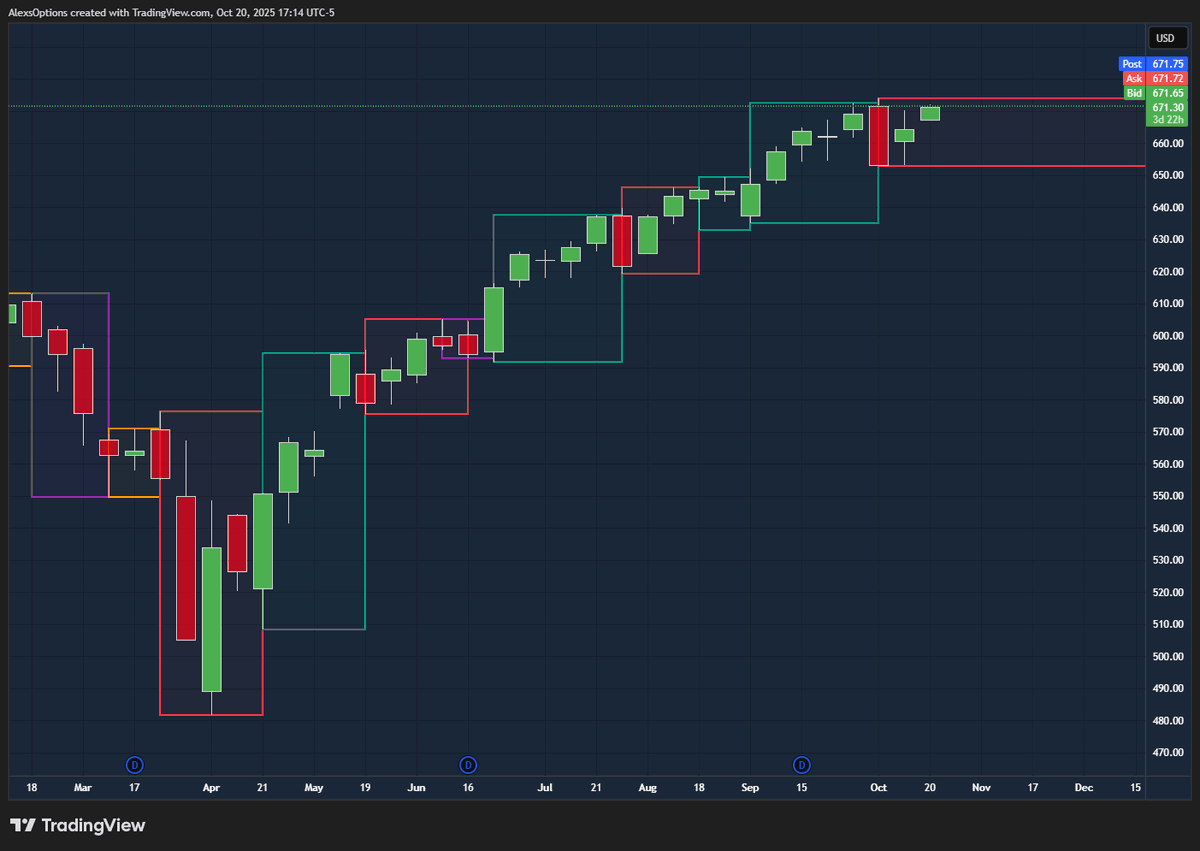

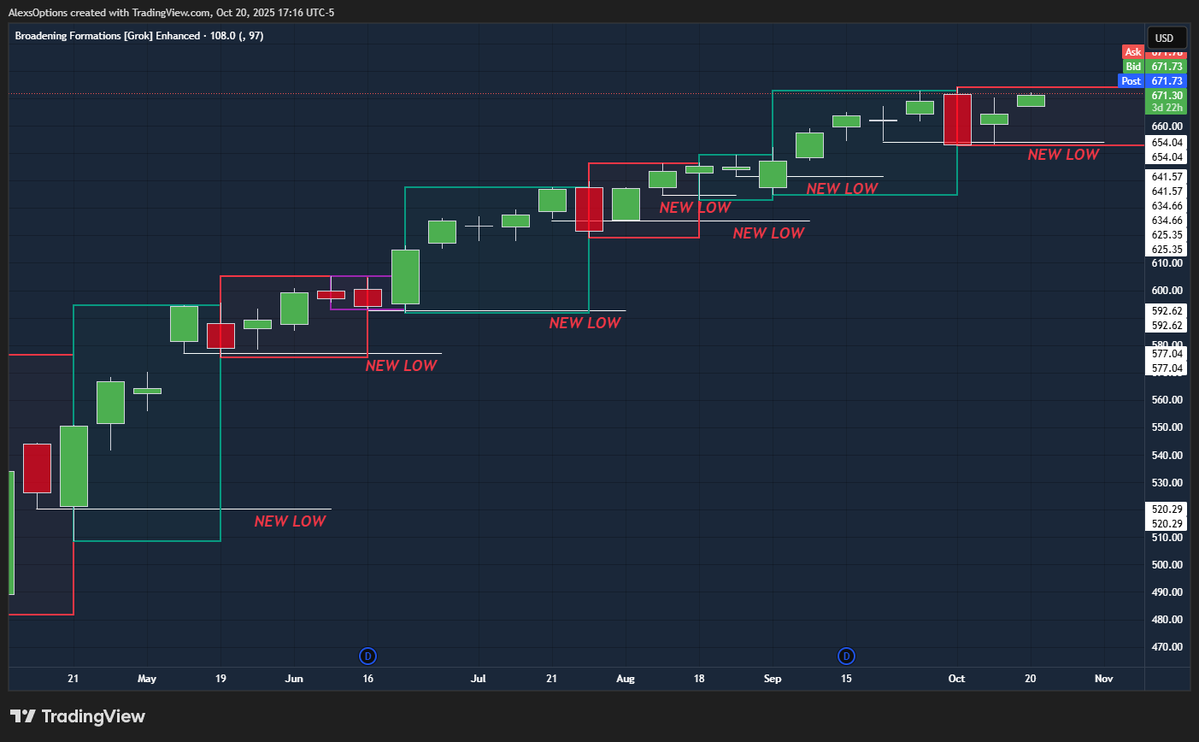

Every box you see [color irrelevant] is a broadening formation.

This is a new script I've been working on.

🧵 You'll notice a few things...

This is a new script I've been working on.

🧵 You'll notice a few things...

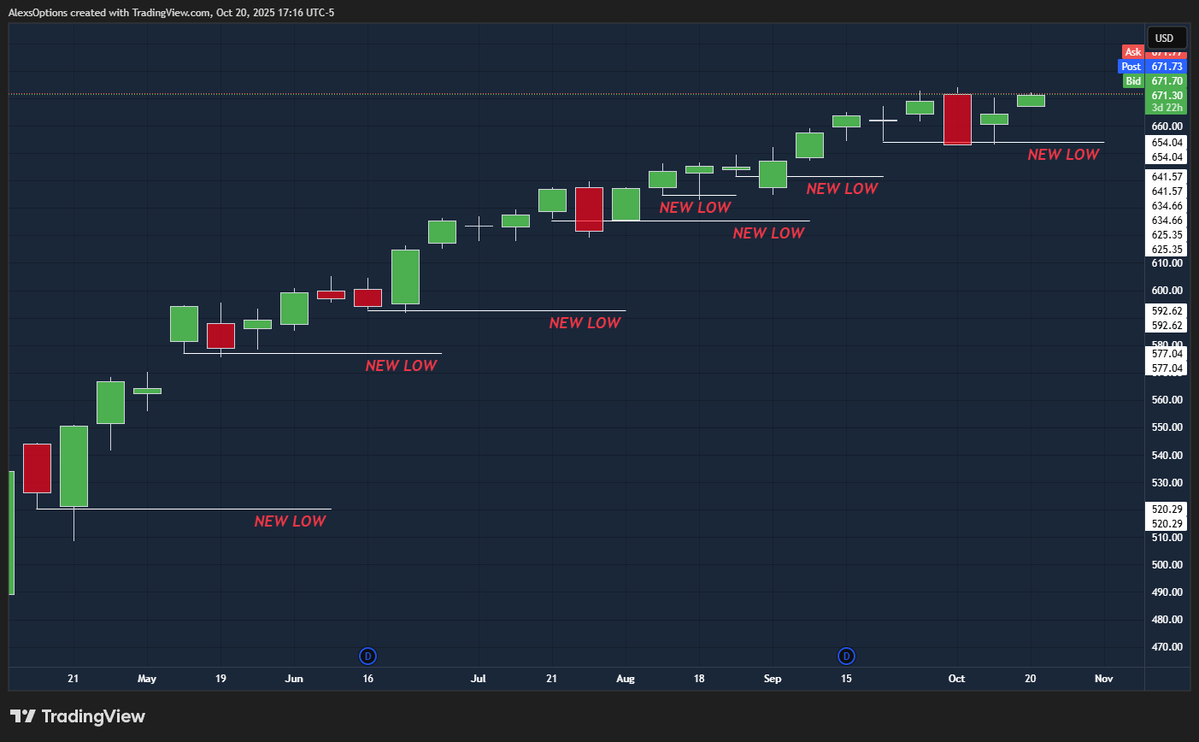

1) Where do these broadening formations start?

They ALL start after making new lows ot a previous bar or multiple bars

They ALL start after making new lows ot a previous bar or multiple bars

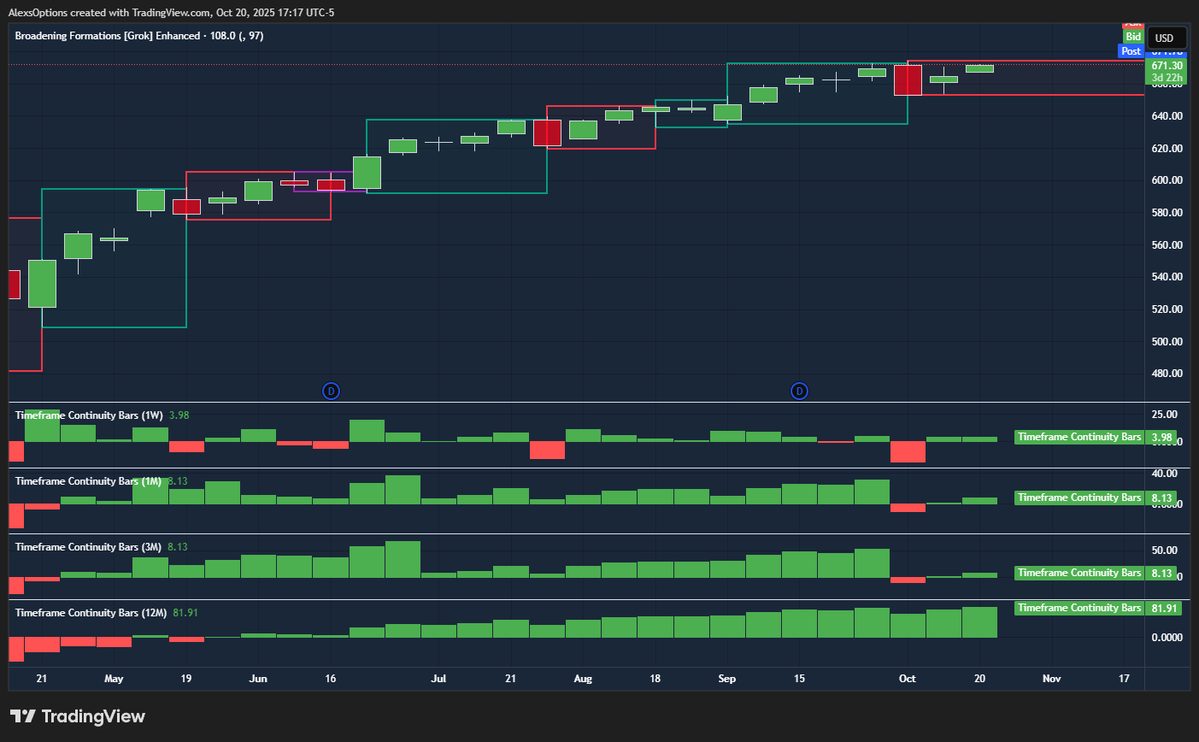

2) These broadening formations went back to the upside due to CONTINUITY

All of these occurred with at least weekly continuity if not the 1m 3m 12m charts all confirming the bf to the upside.

All of these occurred with at least weekly continuity if not the 1m 3m 12m charts all confirming the bf to the upside.

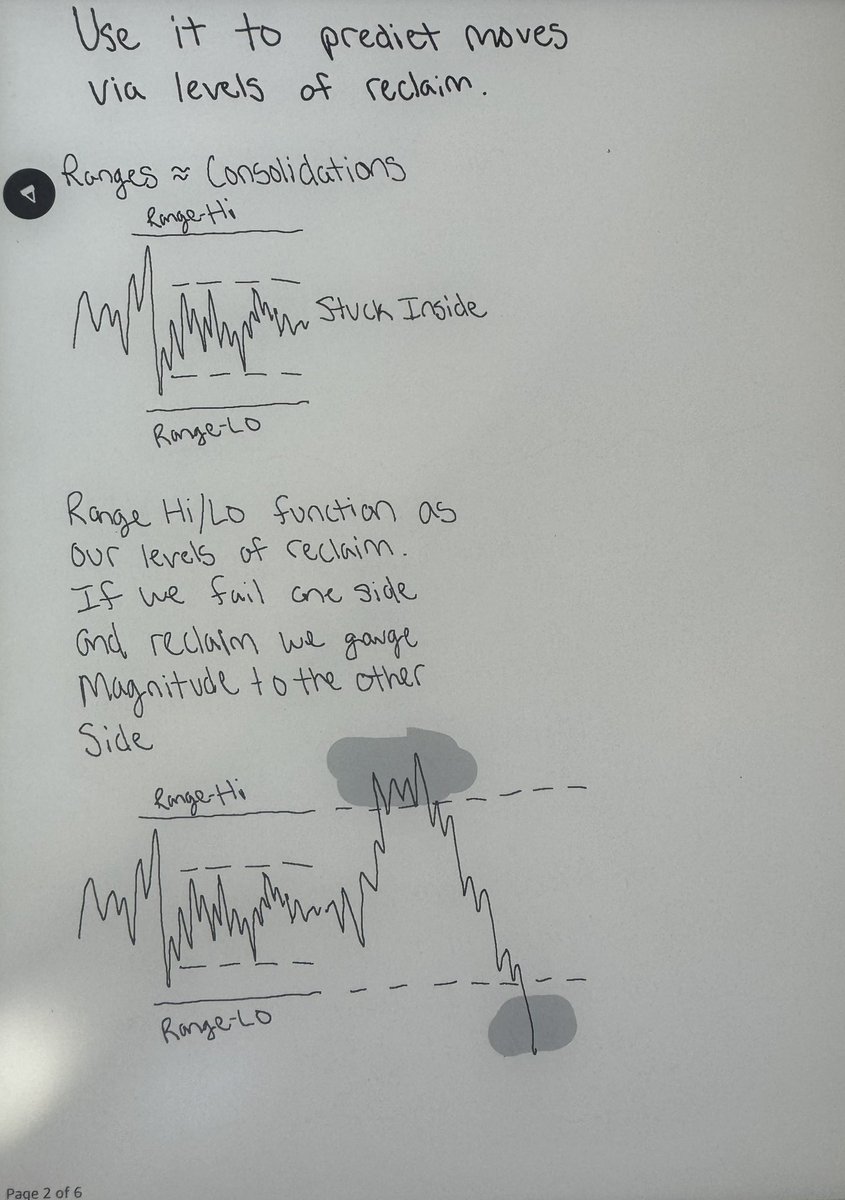

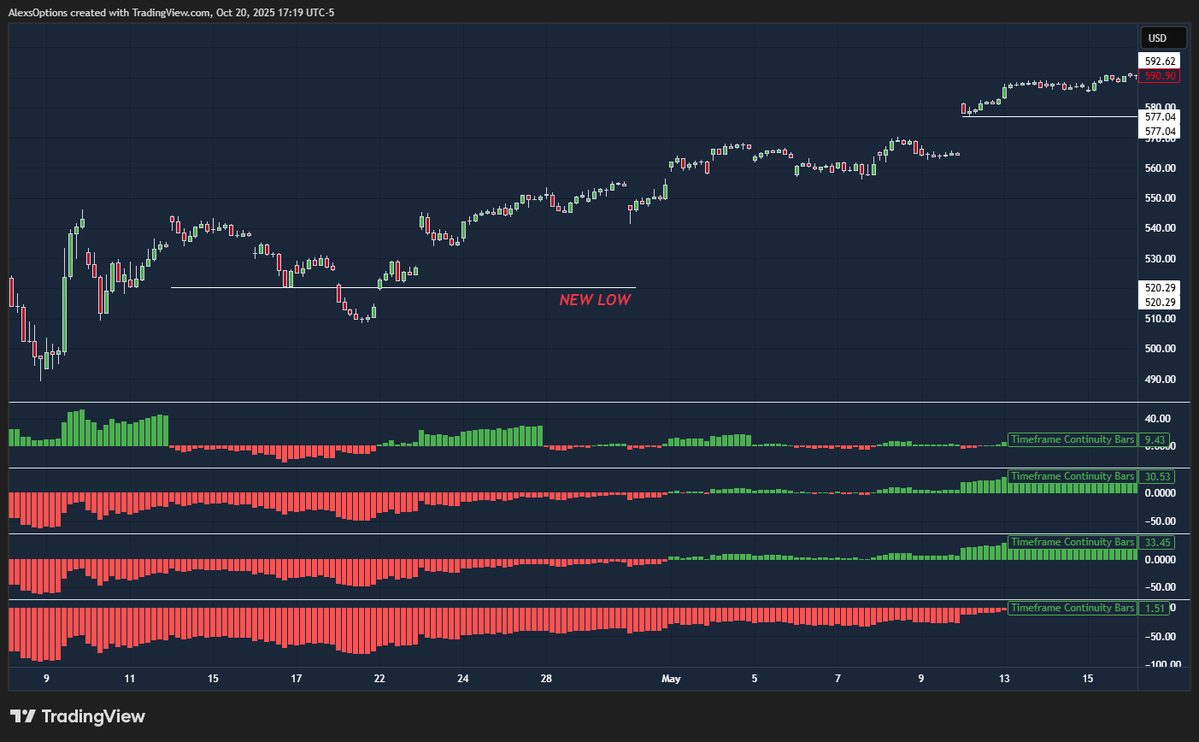

3) On a lower timeframe you'll notice these are ALL levels of reclaim.

When the lows are reclaimed we kick back into a pereiod of continuity up. Where the W M Q Y are all green!

Shorts sell into the lows, aggressive buyers force them to cover

When the lows are reclaimed we kick back into a pereiod of continuity up. Where the W M Q Y are all green!

Shorts sell into the lows, aggressive buyers force them to cover

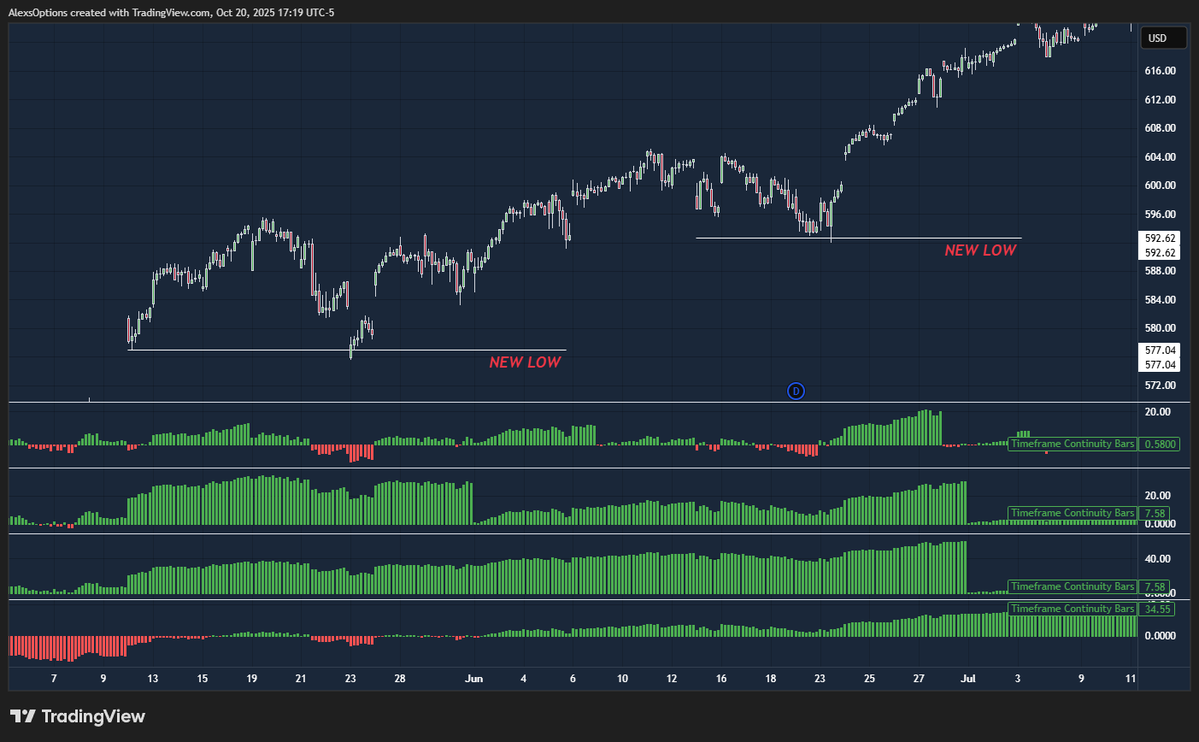

What should you take from this?

Well, outside bars are how price aggregates.

The only time you won't see them occur is during consolidation [because they're occuring on lower timeframes!]

As far as trading goes, when any asset is trending and makes lower lows that is when we want to hit it!

Well, outside bars are how price aggregates.

The only time you won't see them occur is during consolidation [because they're occuring on lower timeframes!]

As far as trading goes, when any asset is trending and makes lower lows that is when we want to hit it!

• • •

Missing some Tweet in this thread? You can try to

force a refresh