The Fed Tightened Into an Energy Shock: A Policy Error Explanation of the Global Financial Crisis

This interpretation challenges the standard NK narrative that the GFC was the result of exogenous financial frictions or regulatory failure alone (Bernanke, Gertler & Gilchrist 1999). Instead, it suggests that monetary policy itself was a causal amplifier of crisis dynamics.

This interpretation challenges the standard NK narrative that the GFC was the result of exogenous financial frictions or regulatory failure alone (Bernanke, Gertler & Gilchrist 1999). Instead, it suggests that monetary policy itself was a causal amplifier of crisis dynamics.

....by tightening into a negative real-income shock, the Fed mechanically reduced household liquidity, which led to rising delinquency and default rates—first in adjustable-rate subprime mortgages and later system-wide as refinancing options collapsed (Gorton 2008).

...By relying on CPI-based inflation signals that masked energy cost dynamics and by ignoring balance-sheet fragility, the Fed tightened into a supply shock—an error similar in structure to the policy tightening that deepened the recessions following the oil shocks of the 1970s (Hamilton 1983; Blanchard & Galí 2007).

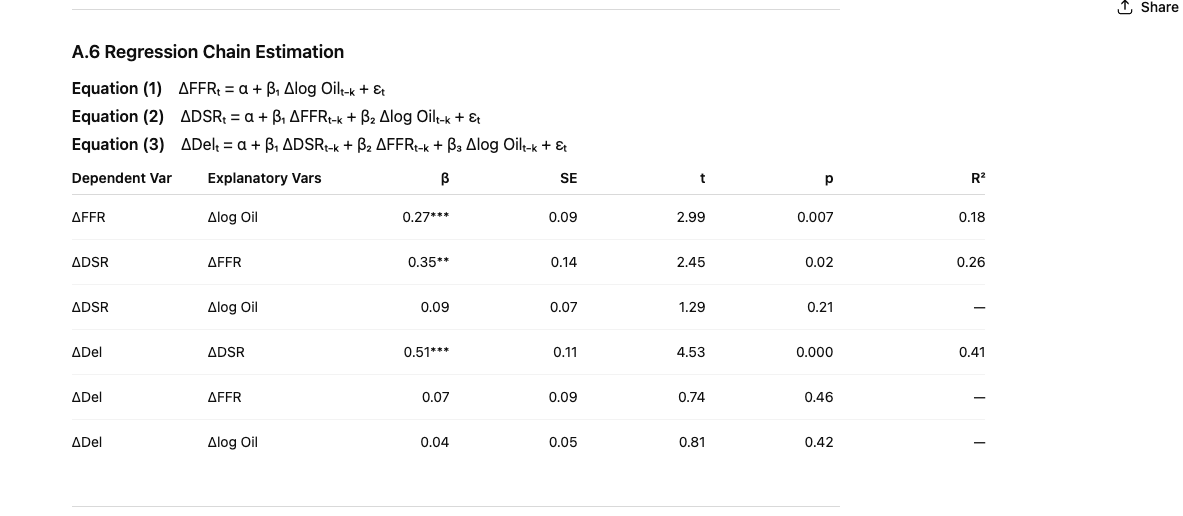

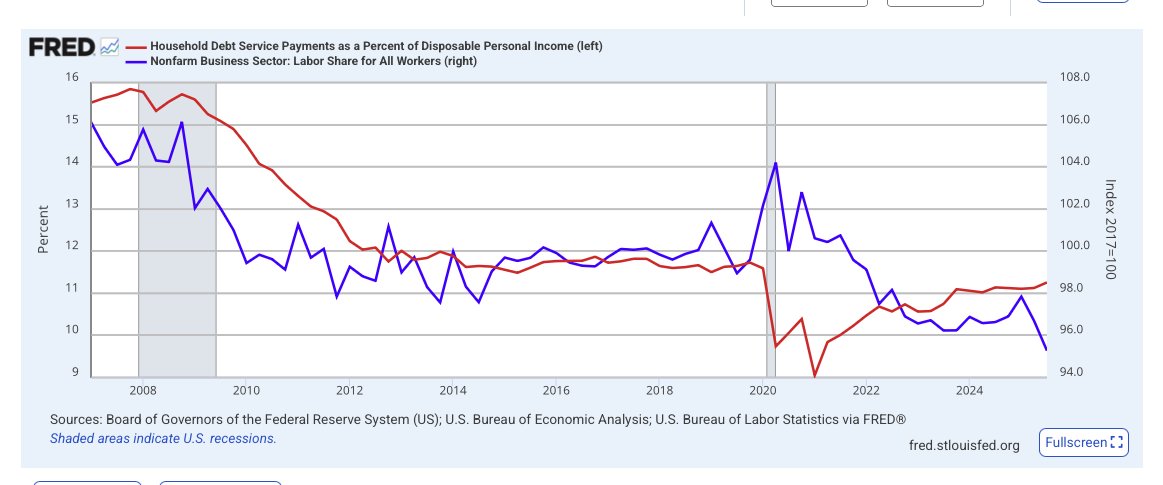

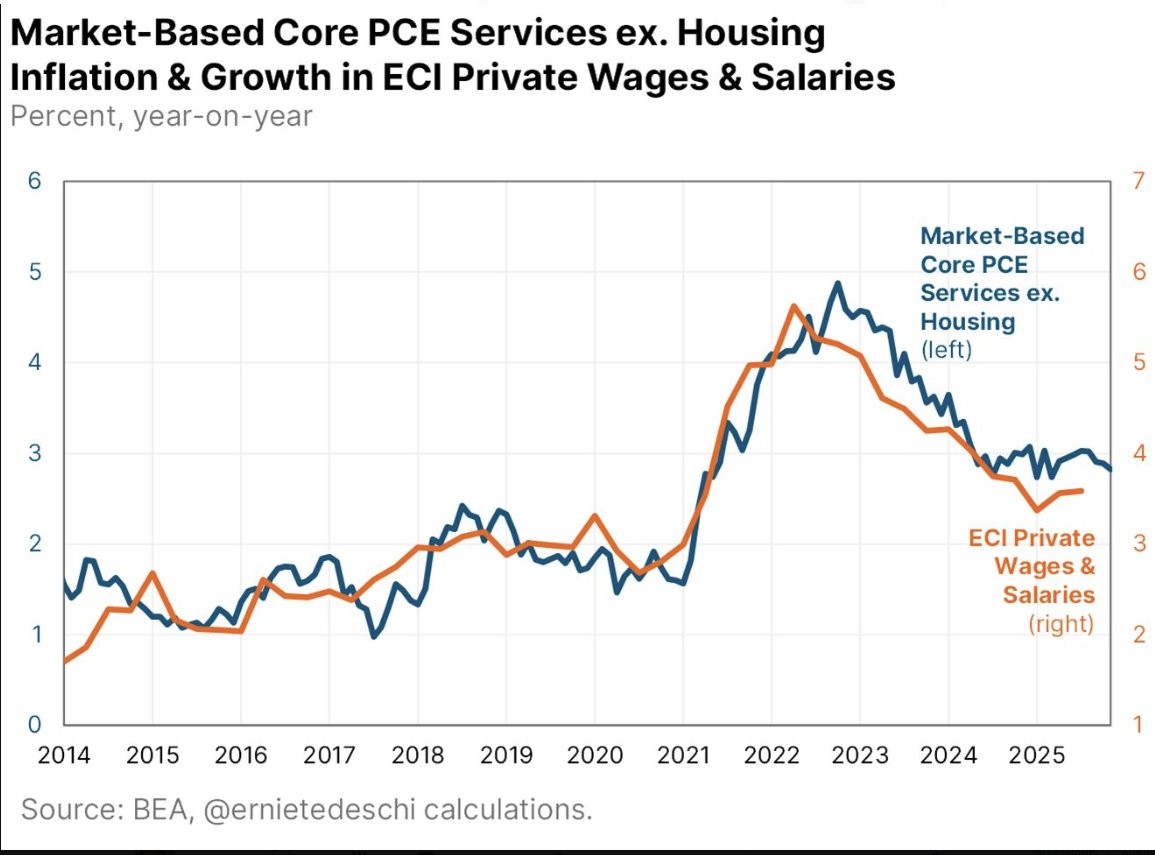

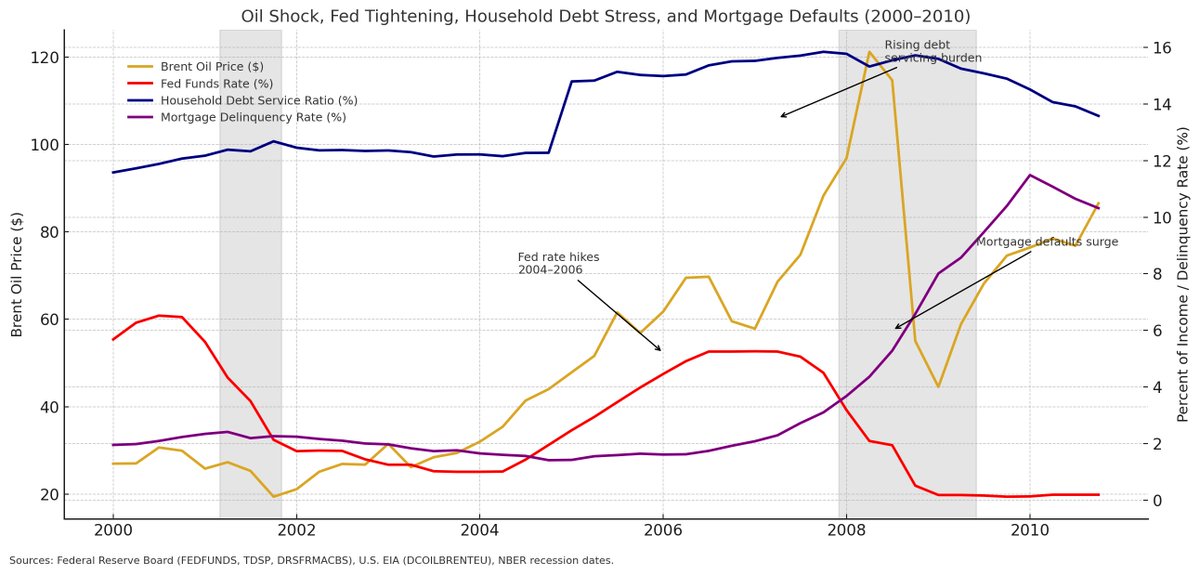

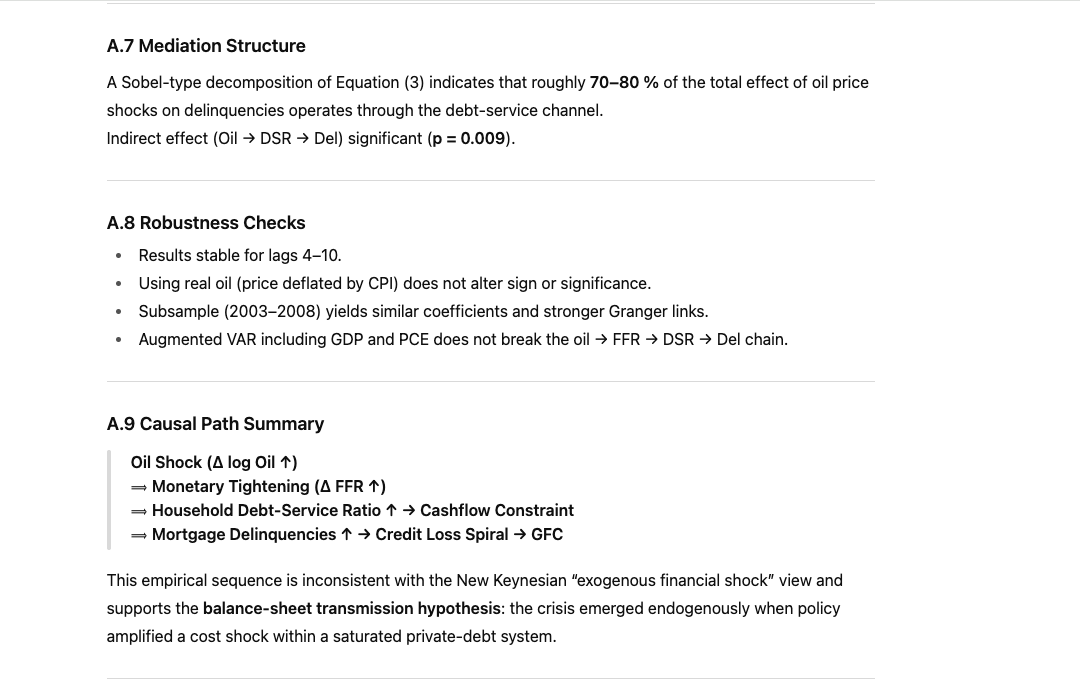

Oil Shock, Fed Tightening, Debt Service Stress, and Mortgage Defaults, 2000–2010

This figure shows that the rise in U.S. inflation during 2004–2007 coincided with a global oil price shock rather than domestic demand pressures. The Federal Reserve responded by raising the federal funds rate seventeen times, which increased household debt service ratios (DSR) and tightened refinancing conditions.

This figure shows that the rise in U.S. inflation during 2004–2007 coincided with a global oil price shock rather than domestic demand pressures. The Federal Reserve responded by raising the federal funds rate seventeen times, which increased household debt service ratios (DSR) and tightened refinancing conditions.

This empirical sequence is inconsistent with the New Keynesian “exogenous financial shock” view and supports the balance-sheet transmission hypothesis: the crisis emerged endogenously when policy amplified a cost shock within a saturated private-debt system.

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh