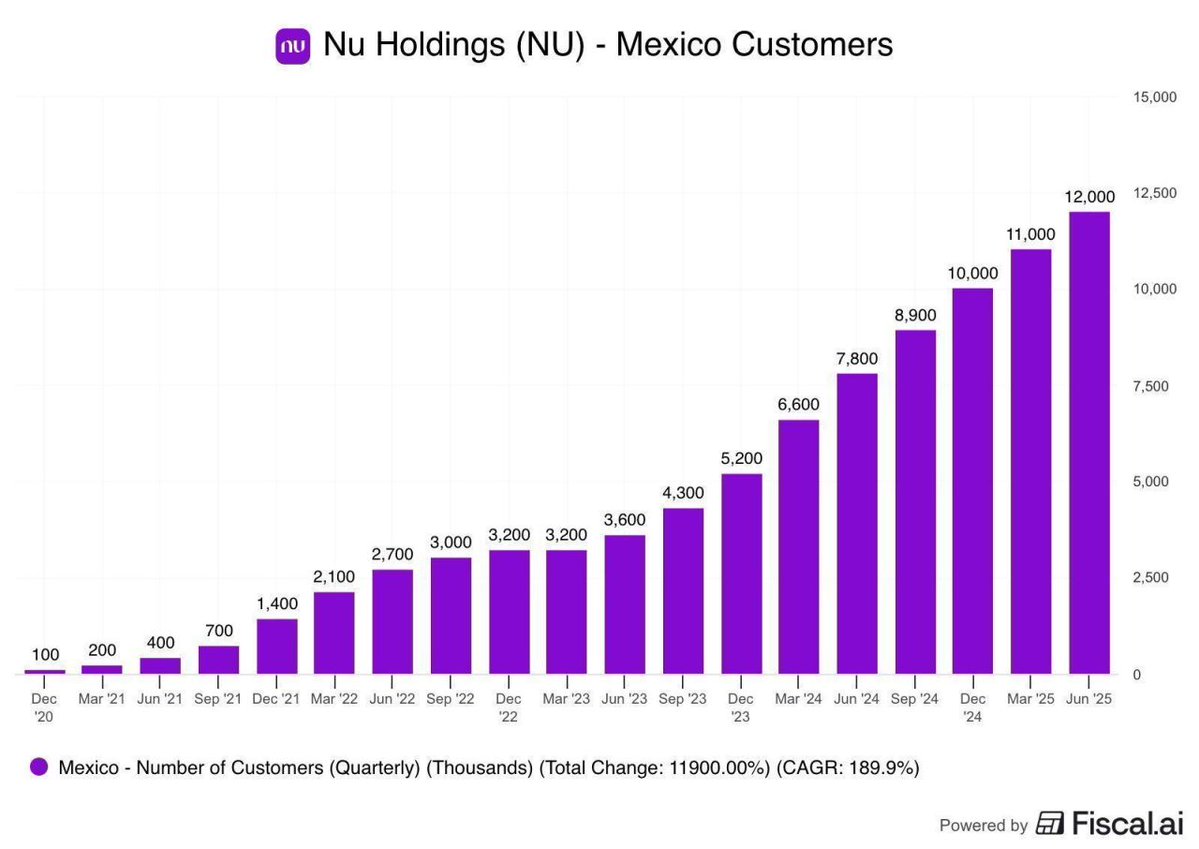

Nubank went from launching in Mexico in 2020 to 12 million customers by mid-2025. Now they're applying for a US bank charter.

Can they repeat the trick?

Most people see Nubank as a Brazil story.

But Mexico is the untold story—and it reveals how they actually win.

---

Here's what matters:

- Monthly ARPAC: ~$11 (more mature cohorts at $25)

- Cost to serve: $0.80 per customer

- Customer acquisition cost: ~$5-6 (80% organic through word-of-mouth)

- Activity rate: 83%+

- Efficiency ratio: sub-30% (vs 50%+ for traditional banks)

Mexico specifically:

- 10M customers as of Jan 2025 (12M by July)

- Doubled customer base in 12 months

- Now serving 25% of Mexico's banked population

- 3rd largest in credit cards issued

~50% of customers got their first credit card from Nubank

Full banking license approved April 2025

---

The US expansion is real:

- Applied for OCC national charter Sept 2025

- Cristina Junqueira (co-founder) relocated full-time to lead it

- 122M+ customers across Brazil, Mexico, Colombia as the foundation for remittances

---

What traditional bank CEOs miss:

They see Nubank's "single global platform" and "single data platform" and try to copy it.

They get the what.

They miss the how.

- It's not abstracting mainframes and calling it "global."

- It's not forcing one data model on every market.

It's:

- 100% cloud-native from day one

- Custom data pipelines for credit models and personalization

- Product-market fit first, scale second

- Credit cards before checking accounts (the hardest vertical first)

- 80-90% customers acquired through referrals, not paid marketing

- 60% of customers use Nubank as primary bank

- Capital discipline — <5% of revenue on marketing, 4x that on R&D

---

The US market is brutally competitive.

But Nubank's Mexico playbook shows something rare: unit economics that improve in new markets.

Mexico's customer engagement and revenue curves grew faster than Brazil at the same maturity stage.

That's what happens when you arrive with battle-tested tech, proven risk models, and a decade of learning compressed into the launch.

The real question isn't whether Nubank can compete in the US.

It's whether US incumbents are ready for a competitor that knows how to build a bank for 122 million customers while spending $0.80 to serve each one.

Ac

Can they repeat the trick?

Most people see Nubank as a Brazil story.

But Mexico is the untold story—and it reveals how they actually win.

---

Here's what matters:

- Monthly ARPAC: ~$11 (more mature cohorts at $25)

- Cost to serve: $0.80 per customer

- Customer acquisition cost: ~$5-6 (80% organic through word-of-mouth)

- Activity rate: 83%+

- Efficiency ratio: sub-30% (vs 50%+ for traditional banks)

Mexico specifically:

- 10M customers as of Jan 2025 (12M by July)

- Doubled customer base in 12 months

- Now serving 25% of Mexico's banked population

- 3rd largest in credit cards issued

~50% of customers got their first credit card from Nubank

Full banking license approved April 2025

---

The US expansion is real:

- Applied for OCC national charter Sept 2025

- Cristina Junqueira (co-founder) relocated full-time to lead it

- 122M+ customers across Brazil, Mexico, Colombia as the foundation for remittances

---

What traditional bank CEOs miss:

They see Nubank's "single global platform" and "single data platform" and try to copy it.

They get the what.

They miss the how.

- It's not abstracting mainframes and calling it "global."

- It's not forcing one data model on every market.

It's:

- 100% cloud-native from day one

- Custom data pipelines for credit models and personalization

- Product-market fit first, scale second

- Credit cards before checking accounts (the hardest vertical first)

- 80-90% customers acquired through referrals, not paid marketing

- 60% of customers use Nubank as primary bank

- Capital discipline — <5% of revenue on marketing, 4x that on R&D

---

The US market is brutally competitive.

But Nubank's Mexico playbook shows something rare: unit economics that improve in new markets.

Mexico's customer engagement and revenue curves grew faster than Brazil at the same maturity stage.

That's what happens when you arrive with battle-tested tech, proven risk models, and a decade of learning compressed into the launch.

The real question isn't whether Nubank can compete in the US.

It's whether US incumbents are ready for a competitor that knows how to build a bank for 122 million customers while spending $0.80 to serve each one.

Ac

• • •

Missing some Tweet in this thread? You can try to

force a refresh