So I started writing this note on a flight back from Austin on Sunday night.

I'd taken my 15-year old gear-head of a daughter to watch F1 for her bday, hence the imagery.

I'd taken my 15-year old gear-head of a daughter to watch F1 for her bday, hence the imagery.

The week before, while everyone was focused on Trumps latest tariff threats over rare earths, it hit me that the core economic issue between China and the United State was a repricing of the terms of trade.

The ultimate ToT repricing manifests itself in a currency repricing.

Slowly for free floaters.

Suddenly for the peggers (minds out of the gutter pls).

Slowly for free floaters.

Suddenly for the peggers (minds out of the gutter pls).

To be clear, the call wasn't for a sudden Chinese devaluation. That's above my pay grade. The call was however, for added stress on weak countries like Argentina and Turkey.

And on the one asset that stood at the intersection of countries struggling with dollar funding issues.

The dollar made a local low on Friday, the day gold made a local top. I pressed my short by adding short gold futures (told subs in the private chat).

Turns out there's a rumor going around Argentina was a seller.

This is a rumor and unverified. But if it walks like a duck....

This is a rumor and unverified. But if it walks like a duck....

https://x.com/BankerWeimar/status/1980648118963290119

Getting back to the flight home, it sucked to see gold to have such a strong open and seeing my short gains wiped out by mid morning the next day.

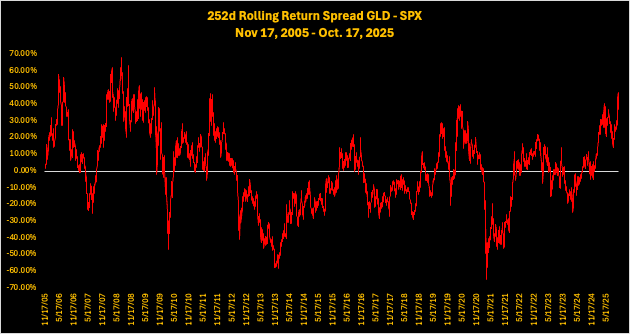

But the chart didn't lie.

But the chart didn't lie.

Now there's obviously a lot of luck thrown in here. It coulda gotten more stretched.

Someone said Diwali. Someone else said Chinese weddings. Both true things!

Someone said Diwali. Someone else said Chinese weddings. Both true things!

But we stuck with the process.

Yesterday I released downside targets in gold, GLD, GDX and GDXJ.

Get after it. This waterfall is likely not over.

It's probably just getting started.

Yesterday I released downside targets in gold, GLD, GDX and GDXJ.

Get after it. This waterfall is likely not over.

It's probably just getting started.

• • •

Missing some Tweet in this thread? You can try to

force a refresh