Chief Economist @LawEconCenter. Antitrust and price theory. 📝Price Theory Newsletter https://t.co/1S7TB6ANUP

3 subscribers

How to get URL link on X (Twitter) App

Right out the gate, Wu is wrong. That is not what the ruling said! Boasberg did not rule on whether Meta had a monopoly is personal social networking.

Right out the gate, Wu is wrong. That is not what the ruling said! Boasberg did not rule on whether Meta had a monopoly is personal social networking.

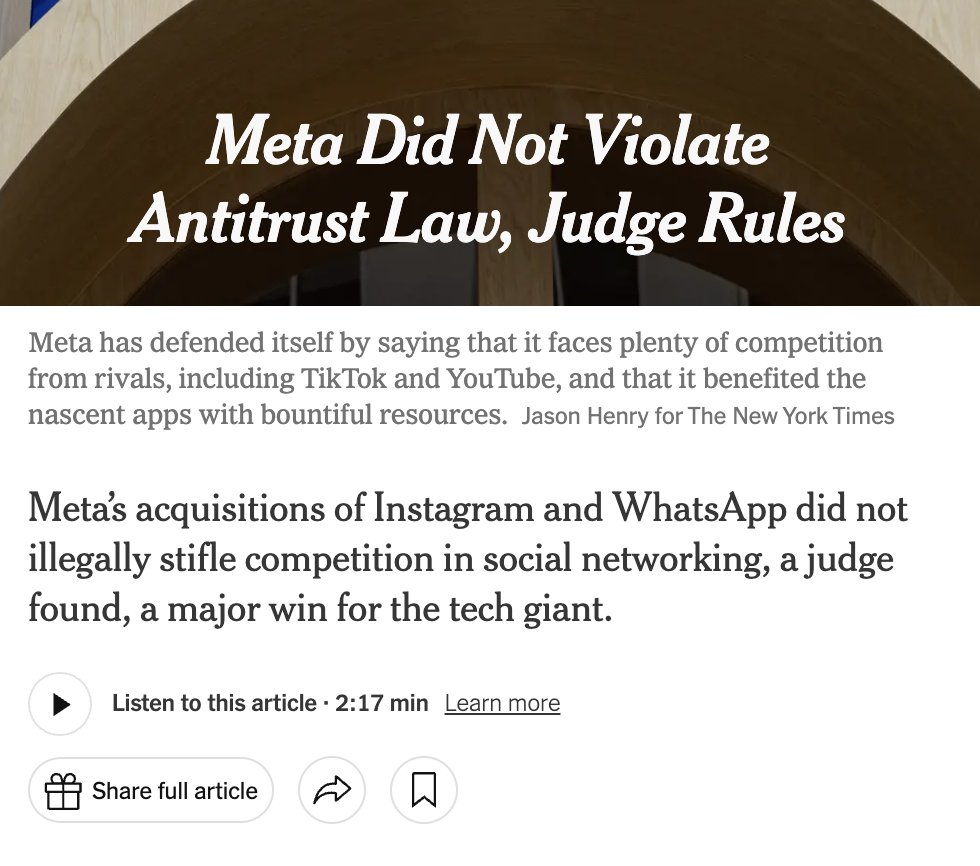

The vibe is set in line 1: Heraclitus and never stepping in the same rivier twice.

The vibe is set in line 1: Heraclitus and never stepping in the same rivier twice.

Piece here nytimes.com/2025/11/16/opi…

Piece here nytimes.com/2025/11/16/opi…

Link to paper:

Link to paper:

Hayek taught us markets require minimal information. Traders only need to know prices, not everyone's preferences or endowments.

Hayek taught us markets require minimal information. Traders only need to know prices, not everyone's preferences or endowments.

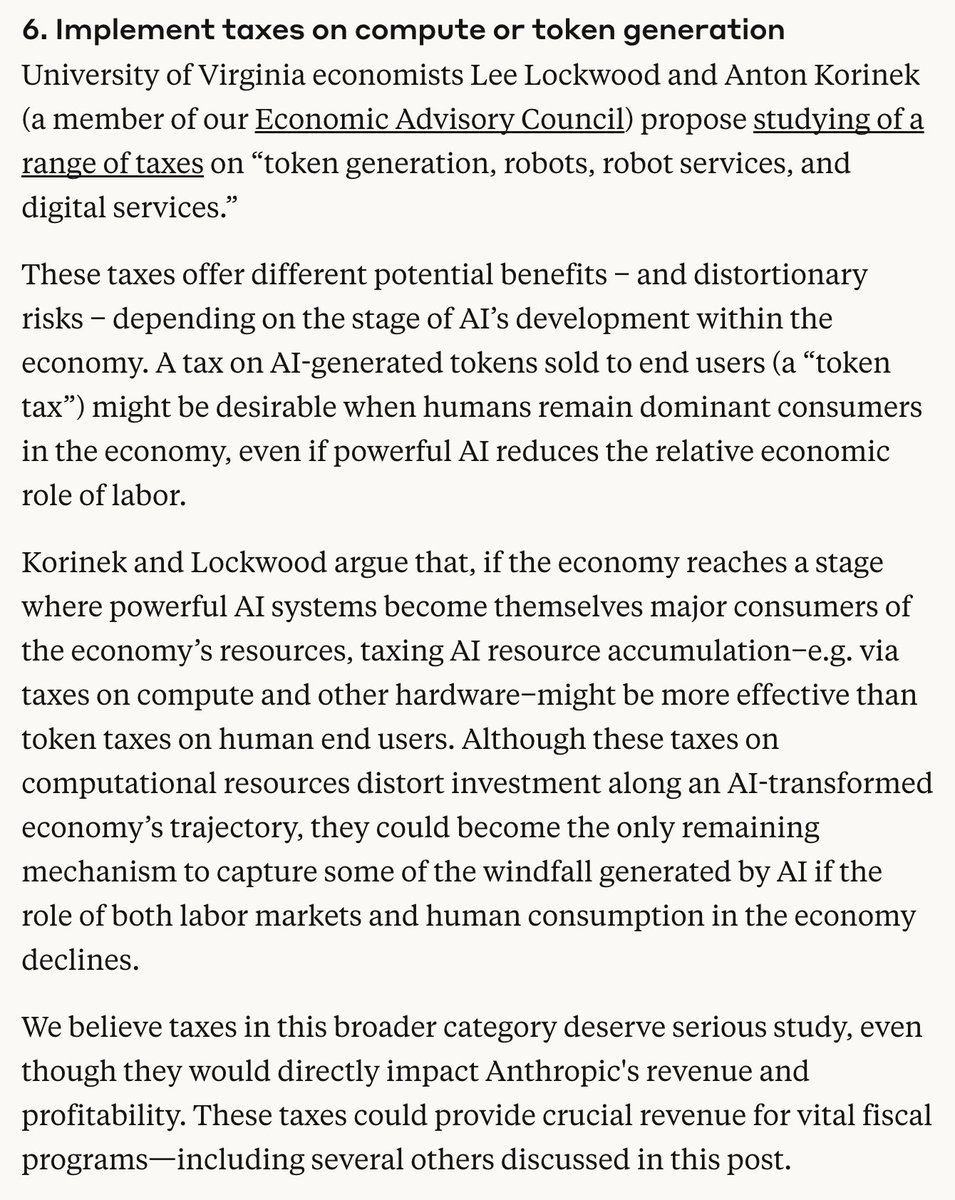

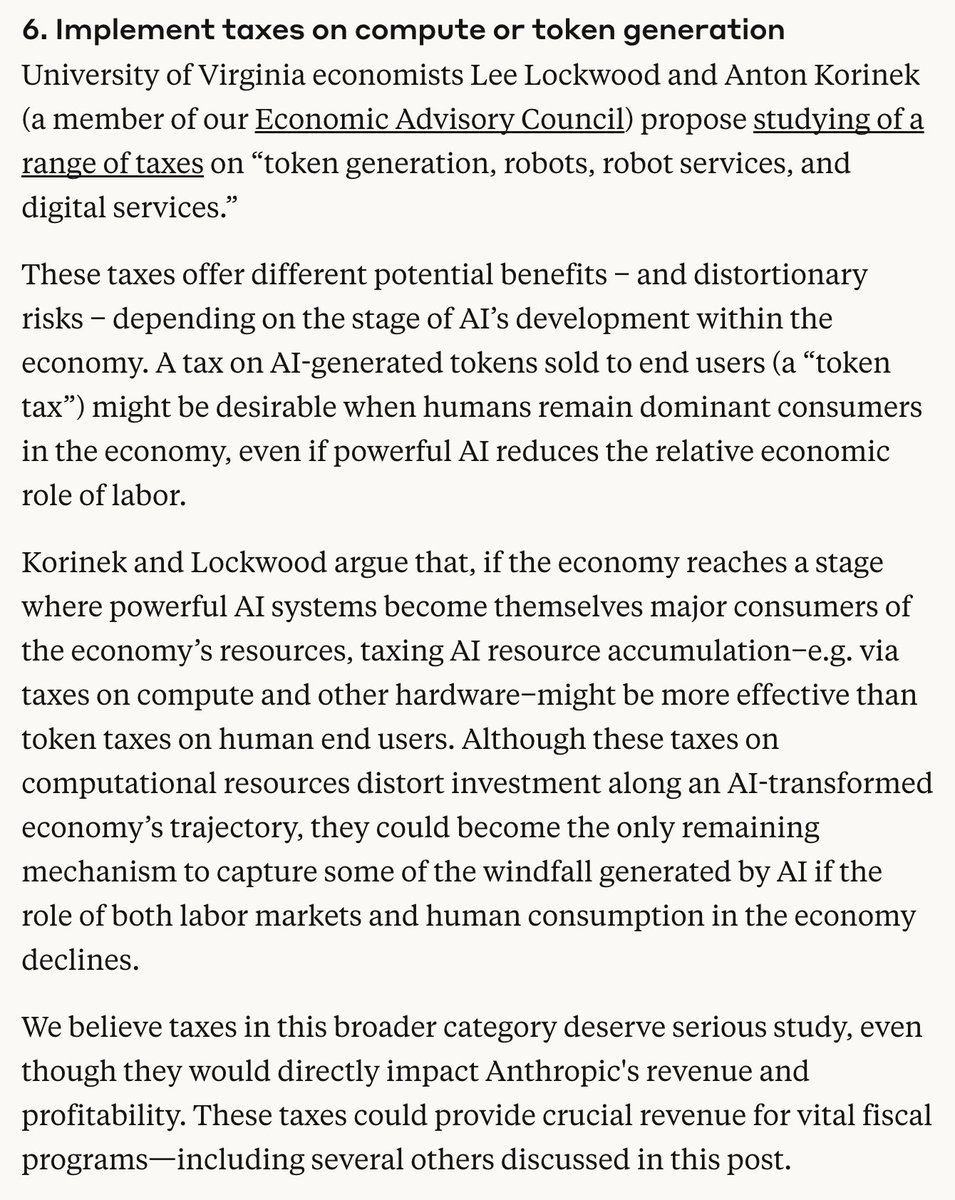

The economic logic makes some sense:

The economic logic makes some sense:

https://twitter.com/AnthropicAI/status/1978157815911891094AI is bad, so tax it! Okay?

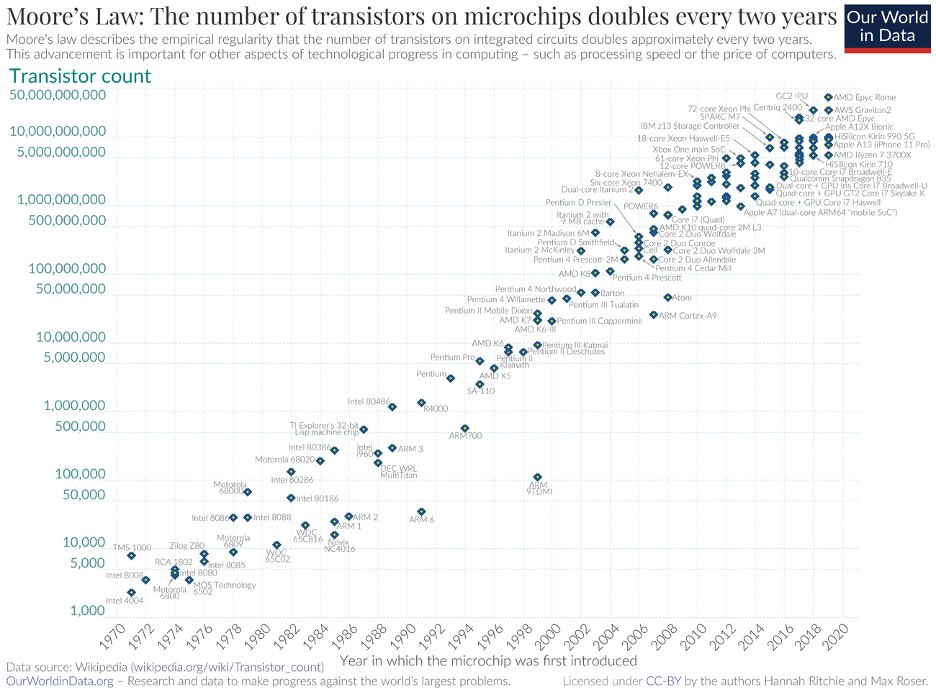

For most of human history, living standards barely changed. Then something shifted.

For most of human history, living standards barely changed. Then something shifted.

https://twitter.com/BrianCAlbrecht/status/1976674351366971487

It's a bit of shadowboxing against I'm not sure who.

It's a bit of shadowboxing against I'm not sure who.

https://x.com/nytimes/status/1962982232013906263First, what the court actually ordered:

https://twitter.com/josephpolitano/status/1955041060197114136x.com/garywinslett/s… x.com/garywinslett/s…

Suppose a good is in fixed supply (perfectly inelastic). Increasing that tax generates no deadweight loss.

Suppose a good is in fixed supply (perfectly inelastic). Increasing that tax generates no deadweight loss.

The thing about small businesses is... They suck, in terms of job creation, productivity, etc.

The thing about small businesses is... They suck, in terms of job creation, productivity, etc.

Don't be confused by the currency/captial/trade stuff. What is he actually saying?

Don't be confused by the currency/captial/trade stuff. What is he actually saying?

The liability phase is in the books.

The liability phase is in the books.

https://twitter.com/antitrust_bot/status/1912876835869974873Judge says: Google’s sin is tying customers, not refusing rivals—so Trinko safe‑harbor ≠ available.

First, network *effects* are not inherently anti-competitive or bad.

First, network *effects* are not inherently anti-competitive or bad.

Again, we see that claim about high tariffs and the 19th century. Any argument provided? Nop.e

Again, we see that claim about high tariffs and the 19th century. Any argument provided? Nop.e

https://twitter.com/briancalbrecht/status/1897742203843137936

Here’s what we have coming up: 90 minutes from each side presenting on the economics, trying to expand on written submissions.

Here’s what we have coming up: 90 minutes from each side presenting on the economics, trying to expand on written submissions.