Pinebrook Capital | David Cervantes

Join our Substack: https://t.co/Nl459lWDxc

@macrostratpb is for our PAID subs

2 subscribers

How to get URL link on X (Twitter) App

The week before, while everyone was focused on Trumps latest tariff threats over rare earths, it hit me that the core economic issue between China and the United State was a repricing of the terms of trade.

The week before, while everyone was focused on Trumps latest tariff threats over rare earths, it hit me that the core economic issue between China and the United State was a repricing of the terms of trade.

https://twitter.com/econstratpb/status/1969145931636351096No one has infinite balance sheet and it will be evident margin risk was respected.

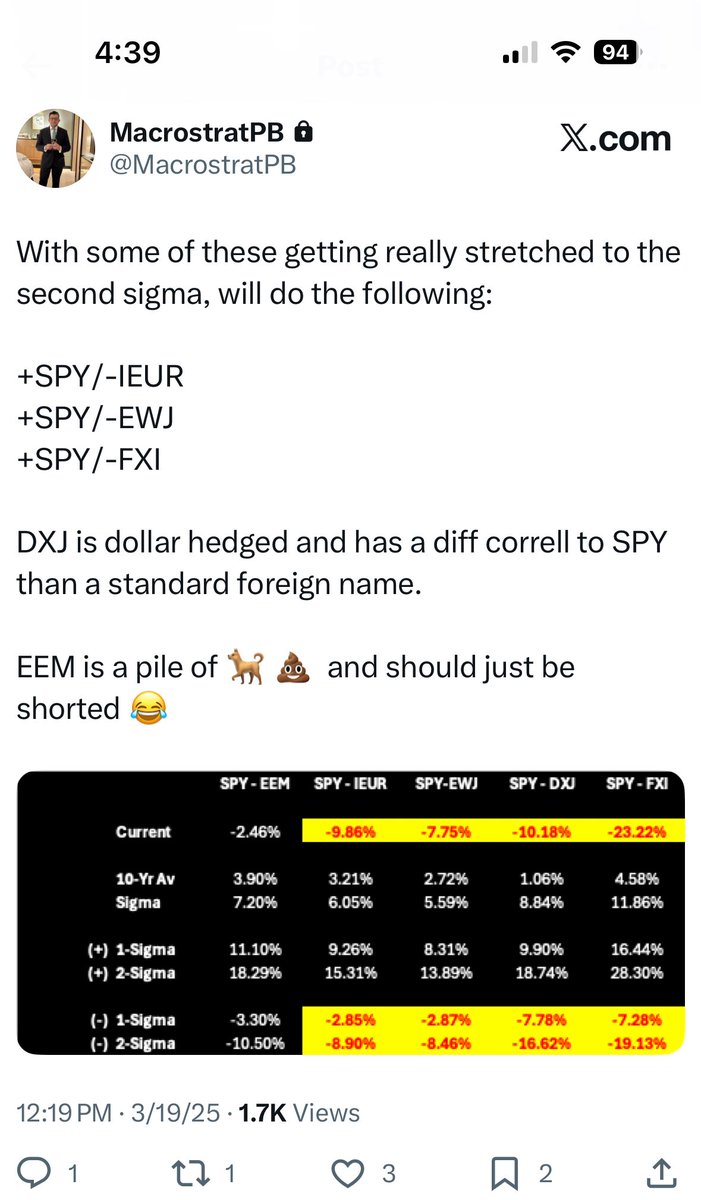

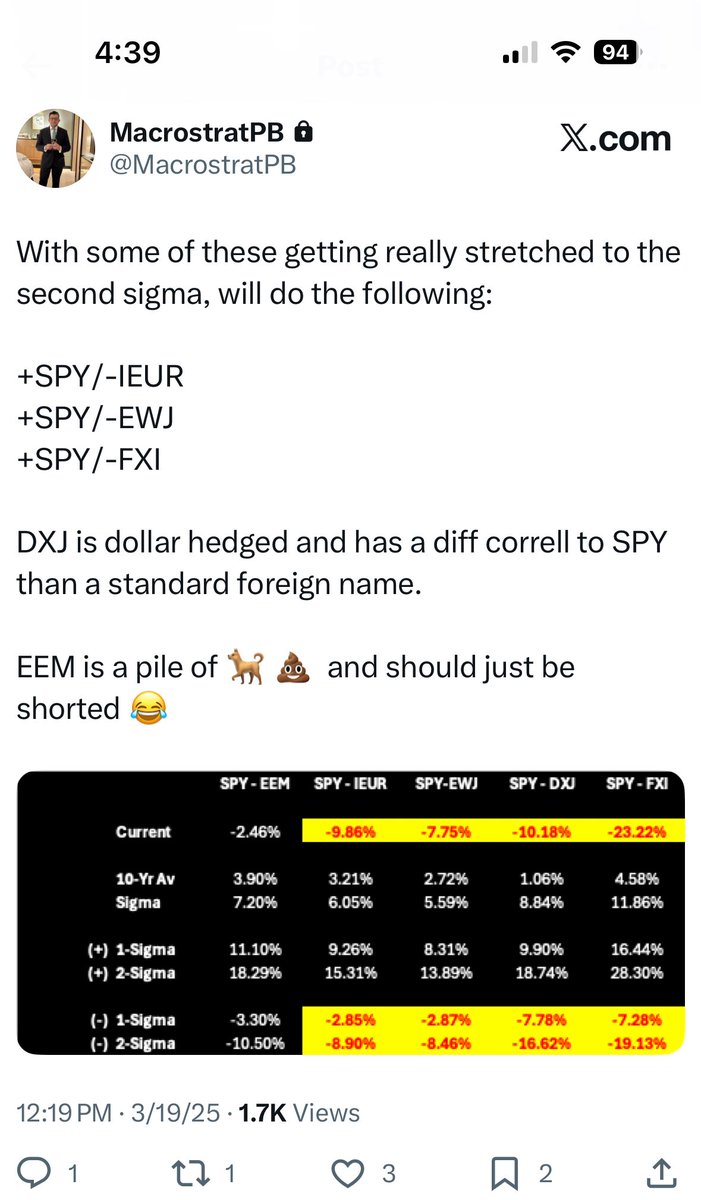

https://twitter.com/econstratpb/status/1969056861937668269As the March selloff got underway, I hedged my US equity longs with RoW shorts, as USA was 2-sigma oversold relative to RoW assets.

https://twitter.com/timpierotti1/status/1965421562376642635Labor required to keep the labor mkt in balance falls.

https://twitter.com/dacdac4dac/status/1964654011069407278People in business have respect for American capitalism.

The most insane was that the win rate for emerging markets in the post pandemic period was 44.07% over any 3yr holding period since the pandemic.

The most insane was that the win rate for emerging markets in the post pandemic period was 44.07% over any 3yr holding period since the pandemic. https://twitter.com/loganmohtashami/status/1958857199545196592Fed policy does not target employment growth.

https://twitter.com/dannydayan5/status/1943427398726488212Given the above, inflation expectations cannot be unanchored.

https://twitter.com/cernovich/status/1943064459150557466In the real world, no one cares about anyone or anything.

https://twitter.com/vigilantfox/status/1928221920207499375Without the elite brainpower, our nuclear defense posture is dead in the water.

https://twitter.com/limitedhangout1/status/1913018216101671365Everyone is a target. If they can go after “those people” on false or flimsy premises they can go after you.

https://twitter.com/bobeunlimited/status/1809605976070234129Mkts look forward and what’s coming in 2H is priced, with a discount ofc.

https://twitter.com/jasonfurman/status/1761829743995789480That little blue line in the top left chart just needs to level out a little and coast until it hits the yellow trend line years into the future before a recession shows up.