It's been a while since I've done a non-political nerd thread. And I wish I could do them more often! So let's do a palette cleanse to talk about this article from WaPo that is technically true, but deeply misinformative about US electric markets. washingtonpost.com/climate-enviro…

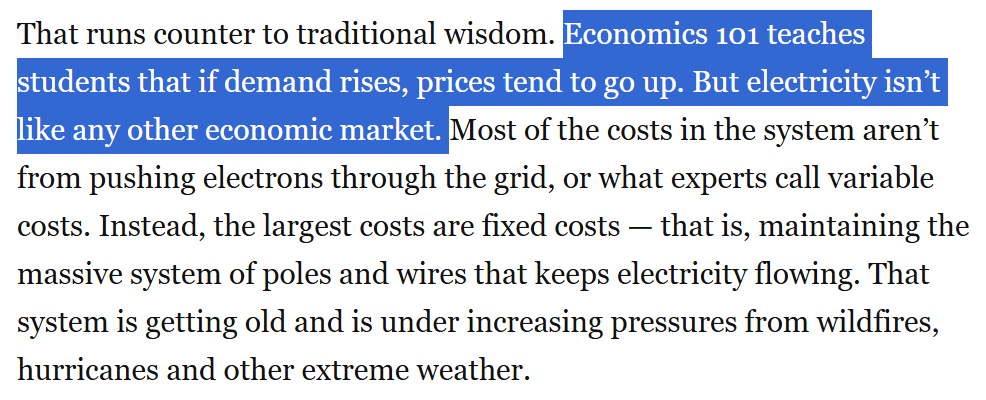

1. Read the whole article, but the big problem is this paragraph. It's true that electricity isn't like other markets, but not because it has high fixed costs. It's because it is a regulated market that isn't subject to those forces you learn in Economics 101.

2. Econ 101 doesn't say that falling demand forces lower costs. It says that happens IF you have competitive markets. When demand falls, you cut costs to try and hold onto market share - not because your changing cost structure compels you to pass savings onto your customers.

3. Electric utilities aren't competitive markets and that is especially true as you get closer to the load where all costs are fixed. You do not have 15 different wires coming into your house where you can choose the lowest cost supply, after all.

4. Some states have deregulated the generation portion of their electric system so that power plants have to compete in real time on price. But all still regulate the distribution wires that connect those generators to your home or business. And they all regulate the same way.

5. And that way is the way first invented by Samuel Insull: the utility gets an obligation to serve everyone in their monopoly territory and in exchange a state official sets their rates. @dickmunson has a nice history of how we got here. richardmunson.com/book/from-edis…

@dickmunson 6. Now, if you read that and thought "that is not remotely how Economics 101 says prices are set" then you understand my beef with the initial article....

@dickmunson 7. But the theory of utility regulation (that tries, but never totally maps to practice) is that the regulator sets prices to give the utility a rate of return that is sufficient to attract the capital necessary to keep the power flowing and not a penny higher.

@dickmunson 8. To do that, they look at the total costs incurred by the utilities to serve the load, add a profit margin to attract future capital investments, divide that number by the total projected electric sales and the result is your $/MWh electric price.

@dickmunson 9. I'm simplifying and conflating different customer classes, billing elements and other nuances, but none of those change the basic formula. [Total costs + profit] / MWh sales= customer price.

@dickmunson 10. So IN THAT HIGHLY REGULATED CONSTRUCT THAT IS TOTALLY INSULATED FROM COMPETITIVE MARKET PRESSURES rising demand leads to lower prices. This is NOT because of fixed costs. It's because of the anti-market regulatory structure.

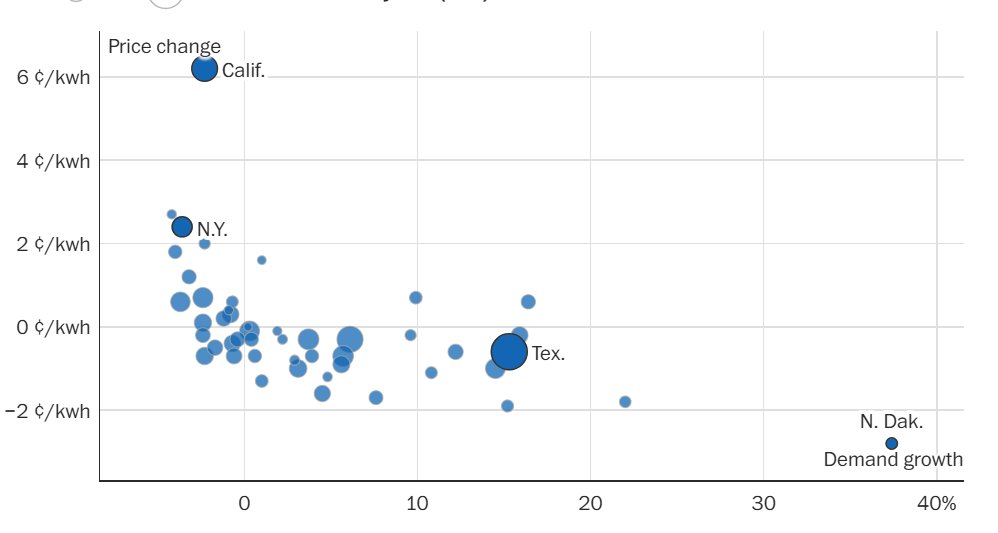

@dickmunson 11. But even in that construct, the idea that rising load leads to lower prices as the WaPo article suggested is only true for short periods of time and only in certain geographic areas. And that's because utilities require so much capital investment.

@dickmunson 12. Recall (point 7) that rates are set to get a fair return on capital. So the utility invests money in the generators, wires, etc. and then starts getting money back in rates to repay investors. At some future point, investors have been paid back with their target return.

@dickmunson 13. If demand is falling, there's no need to invest in new assets. And as the capital invested to build those assets is paid off rates gradually fall. Conversely, if load is growing and new investments are required, new capital amortization charges are added and rates go up.

@dickmunson 14. Again, I'm oversimplifying (old plants gradually require more maintenance, fuel cost rise as efficiencies degrade) but given the capital intensive nature of the business the prior point is generally true.

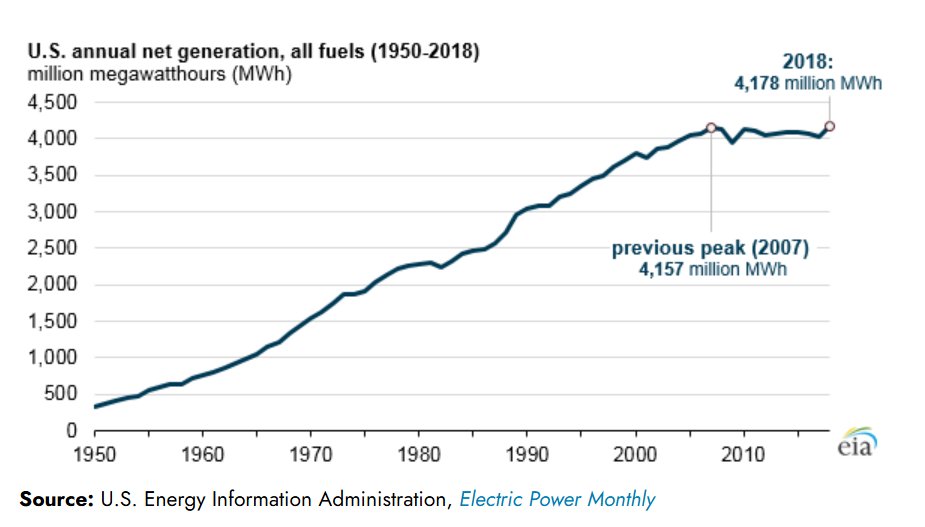

@dickmunson 15. For most of US history, electricity demand grew with GDP and so new investments were steadily made to keep up with old retirements. But something weird happened during the 2008 financial crisis; load growth largely stopped and is only just now picking back up.

@dickmunson 16. So in this moment where load growth has been flat AND if you are in an area where the existing system is overbuilt, then a little load growth lowers rates because of that formula in point 9. And that's especially true if you're in a highly regulated state. Like North Dakota.

@dickmunson 17. But once load growth chews through the existing reserve margin, you have to build more stuff, which means more investment which means higher rates... as long as we retain the anti-market regulatory structure where no one has to take capital cost risk.

@dickmunson 18. So what's a utility regulator to do? First, you could favor technologies with lower costs to reduce the numerator. This is why clean energy = cheap energy. If utilities don't have to pay for fuel, customers don't either. Or (and?) you could embrace competitive markets.

@dickmunson 19. Ironically, the barriers to both of those are the incumbent monopolies who (understandably) like not having any competition. As the old saying goes, the greatest monopoly rent is a good night's sleep. Private actors deploying cheap generation is a threat to that paradigm.

@dickmunson 20. And then they will tell their regulators that they must raise rates to protect them from their failure to compete. Which is why this paragraph in that article is so problematic. This is the result of lobbying, not economics.

@dickmunson 21. Regulators could rely on SCOTUS' 1945 judgment against Market St. Railway (a SF cable car company) who was denied the right to raise rates just because of competitive forces. In their case the automobile, in today's case cheaper renewable energy. supreme.justia.com/cases/federal/…

@dickmunson 22. But that would require a commitment to Econ 101. And an understanding that modern electricity regulation and pricing has only the most incidental connection to those principles. Here's hoping WaPo shows a little more nuance next time. /fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh