🧵 Thread: How AI and Stablecoins Are Rewriting Money

1️⃣

The Clarity Act changes everything.

It’s the biggest monetary overhaul in decades, a bipartisan reset of the financial guardrails that built the modern economy.

It legalizes stablecoins, separates money from credit, and opens the door for AI to move value at machine speed.

Here’s how it rewires money 👇

1️⃣

The Clarity Act changes everything.

It’s the biggest monetary overhaul in decades, a bipartisan reset of the financial guardrails that built the modern economy.

It legalizes stablecoins, separates money from credit, and opens the door for AI to move value at machine speed.

Here’s how it rewires money 👇

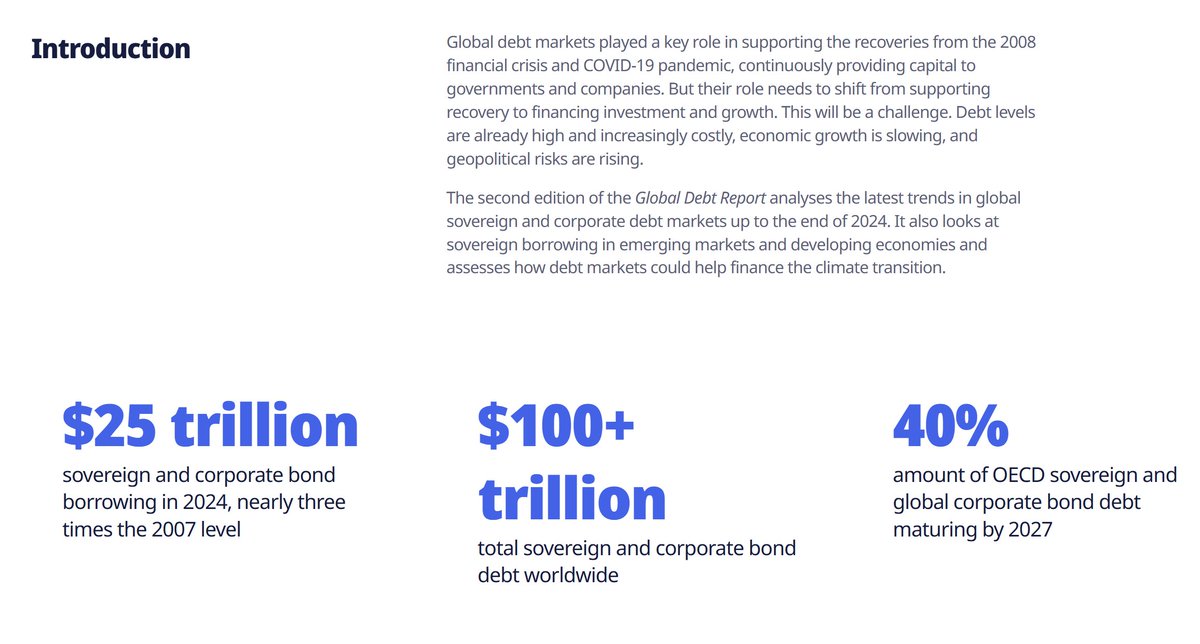

2️⃣

Our financial system still runs on 1970s plumbing.

Wires take days.

Remittances bleed fees.

Settlement takes “T+3.”

That worked when humans ran the economy.

But AI agents don’t sleep, don’t take weekends, and don’t wait for bank hours.

Our financial system still runs on 1970s plumbing.

Wires take days.

Remittances bleed fees.

Settlement takes “T+3.”

That worked when humans ran the economy.

But AI agents don’t sleep, don’t take weekends, and don’t wait for bank hours.

3️⃣

As Circle CEO Jeremy Allaire said:

“When you deposit a million dollars in a bank, they lend it out 12 times. That’s insane. That’s fractional-reserve banking.”

Stablecoins replace that model with fully reserved, programmable dollars, money that moves like data.

As Circle CEO Jeremy Allaire said:

“When you deposit a million dollars in a bank, they lend it out 12 times. That’s insane. That’s fractional-reserve banking.”

Stablecoins replace that model with fully reserved, programmable dollars, money that moves like data.

4️⃣

Most people think crypto = Bitcoin or NFTs.

They’re missing the story:

👉 The Clarity Act and Market Structure Act give America the framework for a new financial internet, stablecoins as base-layer money, tokenized assets as code, and AI as the user.

Most people think crypto = Bitcoin or NFTs.

They’re missing the story:

👉 The Clarity Act and Market Structure Act give America the framework for a new financial internet, stablecoins as base-layer money, tokenized assets as code, and AI as the user.

5️⃣

It’s not about speculation.

It’s about infrastructure.

Stablecoins are the TCP/IP of money, the boring but critical layer that lets everything else work.

It’s not about speculation.

It’s about infrastructure.

Stablecoins are the TCP/IP of money, the boring but critical layer that lets everything else work.

6️⃣

And here’s where AI comes in.

As Allaire predicted:

“The vast majority of stablecoin transactions will be AI-intermediated within five years.”

Money will soon move automatically, 24/7, by algorithms optimizing in real time.

And here’s where AI comes in.

As Allaire predicted:

“The vast majority of stablecoin transactions will be AI-intermediated within five years.”

Money will soon move automatically, 24/7, by algorithms optimizing in real time.

7️⃣

This is why the Clarity Act matters now.

It turns digital dollars from a gray area into legal money for machines.

Without it, AI has no payment rail.

With it, the financial internet can finally scale.

This is why the Clarity Act matters now.

It turns digital dollars from a gray area into legal money for machines.

Without it, AI has no payment rail.

With it, the financial internet can finally scale.

8️⃣

But there’s a global twist.

In Argentina, stablecoins already act as an escape hatch from inflation and capital controls.

@StanChart calls this “crypto-dollarisation," citizens moving into “dollars with an API.”

For emerging markets, stablecoins are both a lifeline and a risk.

But there’s a global twist.

In Argentina, stablecoins already act as an escape hatch from inflation and capital controls.

@StanChart calls this “crypto-dollarisation," citizens moving into “dollars with an API.”

For emerging markets, stablecoins are both a lifeline and a risk.

9️⃣

For corporations, the story is equally big.

Every company will soon have an on-chain treasury, transparent, programmable, and connected to tokenized capital markets.

Coca-Cola could airdrop perks to shareholders.

Tesla could token-gate referrals.

Loyalty and ownership will merge.

For corporations, the story is equally big.

Every company will soon have an on-chain treasury, transparent, programmable, and connected to tokenized capital markets.

Coca-Cola could airdrop perks to shareholders.

Tesla could token-gate referrals.

Loyalty and ownership will merge.

10️⃣

This isn’t Web3 hype.

It’s a Financial Operating System Upgrade.

AI creates intelligence.

Tokenization creates liquidity.

Stablecoins create trust.

Together, they rewrite capitalism for the AI age.

This isn’t Web3 hype.

It’s a Financial Operating System Upgrade.

AI creates intelligence.

Tokenization creates liquidity.

Stablecoins create trust.

Together, they rewrite capitalism for the AI age.

11️⃣

The Clarity Act is the catalyst, the moment regulation catches up to innovation.

It’s not just crypto policy.

It’s the starting gun for the AI economy.

The Clarity Act is the catalyst, the moment regulation catches up to innovation.

It’s not just crypto policy.

It’s the starting gun for the AI economy.

12️⃣

📘 Read the full essay:

“How AI and Stablecoins Are Rewriting Money”

→

The biggest change to money since 1971 is happening right now and most people haven’t noticed. visserlabs.substack.com/p/the-next-int…

📘 Read the full essay:

“How AI and Stablecoins Are Rewriting Money”

→

The biggest change to money since 1971 is happening right now and most people haven’t noticed. visserlabs.substack.com/p/the-next-int…

• • •

Missing some Tweet in this thread? You can try to

force a refresh