Tuesday 🧵

Gold is at an Intermediate Term Peak

But Still Has a Very Long Way to to its Secular Peak

Let's Go!

Gold is at an Intermediate Term Peak

But Still Has a Very Long Way to to its Secular Peak

Let's Go!

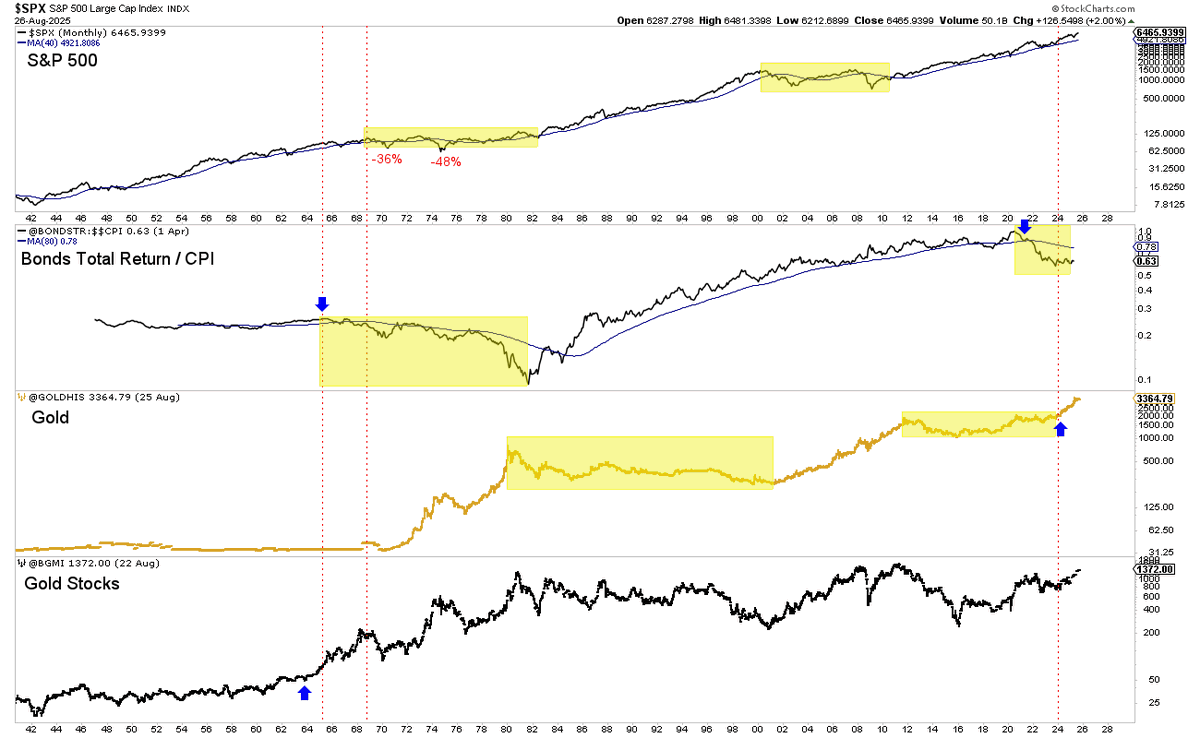

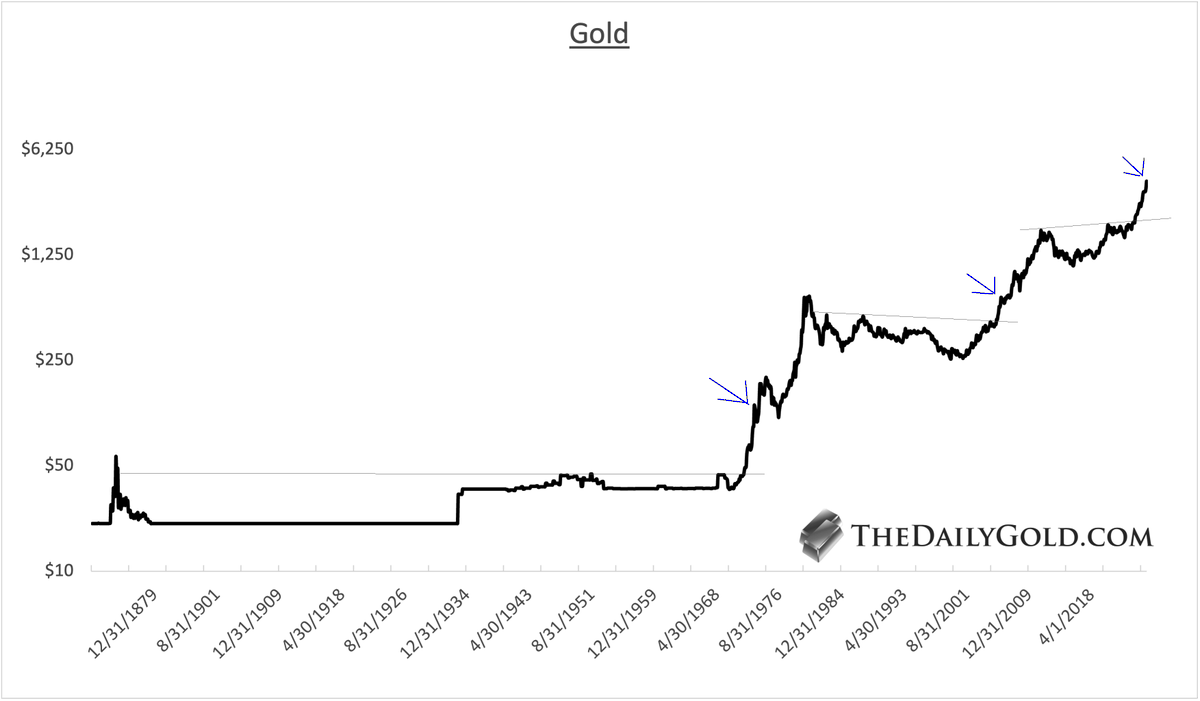

1) First Correction Post-Major Breakout

Gold has begun its first major correction since the major breakout of March 2024.

Gold has had three major breakouts in its history.

1972, 2005 and 2024

The arrows show similar points on this monthly, historical chart.

Gold has begun its first major correction since the major breakout of March 2024.

Gold has had three major breakouts in its history.

1972, 2005 and 2024

The arrows show similar points on this monthly, historical chart.

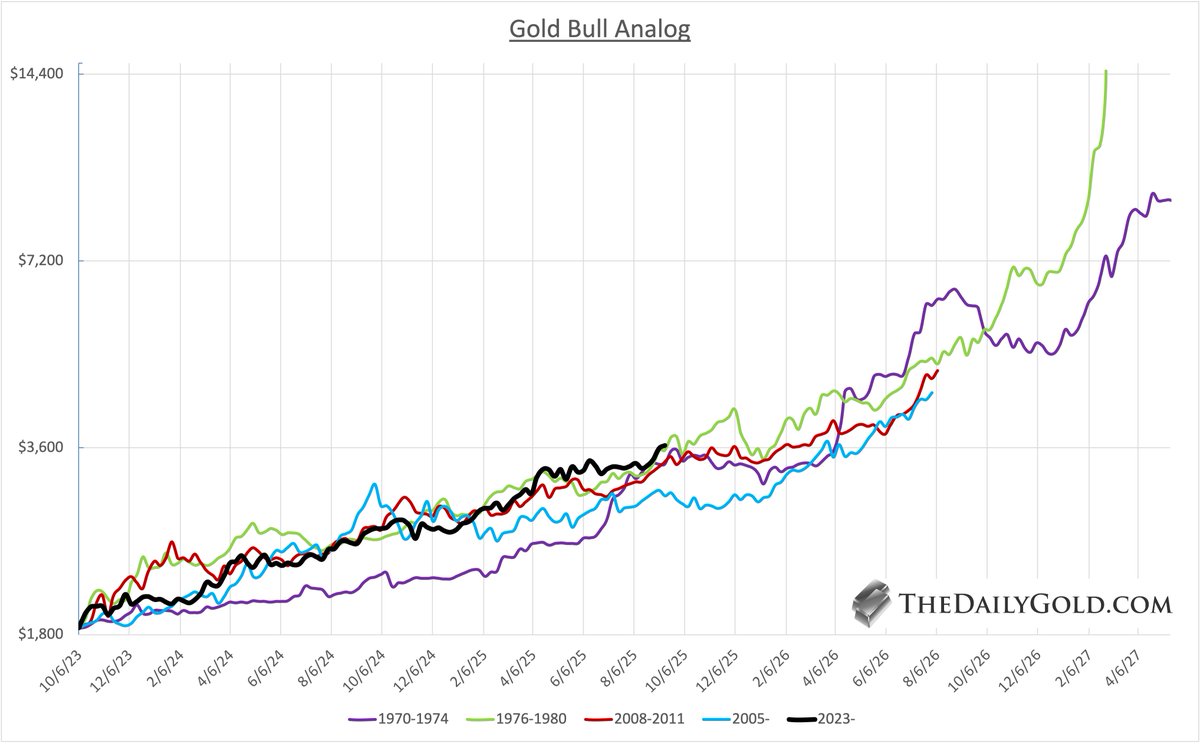

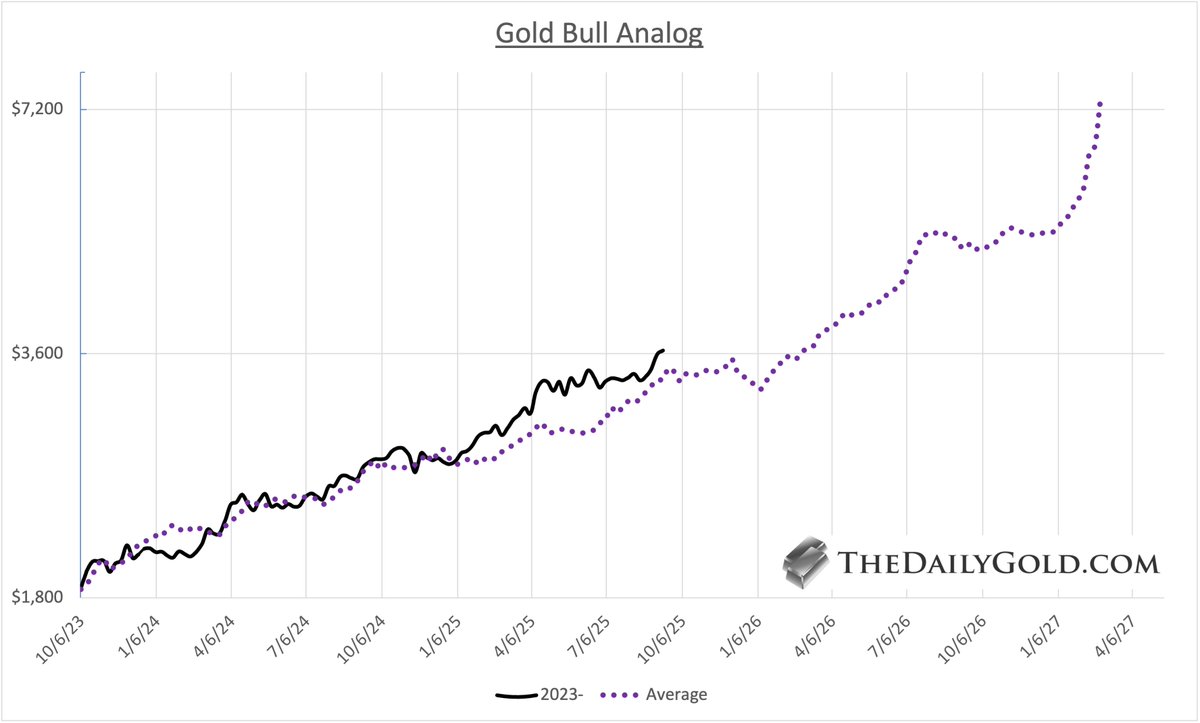

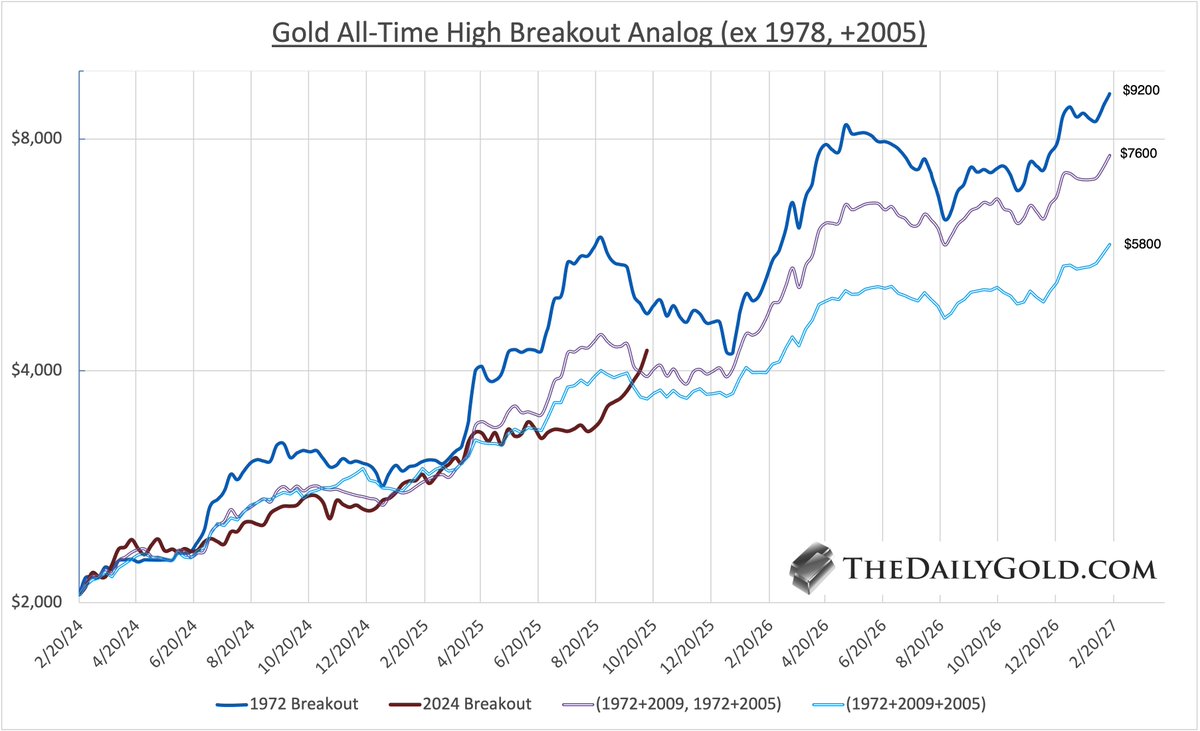

2) Gold All-Time High Breakout Analog

There are numerous similarities to 1972-1973. It has been the best fit for Gold, which has lagged it a bit.

That's a good thing. On the current scale, the 1972-1973 peak was near $6000 before it corrected 28%.

Gold is not as extended this time.

Its going to correct more than 10%-12%, but nowhere near 28%.

A more precise fit for this Gold move is the 1972 breakout and a combination of the 2009 and 2005 breakouts.

That is the middle line in the chart.

That line, along with the other, show a 5 month correction.

The middle line (the precise fit) reaches $7600 in 16 months!

There are numerous similarities to 1972-1973. It has been the best fit for Gold, which has lagged it a bit.

That's a good thing. On the current scale, the 1972-1973 peak was near $6000 before it corrected 28%.

Gold is not as extended this time.

Its going to correct more than 10%-12%, but nowhere near 28%.

A more precise fit for this Gold move is the 1972 breakout and a combination of the 2009 and 2005 breakouts.

That is the middle line in the chart.

That line, along with the other, show a 5 month correction.

The middle line (the precise fit) reaches $7600 in 16 months!

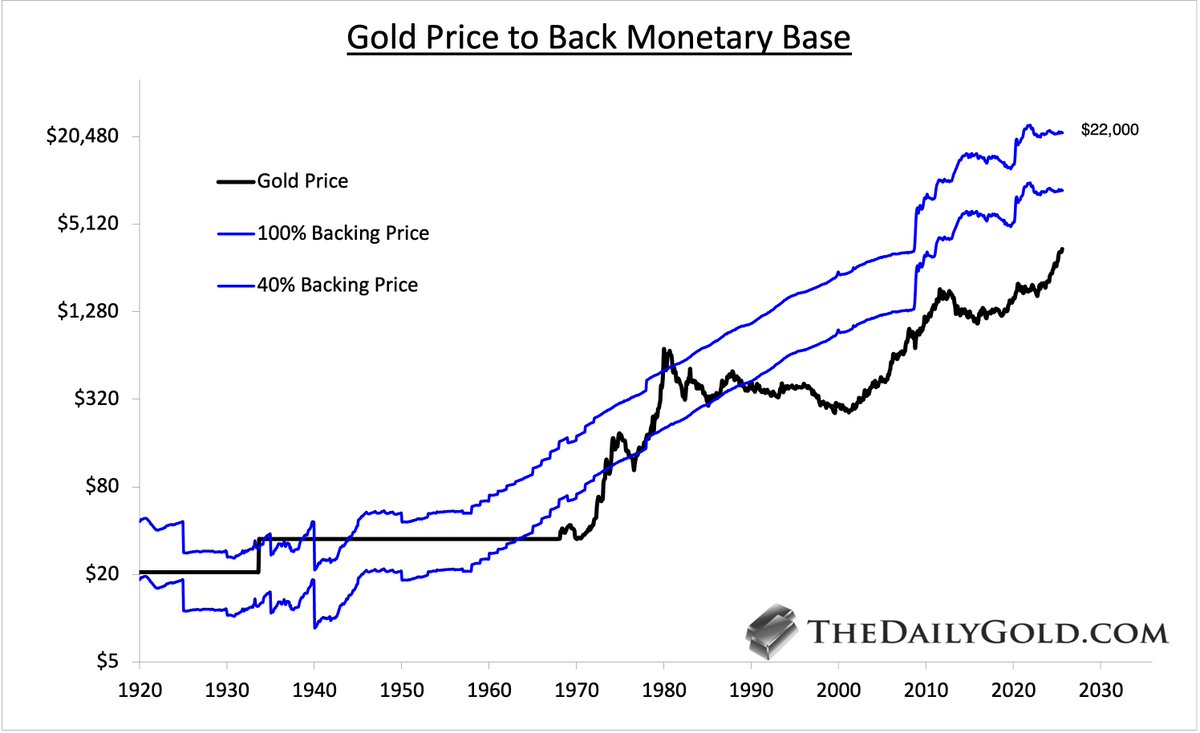

3) Gold vs. Monetary Base

The secular bull markets during the Great Depression & 1970s ended with the Gold price backing over 100% of the Monetary Base.

Today, 100% = nearly $22,000 Gold

The secular bull markets during the Great Depression & 1970s ended with the Gold price backing over 100% of the Monetary Base.

Today, 100% = nearly $22,000 Gold

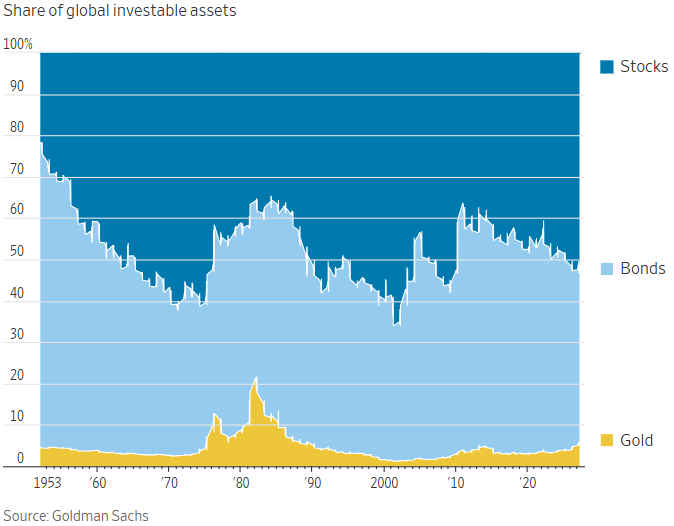

4) Gold's Share of Investable Assets

Gold is up nearly 150% over the last 24 months.

Share of assets has increased from 4% to 6%.

In 1980 it peaked at 22%.

Gold is up nearly 150% over the last 24 months.

Share of assets has increased from 4% to 6%.

In 1980 it peaked at 22%.

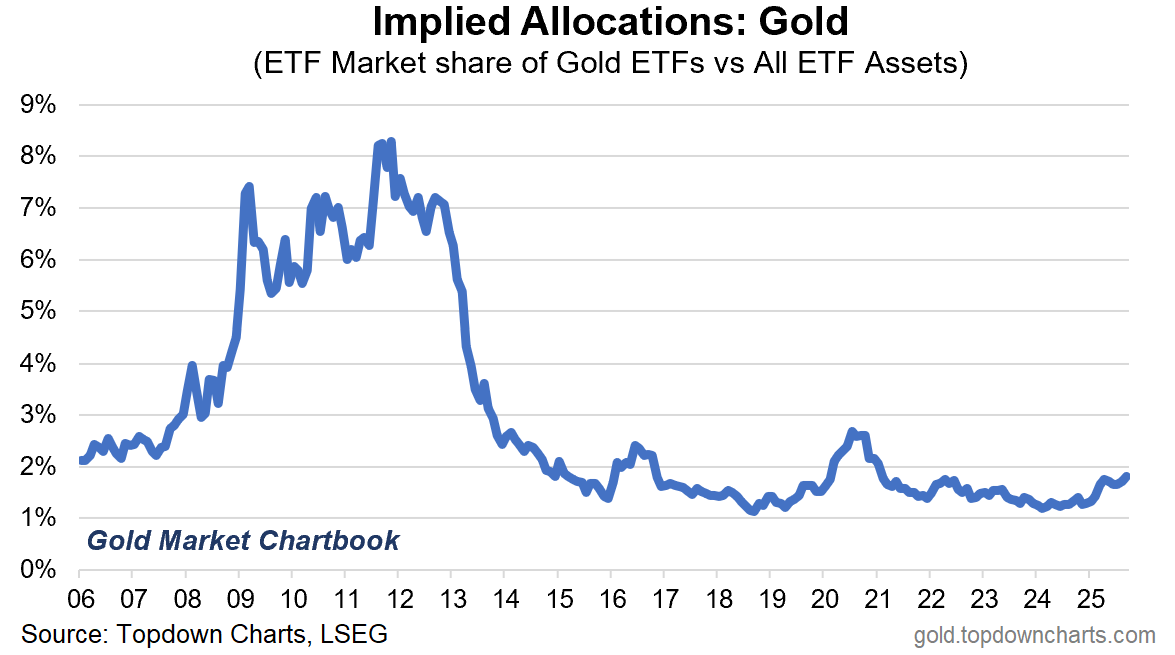

5) Gold ETF Allocation

Chart is one month old.

This data likely hit 2% or slightly higher.

It remains below the 2020 and 2016 peaks.

It remains well below the 2011 peak of almost 8.5%.

Chart is one month old.

This data likely hit 2% or slightly higher.

It remains below the 2020 and 2016 peaks.

It remains well below the 2011 peak of almost 8.5%.

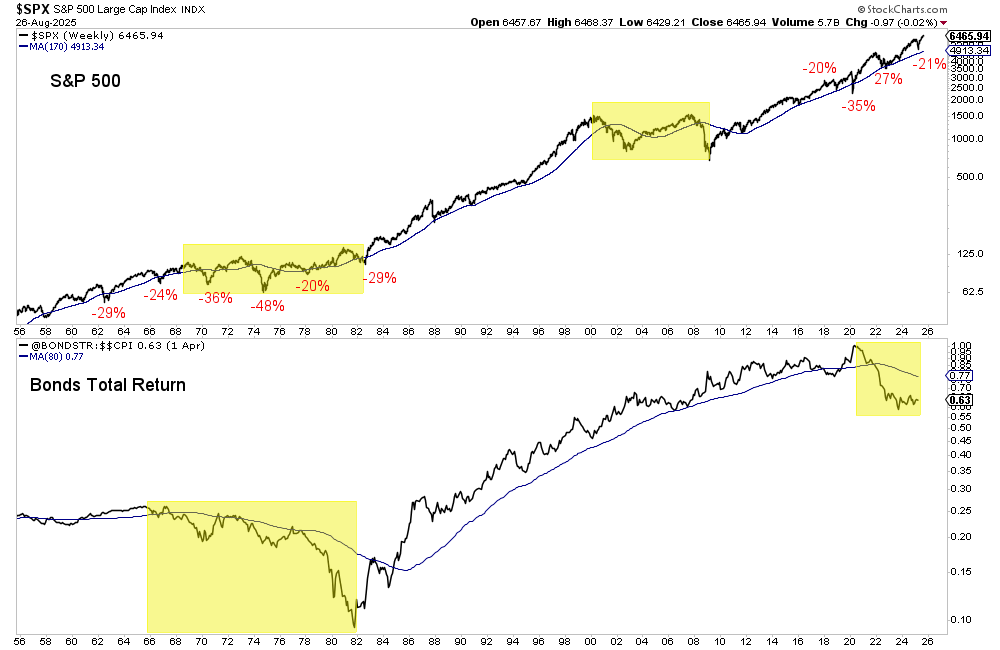

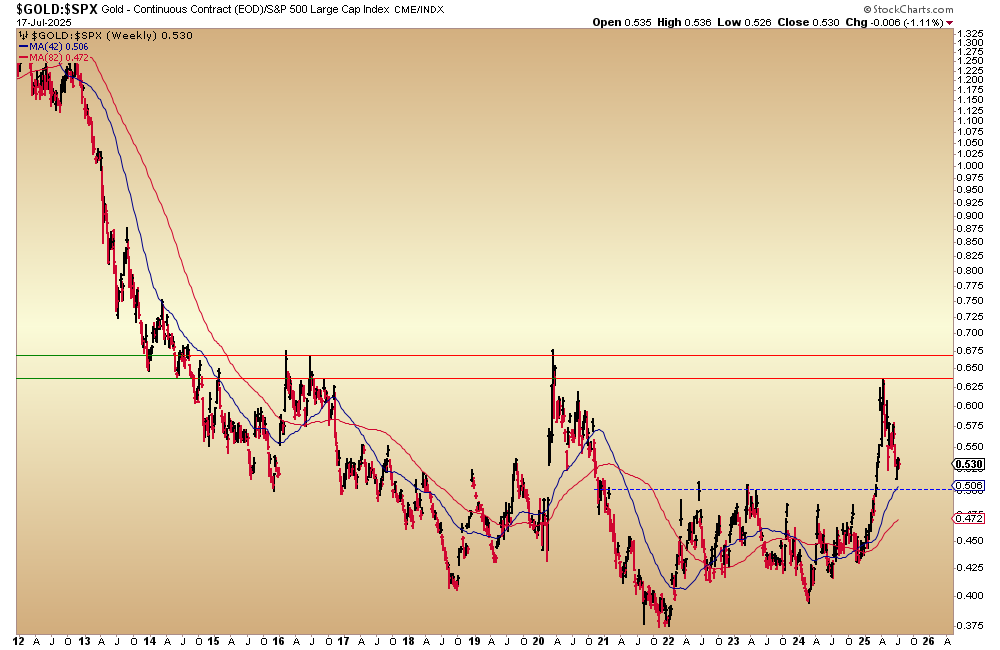

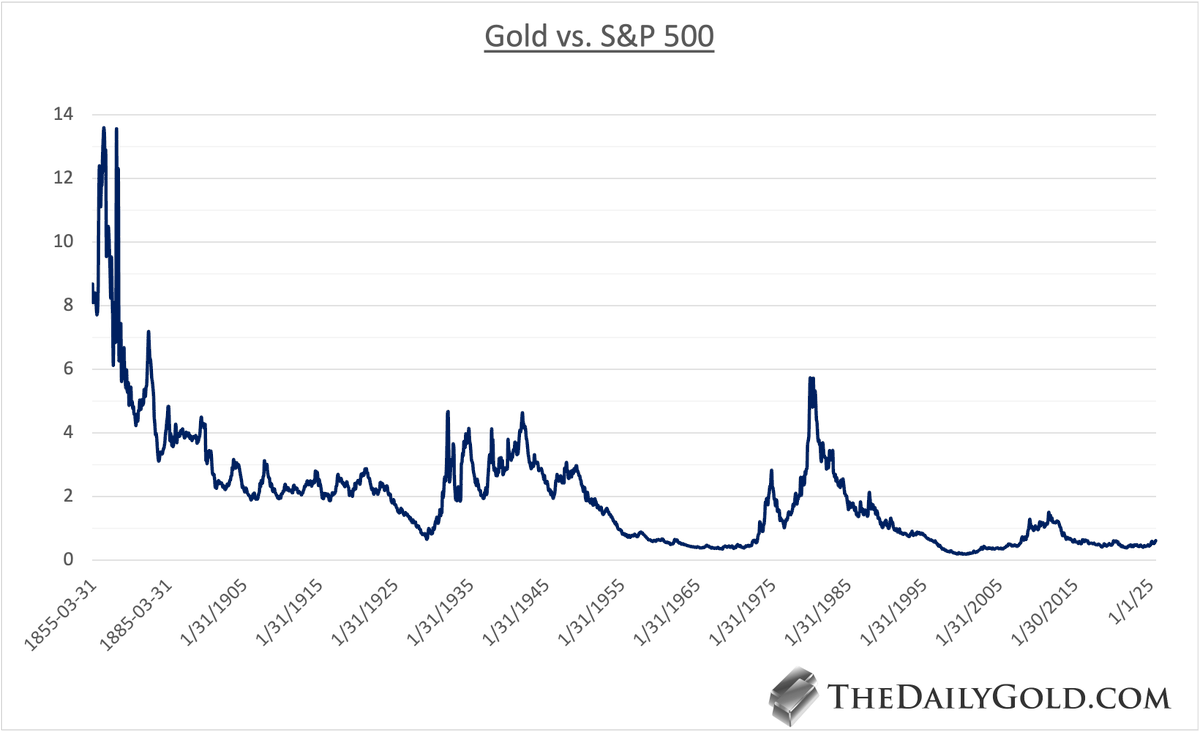

6) Gold vs. S&P 500

The ratio closed today at 0.61. A move beyond 0.65-0.70 would mark an extremely significant breakout, which we will discuss in future tweets.

But zoom out.

For the past 135 years we see most peaks around 4-5. (In weekly terms the 1980 peak was 7).

The S&P is at 6700 right now.

Take 6000 and a ratio of 4. Or 5?

This move has a really long way to go.

The ratio closed today at 0.61. A move beyond 0.65-0.70 would mark an extremely significant breakout, which we will discuss in future tweets.

But zoom out.

For the past 135 years we see most peaks around 4-5. (In weekly terms the 1980 peak was 7).

The S&P is at 6700 right now.

Take 6000 and a ratio of 4. Or 5?

This move has a really long way to go.

7) Summary

Gold is at an intermediate term peak.

It's the first significant post-breakout correction.

1972-1973 remains the best comp but Gold is nowhere close to the 1973 peak which led to 28% decline.

But Gold should correct more than 12% here.

Look for support at $3600-$3700.

1972 plus a combination of 2009 and 2005 breakouts are closest fit to Gold's performance.

Gold will rocket higher again when this correction ends.

Gold is at an intermediate term peak.

It's the first significant post-breakout correction.

1972-1973 remains the best comp but Gold is nowhere close to the 1973 peak which led to 28% decline.

But Gold should correct more than 12% here.

Look for support at $3600-$3700.

1972 plus a combination of 2009 and 2005 breakouts are closest fit to Gold's performance.

Gold will rocket higher again when this correction ends.

8) Thank you for reading!

Would you be so kind to like and retweet this thread?

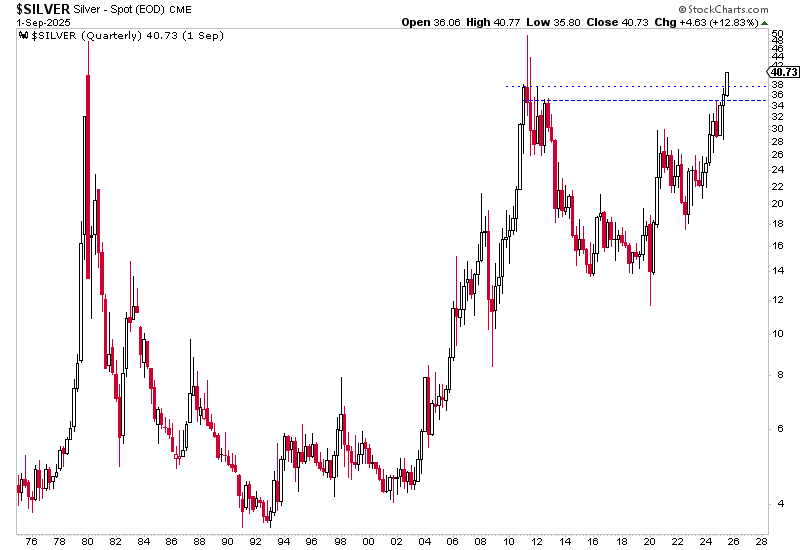

Want to find quality junior silver and junior gold stocks with 5x to 10x potential?

Now is the time.

thedailygold.com/premium

Would you be so kind to like and retweet this thread?

Want to find quality junior silver and junior gold stocks with 5x to 10x potential?

Now is the time.

thedailygold.com/premium

• • •

Missing some Tweet in this thread? You can try to

force a refresh