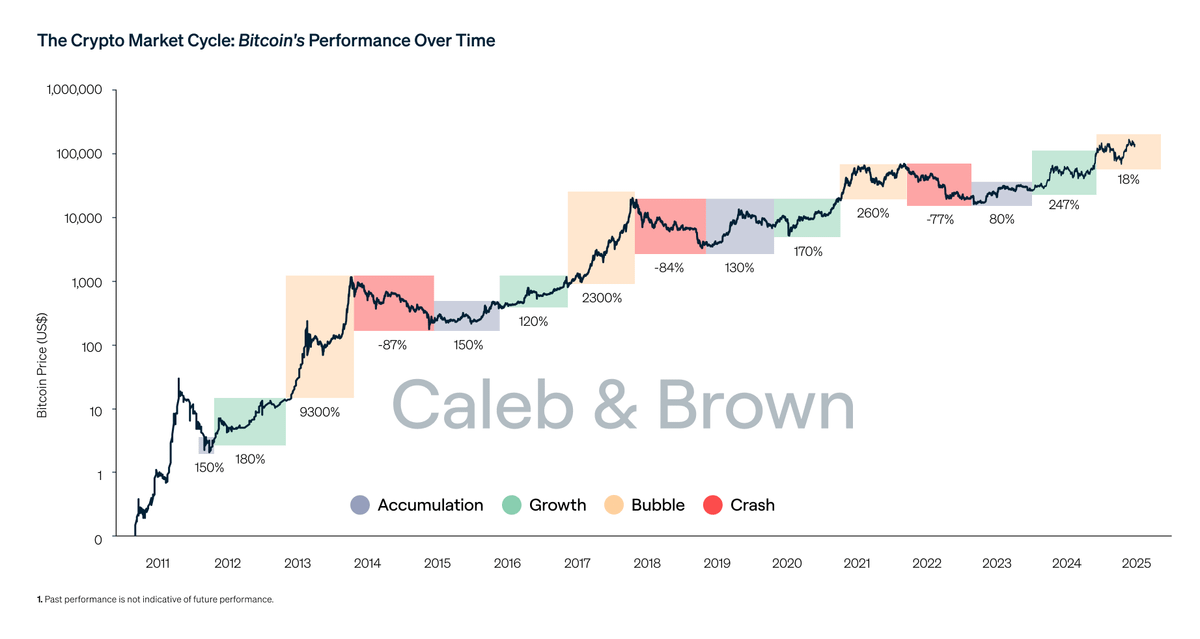

The classic Bitcoin rhythm used to be simple:

Halving → 12–18-month rally → blow-off top → bear market.

That pattern worked for over a decade.

But this time, something’s changed and it’s already visible in the data.

Halving → 12–18-month rally → blow-off top → bear market.

That pattern worked for over a decade.

But this time, something’s changed and it’s already visible in the data.

Bitcoin has shifted from a 4-year to a 5-year cycle, with the next peak expected around Q2 2026.

This is due to a deeper structural shift in the global economy, governments are rolling over debt for longer periods, business cycles are stretching out, and liquidity waves now moving through the system more slowly.

This is due to a deeper structural shift in the global economy, governments are rolling over debt for longer periods, business cycles are stretching out, and liquidity waves now moving through the system more slowly.

That explains what we’re seeing right now in late 2025.

Instead of fading like previous post-halving years, Bitcoin is holding strength after months of volatility.

The market hasn’t topped, it’s digesting liquidity that’s still building underneath.

Instead of fading like previous post-halving years, Bitcoin is holding strength after months of volatility.

The market hasn’t topped, it’s digesting liquidity that’s still building underneath.

Here’s what’s driving that lag.

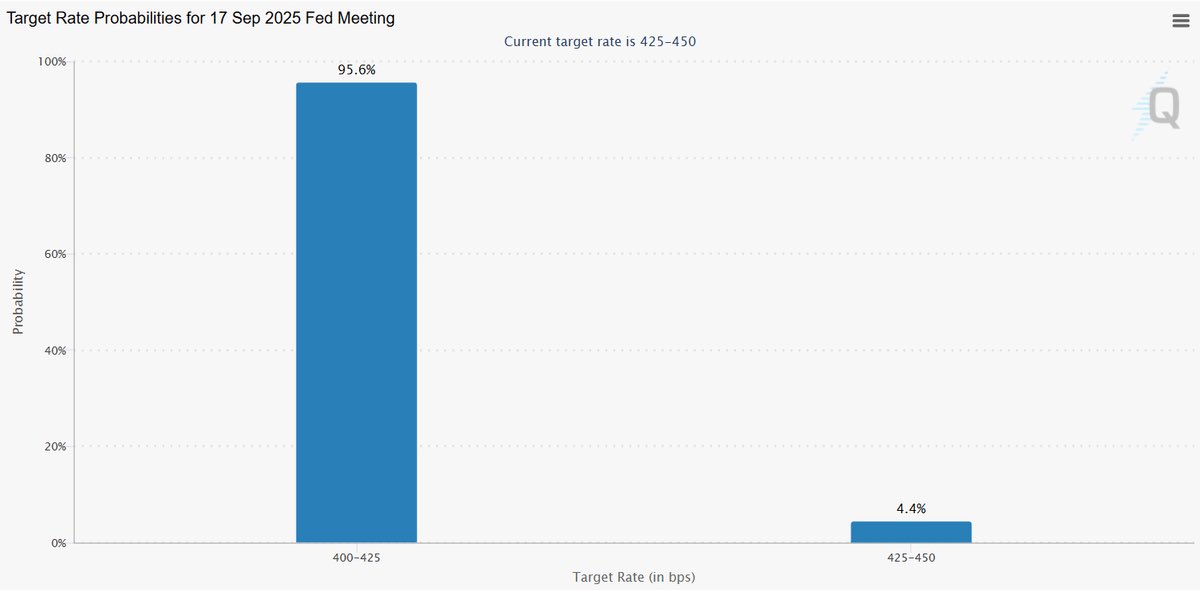

When central banks stop tightening, it takes 6–12 months for liquidity to reach markets.

That’s why the easing signals we got from Powell in Q3 2025, like hints of ending balance-sheet contraction, will impact markets through early 2026, not instantly.

When central banks stop tightening, it takes 6–12 months for liquidity to reach markets.

That’s why the easing signals we got from Powell in Q3 2025, like hints of ending balance-sheet contraction, will impact markets through early 2026, not instantly.

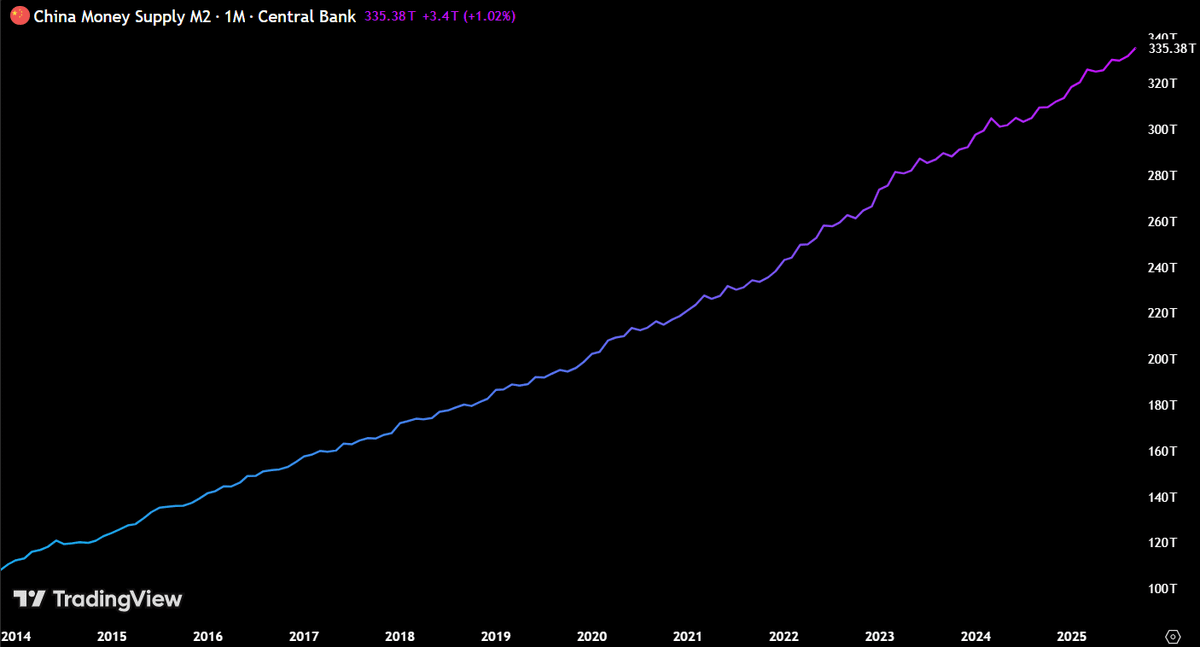

The same delay exists outside the U.S.

China’s money supply (M2) is now over 2× that of the U.S., and it keeps expanding.

Historically, when China’s liquidity rises faster than America’s, Bitcoin rallies a few months later.

That cross-border lag alone stretches the cycle into the first half of 2026.

China’s money supply (M2) is now over 2× that of the U.S., and it keeps expanding.

Historically, when China’s liquidity rises faster than America’s, Bitcoin rallies a few months later.

That cross-border lag alone stretches the cycle into the first half of 2026.

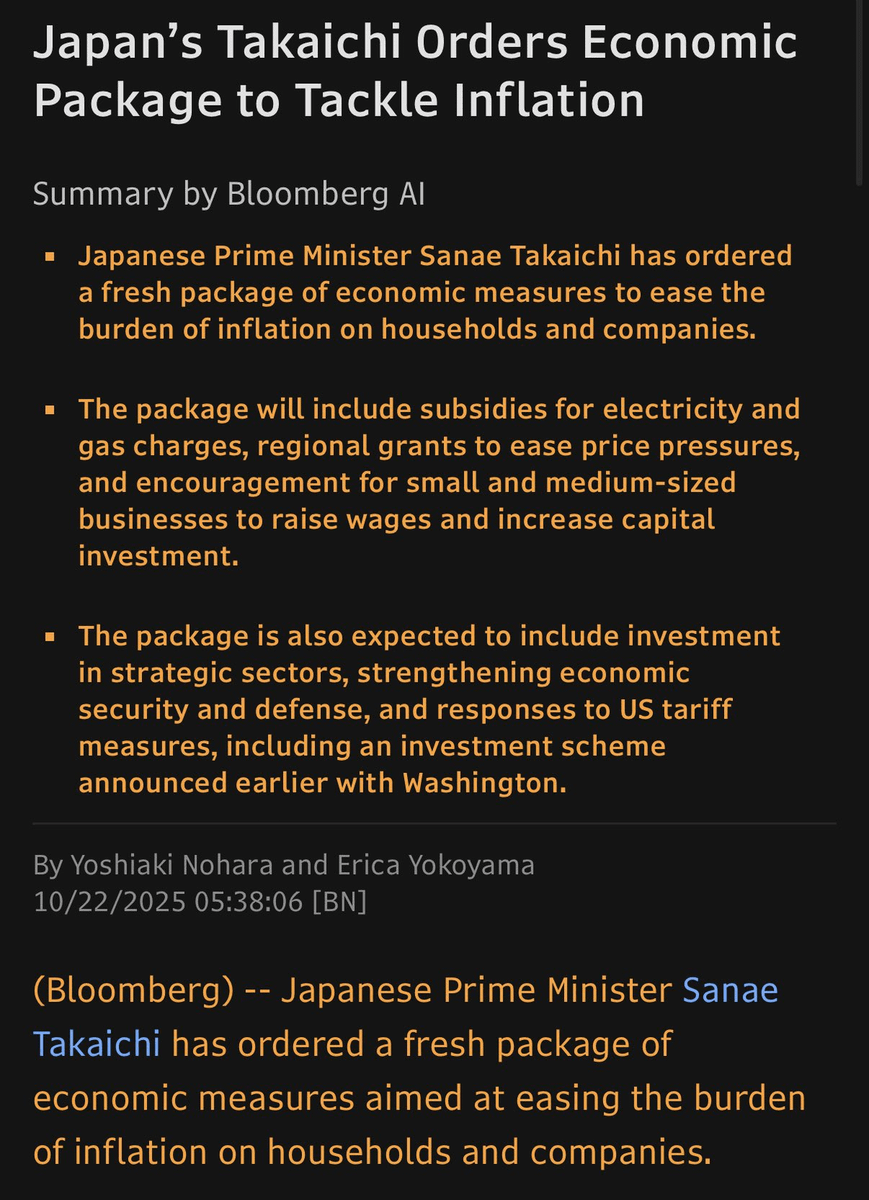

Japan is planning to add more fuel.

Japan's new PM has ordered economic package to tackle inflation.

That liquidity doesn’t stay in Japan, it spreads into global risk assets, from equities to crypto.

So even if U.S. liquidity flattens for a while, Asia’s flow keeps Bitcoin supported.

Japan's new PM has ordered economic package to tackle inflation.

That liquidity doesn’t stay in Japan, it spreads into global risk assets, from equities to crypto.

So even if U.S. liquidity flattens for a while, Asia’s flow keeps Bitcoin supported.

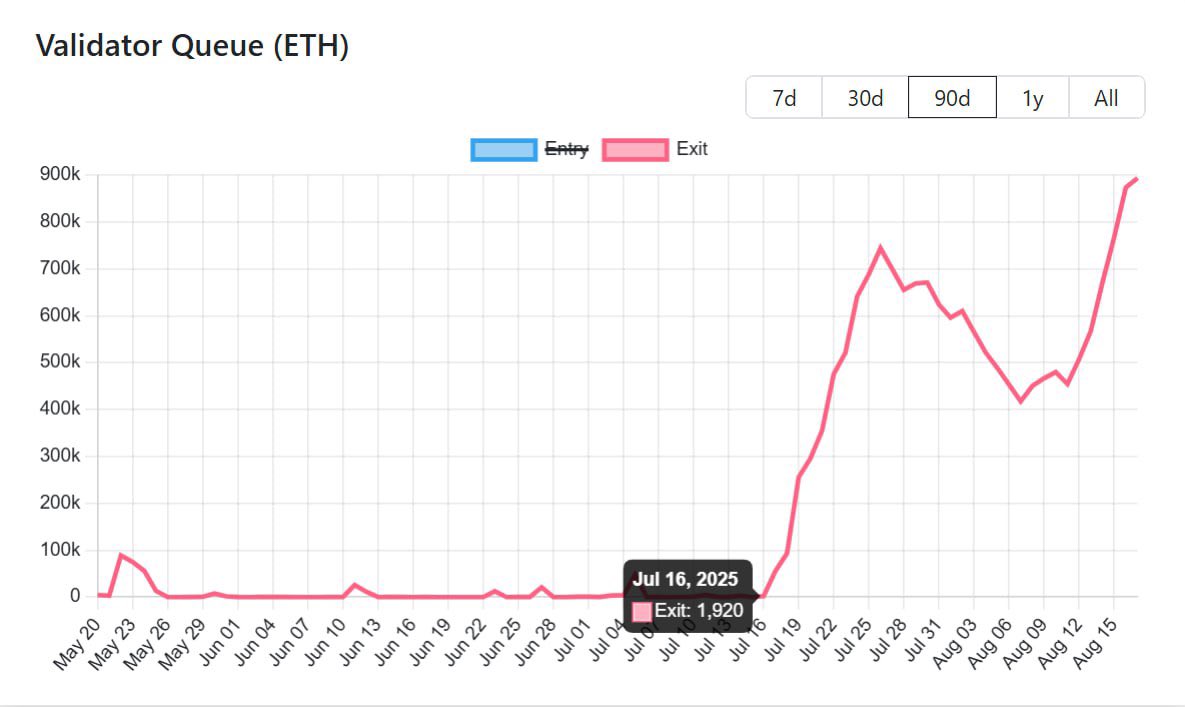

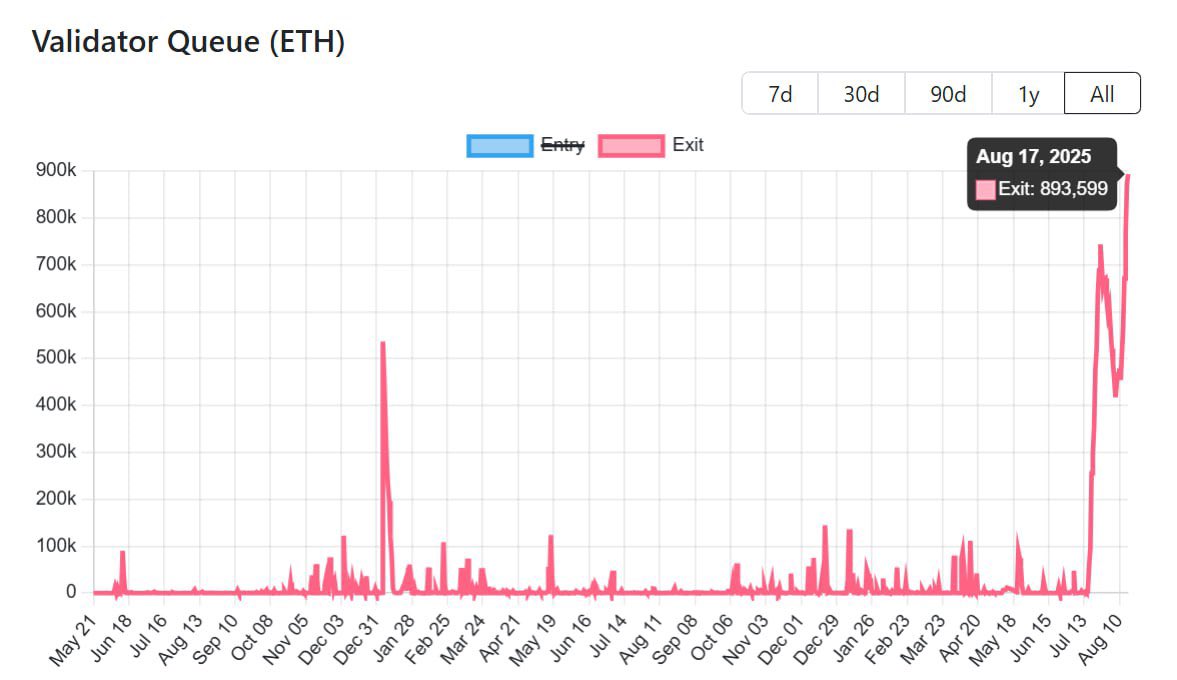

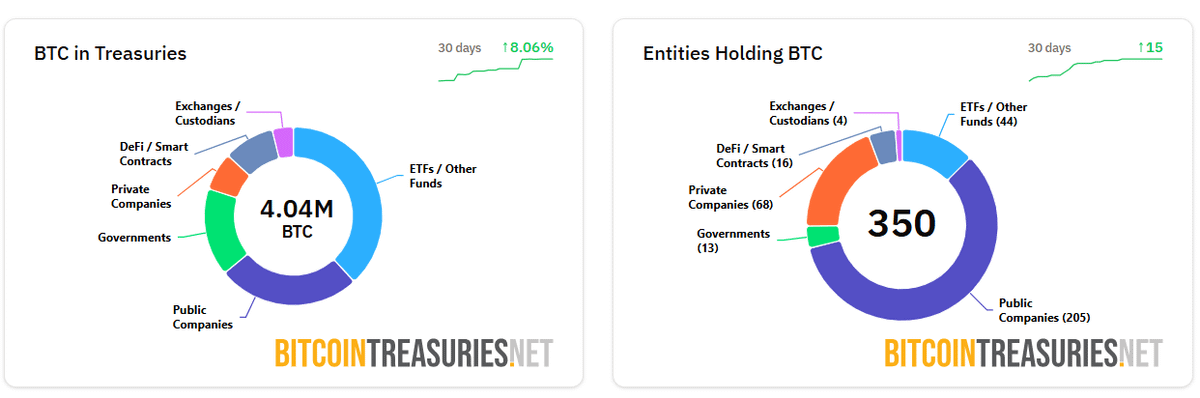

This is also the first cycle driven by institutional accumulation, not retail hype.

Spot ETFs, corporate treasuries, and funds buy gradually and hold longer.

They don’t panic-sell 20 percent drops, they rebalance quarterly.

That behavior alone slows the entire price rhythm and delays the true peak.

Spot ETFs, corporate treasuries, and funds buy gradually and hold longer.

They don’t panic-sell 20 percent drops, they rebalance quarterly.

That behavior alone slows the entire price rhythm and delays the true peak.

Retail, on the other hand, is still mostly out.

Google Trends interest for “Bitcoin” is far below 2021 levels.

We’re in what looks like a quiet expansion phase, not mania.

Retail euphoria, the thing that usually ends cycles, hasn’t arrived yet.

Google Trends interest for “Bitcoin” is far below 2021 levels.

We’re in what looks like a quiet expansion phase, not mania.

Retail euphoria, the thing that usually ends cycles, hasn’t arrived yet.

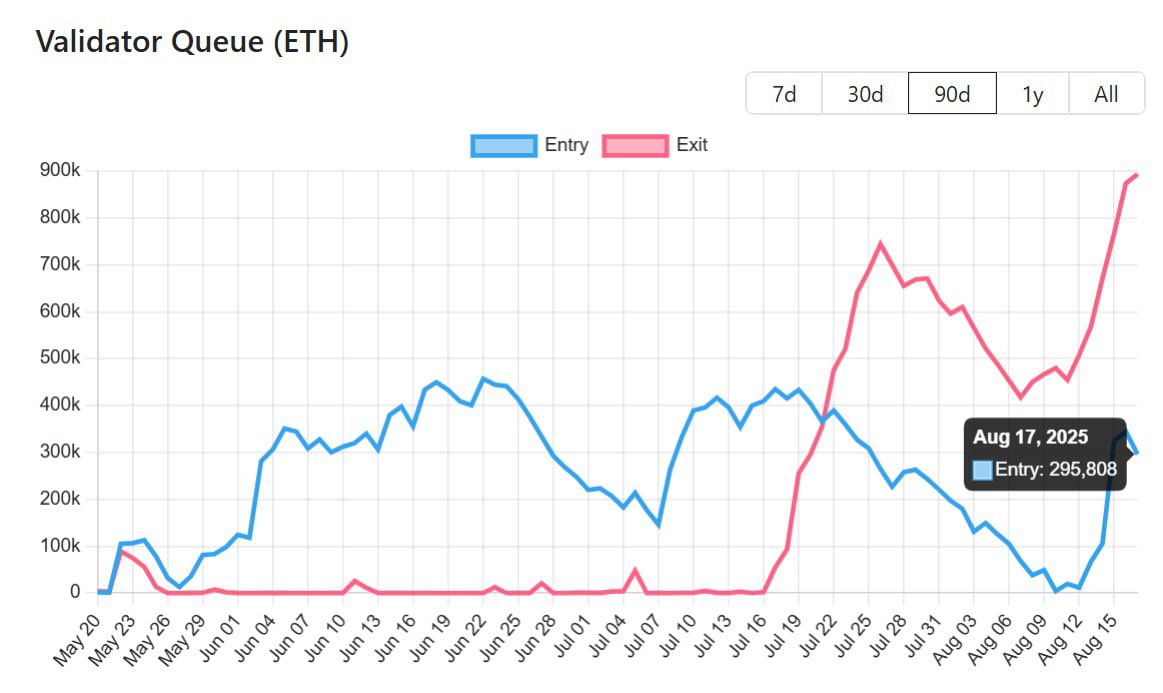

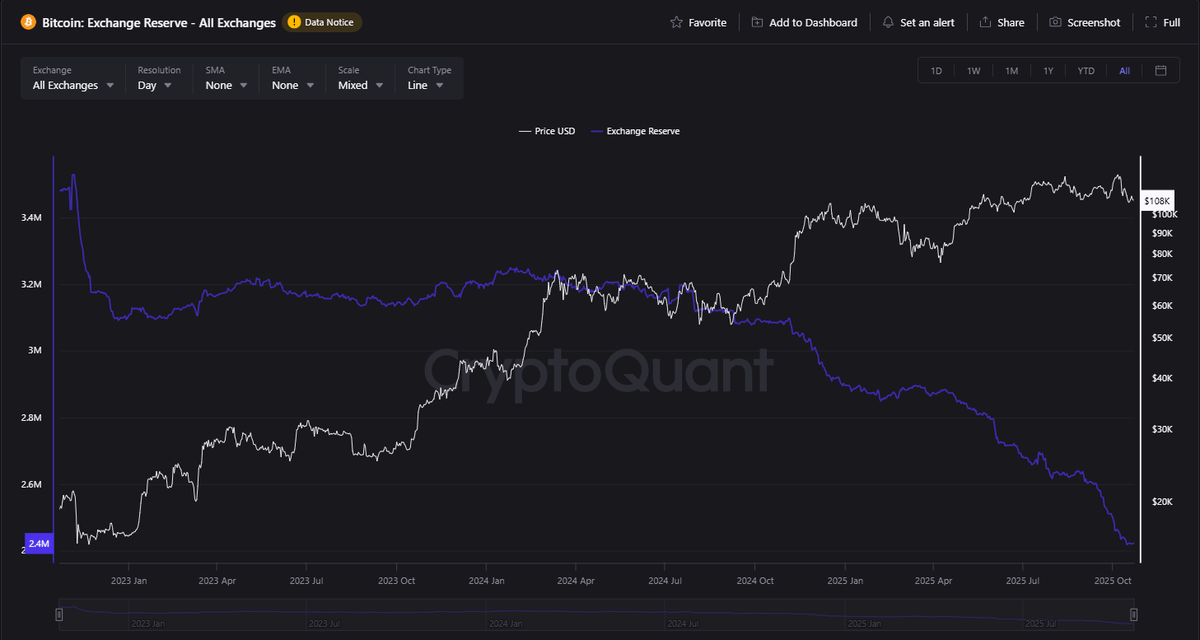

On chain data confirms this mid-cycle structure:

Institutions are still accumulating.

Exchange reserves remain near multi-year lows.

Miner selling pressure has eased post-halving.

All signs that supply is tight, not exhausted.

Institutions are still accumulating.

Exchange reserves remain near multi-year lows.

Miner selling pressure has eased post-halving.

All signs that supply is tight, not exhausted.

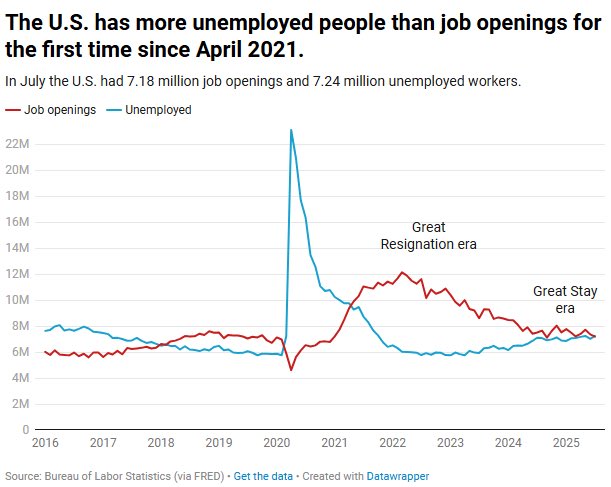

The macro backdrop also supports a longer window.

Real incomes are still stagnant while asset prices remain inflated.

That imbalance forces policymakers to keep liquidity loose.

They can’t crush risk assets without breaking credit markets, so easing continues slowly, prolonging the bull environment.

Real incomes are still stagnant while asset prices remain inflated.

That imbalance forces policymakers to keep liquidity loose.

They can’t crush risk assets without breaking credit markets, so easing continues slowly, prolonging the bull environment.

Each liquidity wave since 2020 has taken longer to form and fade.

2020’s liquidity hit instantly (COVID response).

2023’s wave came from regional bank stress.

2025’s next one is forming from policy lag and global easing, set to peak in early to-mid 2026.

2020’s liquidity hit instantly (COVID response).

2023’s wave came from regional bank stress.

2025’s next one is forming from policy lag and global easing, set to peak in early to-mid 2026.

To summarize what’s happening:

Fed tightening has effectively ended.

Balance-sheet runoff (QT) is close to stopping.

China is still injecting liquidity.

Institutional demand is steady.

Retail interest hasn’t peaked.

All these forces point to an elongated expansion, not an exhausted one.

Fed tightening has effectively ended.

Balance-sheet runoff (QT) is close to stopping.

China is still injecting liquidity.

Institutional demand is steady.

Retail interest hasn’t peaked.

All these forces point to an elongated expansion, not an exhausted one.

So yes, the 4-year halving model still matters.

But it’s now being reshaped by macro liquidity, institutional pacing, and slower global cycles.

And that’s why the real peak of this run could align with Q2 2026, not 2025.

But it’s now being reshaped by macro liquidity, institutional pacing, and slower global cycles.

And that’s why the real peak of this run could align with Q2 2026, not 2025.

We’re no longer waiting for another halving to start fresh.

We’re already inside a cycle that’s expanding with the world’s liquidity curve.

And if that curve continues rising into 2026...

this might be the longest, most mature Bitcoin bull market in history.

We’re already inside a cycle that’s expanding with the world’s liquidity curve.

And if that curve continues rising into 2026...

this might be the longest, most mature Bitcoin bull market in history.

That’s the wrap.

If you found this thread useful:

🔹 Like

🔹 Repost

🔹 Bookmark

Follow @BullTheoryio for more in-depth crypto research.

If you found this thread useful:

🔹 Like

🔹 Repost

🔹 Bookmark

Follow @BullTheoryio for more in-depth crypto research.

https://x.com/BullTheoryio/status/1981295414814134674

• • •

Missing some Tweet in this thread? You can try to

force a refresh