🧵 Thread: “10% of world silver shorted. But don’t worry, it’s fine. Trust the system.”

https://twitter.com/goldseek/status/1982328883555745908

1️⃣

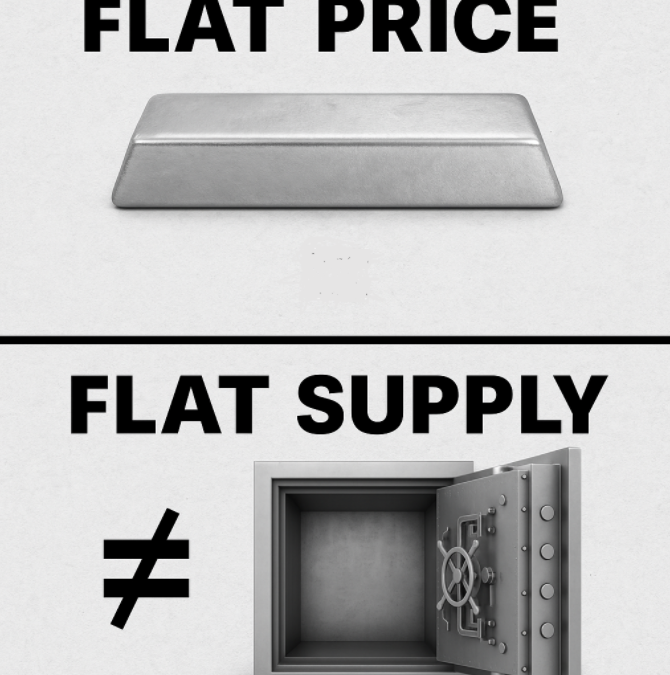

Ed Steer just dropped a bomb:

The short position in $SLV is now equal to 10% of global annual silver production.

83.86 million troy ounces shorted.

Up 54% in two weeks.

All that paper silver... with zero physical metal behind it.

But hey — “trust the process.” 🫠

Ed Steer just dropped a bomb:

The short position in $SLV is now equal to 10% of global annual silver production.

83.86 million troy ounces shorted.

Up 54% in two weeks.

All that paper silver... with zero physical metal behind it.

But hey — “trust the process.” 🫠

2️⃣

There isn’t a single ounce of real silver backing those 83.86M shorted shares.

Not one.

It doesn’t exist — and it never will.

This is what happens when financial alchemy replaces metal with promises.

There isn’t a single ounce of real silver backing those 83.86M shorted shares.

Not one.

It doesn’t exist — and it never will.

This is what happens when financial alchemy replaces metal with promises.

3️⃣

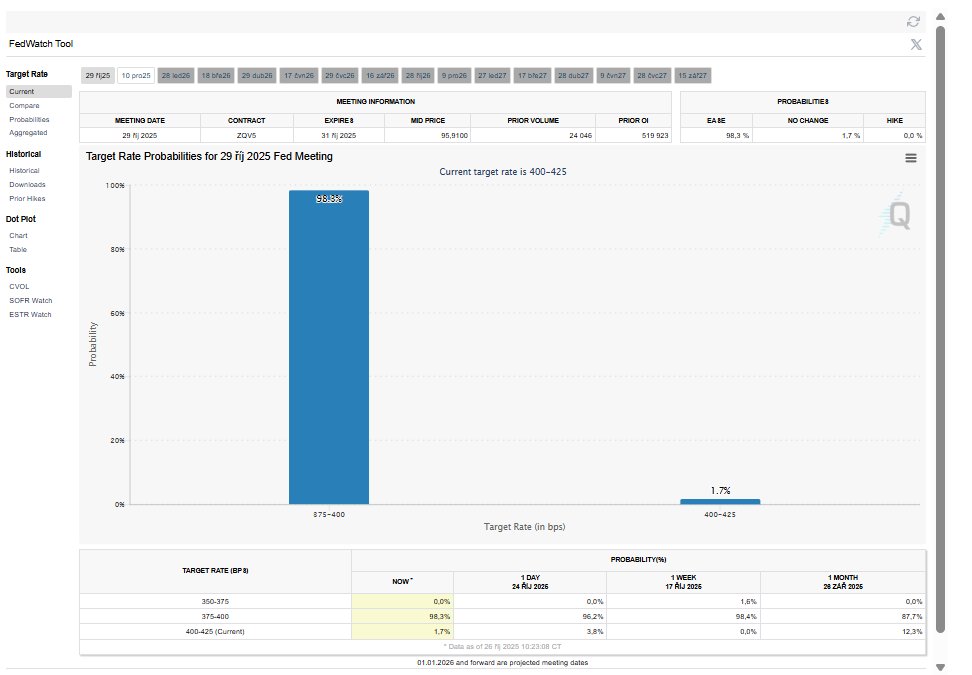

And the irony?

People still think inflation is the problem.

No, my friend — the problem is that reality itself is leveraged.

And the irony?

People still think inflation is the problem.

No, my friend — the problem is that reality itself is leveraged.

4️⃣

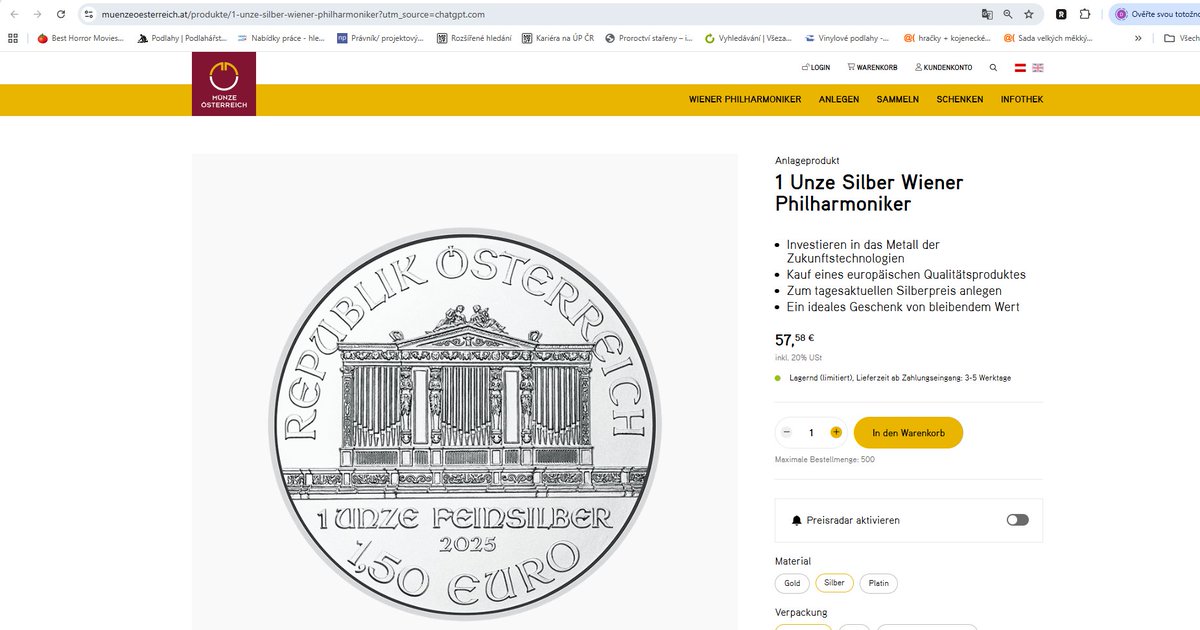

Most people are still asleep, scrolling through nonsense and believing paper wealth means freedom.

Meanwhile, a few of us are quietly stacking real money — the kind you can hold, not the kind that vanishes when a server crashes. 🥈

Most people are still asleep, scrolling through nonsense and believing paper wealth means freedom.

Meanwhile, a few of us are quietly stacking real money — the kind you can hold, not the kind that vanishes when a server crashes. 🥈

5️⃣

We’re still in the preparation phase.

The window is open — for now.

The only ones who can shorten this timeline are India, China, and the physical buyers who are slowly draining the vaults dry.

We’re still in the preparation phase.

The window is open — for now.

The only ones who can shorten this timeline are India, China, and the physical buyers who are slowly draining the vaults dry.

6️⃣

When this paper castle collapses, it won’t be gradual.

It’ll be instant.

No warnings. No second chances.

Just a silent “404: Silver not found.”

When this paper castle collapses, it won’t be gradual.

It’ll be instant.

No warnings. No second chances.

Just a silent “404: Silver not found.”

7️⃣

So keep stacking. Keep thinking.

While the world sleeps — we prepare.

🥈⚡ #SilverSqueeze #StackerLogic #HardAssets #SilverStackers

So keep stacking. Keep thinking.

While the world sleeps — we prepare.

🥈⚡ #SilverSqueeze #StackerLogic #HardAssets #SilverStackers

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh