Not financial advice. Focused on compelling growth opportunities for high-alpha market returns in multiple sectors. Extra research and analysis for subs.

How to get URL link on X (Twitter) App

$SERV The story behind $SERV shows how real this platform already is.

$SERV The story behind $SERV shows how real this platform already is.

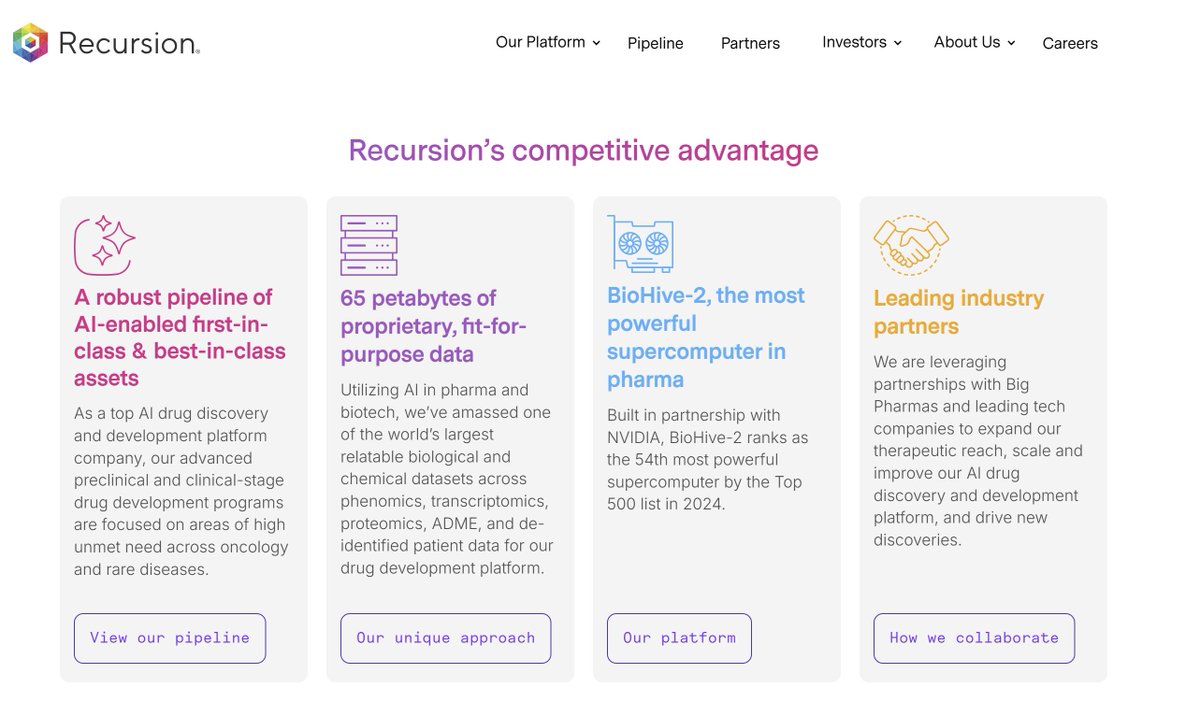

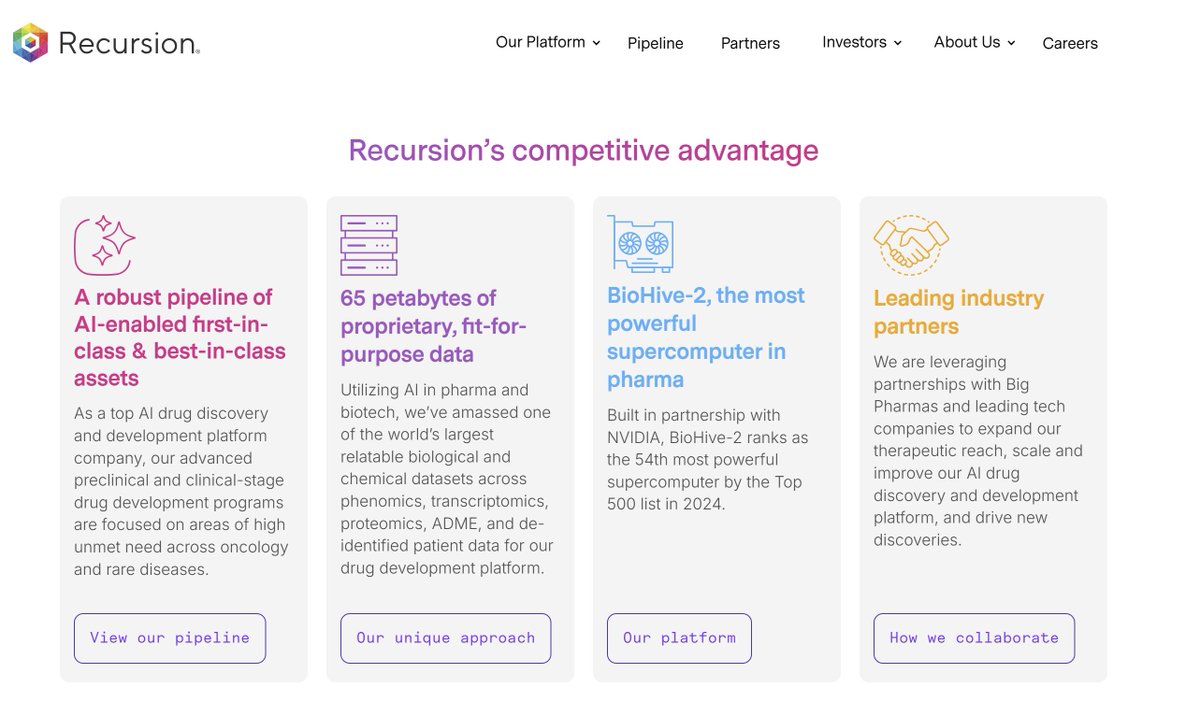

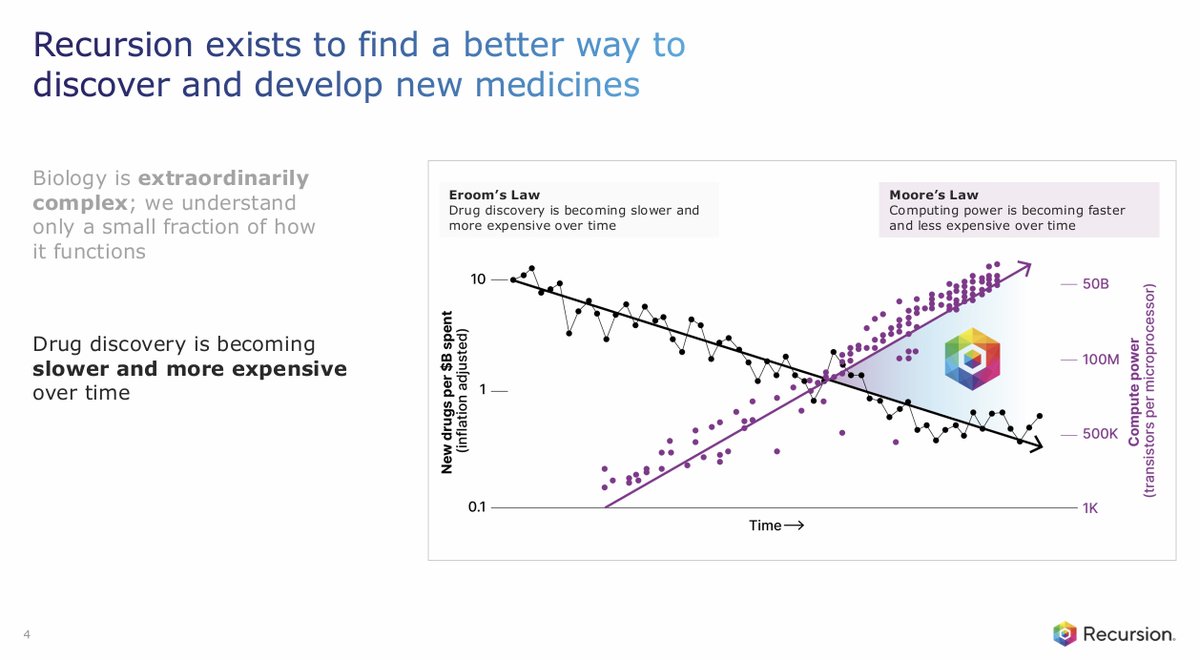

$RXRX The Vision: Solving "Eroom’s Law" with an AI Wetlab OS

$RXRX The Vision: Solving "Eroom’s Law" with an AI Wetlab OS

$PATH The evidence of an AI turnaround is tangible. Customers have already created thousands of autonomous agents and generated over 250,000 agent runs with Agent Builder.

$PATH The evidence of an AI turnaround is tangible. Customers have already created thousands of autonomous agents and generated over 250,000 agent runs with Agent Builder.

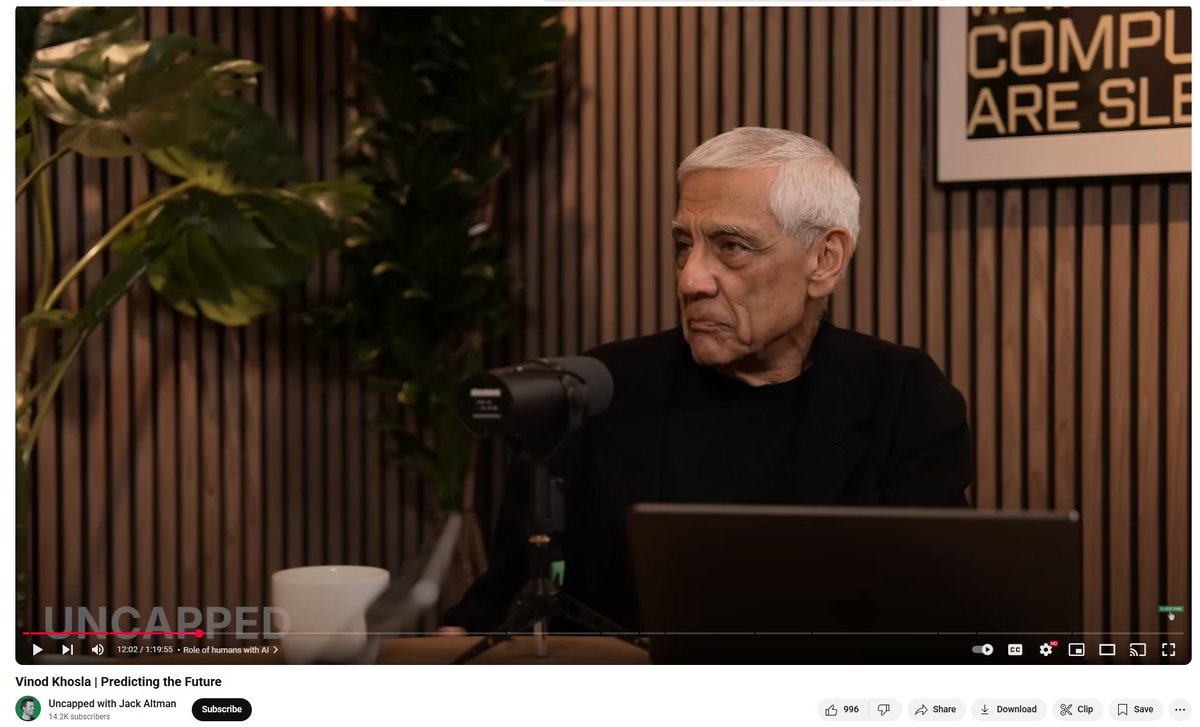

$TSLA $TEM $NBIS $CRWV $NVDA $GOOG Khosla doubles down on the social fallout. He predicts that somewhere around 2030 the sheer productivity gain flips the labor equation: "The need to work will go away. People will work on things because they want to, not because they need to pay the mortgage."

$TSLA $TEM $NBIS $CRWV $NVDA $GOOG Khosla doubles down on the social fallout. He predicts that somewhere around 2030 the sheer productivity gain flips the labor equation: "The need to work will go away. People will work on things because they want to, not because they need to pay the mortgage."

$TEM THE MASSIVE OPPORTUNITY: The Scale Is Inhuman

$TEM THE MASSIVE OPPORTUNITY: The Scale Is Inhuman

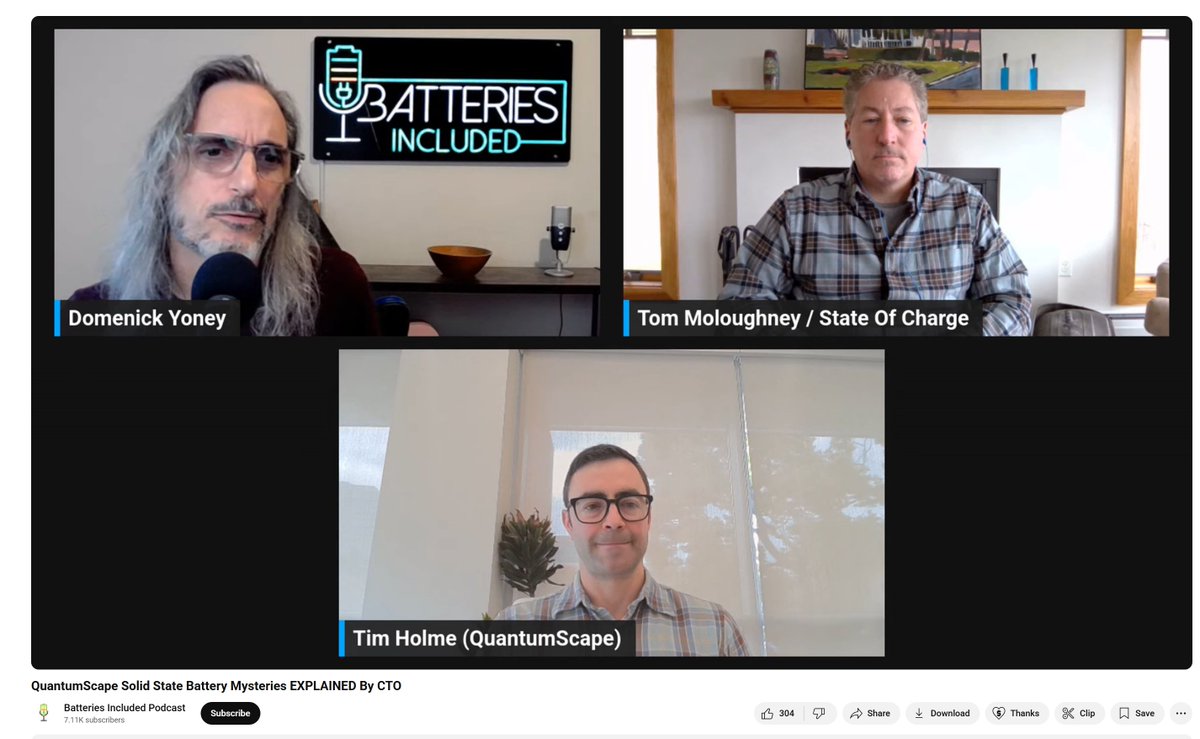

$QS A Battery That Changes All the Rules

$QS A Battery That Changes All the Rules