Meesho clocked ₹30,000 crore of Sales in FY25 - this is approx. 30 lakh orders per day fulfilled by 5 lakh sellers!

They aim to raise ~₹6,500 crore in their upcoming IPO; and it is the first horizontal e-commerce platform to go public in India (Flipkart started 8 years prior btw!)

Meesho’s updated 667 page DRHP is a must read for anyone who follows E-Commerce in India

Here are my 5 key takeaways from the filings⤵️

They aim to raise ~₹6,500 crore in their upcoming IPO; and it is the first horizontal e-commerce platform to go public in India (Flipkart started 8 years prior btw!)

Meesho’s updated 667 page DRHP is a must read for anyone who follows E-Commerce in India

Here are my 5 key takeaways from the filings⤵️

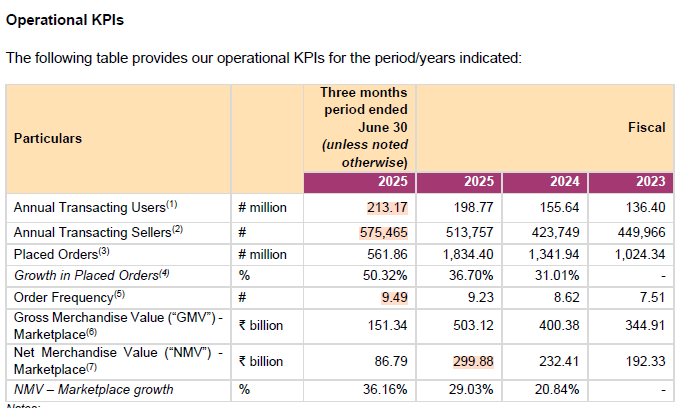

(1) Meesho has 21 crore active shoppers who place avg. 9+ orders per year 🤯

Few observations v/s their 2024 annual report:

(a) LTM order frequency is up from 9 to 9.5

(b) ATUs (active shoppers) is also up from 18.7 crore to 21.3 crore

(c) Order growth (50% YOY) is outstripping NMV growth (36% YOY) - this is interesting, Meesho is already a value commerce platform - the AOV is declining even further (by design) - to grow the customer base!

AOV has reduced from ₹336 (FY 23) to ~₹270 (Q1 FY26) - worth tracking this for the future! Valmo (check pt 3) is critical to making this AOV decline unit economic sustainable.

PS - I had covered Meesho’s 2024 Annual Report a few months back (bookmark for later):

x.com/Rahul_J_Mathur…

Few observations v/s their 2024 annual report:

(a) LTM order frequency is up from 9 to 9.5

(b) ATUs (active shoppers) is also up from 18.7 crore to 21.3 crore

(c) Order growth (50% YOY) is outstripping NMV growth (36% YOY) - this is interesting, Meesho is already a value commerce platform - the AOV is declining even further (by design) - to grow the customer base!

AOV has reduced from ₹336 (FY 23) to ~₹270 (Q1 FY26) - worth tracking this for the future! Valmo (check pt 3) is critical to making this AOV decline unit economic sustainable.

PS - I had covered Meesho’s 2024 Annual Report a few months back (bookmark for later):

x.com/Rahul_J_Mathur…

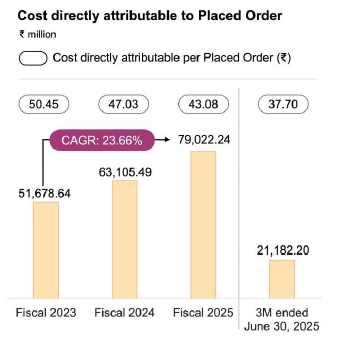

(2) Scale economies are somewhat questionable….. (my only bear case on this business)

(a) The cost per order is down to ~₹37 in Q1 FY26 from ~₹50 in FY23 👍 Awesome, right?

(b) Well, not really - because AOV has also come down!

(c) As a % of AOV - cost per order is ~13.7% v/s 15% in FY23 - not much has changed…

This actually flows into the Contribution Margin - it remains at ~4.5% in Q1 FY26 v/s the peak ~5.6% in FY24.

Now, I’d also highlight that the bull case here is - AOV decline will plateau and as Meesho moves from 60% Valmo orchestration to ~80%+ orchestration (plus some further tweaks) - this should work just fine (if it doesn’t, don’t ask me).

(a) The cost per order is down to ~₹37 in Q1 FY26 from ~₹50 in FY23 👍 Awesome, right?

(b) Well, not really - because AOV has also come down!

(c) As a % of AOV - cost per order is ~13.7% v/s 15% in FY23 - not much has changed…

This actually flows into the Contribution Margin - it remains at ~4.5% in Q1 FY26 v/s the peak ~5.6% in FY24.

Now, I’d also highlight that the bull case here is - AOV decline will plateau and as Meesho moves from 60% Valmo orchestration to ~80%+ orchestration (plus some further tweaks) - this should work just fine (if it doesn’t, don’t ask me).

(3) Valmo (Meesho’s logistics arm) delivers 20-30 Lakh orders per day!

Meesho launched its own logistics aggregation business (Valmo) in August 2022; Valmo processed 30 crore orders in Q1 FY26 with a team of ~200 employees 🤯

The statistics are eye popping:

(a) Meesho is the highest contributor to e-commerce orders in India (~31% of total)

(b) Meesho has 13.5K partner logistics firms (SMEs mostly) who in-turn work with ~85.5K deliver agents

(c) Valmo’s orchestration network today handles ~62% of Meesho orders v/s 0 approx. 3 years ago!!

For context: In FY25, Valmo handled 75 crore orders i.e. 20 Lakh orders per day! Which is now at a 30 Lakh per day runrate.

RIP E-Commerce Express 🙏 Logistics is an unforgiving business esp. when your anchor customer decides to insource v/s outsource.

PS: I wrote about Valmo when it was launched last year (bookmark & read for later):

x.com/Rahul_J_Mathur…

Meesho launched its own logistics aggregation business (Valmo) in August 2022; Valmo processed 30 crore orders in Q1 FY26 with a team of ~200 employees 🤯

The statistics are eye popping:

(a) Meesho is the highest contributor to e-commerce orders in India (~31% of total)

(b) Meesho has 13.5K partner logistics firms (SMEs mostly) who in-turn work with ~85.5K deliver agents

(c) Valmo’s orchestration network today handles ~62% of Meesho orders v/s 0 approx. 3 years ago!!

For context: In FY25, Valmo handled 75 crore orders i.e. 20 Lakh orders per day! Which is now at a 30 Lakh per day runrate.

RIP E-Commerce Express 🙏 Logistics is an unforgiving business esp. when your anchor customer decides to insource v/s outsource.

PS: I wrote about Valmo when it was launched last year (bookmark & read for later):

x.com/Rahul_J_Mathur…

(4) Creator led discovery generates ₹1,000 crore in Sales!

As of 30th June, Meesho has ~40K active creators who record short form videos & host live streams to guide Meesho shoppers who contributed ~₹1,000 crore in net Sales for the past 12 months!

(a) Meesho launched the Meesho Creator Club in March ‘23

(b) The creator base is growing fast; it was ~28K as of March ‘25

(c) The 40K active creators produced ~6.8 Lakh pieces of order generating content in the past 12 months!

Note: Creators are directly attributed with ~3% of net Sales of Meesho; this is a far cry from their previous pure re-seller driven model.

Nonetheless, Meesho is a great example of why Brands continue to deploy capital into the Creator Economy - influence & familiarity drives transactions!

As of 30th June, Meesho has ~40K active creators who record short form videos & host live streams to guide Meesho shoppers who contributed ~₹1,000 crore in net Sales for the past 12 months!

(a) Meesho launched the Meesho Creator Club in March ‘23

(b) The creator base is growing fast; it was ~28K as of March ‘25

(c) The 40K active creators produced ~6.8 Lakh pieces of order generating content in the past 12 months!

Note: Creators are directly attributed with ~3% of net Sales of Meesho; this is a far cry from their previous pure re-seller driven model.

Nonetheless, Meesho is a great example of why Brands continue to deploy capital into the Creator Economy - influence & familiarity drives transactions!

(5) COD (Cash On Delivery) is ~75% of orders (even today!)

This statistic might surprise you - but you & I are in the minority of e-commerce shoppers who pre-pay using credit cards 😁

(a) COD as % of total orders is down from ~88% (2023) to ~75% (Q1 FY26); there is a slow but subtle shift from COD to pre-paid orders

(b) However, there is NO improvement in the success rate of COD orders (despite taking control over logistics with Valmo)

Key Q: how does Meesho compare v/s the industry average?

- Meesho (75% COD) is higher than industry average (60%)

- Meesho RTO rate of 25% on COD orders is quite the industry average 😄

Btw, earlier this year, I had done a 20 minute Breakdown video on how Meesho’s creator led value commerce playbook works:

youtu.be/iraHLFVcTRc?si…

This statistic might surprise you - but you & I are in the minority of e-commerce shoppers who pre-pay using credit cards 😁

(a) COD as % of total orders is down from ~88% (2023) to ~75% (Q1 FY26); there is a slow but subtle shift from COD to pre-paid orders

(b) However, there is NO improvement in the success rate of COD orders (despite taking control over logistics with Valmo)

Key Q: how does Meesho compare v/s the industry average?

- Meesho (75% COD) is higher than industry average (60%)

- Meesho RTO rate of 25% on COD orders is quite the industry average 😄

Btw, earlier this year, I had done a 20 minute Breakdown video on how Meesho’s creator led value commerce playbook works:

youtu.be/iraHLFVcTRc?si…

Congratulations to Vidit, Sanjeev, early investors (YC, Good Capital, Venture Highway, PeakXV, Elevation) and the employees 👏

Big win (again) for YC and PeakXV - another IPO filing after Groww

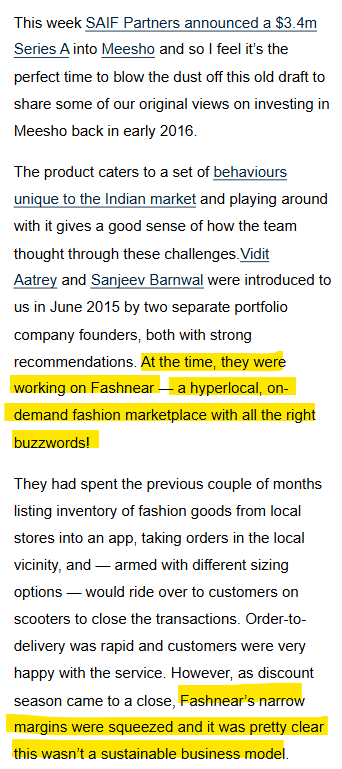

This business has been through 4 distinct avatars & multiple near death moments - Fashnear (hyperlocal fashion), reseller-led group buying, social commerce and now Value E-Commerce.

Meesho’s current Value E-Commerce playbook in a nutshell is: Match long tail unbranded supply to non-metro city demand through video first discovery (via creators) - delivered to the doorstep via a closed loop logistics network.

➡️ Download UDRHP here: investor.meesho.com/ipo-disclosure…

Discl: Views are my own. DYOR prior to subscribing to any IPO - this post is not an endorsement or paid promotion. Shared for informational purposes only.

Big win (again) for YC and PeakXV - another IPO filing after Groww

This business has been through 4 distinct avatars & multiple near death moments - Fashnear (hyperlocal fashion), reseller-led group buying, social commerce and now Value E-Commerce.

Meesho’s current Value E-Commerce playbook in a nutshell is: Match long tail unbranded supply to non-metro city demand through video first discovery (via creators) - delivered to the doorstep via a closed loop logistics network.

➡️ Download UDRHP here: investor.meesho.com/ipo-disclosure…

Discl: Views are my own. DYOR prior to subscribing to any IPO - this post is not an endorsement or paid promotion. Shared for informational purposes only.

• • •

Missing some Tweet in this thread? You can try to

force a refresh