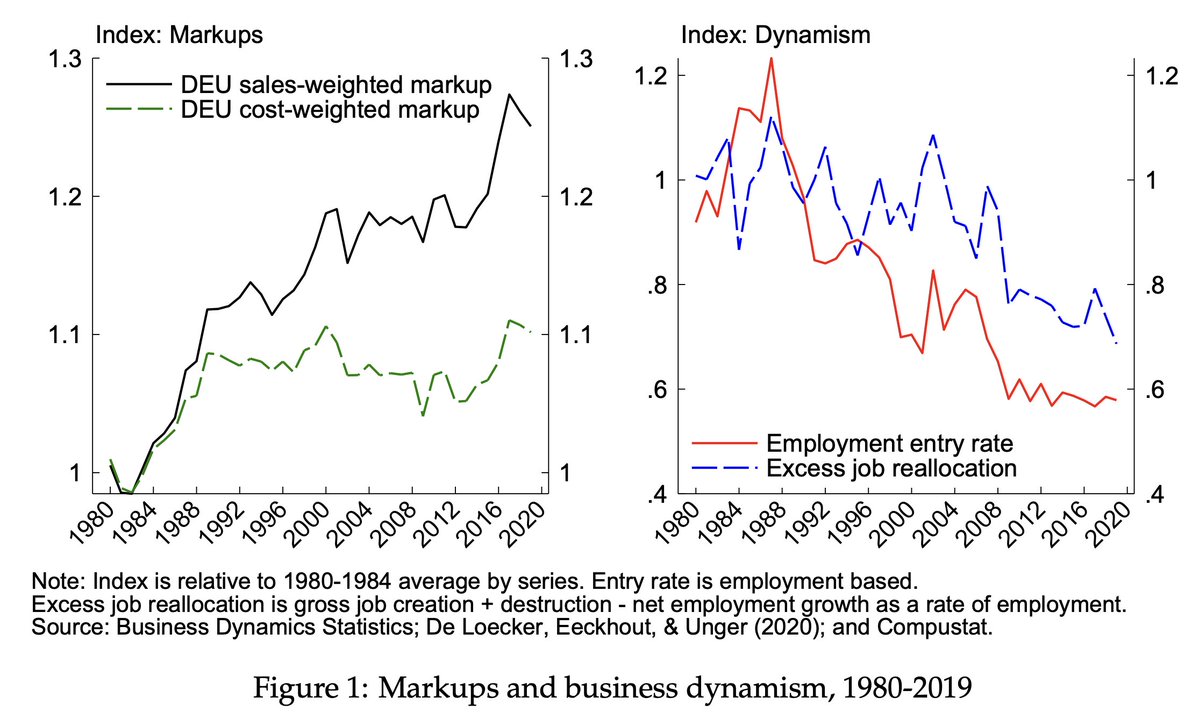

Two macro trends over 40 years:

- Rising markups

- Falling business dynamism

Are these related? Many economists say so.

@UpdatedPriors and I have an updated paper where we take an IO approach and look sector by sector.

Spoiler: The industry data tells a different story 🧵

- Rising markups

- Falling business dynamism

Are these related? Many economists say so.

@UpdatedPriors and I have an updated paper where we take an IO approach and look sector by sector.

Spoiler: The industry data tells a different story 🧵

The economic logic makes some sense:

Higher markups → firms have market power → barriers keep out competitors → less entry/dynamism

This story is so widely accepted. It's in the background of all antitrust discourse.

But what happens when we test it at the industry level?

Higher markups → firms have market power → barriers keep out competitors → less entry/dynamism

This story is so widely accepted. It's in the background of all antitrust discourse.

But what happens when we test it at the industry level?

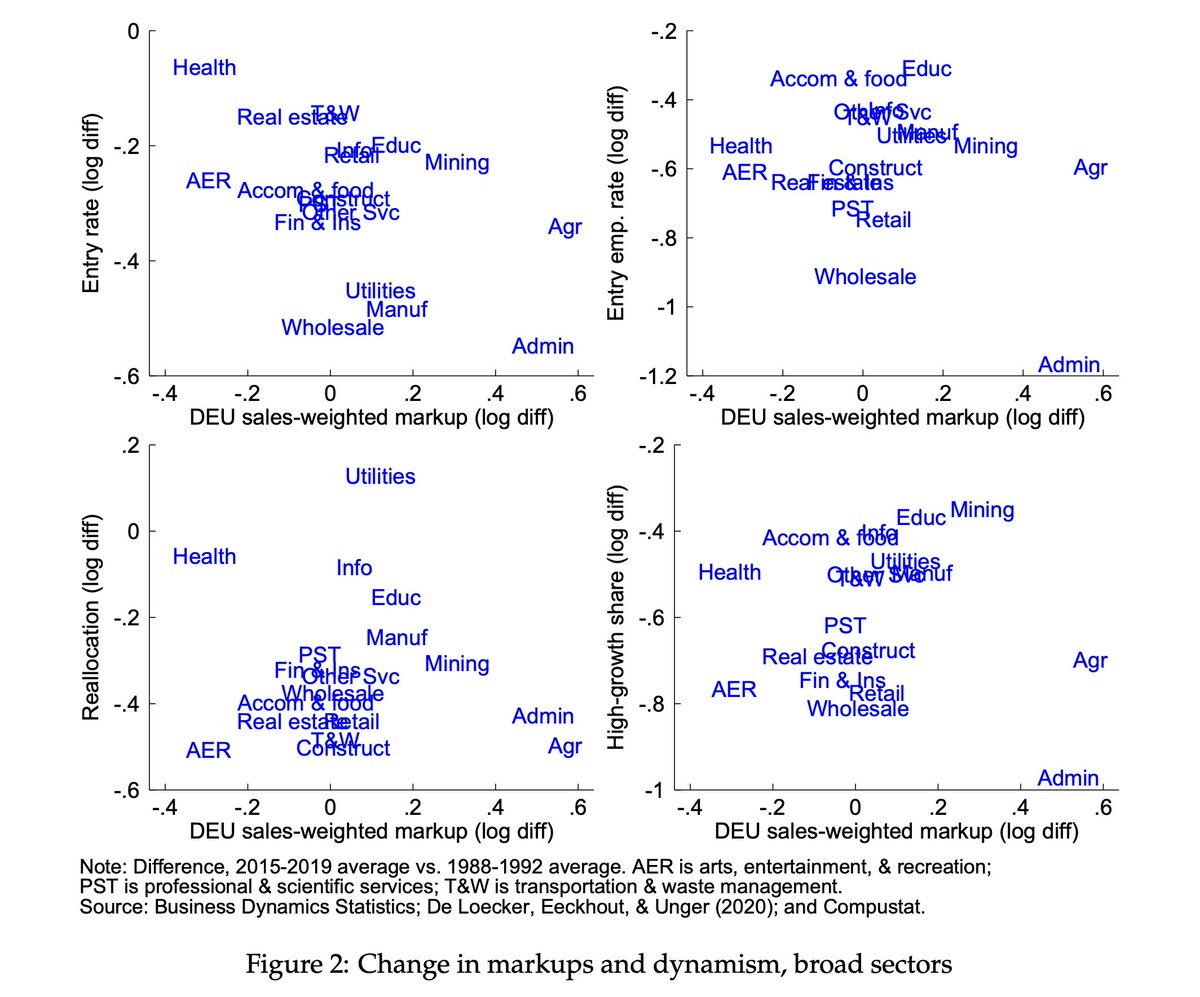

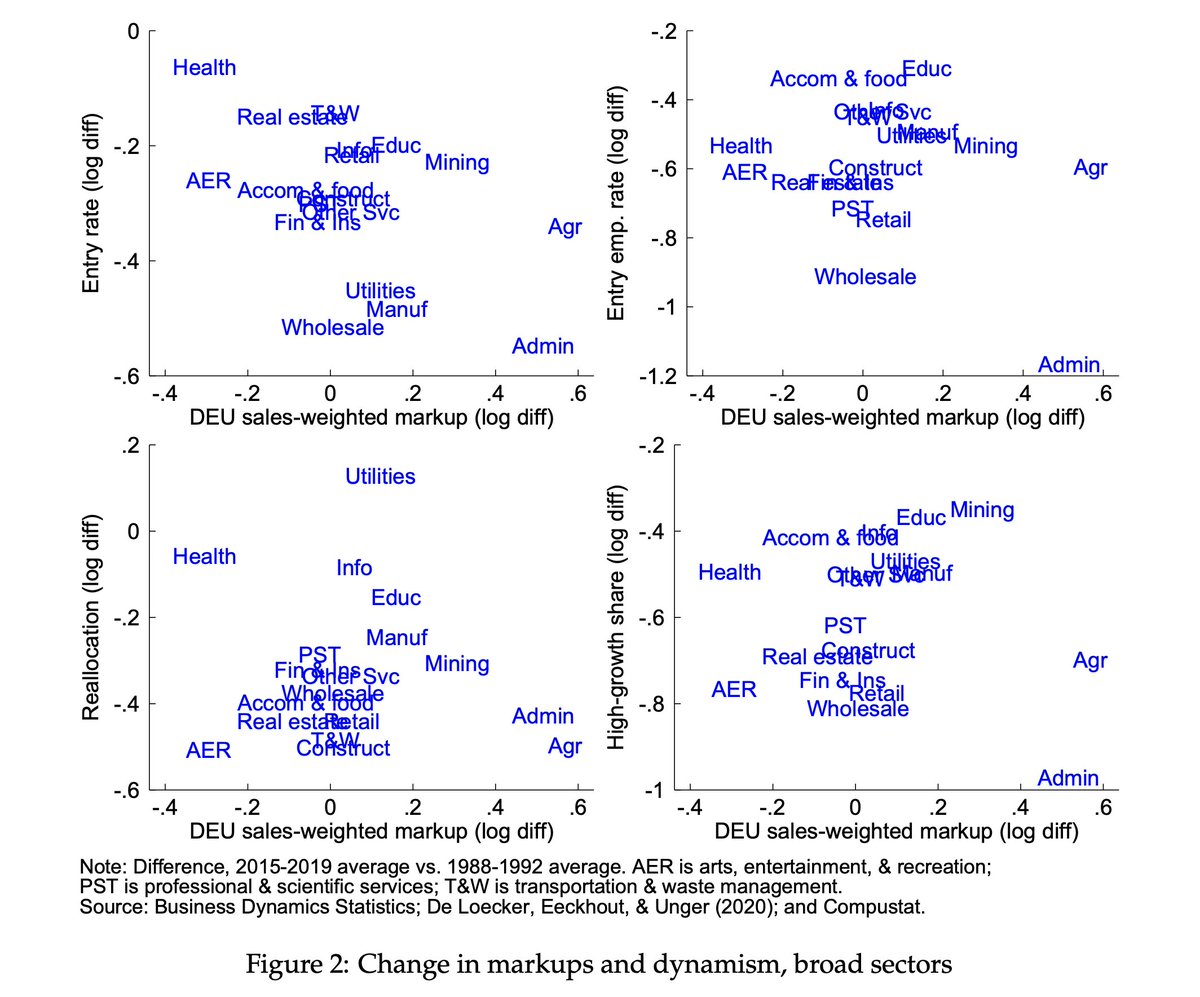

Plot twist: no relationship.

If anything, industries with BIGGER markup increases had SMALLER dynamism declines.

That's the opposite of what the market power story predicts.

We checked this relationship every way imaginable.

If anything, industries with BIGGER markup increases had SMALLER dynamism declines.

That's the opposite of what the market power story predicts.

We checked this relationship every way imaginable.

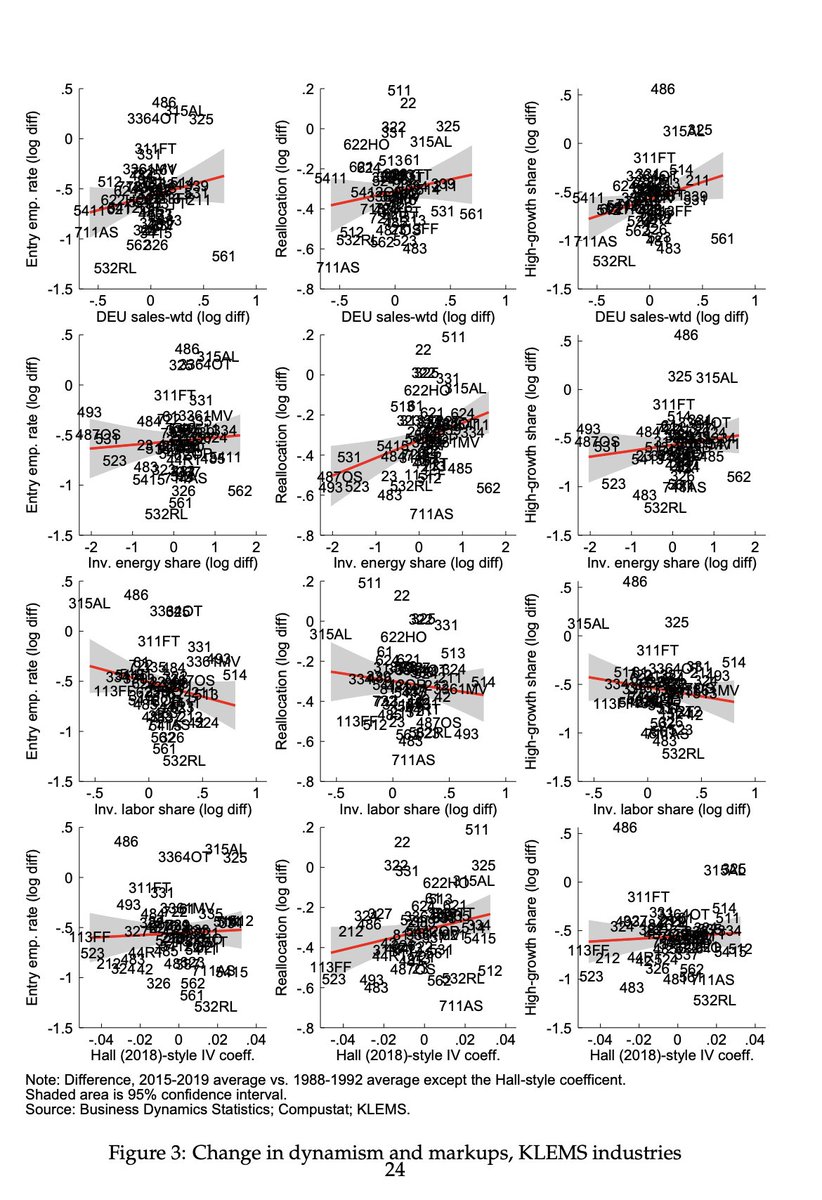

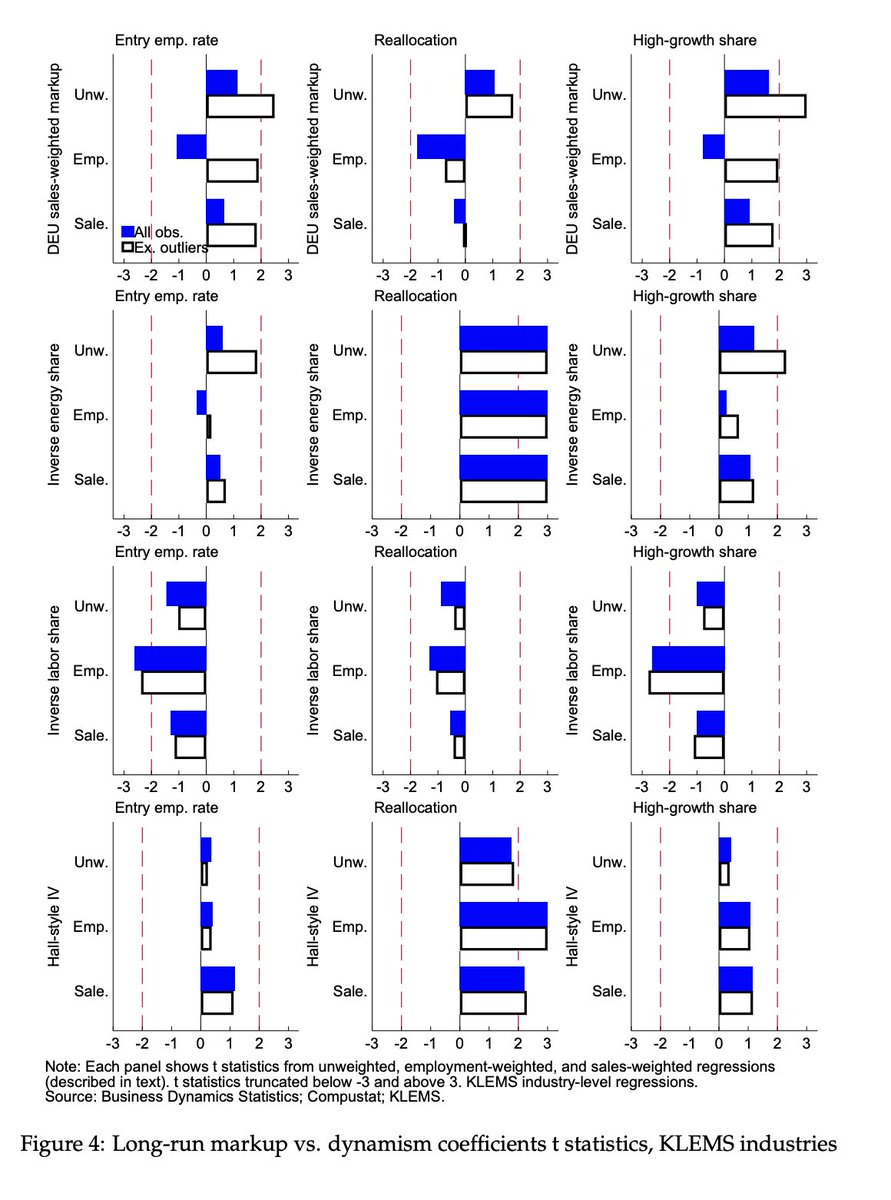

We ran hundreds of specifications:

- Different markup measures

- Different dynamism metrics

- Different weighting

T-stats cluster around zero or slightly positive. The median effect? Positive!

- Different markup measures

- Different dynamism metrics

- Different weighting

T-stats cluster around zero or slightly positive. The median effect? Positive!

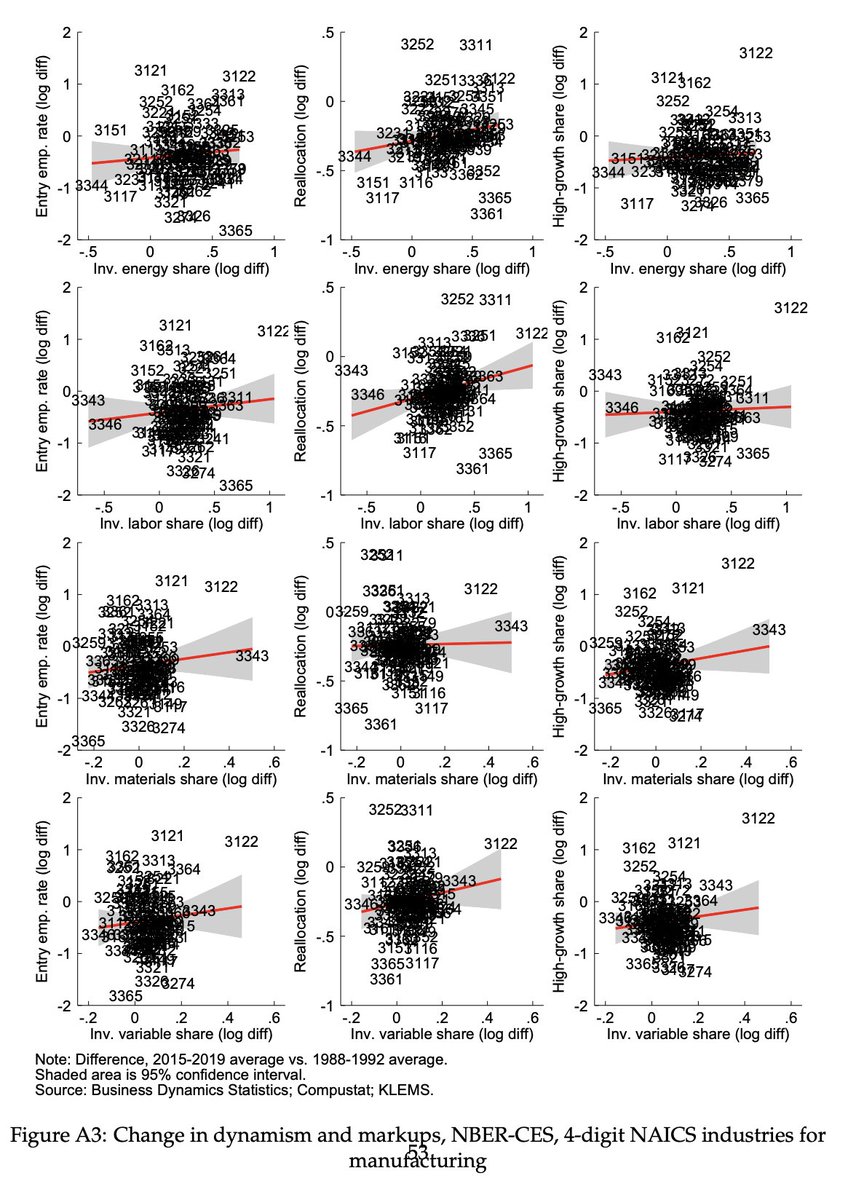

NEW in this version: We added NBER-CES manufacturing data through 2019

Why this matters:

- Much finer detail (up to 4-digit NAICS vs 2-3 digit elsewhere)

- Census plant-level sources, not just public firms

Same method, same result: no relationship

Why this matters:

- Much finer detail (up to 4-digit NAICS vs 2-3 digit elsewhere)

- Census plant-level sources, not just public firms

Same method, same result: no relationship

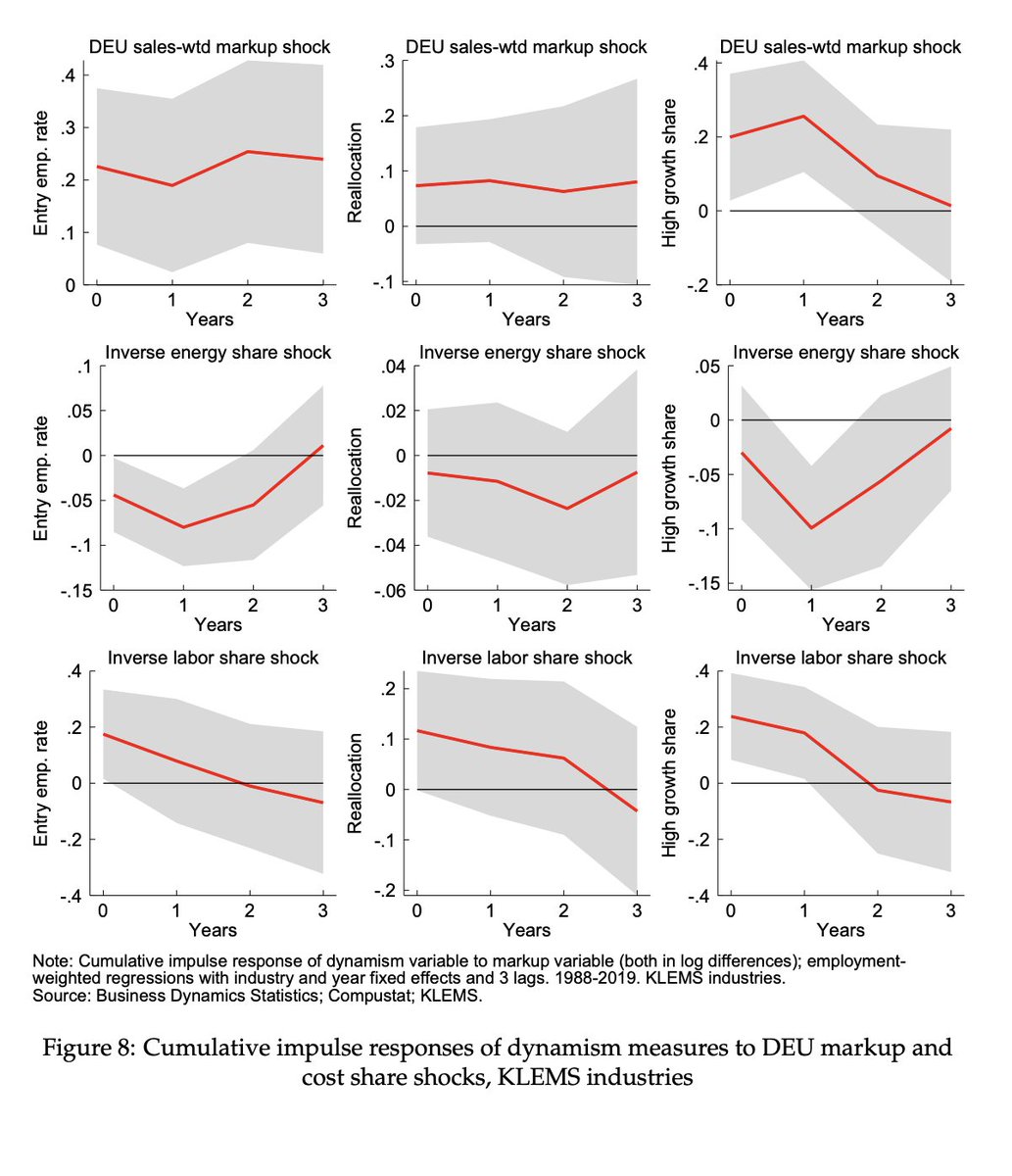

Maybe it's about timing?

We use local projections to trace out dynamic effects.

A markup increase today should reduce entry/dynamism in future years if market power is the mechanism.

Nope. Nothing.

We use local projections to trace out dynamic effects.

A markup increase today should reduce entry/dynamism in future years if market power is the mechanism.

Nope. Nothing.

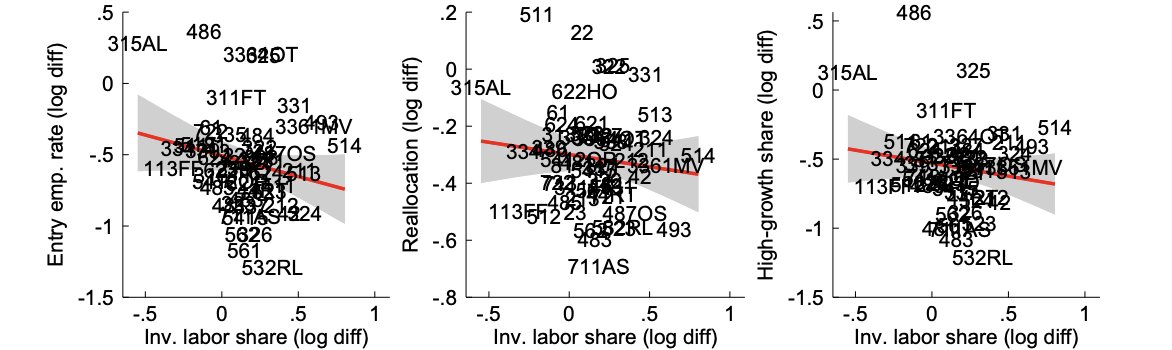

One markup measure does correlate: labor share.

When labor markup rises, dynamism drops.

But this might reflect automation or changing production technology, not market power. Pure market power should show up in all markup measures.

When labor markup rises, dynamism drops.

But this might reflect automation or changing production technology, not market power. Pure market power should show up in all markup measures.

What our results really suggest: Rising markups and declining dynamism are parallel trends, not cause and effect.

They're occurring in different industries at different times.

Any aggregate correlation seems spurious; two independent phenomena happening to coincide temporally

They're occurring in different industries at different times.

Any aggregate correlation seems spurious; two independent phenomena happening to coincide temporally

This week's Nobel commentary keeps treating "rising markups killed dynamism" as settled science.

It's not. Our industry-level evidence suggests these are independent trends.

We're designing competition policy based on a correlation that doesn't exist.

It's not. Our industry-level evidence suggests these are independent trends.

We're designing competition policy based on a correlation that doesn't exist.

We see this as challenging the conventional wisdom. As such, we welcome feedback.

Full paper here briancalbrecht.com/Albrecht_Decke…

Full paper here briancalbrecht.com/Albrecht_Decke…

• • •

Missing some Tweet in this thread? You can try to

force a refresh