1/ China just shut down three Shuibei gold/jewelry companies — accused of running a “casino”: quasi-futures, high leverage, paper contracts with no physical backing.

Translation: paper games are being squeezed. 🧯

MANY THANKS TO: @oriental_ghost

Translation: paper games are being squeezed. 🧯

MANY THANKS TO: @oriental_ghost

2/ The model under fire? “Pre-pricing” + OTC margin bets sold as “gold trading.”

Minimum deposits as low as ~2–3% to lever up. When spot moves, retail gets wiped, platforms scramble, and systemic risk leaks into the real economy.

Minimum deposits as low as ~2–3% to lever up. When spot moves, retail gets wiped, platforms scramble, and systemic risk leaks into the real economy.

3/ Regulators finally called it what it is: gambling.

Depending on “hedging/manipulation,” cases can be charged as illegal business ops, gambling, or operating a casino.

That’s not a slap on the wrist — that’s a paradigm check.

Depending on “hedging/manipulation,” cases can be charged as illegal business ops, gambling, or operating a casino.

That’s not a slap on the wrist — that’s a paradigm check.

4/ Why it matters globally: when authorities attack paper leverage, liquidity thins, volatility rises, and trust migrates from derivatives to real metal.

This isn’t just about Shenzhen; it’s the direction of travel.

This isn’t just about Shenzhen; it’s the direction of travel.

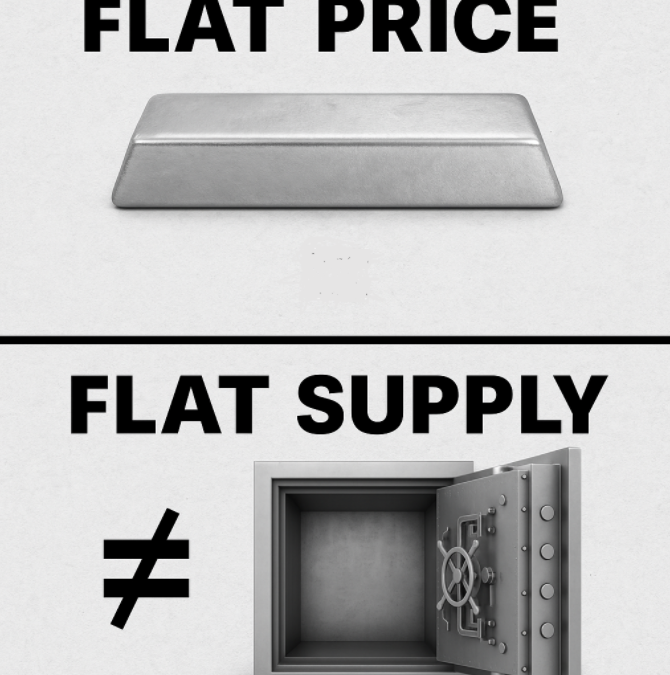

5/ Paper markets promise “exposure.” Real markets demand metal.

When leverage is curtailed, fake supply vanishes and the physical premium speaks louder.

We’ve seen this movie in other commodities — act 2 is a squeeze.

When leverage is curtailed, fake supply vanishes and the physical premium speaks louder.

We’ve seen this movie in other commodities — act 2 is a squeeze.

6/ Silver angle: gold gets the headlines, but the industrial cousin (Ag) is the one with tight mine supply, rising industrial demand, and thin visible inventories.

If carry trades and OTC rehypothecation shrink, physical silver becomes king. 🥈👑

If carry trades and OTC rehypothecation shrink, physical silver becomes king. 🥈👑

7/ Think second-order effects:

– De-leveraging → less synthetic “sell supply.”

– Tighter credit → slower scrap flow.

– Higher risk awareness → stackers crowd the physical window.

Result: premiums/lead times can jump before price does.

– De-leveraging → less synthetic “sell supply.”

– Tighter credit → slower scrap flow.

– Higher risk awareness → stackers crowd the physical window.

Result: premiums/lead times can jump before price does.

8/ Message for retail: If you can’t touch it, you don’t own it. Vaulted, allocated, or in hand beats “contracts with a promise.”

The market is quietly telling you to move up the quality and custody stack.

The market is quietly telling you to move up the quality and custody stack.

9/ Short term? Expect chop as paper venues adjust. Medium/long term? Less leverage + more scrutiny = truer pricing of scarce metals.

Silver remains the most mispriced critical material of the energy/tech transition.

Silver remains the most mispriced critical material of the energy/tech transition.

10/ This is not fear. It’s clarity: the world is re-rating counterparty risk. Hold your own metal.

Stack consistently. Ignore the weekly noise. When casinos close, the house of silver stays open. 🦍🥈

#Silver #Gold #PhysicalOverPaper #Stackers

Stack consistently. Ignore the weekly noise. When casinos close, the house of silver stays open. 🦍🥈

#Silver #Gold #PhysicalOverPaper #Stackers

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh