🧵 THREAD:

“China’s silver vaults are draining fast.” 🐉🥈

1️⃣

Shanghai Gold Exchange just reported another 57 tons of silver withdrawn last week.

That’s 1.83 million ounces gone — in one week.

SGE inventories dropped from 1 108 t → 1 050 t, approaching the 1 000 t mark for the first time in years.

“China’s silver vaults are draining fast.” 🐉🥈

1️⃣

Shanghai Gold Exchange just reported another 57 tons of silver withdrawn last week.

That’s 1.83 million ounces gone — in one week.

SGE inventories dropped from 1 108 t → 1 050 t, approaching the 1 000 t mark for the first time in years.

https://x.com/honzacern1/status/1980477119546511612

2️⃣

For perspective:

if this pace continues (−50 t per week), China’s vaults could dip below 1 000 t by mid-November.

That would mark one of the lowest levels since 2020, when supply chains were shattered and premiums exploded across Asia.

For perspective:

if this pace continues (−50 t per week), China’s vaults could dip below 1 000 t by mid-November.

That would mark one of the lowest levels since 2020, when supply chains were shattered and premiums exploded across Asia.

3️⃣

Why it matters:

When physical silver drains from Chinese vaults, it usually signals tightness in the real market — not paper.

Industrial demand (solar, electronics) and investor buying are both pulling from the same pool.

And that pool is shrinking.

Why it matters:

When physical silver drains from Chinese vaults, it usually signals tightness in the real market — not paper.

Industrial demand (solar, electronics) and investor buying are both pulling from the same pool.

And that pool is shrinking.

4️⃣

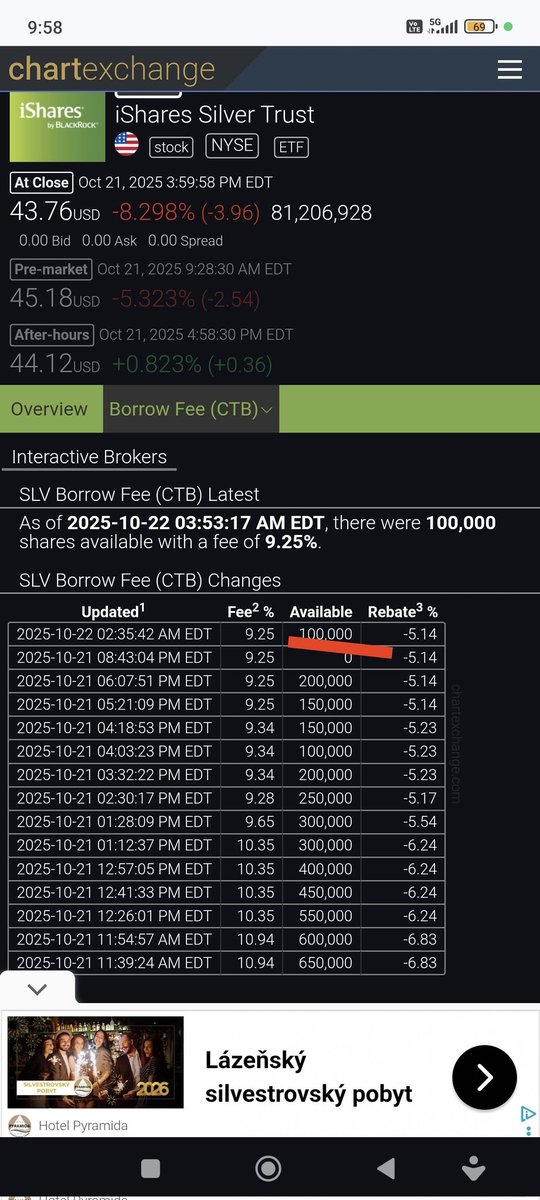

Meanwhile, Western “paper markets” still pretend everything’s fine —but you can’t short what’s not there.

China’s silver outflows are a real-world stress test for the illusion of abundance created in London and New York.

Meanwhile, Western “paper markets” still pretend everything’s fine —but you can’t short what’s not there.

China’s silver outflows are a real-world stress test for the illusion of abundance created in London and New York.

5️⃣

Keep watching the SGE inventory chart.

When it breaks below 1 000 t — it’s not just a number.

It’s a signal that Asia owns the price discovery,

and the East is stacking while the West is sleeping. 🥈🐉

#Silver #China #SGE #SilverSqueeze

Keep watching the SGE inventory chart.

When it breaks below 1 000 t — it’s not just a number.

It’s a signal that Asia owns the price discovery,

and the East is stacking while the West is sleeping. 🥈🐉

#Silver #China #SGE #SilverSqueeze

• • •

Missing some Tweet in this thread? You can try to

force a refresh