Decoding Kondratieff, Schumpeter LongWave Economic Cycles Historian & Macroeconomist Tracking K4 Winter❄️ Transition Where Social Forces Meet Market Reality 📈

How to get URL link on X (Twitter) App

When you “buy a home,” what you’re really doing is entering into a long-term loan agreement (mortgage), often spanning 25-30 years.👉

When you “buy a home,” what you’re really doing is entering into a long-term loan agreement (mortgage), often spanning 25-30 years.👉

1

1

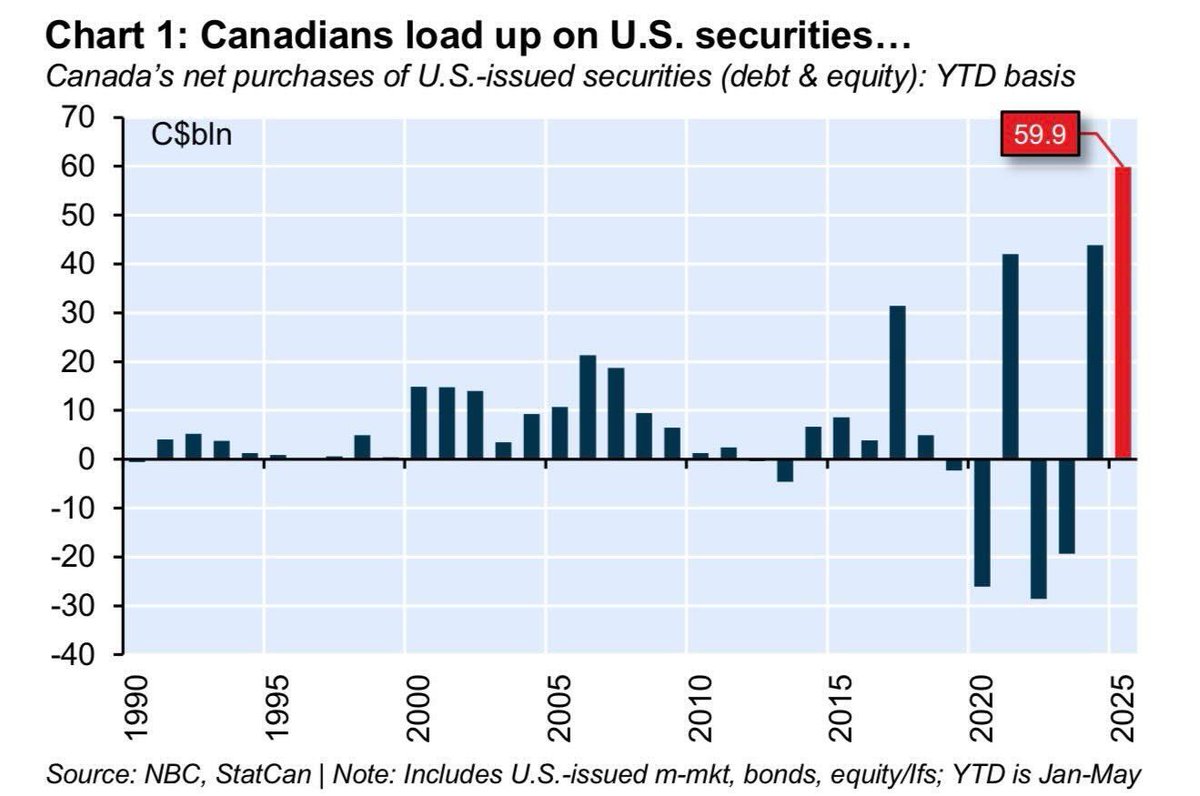

📊 The numbers don’t lie:

📊 The numbers don’t lie:

What does 'economic winter' actually mean? 🧵👇

What does 'economic winter' actually mean? 🧵👇

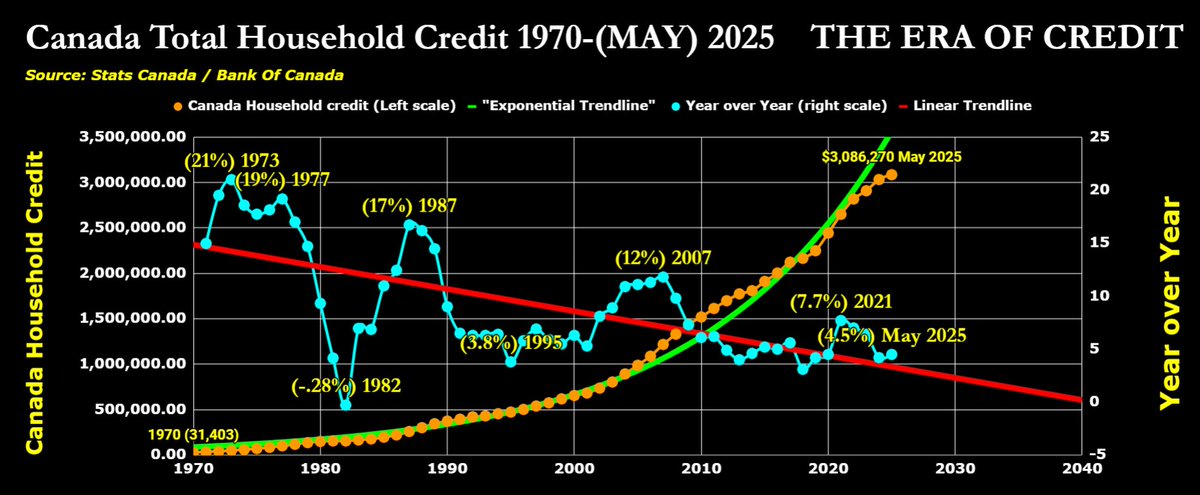

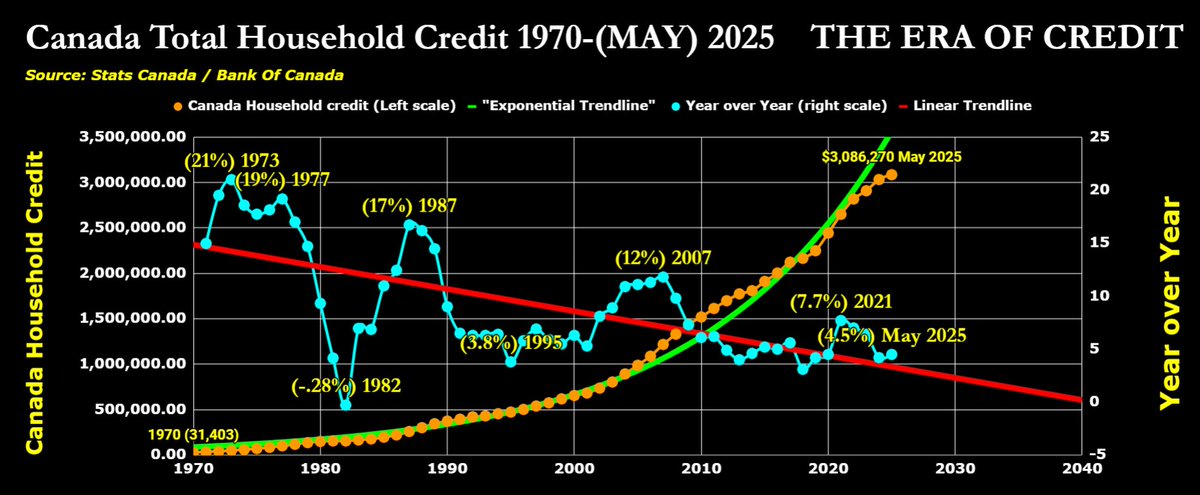

The underlying mathematics is staggering: between 1976 and 2022, real home prices increased by 512% while real incomes grew by only 15%.

The underlying mathematics is staggering: between 1976 and 2022, real home prices increased by 512% while real incomes grew by only 15%.

The Numbers:📊 2005: $335k = 558 oz of gold

The Numbers:📊 2005: $335k = 558 oz of gold

2/15 📊

2/15 📊

2/8

2/8