Coatue October 2025 State of the Markets Update

60 Pages on Public Markets every investor should read

Get the Full Deck below ⬇️

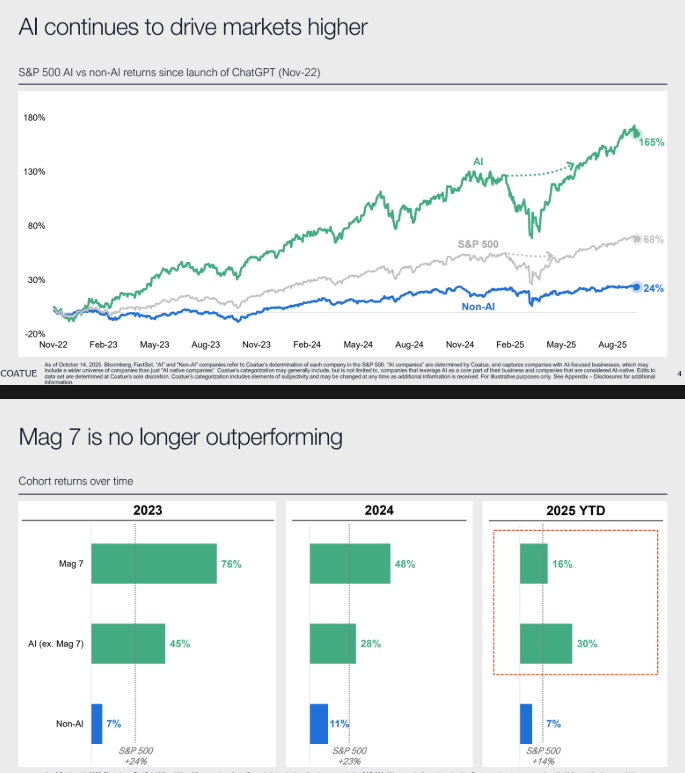

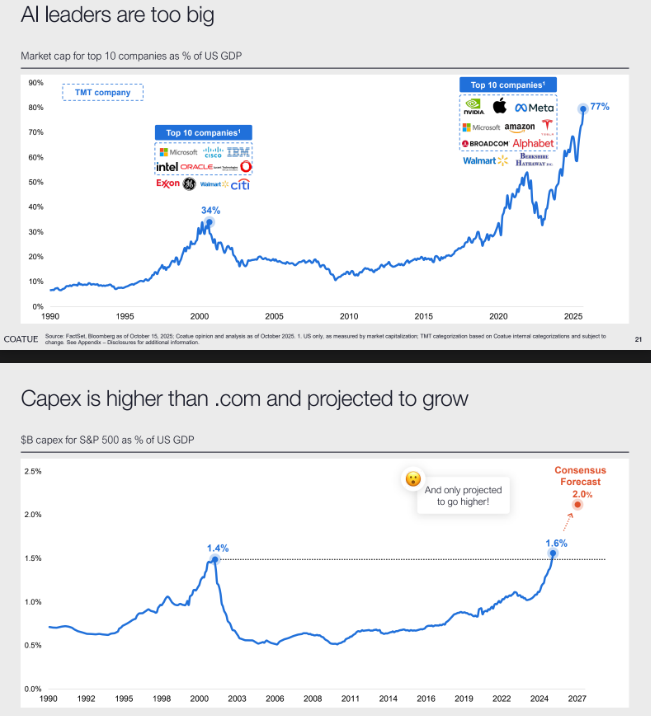

1) AI continues to drive markets higher while...

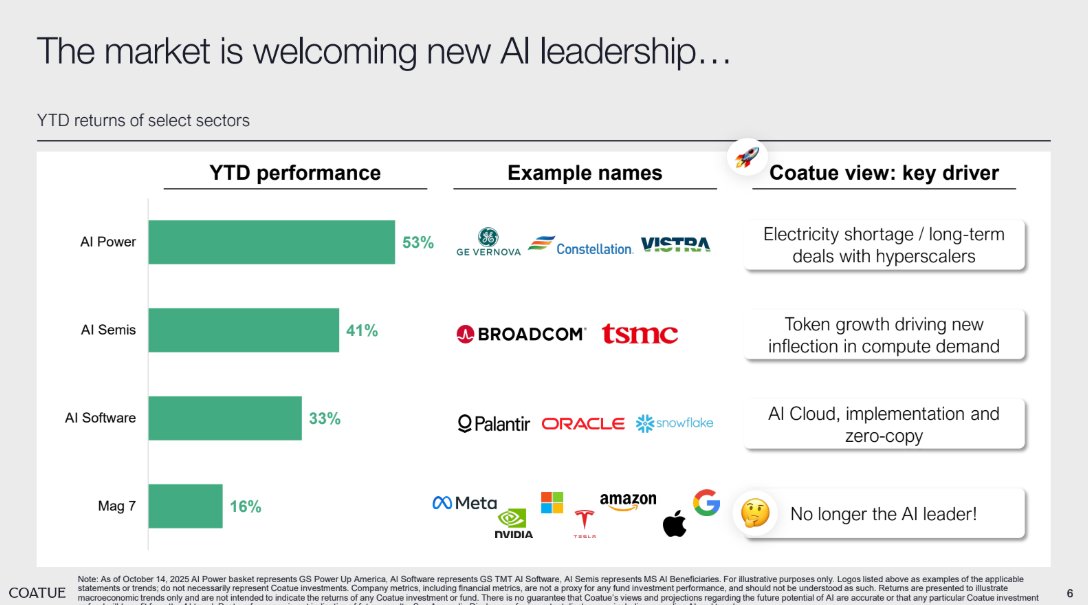

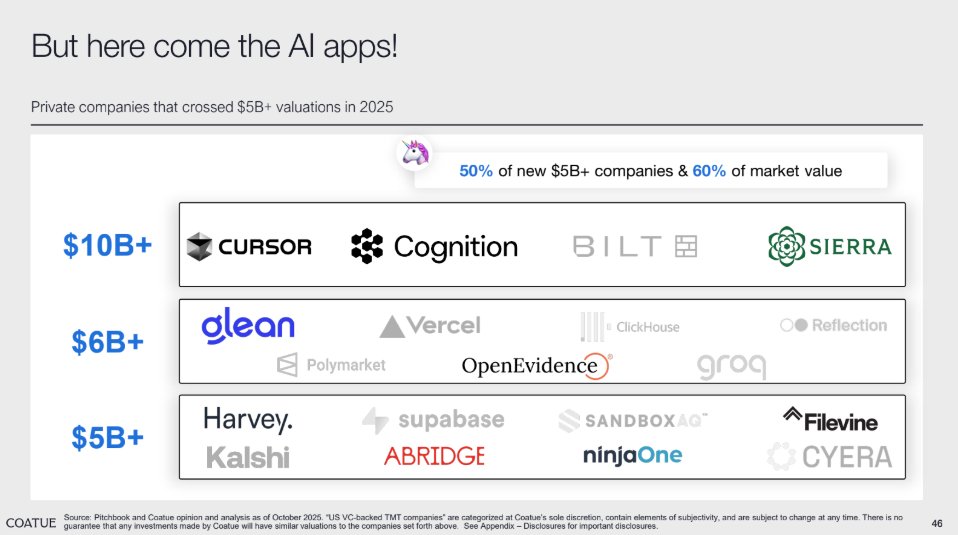

2) In addition, new names are winning the AI Race

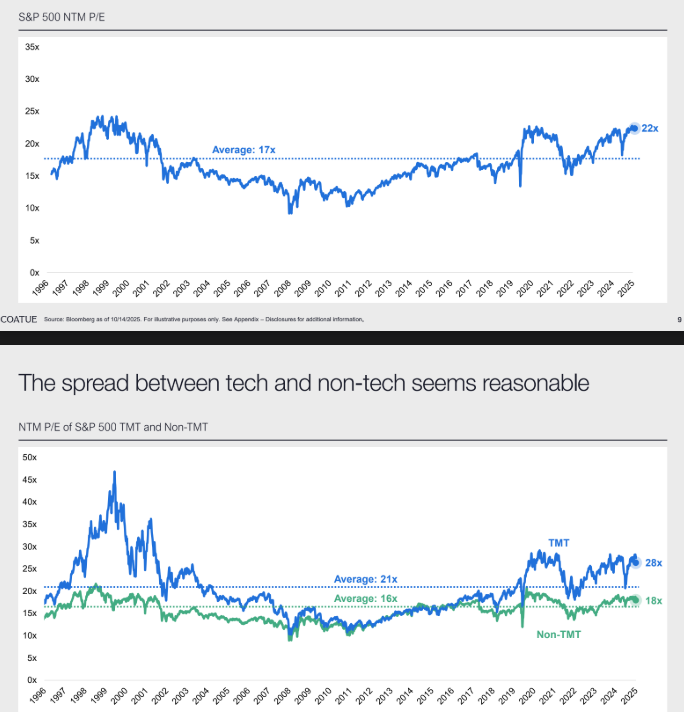

3) The market is very expensive, but...

....

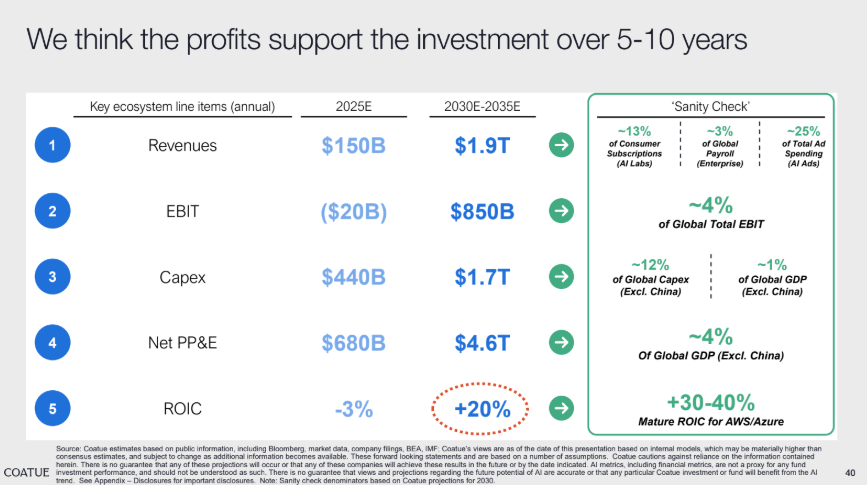

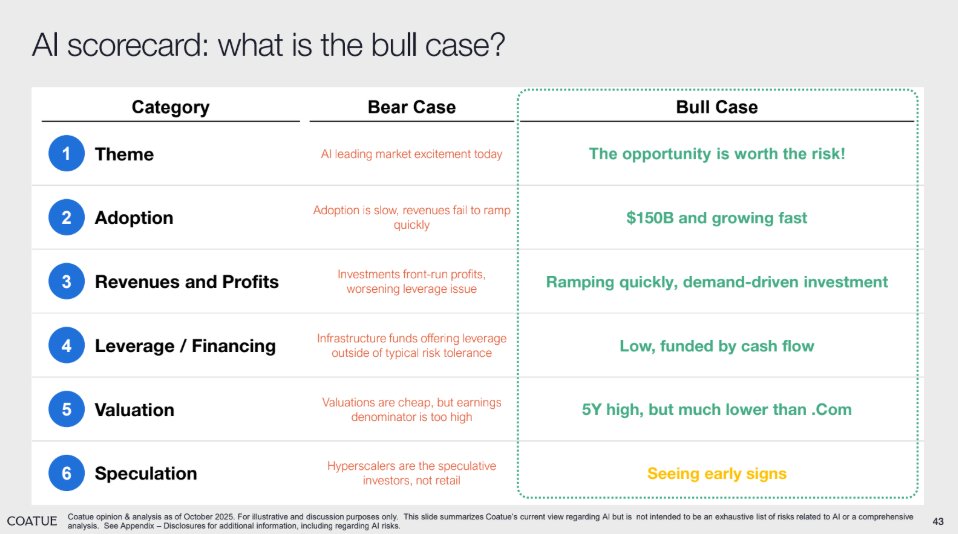

6) Coatue is not selling, the AI Bull Case

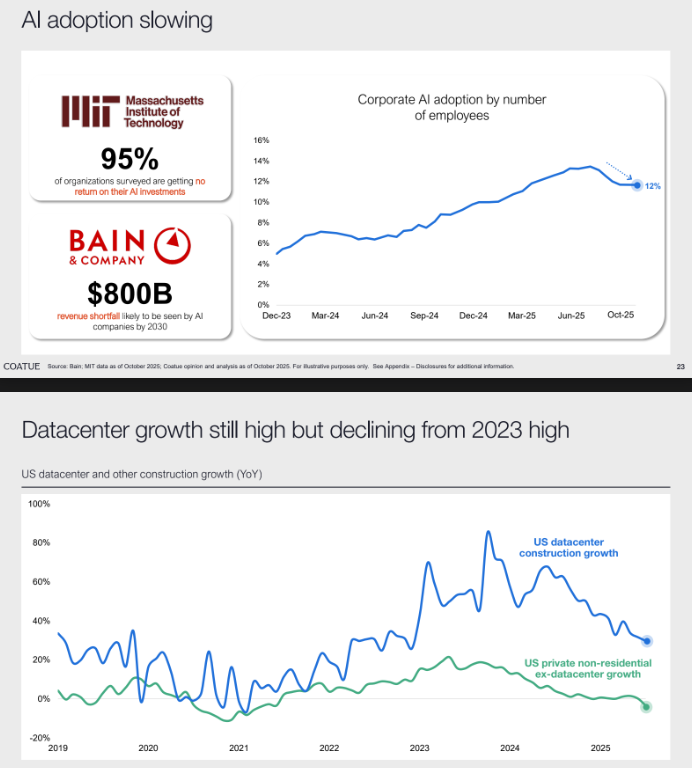

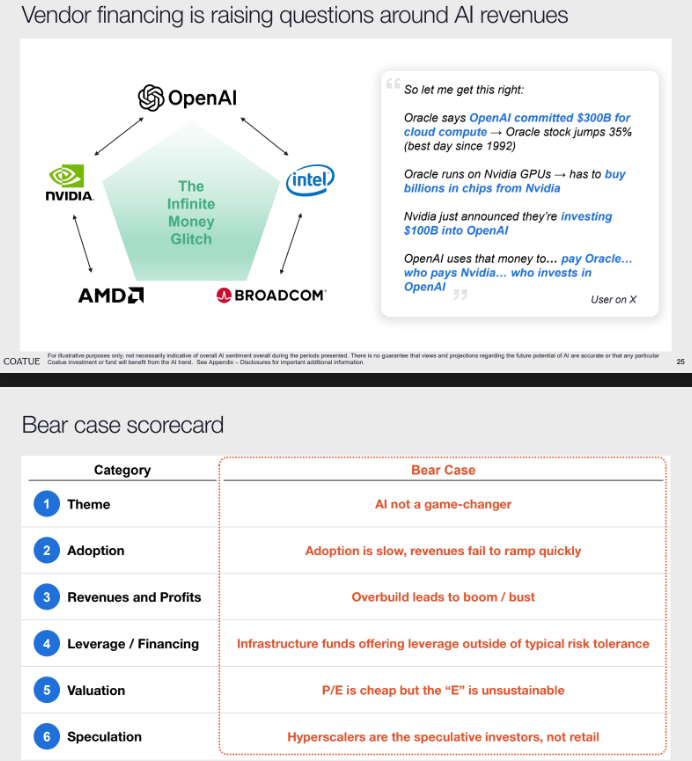

7) Coatue ROIC Math on AI

8) AI Bull and Bear Case comparison

9) AI Apps Landscape

60 Pages on Public Markets every investor should read

Get the Full Deck below ⬇️

1) AI continues to drive markets higher while...

2) In addition, new names are winning the AI Race

3) The market is very expensive, but...

....

6) Coatue is not selling, the AI Bull Case

7) Coatue ROIC Math on AI

8) AI Bull and Bear Case comparison

9) AI Apps Landscape

6) Coatue is not selling, the AI Bull Case

Key arguments

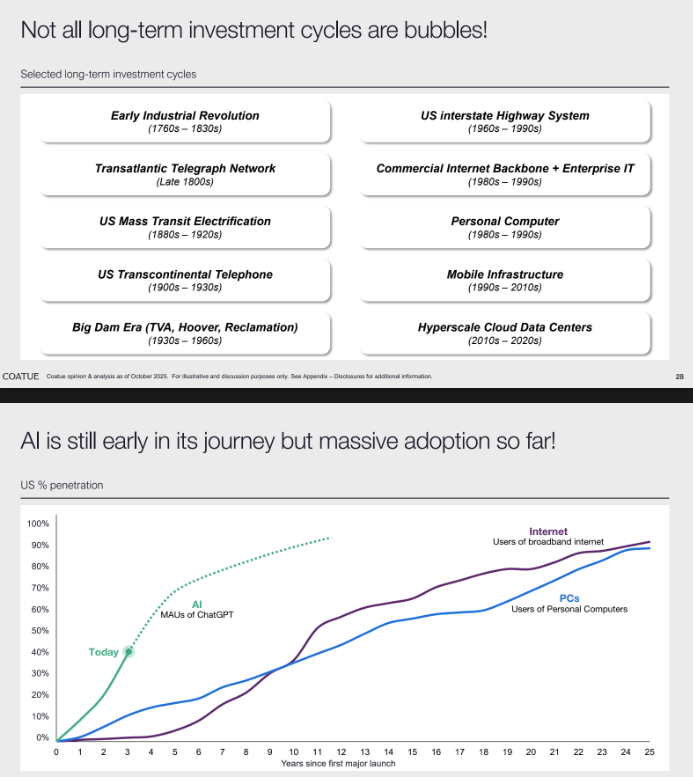

- Adoptions is still increasing

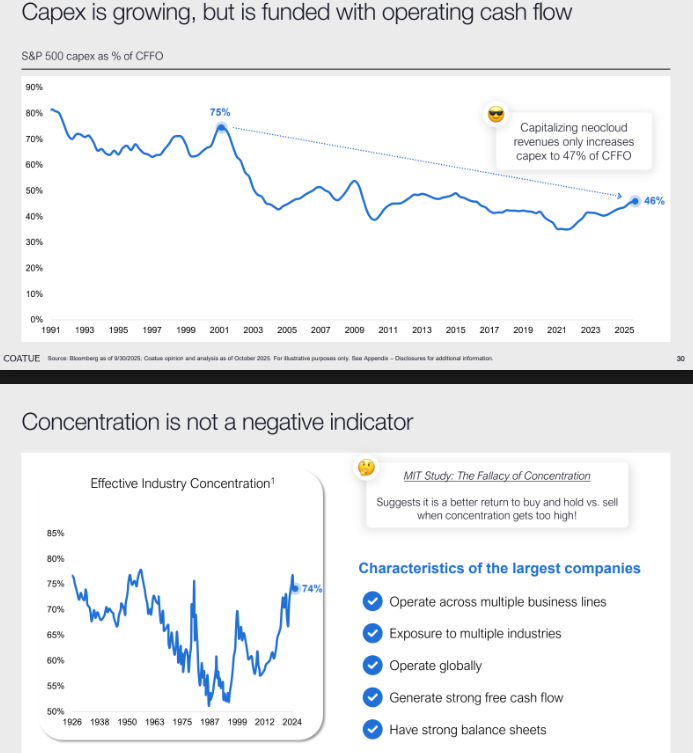

- CapEx is cash flow funded

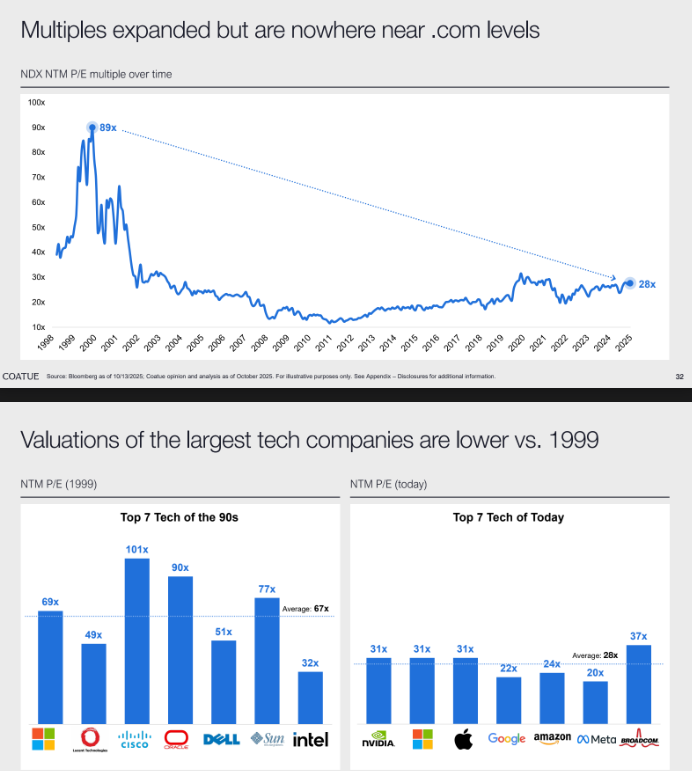

- Valuations are high, but reasonable

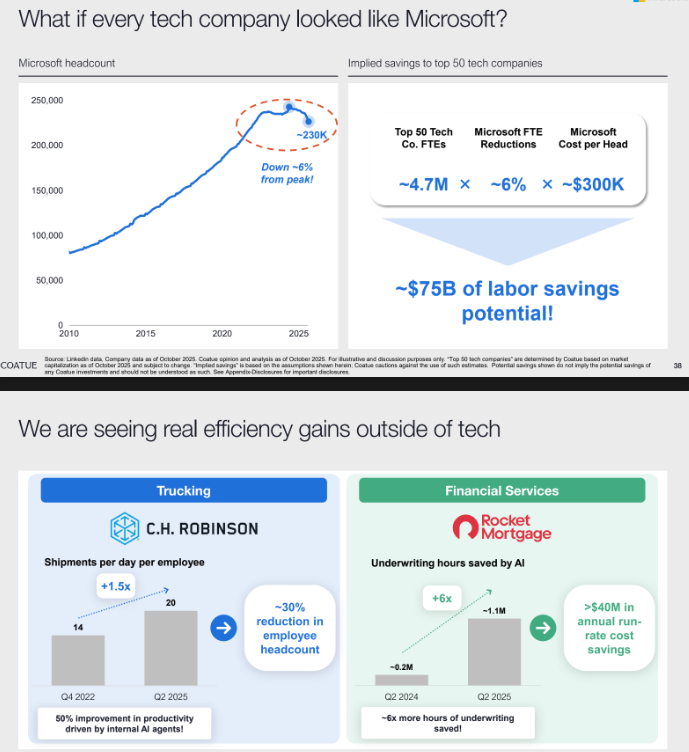

- AI is saving big money

Key arguments

- Adoptions is still increasing

- CapEx is cash flow funded

- Valuations are high, but reasonable

- AI is saving big money

Interested in the Full Deck?

Reshare the first post and comment "Pari Passu Newsletter" - I will send you a DM with the PDF

Reshare the first post and comment "Pari Passu Newsletter" - I will send you a DM with the PDF

https://x.com/Restructuring__/status/1980814854131720438

• • •

Missing some Tweet in this thread? You can try to

force a refresh