Russia is preparing a large-scale bond issue.

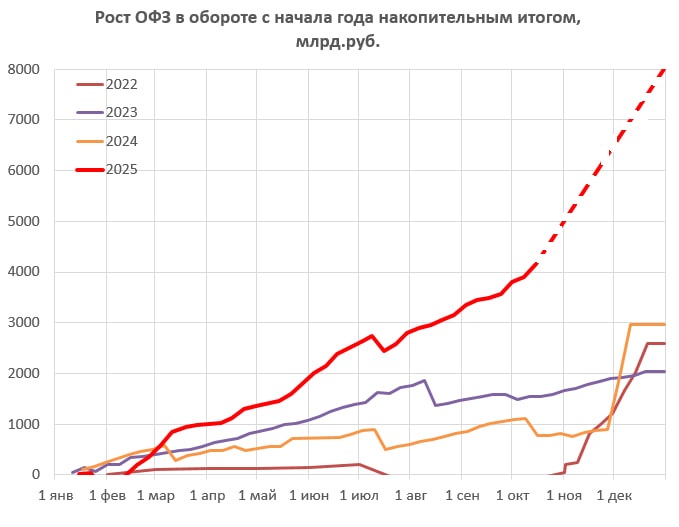

Today, news broke that the Russian Ministry of Finance has registered five new bond issues with a nominal value of 4.25 trillion rubles.

Explanation:

To cover the budget deficit, the Ministry of Finance needs funds. The Ministry

1/

Today, news broke that the Russian Ministry of Finance has registered five new bond issues with a nominal value of 4.25 trillion rubles.

Explanation:

To cover the budget deficit, the Ministry of Finance needs funds. The Ministry

1/

issues bonds and sells them on the market, with the proceeds going to the budget to cover the deficit.

But the problem is that it's impossible to borrow such huge sums on the Russian market.

To do this, the Central Bank issues repo agreements to banks secured by OFZs, so that

2/

But the problem is that it's impossible to borrow such huge sums on the Russian market.

To do this, the Central Bank issues repo agreements to banks secured by OFZs, so that

2/

the banks can use these funds to buy OFZs again. This is essentially an ISSUE (printing money without any backing). Since, under Ru law, the Central Bank of Rus is not allowed to directly finance the budget, a scheme is being used with intermediary banks. Thus, 4 tril rub

3/

3/

could be injected into circulation by the end of the year.

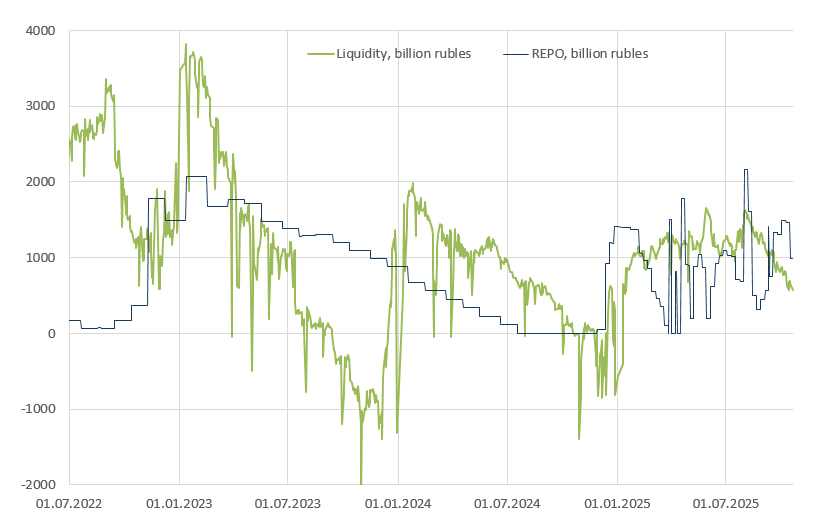

But there's another problem: throughout the year, the Central Bank has already issued banks repo agreements worth 1 tril rub... and the banks haven't returned these funds to the CB, so they're still floating around.

4/

But there's another problem: throughout the year, the Central Bank has already issued banks repo agreements worth 1 tril rub... and the banks haven't returned these funds to the CB, so they're still floating around.

4/

This means the Central Bank must issue banks another 4 trillion rubles in addition to the 1 trillion rubles already issued.

This entire setup will lead to a devaluation of the ruble supply, as there will be a sharp increase in rubles in circulation. This scheme is perfectly

5/

This entire setup will lead to a devaluation of the ruble supply, as there will be a sharp increase in rubles in circulation. This scheme is perfectly

5/

feasible during times of crisis, but playing with such volumes can lead to uncontrollable processes. And the 1 trillion repo figure, which hasn't decreased for a year, shows that they're getting deeper and deeper into these games. And funding for these expenses is partially

6/

6/

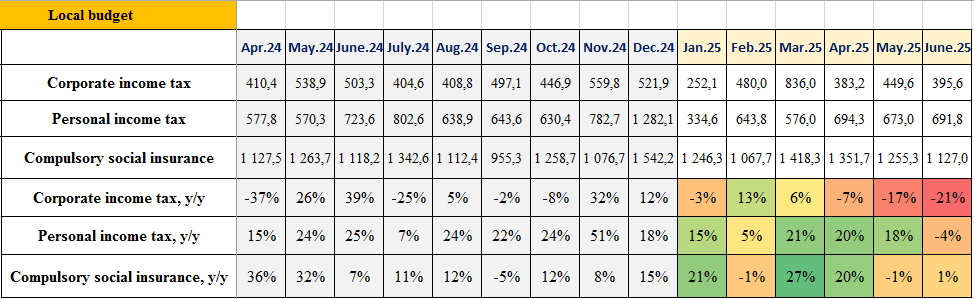

And funding for these expenses is partially shifting from tax collection to outright money printing.

To put it even more simply, Russia is ramping up its printing press on an unprecedented scale.

7/7

To put it even more simply, Russia is ramping up its printing press on an unprecedented scale.

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh