Some thoughts on 10 year notes since Powell guided for a restart of the cutting cycle at Jackson Hole. Trying to answer what the bond market is saying

Nominal yields have fallen 33bp

Nominal yields have fallen 33bp

Note yields are driven lower by

1)Falling real GDP expectations

2)Falling Inflation expectations

3) Falling "risk" of owning assets

4) Improving supply/demand balance vs expectations.

In attributing nominal yield changes to these 4 things unfortunately market prices don't

1)Falling real GDP expectations

2)Falling Inflation expectations

3) Falling "risk" of owning assets

4) Improving supply/demand balance vs expectations.

In attributing nominal yield changes to these 4 things unfortunately market prices don't

Easily demonstrate these things. For instance 3&4 are only able to be measured via a model which estimates risk premiums or the expected return over holding cash

Even Breakeven inflation and real TIPS yields have risk premium buried in there market yields. However we can try

Even Breakeven inflation and real TIPS yields have risk premium buried in there market yields. However we can try

TIPs yields fall due to falling real growth expectations and contracting risk premiums. They have fallen 24 of the 33 bp of Nominal yield reflecting falling growth expectations and some portion of risk premium contraction

Inflation b/e have fallen modestly totaling 9 bp of which some is inflation expectations and some is risk premium. Fair to say inflation expectations haven't moved much

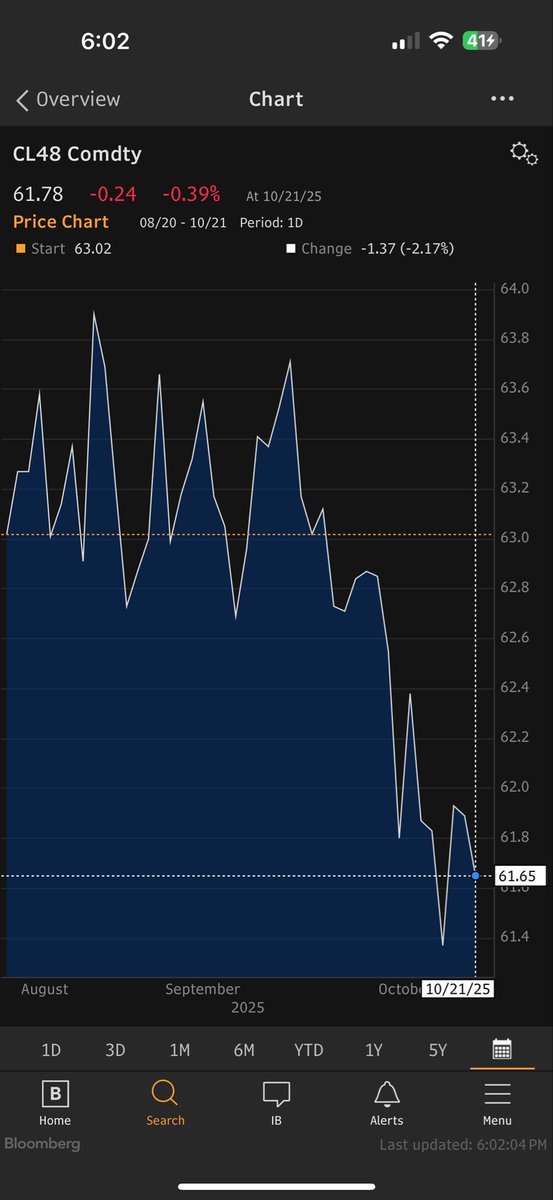

One negative driver of inflation expectations (which is headline CPI ) is oil. While very short term oil has fallen meaningfully down 8% since Jackson Hole, long term oil is only down 2%. Ironically now that oil is in contango inflation expectations are supported by forward oils price increases

So oil isn't the driver.

Risk premiums are driven by expected risk and supply and demand expectations. They have modestly fallen. (This chart is 5 days lagged and the change (using my own model) is a few bp more it suggest that RP is about 11 of the 33 bp decline

Risk premiums are driven by expected risk and supply and demand expectations. They have modestly fallen. (This chart is 5 days lagged and the change (using my own model) is a few bp more it suggest that RP is about 11 of the 33 bp decline

Risk of holding bonds as a driver of risk premium can be proxied with measures of price volatility. There are more sophisticated ones than Move but they are telling the same story. Bond risk is basically unchanged and already low since Jackson Hole as bond risk has cratered

That leaves supply and demand shifts as the driver of risk premium declines over the past few months. Now there are tons of reasons to be worried about the debt, ongoing deficits, and geopolitical weaponization of the bond market. BUT in the short term those major concerns

haven't realistically changed. What has changed is the Fed has announced QT ending which because of the decision to continue runoff of MBS and yet NOW reinvest the proceeds in UST will reduce the supply of UST offered to the private sector in coming years.

While this was expected no later than end of Powell's term in May it's a little earlier and 60-120 bn more UST will find a home on the Fed's balance sheet. That helps a bit. Furthermore the budget deficit after tariffs is already falling by 100Bn which will allow the Treasury

modestly more flexibility on issuance. All told the supply demand conditions for bonds have modestly improved and term premiums have begun to reflect that modest improvement

What doesn't connect to me is what other markets are saying about growth and inflation. Gold expects

What doesn't connect to me is what other markets are saying about growth and inflation. Gold expects

Debasement and inflation. Equity's reflect robust growth. But simply reading the bond market the outlook is clear

Inflation is not a problem

Growth expectations are falling

Supply and demand is improving

And bonds are low risk

Is that right? Who knows?

Inflation is not a problem

Growth expectations are falling

Supply and demand is improving

And bonds are low risk

Is that right? Who knows?

A lot has been said about a Fed policy mistake. They do make mistakes for sure but the bond market is not saying the Fed is making a policy mistake by cutting. No one knows if the economy is going to overheat, cool rapidly, or stagflate.

While brilliant minds predict a tipping point where U.S. debt cannot clear the market at acceptable yields, yields that the economy can tolerate, that tipping point can be soon or a decade from now.

All we can do is read what markets are saying and what the bond market is saying is clear.

All we can do is read what markets are saying and what the bond market is saying is clear.

• • •

Missing some Tweet in this thread? You can try to

force a refresh