1/

🇮🇳 CONNECT THE DOTS:

Until March 31 2026, India restricts silver imports (DGFT licensing).

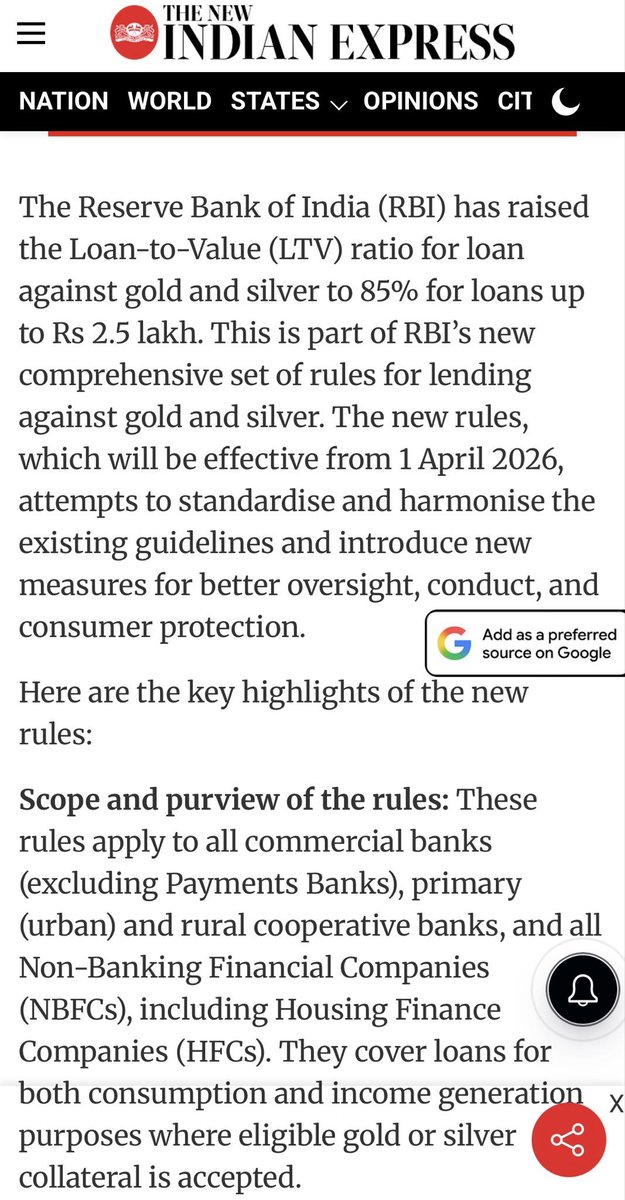

From April 1 2026, the RBI will allow 85% LTV loans against gold and silver. 🏦🥈

🇮🇳 CONNECT THE DOTS:

Until March 31 2026, India restricts silver imports (DGFT licensing).

From April 1 2026, the RBI will allow 85% LTV loans against gold and silver. 🏦🥈

2/

What changed?

“Free” imports → now Restricted.

You’ll need a license to import certain silver jewelry/products.

Goal: curb duty evasion, improve traceability, and clean up import channels.

What changed?

“Free” imports → now Restricted.

You’ll need a license to import certain silver jewelry/products.

Goal: curb duty evasion, improve traceability, and clean up import channels.

3/

Timing isn’t random.

First, tighten the gates on unmonitored inflows.

Then, let banks operate with silver as collateral safely and transparently.

March 31 → April 1. That’s not coincidence.

Timing isn’t random.

First, tighten the gates on unmonitored inflows.

Then, let banks operate with silver as collateral safely and transparently.

March 31 → April 1. That’s not coincidence.

4/

Mechanics:

Less “fake jewelry” entering duty-free = more verifiable physical silver in the system.

Banks can now lend against clean, certified metal.

→ Risk management 101.

Mechanics:

Less “fake jewelry” entering duty-free = more verifiable physical silver in the system.

Banks can now lend against clean, certified metal.

→ Risk management 101.

5/

Short-term in India:

– Imports slow → premiums rise.

– Possible local shortages around festivals & weddings.

– Watch MCX vs. global spot and INR moves.

Short-term in India:

– Imports slow → premiums rise.

– Possible local shortages around festivals & weddings.

– Watch MCX vs. global spot and INR moves.

6/

Mid-term:

– Banks & NBFCs launch silver-backed loan products.

– Households keep their silver and borrow instead of selling.

→ The physical market tightens.

Mid-term:

– Banks & NBFCs launch silver-backed loan products.

– Households keep their silver and borrow instead of selling.

→ The physical market tightens.

7/

Global angle:

India is a metals powerhouse.

Every import restriction + domestic bank demand = less free float for the rest of the world.

Expect higher premiums & tighter supply elsewhere.

Global angle:

India is a metals powerhouse.

Every import restriction + domestic bank demand = less free float for the rest of the world.

Expect higher premiums & tighter supply elsewhere.

8/

Keep an eye on:

– DGFT license policy updates.

– RBI lending guidelines & collateral standards.

– Hallmarking / assay rules for eligible silver.

– MCX–London/NY spread.

Keep an eye on:

– DGFT license policy updates.

– RBI lending guidelines & collateral standards.

– Hallmarking / assay rules for eligible silver.

– MCX–London/NY spread.

9/

Risks / counterpoints:

– Broad licensing or new smuggling routes could blunt the impact.

– A volatile rupee may offset part of the price effect.

Risks / counterpoints:

– Broad licensing or new smuggling routes could blunt the impact.

– A volatile rupee may offset part of the price effect.

10/

Bottom line for stackers:

First tighten the door (imports), then open the window (bank collateral).

This is silent remonetization in real time.

CONNECT THE DOTS. 🦍🥈

#Silver #India #RBI #DGFT

Bottom line for stackers:

First tighten the door (imports), then open the window (bank collateral).

This is silent remonetization in real time.

CONNECT THE DOTS. 🦍🥈

#Silver #India #RBI #DGFT

@threadreaderapp unroll

If you understand what’s really happening — you’re already one of us.

Follow @honzacern1 and connect the dots. 🦍🥈

#SilverStackers #StackerLogic

https://x.com/honzacern1/status/1981011681523454374

• • •

Missing some Tweet in this thread? You can try to

force a refresh