What caused Great Depression was leverage: people would give unsecured loans for other people to buy stocks; one dollar of borrowed money could be used to purchase ten dollars of speculative stocks. This "margin buying" also caused the 2008 subprime housing crisis (derivatives).

https://twitter.com/romanhelmetguy/status/1981351484081262870

Leverage before the Great Depression was that one dollar of real money could be used to purchase 10-12 fake dollars.

Leverage before the 2008 subprime housing crisis was that one dollar of real money could be used to purchase 30-80 fake dollars (synthetic CDOs, Fannie Mae).

Leverage before the 2008 subprime housing crisis was that one dollar of real money could be used to purchase 30-80 fake dollars (synthetic CDOs, Fannie Mae).

Leverage essentially allows you to counterfeit money and to frontrun authentic price discovery, by injecting fictional money into capital markets, which in the short-term is valued exactly the same as real money.

https://x.com/romanhelmetguy/status/1981351484081262870

The problem is that all money is basically fake, and banks operate based on the same principle "fractional reserve banking system" of lending money they don't have, whether that's one real dollar to every 10, 20, or 30 fake dollars of credit.

The Big Short explains how this works pretty well. But it's really not complicated, and it has nothing to do with gold, or Bitcoin. Banks create fake credit and eventually fake credit drives out real money. (Gresham's Law, bad money drives out good)

institutional criminals who blew up financial system react by scapegoating victims ("hoarding gold"). This is exactly the same as when Bolsheviks blame "kulak capitalist wreckers" for famines and mass starvation, real Communism has never been tried.

https://x.com/romanhelmetguy/status/1981351484081262870

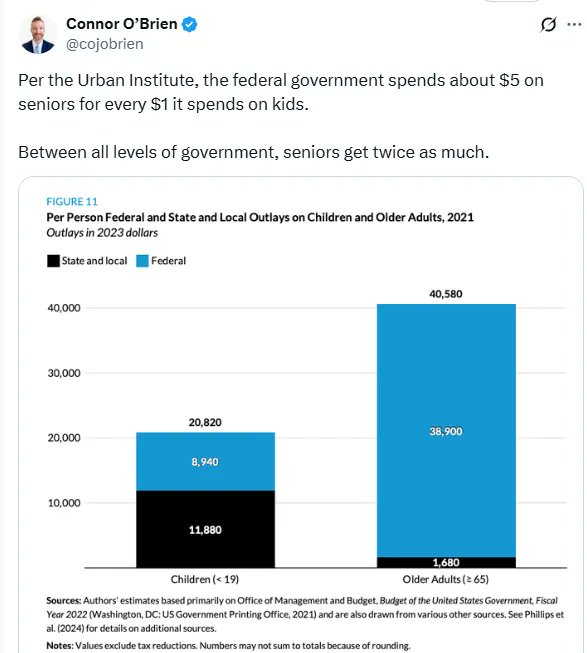

blaming gold for causing the Great Depression is like Social Security going bankrupt, then Ponzi Scheme Boomers blaming Zoomers for purchasing Bitcoin and not contributing enough to keep pensions afloat. The institutions that created the pyramid scheme are angry nobody buys in.

the more interesting aspect of this conversation is alluded to when you propose the questions:

"why every country abandoned it, and how their new system would prevent all that from just happening again."

"why every country abandoned it, and how their new system would prevent all that from just happening again."

https://x.com/romanhelmetguy/status/1981351484081262870

the basic value proposition of leverage, and "fractional reserve banking system", is that if you don't inject ten fake dollars of credit into the economy for every real dollar, then rich people get scared and stop spending their money.

https://x.com/romanhelmetguy/status/1981351484081262870

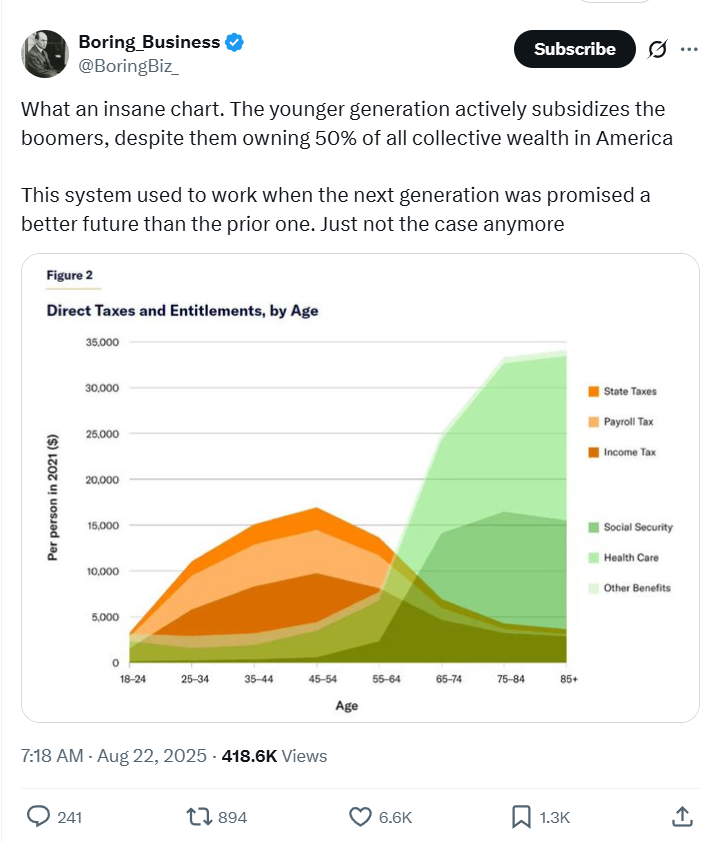

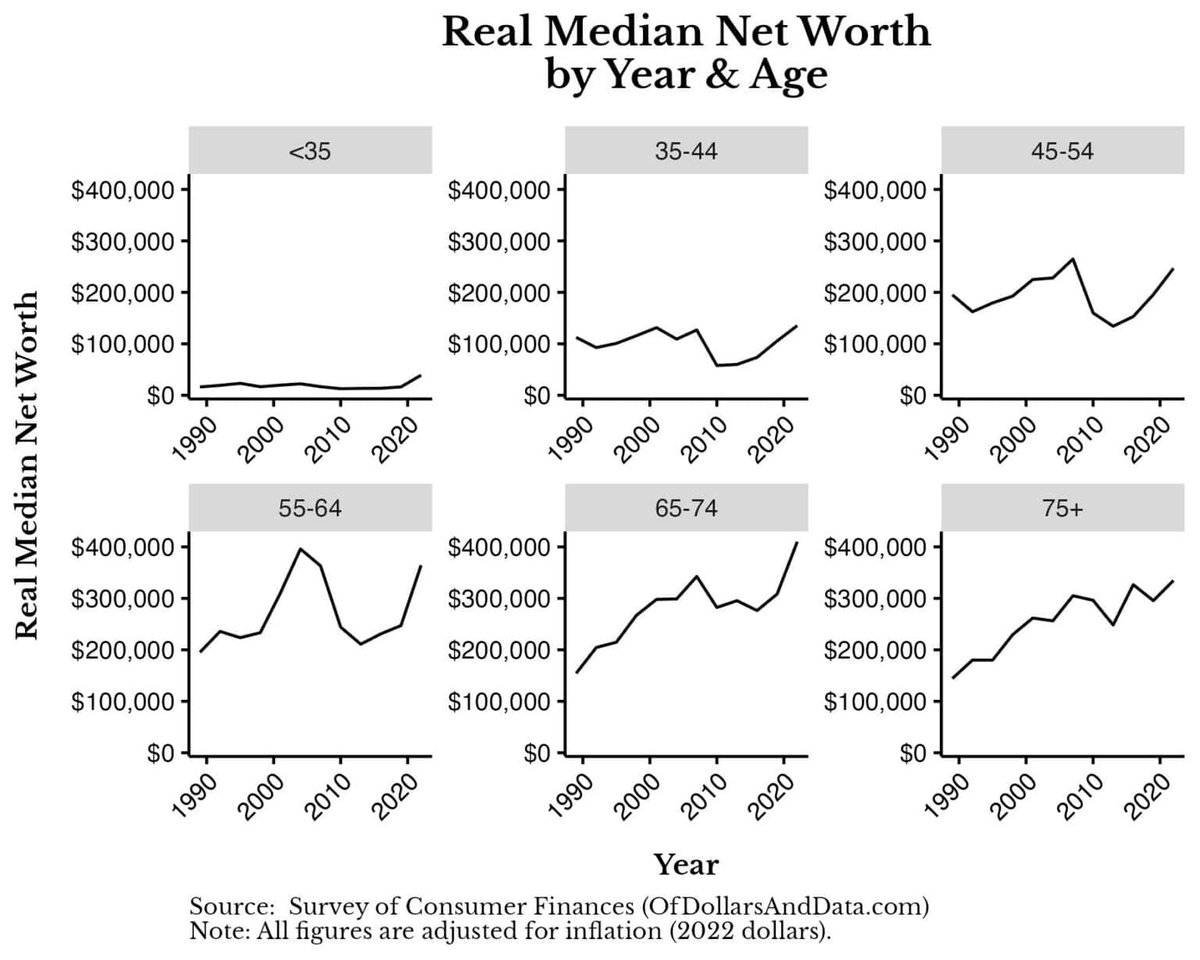

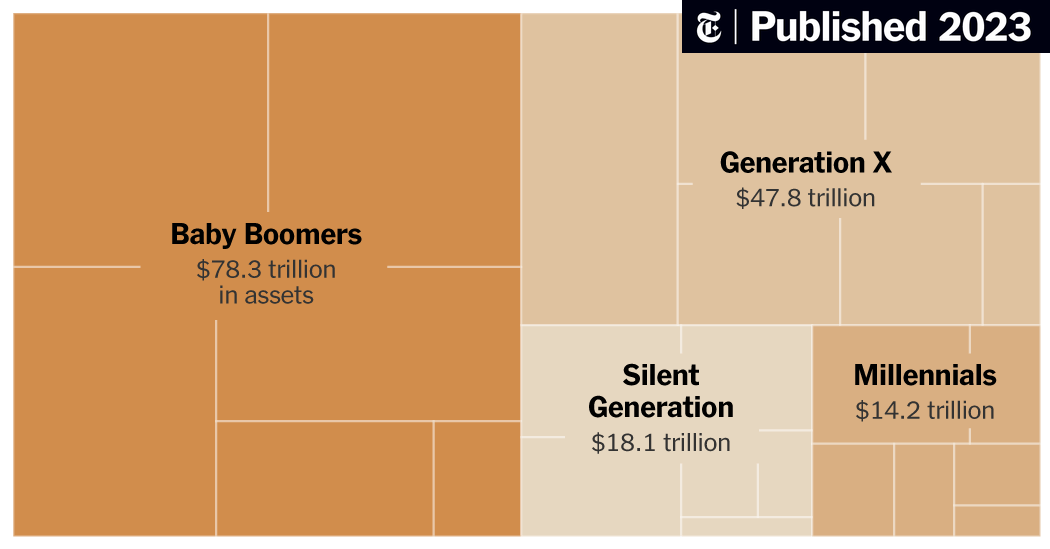

Boomers will just sit on their assets for 30 years at a time, living on the annual interest of their assets. This locks out capital formation for young people, small businesses, and kills the investment cycle that drives the economy.

There are basically 3 versions of financial system:

1.) zero credit, all real money.

2.) some healthy amount of credit (Goldilocks zone)

3.) excess credit (Great Depression, 2008 housing crisis), vicious cycle of rich people frontrunning public and sucking up all wealth.

1.) zero credit, all real money.

2.) some healthy amount of credit (Goldilocks zone)

3.) excess credit (Great Depression, 2008 housing crisis), vicious cycle of rich people frontrunning public and sucking up all wealth.

In an ideal world, the economy would run on a stable amount of credit, which is something like 5 to 8 fake dollars per every real dollar.

The problem is the ability to create fake money out of nothing is extremely powerful (Cantillon Effect), it's invisible robbery of assets.

The problem is the ability to create fake money out of nothing is extremely powerful (Cantillon Effect), it's invisible robbery of assets.

Let's imagine 2 companies worth $100 million.

If Company A runs on fake leveraged credit (30 fake dollars : 1) real dollar, and Company B relies purely on sound money, then Company A can use leverage and debt to purchase 20 real companies, then load up debt and purchase more.

If Company A runs on fake leveraged credit (30 fake dollars : 1) real dollar, and Company B relies purely on sound money, then Company A can use leverage and debt to purchase 20 real companies, then load up debt and purchase more.

This is all kind of an oversimplified version of how financial markets work. TLDR: credit is an incredible weapon that will conquer real assets every time. Eventually debt bubbles implode and destroy the economy, but that's someone else's problem.

Modern governments are designed to create massive unhealthy debt bubbles to seize power: rather than trying to prevent economic catastrophes, modern governments are designed to scapegoat their victims and offload consequences.

The basic game theory of this situation is tragedy of the commons, King of the Hill: if you don't seize the high ground, then your enemy will seize the high ground and use it to destroy you.

The root problem is that nobody has ownership of the economic system, it's a financial arms race between thousands of decentralized competitors and institutions, so there's a perverse incentive to load up on debt and blow the economy up before your peer competitor does it to you.

The actual solution is something like a king, warlord, dictator, Caesar, or CEO having ownership of the situation, to prevent the credit ratios from going crazy. Otherwise, it's simply too tempting to create fake money to purchase real assets, houses, companies, etc..

gold has nothing to do with any of this. Small people purchase gold because they can see the economy is designed to periodically explode, and their only protection is to hide what little they can while their money is robbed and inflated away.

https://x.com/romanhelmetguy/status/1981351484081262870

Octavian owned something like 40% of all of the Roman Empire if I am remembering correctly

https://x.com/cosmogoniceros/status/1981385806057988305

• • •

Missing some Tweet in this thread? You can try to

force a refresh