobility to cut costs and improve urban efficiency. Uber’s continued ownership and partnership serve as powerful validation from one of the most proven innovators in modern logistics technology.

It is not just NVIDIA that sees Serve as a crucial part of its early AI robotics ecosystem. Uber’s investment and integration show that two of the world’s most advanced technology companies are betting on Serve’s platform as the bridge between artificial intelligence and real-world autonomy.

$SERV What $SERV’s delivery robots actually do every day

Serve’s fleet operates in dense city environments across Los Angeles, Miami, Dallas, Atlanta, and soon Chicago. Each robot carries up to 15 gallons of cargo, enough for four 16-inch pizzas, and runs up to 14 hours per charge across 48 miles of range.

They navigate sidewalks and crosswalks at up to 11 mph, handling real weather, curbs, pedestrians, and even construction zones. Using Ouster REV7 LiDAR, high-resolution cameras, and redundant sensors, the robots perceive depth and motion like an autonomous vehicle but at human scale. The result: Level 4 autonomy, where no human driver or remote operator is required within the robot’s operating domain.

Serve Robotics isn’t testing theory. It’s one of the first autonomous vehicle companies to commercialize Level 4 autonomy for delivery robots.

That means no human is in the loop for safety within the robot’s defined operational domain. Every delivery is handled by the robot itself, using redundant sensors, NVIDIA Jetson Orin compute, and edge AI for navigation, braking, and obstacle avoidance.

Level 2 and 3 systems still depend on remote human control, which limits safety and scalability. Serve’s Level 4 architecture eliminates that dependency, improving economics and reliability.

The company’s deep-tech moat comes from this autonomy stack, which sits between remote-controlled robotics and fully self-driving (Level 5) systems, delivering real-world scalability now while others are still in R&D and face regulatory uncertainty.

Serve isn’t promising autonomy. It’s already shipping it.

Serve’s fleet operates in dense city environments across Los Angeles, Miami, Dallas, Atlanta, and soon Chicago. Each robot carries up to 15 gallons of cargo, enough for four 16-inch pizzas, and runs up to 14 hours per charge across 48 miles of range.

They navigate sidewalks and crosswalks at up to 11 mph, handling real weather, curbs, pedestrians, and even construction zones. Using Ouster REV7 LiDAR, high-resolution cameras, and redundant sensors, the robots perceive depth and motion like an autonomous vehicle but at human scale. The result: Level 4 autonomy, where no human driver or remote operator is required within the robot’s operating domain.

Serve Robotics isn’t testing theory. It’s one of the first autonomous vehicle companies to commercialize Level 4 autonomy for delivery robots.

That means no human is in the loop for safety within the robot’s defined operational domain. Every delivery is handled by the robot itself, using redundant sensors, NVIDIA Jetson Orin compute, and edge AI for navigation, braking, and obstacle avoidance.

Level 2 and 3 systems still depend on remote human control, which limits safety and scalability. Serve’s Level 4 architecture eliminates that dependency, improving economics and reliability.

The company’s deep-tech moat comes from this autonomy stack, which sits between remote-controlled robotics and fully self-driving (Level 5) systems, delivering real-world scalability now while others are still in R&D and face regulatory uncertainty.

Serve isn’t promising autonomy. It’s already shipping it.

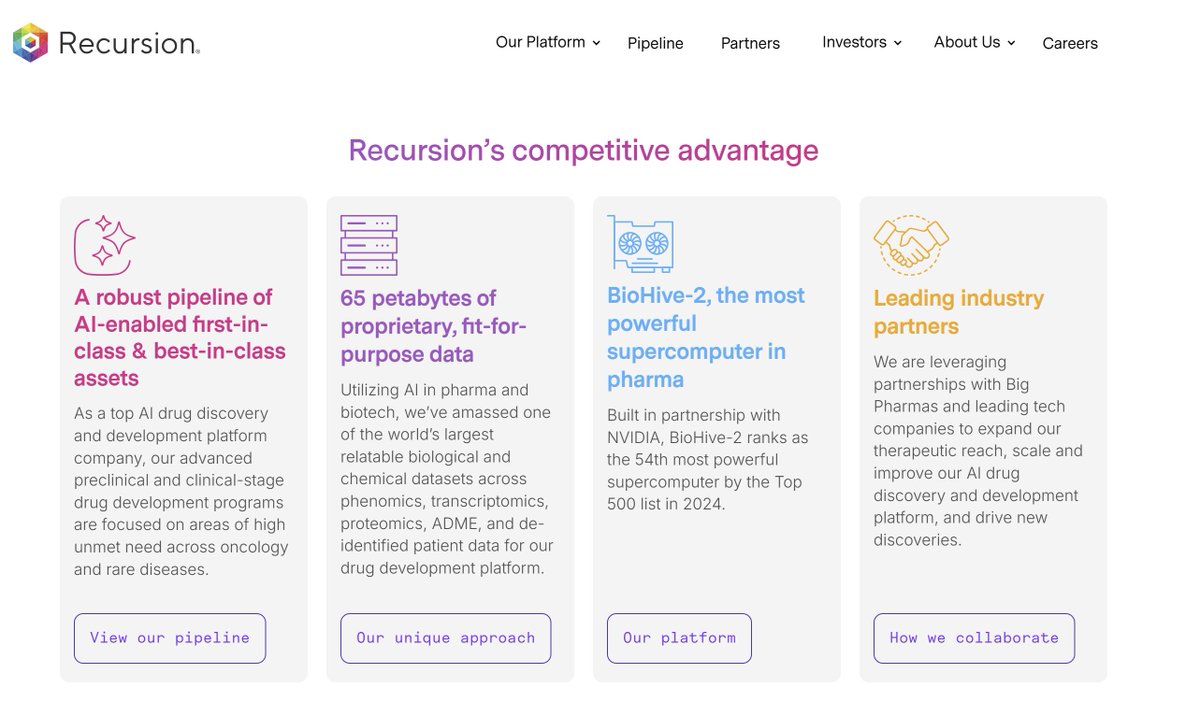

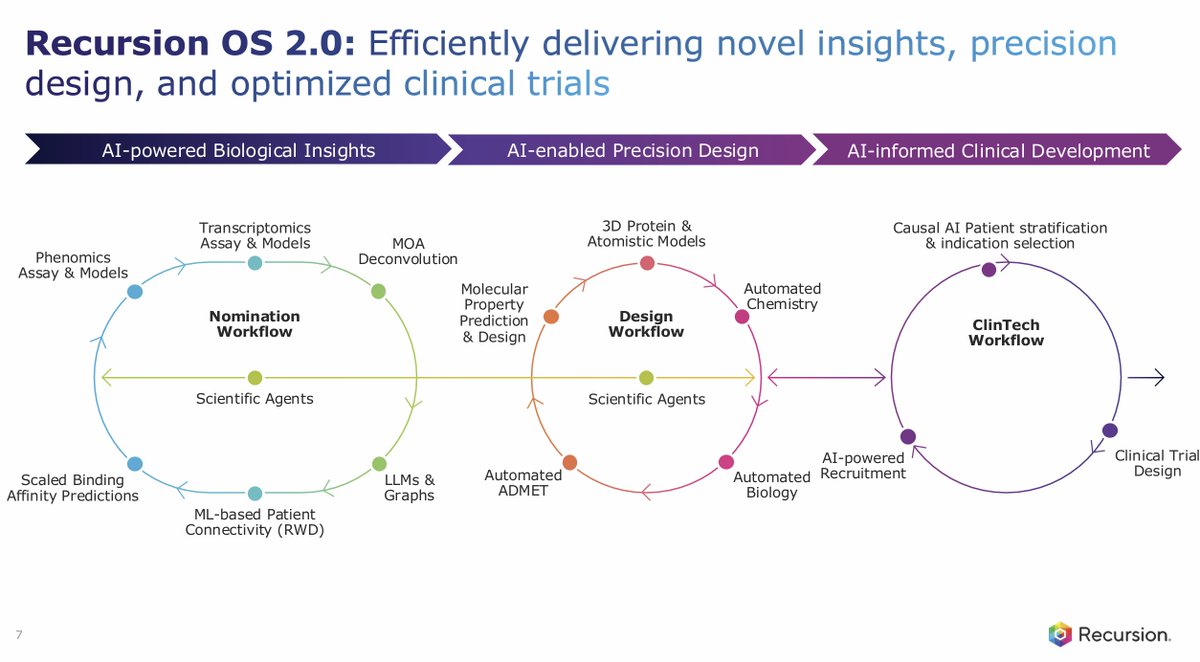

$SERV Why the Vayu Robotics integration is a huge deal for Serve

Serve’s recent acquisition of Vayu Robotics combines two of the hardest things in autonomy: massive real-world data and foundation-model intelligence.

Vayu’s system trains large AI models that learn navigation directly from multimodal data including LiDAR, cameras, and simulation rather than relying on hand-coded rules. This allows robots to adapt to new cities, lighting, terrain, and unpredictable human behavior with minimal retraining.

When fused with Serve’s unmatched sidewalk dataset, it creates an AI loop that can learn from every delivery. The models are refined through NVIDIA Isaac Sim and redeployed to the fleet, improving safety, efficiency, and speed with each update.

The result is a platform that scales like software while moving through the physical world. It is the technical leap that pushes Serve toward the frontier of “physical AI.”

Vayu + Serve is a huge AI data/training robotics flywheel for the future!

Serve’s recent acquisition of Vayu Robotics combines two of the hardest things in autonomy: massive real-world data and foundation-model intelligence.

Vayu’s system trains large AI models that learn navigation directly from multimodal data including LiDAR, cameras, and simulation rather than relying on hand-coded rules. This allows robots to adapt to new cities, lighting, terrain, and unpredictable human behavior with minimal retraining.

When fused with Serve’s unmatched sidewalk dataset, it creates an AI loop that can learn from every delivery. The models are refined through NVIDIA Isaac Sim and redeployed to the fleet, improving safety, efficiency, and speed with each update.

The result is a platform that scales like software while moving through the physical world. It is the technical leap that pushes Serve toward the frontier of “physical AI.”

Vayu + Serve is a huge AI data/training robotics flywheel for the future!

$SERV The Vinod Khosla connection takes $SERV to another level

Vinod Khosla, founder of Sun Microsystems and one of the most influential investors in AI and deep technology, joined Serve Robotics’ Advisory Board through the Vayu Robotics acquisition. He also took a direct financial position, receiving Serve stock and warrants tied to autonomy performance milestones and holding a stake via Khosla Ventures, which funded Vayu.

Khosla’s reputation carries enormous weight. He was an early backer of OpenAI, $QS QuantumScape, and $DASH DoorDash, and has spent decades identifying technology inflection points that change industries. His endorsement of Serve is not passive; it signals that he views foundation-model robotics as the next trillion-dollar platform shift.

Khosla said, “AI models are driving a new class of robotics across a range of industries. We invested early in Vayu because last-mile delivery stood out as one of the applications where autonomous delivery robots could create immense value.”

Readers of my account know I follow him closely. He is one of the sharpest minds in technology, the kind of investor who shaped how the internet, renewable energy, and now AI infrastructure evolved. His decision to take equity and a board role in Serve Robotics is a massive vote of confidence in the company’s mission to scale real-world autonomy.

Vinod Khosla, founder of Sun Microsystems and one of the most influential investors in AI and deep technology, joined Serve Robotics’ Advisory Board through the Vayu Robotics acquisition. He also took a direct financial position, receiving Serve stock and warrants tied to autonomy performance milestones and holding a stake via Khosla Ventures, which funded Vayu.

Khosla’s reputation carries enormous weight. He was an early backer of OpenAI, $QS QuantumScape, and $DASH DoorDash, and has spent decades identifying technology inflection points that change industries. His endorsement of Serve is not passive; it signals that he views foundation-model robotics as the next trillion-dollar platform shift.

Khosla said, “AI models are driving a new class of robotics across a range of industries. We invested early in Vayu because last-mile delivery stood out as one of the applications where autonomous delivery robots could create immense value.”

Readers of my account know I follow him closely. He is one of the sharpest minds in technology, the kind of investor who shaped how the internet, renewable energy, and now AI infrastructure evolved. His decision to take equity and a board role in Serve Robotics is a massive vote of confidence in the company’s mission to scale real-world autonomy.

$SERV $DASH The DoorDash partnership is massive validation for $SERV

Vinod Khosla knows DoorDash well. His firm backed the company in its early days and helped it scale into the number-one food delivery platform in America. Now the company he advises and holds equity in, Serve Robotics, is officially partnering with DoorDash on autonomous deliveries across the United States.

Serve will fulfill DoorDash orders under a multi-year agreement, starting in Los Angeles and expanding nationwide. The robots already operate in five major cities including Los Angeles, Miami, Dallas, Chicago, and Atlanta, and have completed tens of thousands of real deliveries.

What makes this deal so important is that Serve’s partnerships are not exclusive. The same fleet that runs Uber Eats orders can also handle DoorDash deliveries, similar to how human couriers switch between apps. That means higher robot utilization, fewer empty miles, and stronger economics.

Serve CEO Ali Kashani called the move “a good validation because now both of the major platforms in the country are investing heavily in autonomy.” For years, Serve has argued that sidewalk robots would become a core layer of logistics. DoorDash agreeing to deploy them proves the market is catching up.

This is the moment when Serve transitions from a single-platform operator to a cross-network logistics AI company, supplying automation to the two largest delivery ecosystems in America.

Vinod Khosla knows DoorDash well. His firm backed the company in its early days and helped it scale into the number-one food delivery platform in America. Now the company he advises and holds equity in, Serve Robotics, is officially partnering with DoorDash on autonomous deliveries across the United States.

Serve will fulfill DoorDash orders under a multi-year agreement, starting in Los Angeles and expanding nationwide. The robots already operate in five major cities including Los Angeles, Miami, Dallas, Chicago, and Atlanta, and have completed tens of thousands of real deliveries.

What makes this deal so important is that Serve’s partnerships are not exclusive. The same fleet that runs Uber Eats orders can also handle DoorDash deliveries, similar to how human couriers switch between apps. That means higher robot utilization, fewer empty miles, and stronger economics.

Serve CEO Ali Kashani called the move “a good validation because now both of the major platforms in the country are investing heavily in autonomy.” For years, Serve has argued that sidewalk robots would become a core layer of logistics. DoorDash agreeing to deploy them proves the market is catching up.

This is the moment when Serve transitions from a single-platform operator to a cross-network logistics AI company, supplying automation to the two largest delivery ecosystems in America.

$SERV $UBER $DASH is quietly becoming the universal AI layer for last-mile delivery

Uber and DoorDash are the two biggest delivery networks in the United States. Both are now using Serve Robotics’ autonomous delivery platform. This is the first time one robotics company has integrated at scale with both giants.

Serve’s model is simple but powerful. The same fleet of robots can dynamically switch between orders from Uber Eats and DoorDash, maximizing utilization and minimizing idle time. Every completed trip feeds new data into the autonomy stack, improving Serve’s AI foundation models and driving down cost per delivery.

Uber’s ownership stake ensures Serve is deeply embedded in the largest on-demand ecosystem in the world. DoorDash’s new partnership adds the second major leg of the market and signals that the company is ready to operate as a shared infrastructure layer rather than a captive service.

In effect, Serve is building what robotaxis could never deliver: a real, revenue-generating AI logistics network operating daily in U.S. cities. Two platforms, one fleet, one brain. That is how physical AI scales.

Uber and DoorDash are the two biggest delivery networks in the United States. Both are now using Serve Robotics’ autonomous delivery platform. This is the first time one robotics company has integrated at scale with both giants.

Serve’s model is simple but powerful. The same fleet of robots can dynamically switch between orders from Uber Eats and DoorDash, maximizing utilization and minimizing idle time. Every completed trip feeds new data into the autonomy stack, improving Serve’s AI foundation models and driving down cost per delivery.

Uber’s ownership stake ensures Serve is deeply embedded in the largest on-demand ecosystem in the world. DoorDash’s new partnership adds the second major leg of the market and signals that the company is ready to operate as a shared infrastructure layer rather than a captive service.

In effect, Serve is building what robotaxis could never deliver: a real, revenue-generating AI logistics network operating daily in U.S. cities. Two platforms, one fleet, one brain. That is how physical AI scales.

$SERV Serve isn’t just sidewalk robots anymore: drones, couriers, sanitation, and hospital AI robotics are next

Serve CEO Ali Kashani said, “To me, food delivery is the book to our Amazon. We’re just starting with that as a first market, but there is almost infinite demand for where we can go.”

The company’s roadmap extends far beyond restaurants. Serve plans to adapt its platform for groceries, prescriptions, and hospital logistics, moving critical items through campuses, malls, or factories using the same AI navigation stack that powers its delivery robots.

Kashani also confirmed that Serve is testing drone delivery integrations with partners such as Flytrex and Alphabet’s Wing, expanding into airborne autonomy for faster, lightweight dispatches. The same AI foundation models that teach a sidewalk robot to avoid pedestrians can teach a drone to navigate safely through complex urban airspace.

Serve is building a single autonomy layer that can move anything, anywhere. Sidewalks were only the training ground. The next phase is every surface and every altitude.

Serve CEO Ali Kashani said, “To me, food delivery is the book to our Amazon. We’re just starting with that as a first market, but there is almost infinite demand for where we can go.”

The company’s roadmap extends far beyond restaurants. Serve plans to adapt its platform for groceries, prescriptions, and hospital logistics, moving critical items through campuses, malls, or factories using the same AI navigation stack that powers its delivery robots.

Kashani also confirmed that Serve is testing drone delivery integrations with partners such as Flytrex and Alphabet’s Wing, expanding into airborne autonomy for faster, lightweight dispatches. The same AI foundation models that teach a sidewalk robot to avoid pedestrians can teach a drone to navigate safely through complex urban airspace.

Serve is building a single autonomy layer that can move anything, anywhere. Sidewalks were only the training ground. The next phase is every surface and every altitude.

$SERV $GOOG Serve is taking autonomy airborne with its new drone partnership with Google

Serve Robotics is now integrating its sidewalk robots with Wing Aviation, an Alphabet company, to create a hybrid ground-to-air delivery network. The robots handle restaurant pickups, then hand off orders to drones for the final flight segment. This extends the average delivery radius from around 2 miles to as far as 6 miles, while cutting total delivery time and cost per order.

The pilot program in Dallas is already active. Serve’s robots retrieve food directly from restaurant partners, bring it to designated drone loading zones, and coordinate the handoff with Wing’s autonomous aircraft. The drones then complete the delivery in minutes, bypassing traffic and expanding the reachable market.

This partnership is not a small experiment. It represents a multi-modal autonomy system that connects sidewalk robots, road-based navigation, and aerial logistics under one unified AI brain. The same foundation models that train robots to detect obstacles on sidewalks are now being adapted to teach drones to plan safe, efficient aerial routes.

Serve’s long-term vision is to create a single, adaptable autonomy layer that can move goods by land or air. The company is proving that true “physical AI” is not limited to one form of mobility but can extend across every mode of delivery.

Serve Robotics is now integrating its sidewalk robots with Wing Aviation, an Alphabet company, to create a hybrid ground-to-air delivery network. The robots handle restaurant pickups, then hand off orders to drones for the final flight segment. This extends the average delivery radius from around 2 miles to as far as 6 miles, while cutting total delivery time and cost per order.

The pilot program in Dallas is already active. Serve’s robots retrieve food directly from restaurant partners, bring it to designated drone loading zones, and coordinate the handoff with Wing’s autonomous aircraft. The drones then complete the delivery in minutes, bypassing traffic and expanding the reachable market.

This partnership is not a small experiment. It represents a multi-modal autonomy system that connects sidewalk robots, road-based navigation, and aerial logistics under one unified AI brain. The same foundation models that train robots to detect obstacles on sidewalks are now being adapted to teach drones to plan safe, efficient aerial routes.

Serve’s long-term vision is to create a single, adaptable autonomy layer that can move goods by land or air. The company is proving that true “physical AI” is not limited to one form of mobility but can extend across every mode of delivery.

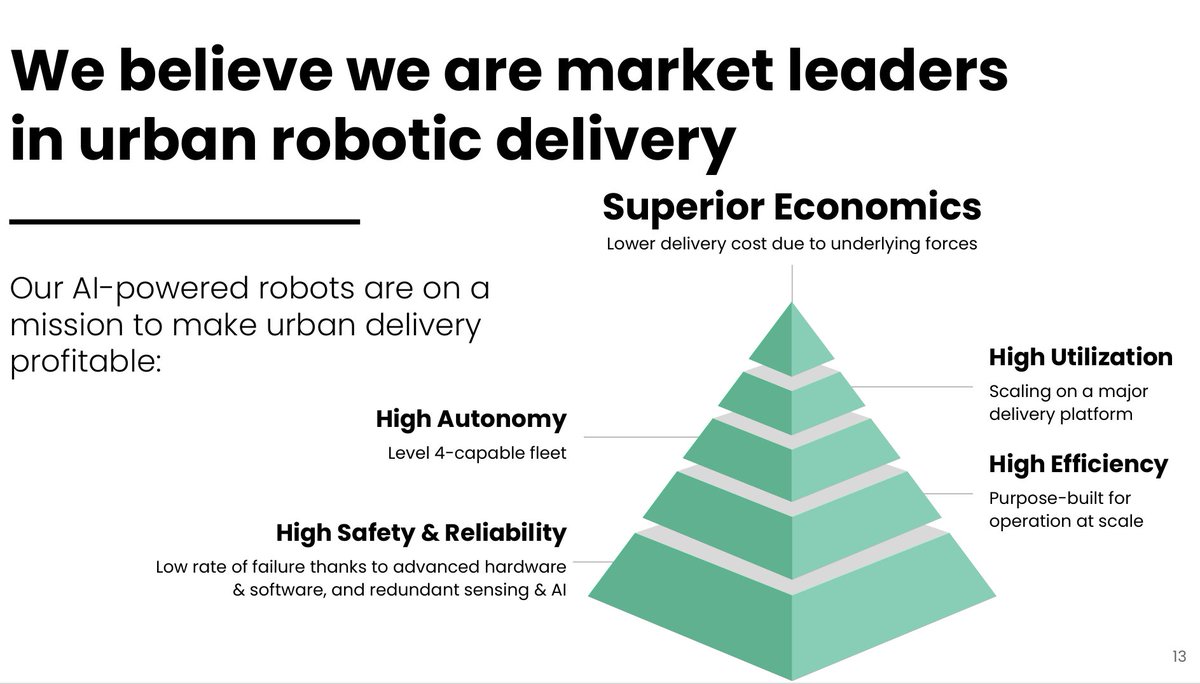

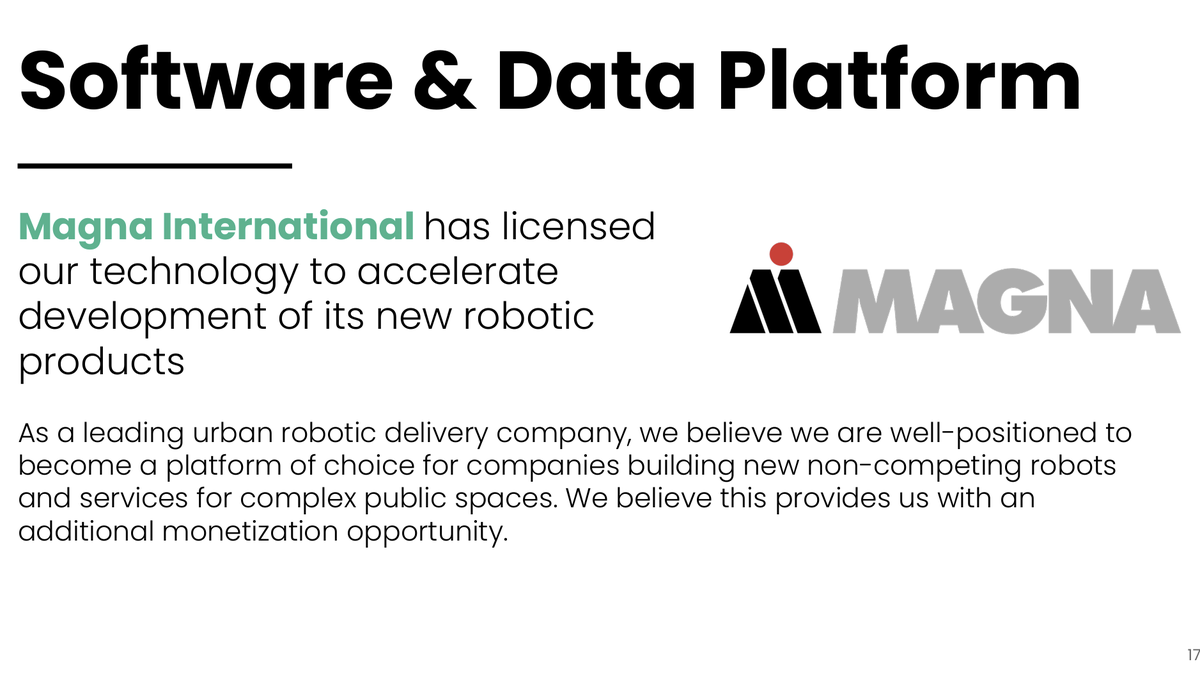

$SERV The Magna partnership proves $SERV is becoming the OS for AI robotics

Serve’s technology is now licensed and manufactured by Magna International, one of the largest automotive and robotics suppliers in the world. Magna builds vehicles and automation systems for Tesla, GM, and BMW, and is now producing Serve’s next-generation delivery robots while adopting its autonomy stack for new applications.

The partnership gives Magna a license to use Serve’s AI platform to develop entirely new robots and logistics systems. That means Serve’s navigation and perception engine can live inside robots far beyond food delivery, including industrial, commercial, and consumer uses.

CEO Ali Kashani said, “This collaboration positions our proprietary robotics technology as a platform upon which new robots can be built.” Magna Executive VP Matteo Del Sorbo added, “We are excited to continue collaborating with Serve, leveraging our manufacturing and technical expertise to help fuel Serve’s growth potential.”

Serve is no longer just a delivery company. It is becoming the operating system for physical AI, powering the next generation of intelligent robots that move goods, materials, and everything that makes cities function.

Serve’s technology is now licensed and manufactured by Magna International, one of the largest automotive and robotics suppliers in the world. Magna builds vehicles and automation systems for Tesla, GM, and BMW, and is now producing Serve’s next-generation delivery robots while adopting its autonomy stack for new applications.

The partnership gives Magna a license to use Serve’s AI platform to develop entirely new robots and logistics systems. That means Serve’s navigation and perception engine can live inside robots far beyond food delivery, including industrial, commercial, and consumer uses.

CEO Ali Kashani said, “This collaboration positions our proprietary robotics technology as a platform upon which new robots can be built.” Magna Executive VP Matteo Del Sorbo added, “We are excited to continue collaborating with Serve, leveraging our manufacturing and technical expertise to help fuel Serve’s growth potential.”

Serve is no longer just a delivery company. It is becoming the operating system for physical AI, powering the next generation of intelligent robots that move goods, materials, and everything that makes cities function.

$SERV is led by one of the strongest robotics and AI teams in the industry

Serve Robotics is not just a tech story. It is a leadership story. The company is run by pioneers with decades of experience in robotics, autonomy, and scaling real-world systems.

Dr. Ali Kashani, CEO and co-founder, holds a PhD in robotics and computer vision. He led the Postmates X robotics division that built the original Serve robot and spun the company out of Uber in 2021 to keep it platform-agnostic. A TED speaker and EY Entrepreneur of the Year 2025, Kashani is known for his optimism about AI’s potential to improve quality of life. “Every major invention was feared at first. AI is going to improve healthcare, quality of life, everything,” he said.

Anthony Armenta, Chief Software and Data Officer, was previously CTO of GM’s BrightDrop, VP of Engineering at Postmates, and a senior leader at Anki Robotics. He brings 30 years of experience in autonomous systems and logistics technology. “Serve has built a leading autonomous delivery robot, demonstrating what’s possible for real-world performance,” he said.

Euan Abraham, VP of Hardware Engineering, came from GoPro and leads the design of Serve’s third-generation robots. He integrated Ouster LiDAR and sensor redundancy to achieve Level 4 autonomy. “We continue to be impressed by Ouster’s quality and reliability,” Abraham said.

The team expanded further with top engineers from Vayu Robotics, including former Velodyne CEO Dr. Anand Gopalan, a pioneer in perception hardware and autonomy. Legendary investor Vinod Khosla also joined Serve’s Advisory Board, bringing decades of deep-tech insight.

Serve’s board includes Sarfraz Maredia, Uber’s VP of Delivery, and investors such as Uber, NVIDIA, and 7-Eleven’s corporate fund. With more than 300 employees and a concentration of robotics PhDs and senior engineers, Serve has one of the highest “talent densities” in the sector.

This is a team that has already built and commercialized robots at scale. They are now building the future of physical AI.

Serve Robotics is not just a tech story. It is a leadership story. The company is run by pioneers with decades of experience in robotics, autonomy, and scaling real-world systems.

Dr. Ali Kashani, CEO and co-founder, holds a PhD in robotics and computer vision. He led the Postmates X robotics division that built the original Serve robot and spun the company out of Uber in 2021 to keep it platform-agnostic. A TED speaker and EY Entrepreneur of the Year 2025, Kashani is known for his optimism about AI’s potential to improve quality of life. “Every major invention was feared at first. AI is going to improve healthcare, quality of life, everything,” he said.

Anthony Armenta, Chief Software and Data Officer, was previously CTO of GM’s BrightDrop, VP of Engineering at Postmates, and a senior leader at Anki Robotics. He brings 30 years of experience in autonomous systems and logistics technology. “Serve has built a leading autonomous delivery robot, demonstrating what’s possible for real-world performance,” he said.

Euan Abraham, VP of Hardware Engineering, came from GoPro and leads the design of Serve’s third-generation robots. He integrated Ouster LiDAR and sensor redundancy to achieve Level 4 autonomy. “We continue to be impressed by Ouster’s quality and reliability,” Abraham said.

The team expanded further with top engineers from Vayu Robotics, including former Velodyne CEO Dr. Anand Gopalan, a pioneer in perception hardware and autonomy. Legendary investor Vinod Khosla also joined Serve’s Advisory Board, bringing decades of deep-tech insight.

Serve’s board includes Sarfraz Maredia, Uber’s VP of Delivery, and investors such as Uber, NVIDIA, and 7-Eleven’s corporate fund. With more than 300 employees and a concentration of robotics PhDs and senior engineers, Serve has one of the highest “talent densities” in the sector.

This is a team that has already built and commercialized robots at scale. They are now building the future of physical AI.

$SERV has the balance sheet, growth, and platform to scale fast

Serve posted Q2 revenue of $642,000, up 46% quarter over quarter, with management guiding 170% to 215% year-over-year growth for Q3 2025. The company reiterated a $60–80 million annualized revenue target once its 2,000-robot fleet is fully utilized.

Serve ended Q2 with $183 million in cash and marketable securities, providing a clear runway through 2026. This liquidity allows it to self-finance robot production and expansion without relying on near-term dilution or debt.

Each robot generates recurring delivery income through partners like Uber Eats and DoorDash, while the platform adds high-margin software revenue through licensing agreements such as Magna International. As fleet utilization rises, unit economics improve dramatically.

It is still early days financially, and I would expect some capital raising, but the platform is remarkable. Serve has the foundation, partnerships, and scale potential to redefine last-mile logistics. For me, this earns a speculative buy rating within my AI portfolio.

Serve posted Q2 revenue of $642,000, up 46% quarter over quarter, with management guiding 170% to 215% year-over-year growth for Q3 2025. The company reiterated a $60–80 million annualized revenue target once its 2,000-robot fleet is fully utilized.

Serve ended Q2 with $183 million in cash and marketable securities, providing a clear runway through 2026. This liquidity allows it to self-finance robot production and expansion without relying on near-term dilution or debt.

Each robot generates recurring delivery income through partners like Uber Eats and DoorDash, while the platform adds high-margin software revenue through licensing agreements such as Magna International. As fleet utilization rises, unit economics improve dramatically.

It is still early days financially, and I would expect some capital raising, but the platform is remarkable. Serve has the foundation, partnerships, and scale potential to redefine last-mile logistics. For me, this earns a speculative buy rating within my AI portfolio.

My take: $SERV is the most promising small-cap AI robotics stock on the market

Serve is not just a delivery company. It is building the operating system for physical AI, a full-stack robotics platform that combines NVIDIA-powered autonomy, foundation model learning, and real-world data at scale. The same software that drives burrito deliveries today could one day power drones, hospital couriers, and factory logistics.

The company has tier-one validation from $UBER Uber, $DASH DoorDash, $NVDA NVIDIA, Magna, and legendary VC Vinod Khosla. It has achieved commercial Level 4 autonomy, strong early revenue growth, and a cash position that allows it to execute aggressively without dilution.

This is how big technological shifts begin: small teams, proven tech, and an expanding data flywheel. Serve’s robots are already navigating real cities and generating the datasets that will train the next generation of AI robotics.

It is still speculative, but in my view, $SERV represents the clearest early-stage exposure to the physical AI revolution. I am adding it to my Speculative AI Portfolio alongside $PATH, $RXRX, and $ASAN as a long-term asymmetric bet on the future of intelligent robotics.

Serve is not just a delivery company. It is building the operating system for physical AI, a full-stack robotics platform that combines NVIDIA-powered autonomy, foundation model learning, and real-world data at scale. The same software that drives burrito deliveries today could one day power drones, hospital couriers, and factory logistics.

The company has tier-one validation from $UBER Uber, $DASH DoorDash, $NVDA NVIDIA, Magna, and legendary VC Vinod Khosla. It has achieved commercial Level 4 autonomy, strong early revenue growth, and a cash position that allows it to execute aggressively without dilution.

This is how big technological shifts begin: small teams, proven tech, and an expanding data flywheel. Serve’s robots are already navigating real cities and generating the datasets that will train the next generation of AI robotics.

It is still speculative, but in my view, $SERV represents the clearest early-stage exposure to the physical AI revolution. I am adding it to my Speculative AI Portfolio alongside $PATH, $RXRX, and $ASAN as a long-term asymmetric bet on the future of intelligent robotics.

• • •

Missing some Tweet in this thread? You can try to

force a refresh