“Real estate is not savings — it’s the amortization of a liability.”

🧵

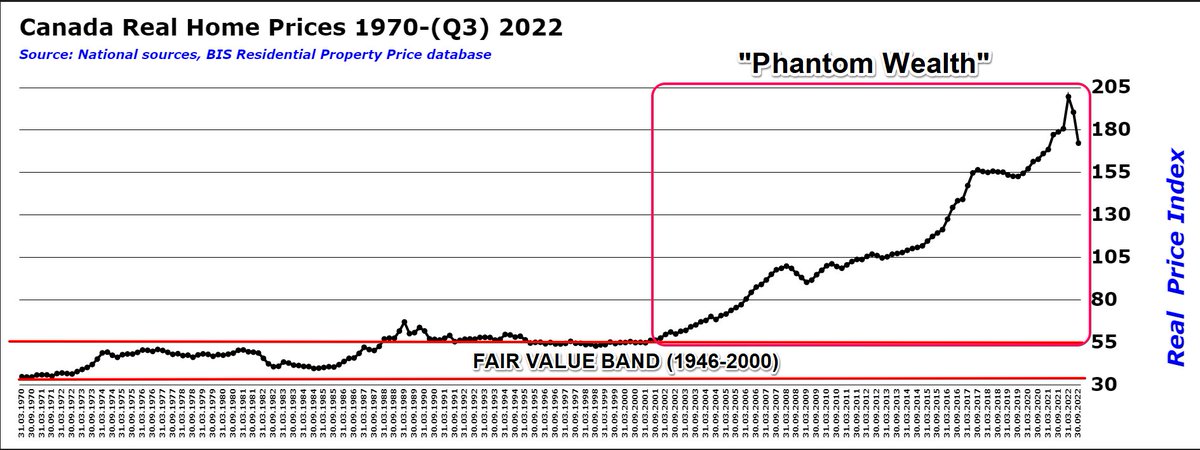

Everyone thinks they’re rich because their house price went up.

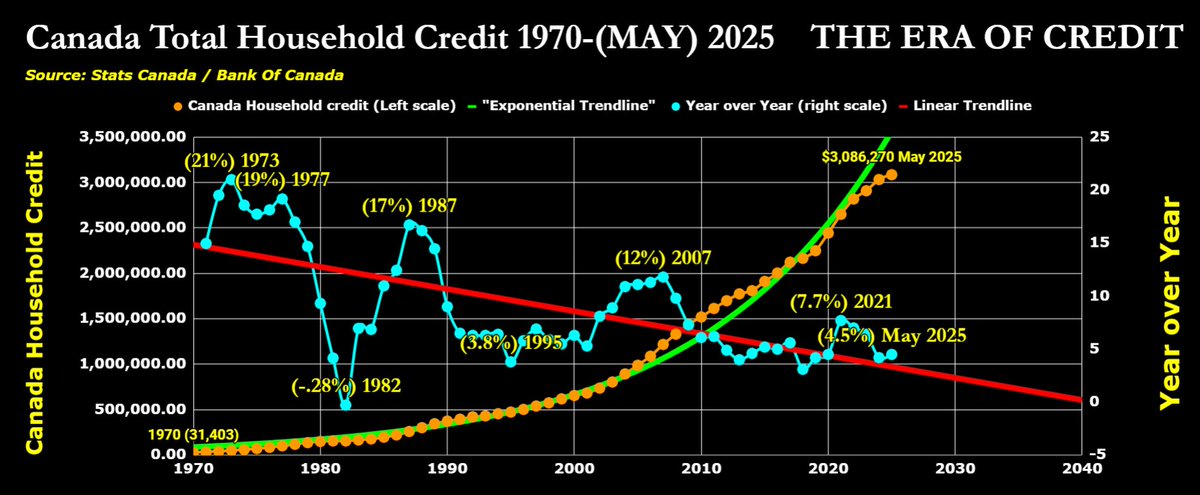

But real estate wealth = borrowed money + falling interest rates.

When the credit tide goes out, you’ll see who actually owns equity. 💡

🧵

Everyone thinks they’re rich because their house price went up.

But real estate wealth = borrowed money + falling interest rates.

When the credit tide goes out, you’ll see who actually owns equity. 💡

When you “buy a home,” what you’re really doing is entering into a long-term loan agreement (mortgage), often spanning 25-30 years.👉

Each monthly mortgage payment isn’t saving — it’s repaying principal (the loan) + interest (the cost of borrowing).

Each monthly mortgage payment isn’t saving — it’s repaying principal (the loan) + interest (the cost of borrowing).

You’re amortizing a liability.

Liquidity ≠ Savings Real estate is illiquid, unlike savings.

You can’t withdraw $50,000 from your house on demand without selling or taking on more debt (e.g., a HELOC, a reverse mortgage, etc.).

Liquidity ≠ Savings Real estate is illiquid, unlike savings.

You can’t withdraw $50,000 from your house on demand without selling or taking on more debt (e.g., a HELOC, a reverse mortgage, etc.).

So calling it “savings” stretches the term beyond its real meaning.

Price Volatility

Unlike cash or short-term savings instruments, property values are speculative and cyclical. If purchased at the top of a bubble, that "savings" could evaporate by 30–50% in real terms over a decade (see: Japan, U.S. 2006, Canada now?).

Price Volatility

Unlike cash or short-term savings instruments, property values are speculative and cyclical. If purchased at the top of a bubble, that "savings" could evaporate by 30–50% in real terms over a decade (see: Japan, U.S. 2006, Canada now?).

False Sense of Wealth

The housing boom often creates an illusion of financial health.

Homeowners feel wealthier as home prices rise, even if they're still buried in debt — a classic example of the wealth effect, which is more psychological than real.

The housing boom often creates an illusion of financial health.

Homeowners feel wealthier as home prices rise, even if they're still buried in debt — a classic example of the wealth effect, which is more psychological than real.

🌀 The Kondratieff Cycle View

In the autumn phase (late boom), real estate is mistakenly viewed as the ultimate safe asset — a form of savings, retirement plan, and wealth-building tool all in one.

But in the winter phase, that illusion collapses.

In the autumn phase (late boom), real estate is mistakenly viewed as the ultimate safe asset — a form of savings, retirement plan, and wealth-building tool all in one.

But in the winter phase, that illusion collapses.

❄️ Debt deflation hits.

Asset prices correct.

Leverage becomes a trap, not a tool.

Asset prices correct.

Leverage becomes a trap, not a tool.

So yes, during the economic winter, real estate is reclassified — not as savings, but as an amortizing liability tied to a volatile asset.

"Owning real estate with a mortgage isn’t saving. It’s slowly buying your way out of debt — and hoping the asset holds its value."

"Owning real estate with a mortgage isn’t saving. It’s slowly buying your way out of debt — and hoping the asset holds its value."

• • •

Missing some Tweet in this thread? You can try to

force a refresh