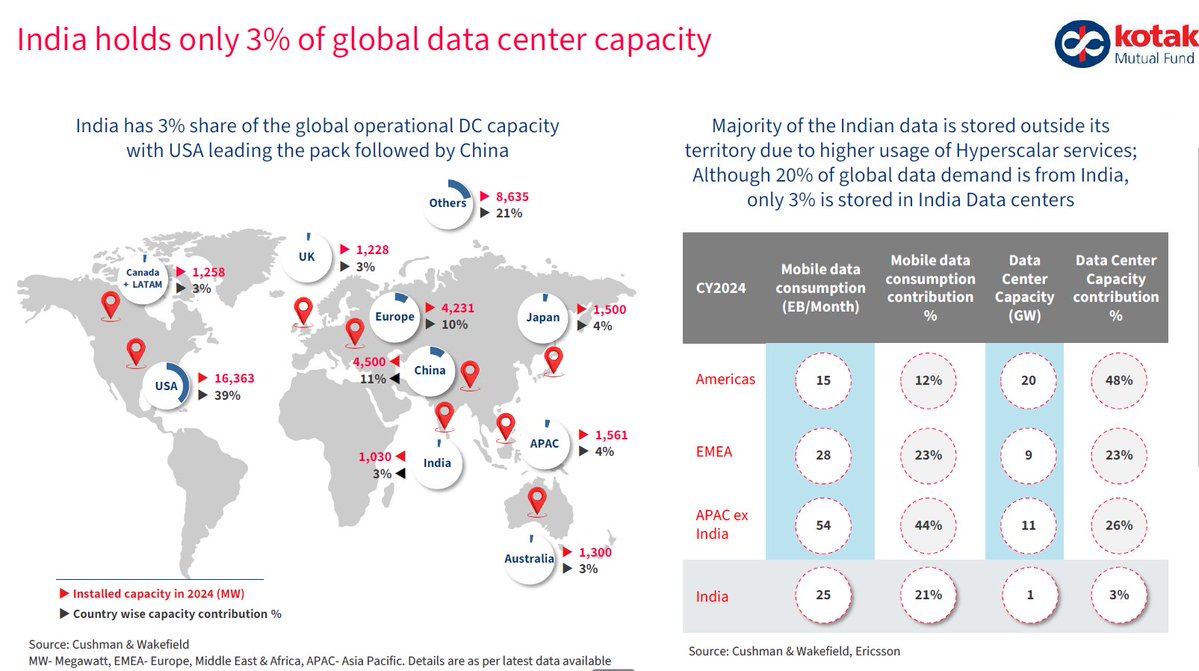

Sify Infinit’s 560 page DRHP is a masterclass on the Data Center (DC) market in India

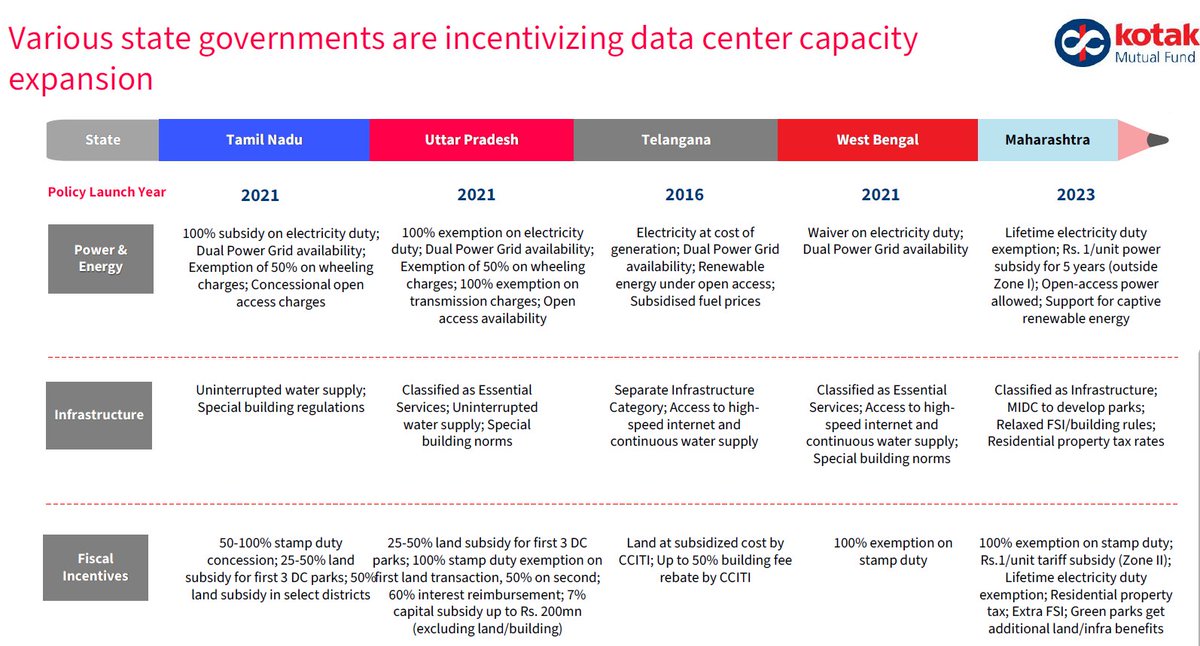

Apart from covering the nuances of its own business, Sify has also included a primer on India’s 5GW ambition for FY30 and the challenges that lie ahead

After China, India has the lowest cost per MW of DC capacity - we plan to almost X3 our DC capacity in the next 5 years.

Sharing a few takeaways ⤵️

Apart from covering the nuances of its own business, Sify has also included a primer on India’s 5GW ambition for FY30 and the challenges that lie ahead

After China, India has the lowest cost per MW of DC capacity - we plan to almost X3 our DC capacity in the next 5 years.

Sharing a few takeaways ⤵️

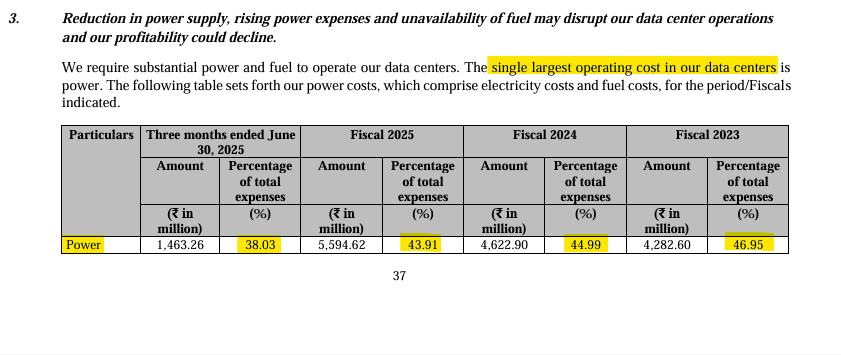

(1) Energy is 44% of total expenses

- This data point confirms what several industry reports have pointed out: Energy is the single largest OPEX component of a DC

- This % has been on a downward trend for Sify from ~47% to ~38% - driven by shifting to more Renewables & operational efficiency

PS: PUE (Power Usage Effectiveness) is the KPI for measuring energy efficiency; Sify doesn’t provide this figure in its DRHP

- However, Sify does shared that 27% improvement in PUE in FY24; driven by 20% reduction in energy leakages.

- Btw, Sify passes these costs on to its customer (this is part of the Colocation DC operating model - more on this below).

Imp nuance (can skip too): Industry avg. PUE in India is close to 1.5 - versus high end DCs in USA which are at 1.1 i.e. they are able to reduce energy wastage by ~40% (hence, can operate at Energy as ~30% of COGS).

- This data point confirms what several industry reports have pointed out: Energy is the single largest OPEX component of a DC

- This % has been on a downward trend for Sify from ~47% to ~38% - driven by shifting to more Renewables & operational efficiency

PS: PUE (Power Usage Effectiveness) is the KPI for measuring energy efficiency; Sify doesn’t provide this figure in its DRHP

- However, Sify does shared that 27% improvement in PUE in FY24; driven by 20% reduction in energy leakages.

- Btw, Sify passes these costs on to its customer (this is part of the Colocation DC operating model - more on this below).

Imp nuance (can skip too): Industry avg. PUE in India is close to 1.5 - versus high end DCs in USA which are at 1.1 i.e. they are able to reduce energy wastage by ~40% (hence, can operate at Energy as ~30% of COGS).

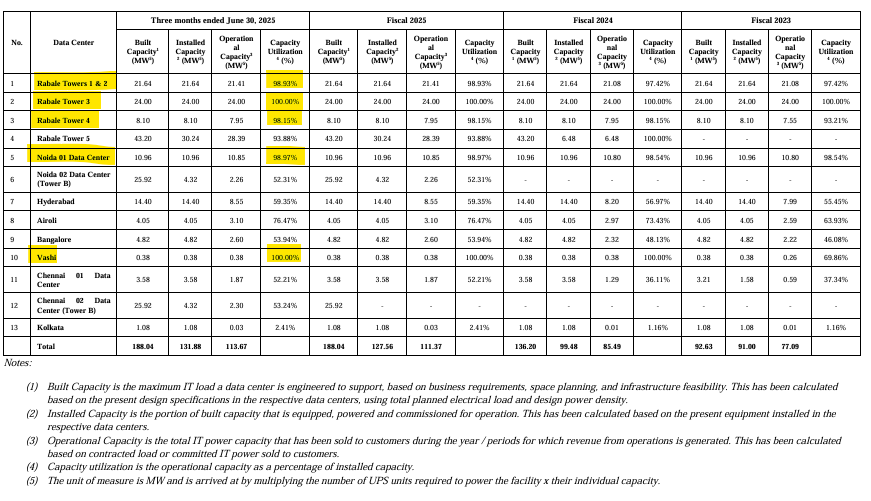

(2) India is really DC capacity starved!

Don’t even bother zooming into the capacity utilization chart - the mature DCs operate at 98% to 100% capacity (!!)

- For context: Global average vacancy for mature DCs is ~6%; Sify is close to 2% for mature sites

- It takes anywhere from 3 to 24 months post operationalization for a DC to start seeing high capacity utilization

- On a overall basis, utilization is up from 84.7% to 86.2% DESPITE growing operational capacity from 77MW to 113 MW (i.e. ~50%) in past 2.5 years

It was one thing to read about this from an industry POV (Kotak MF and JM Financial) but very interesting to see it in a company’s filings 🙂

Don’t even bother zooming into the capacity utilization chart - the mature DCs operate at 98% to 100% capacity (!!)

- For context: Global average vacancy for mature DCs is ~6%; Sify is close to 2% for mature sites

- It takes anywhere from 3 to 24 months post operationalization for a DC to start seeing high capacity utilization

- On a overall basis, utilization is up from 84.7% to 86.2% DESPITE growing operational capacity from 77MW to 113 MW (i.e. ~50%) in past 2.5 years

It was one thing to read about this from an industry POV (Kotak MF and JM Financial) but very interesting to see it in a company’s filings 🙂

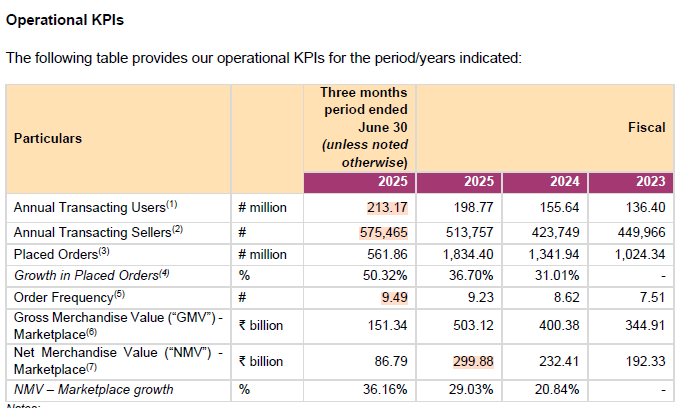

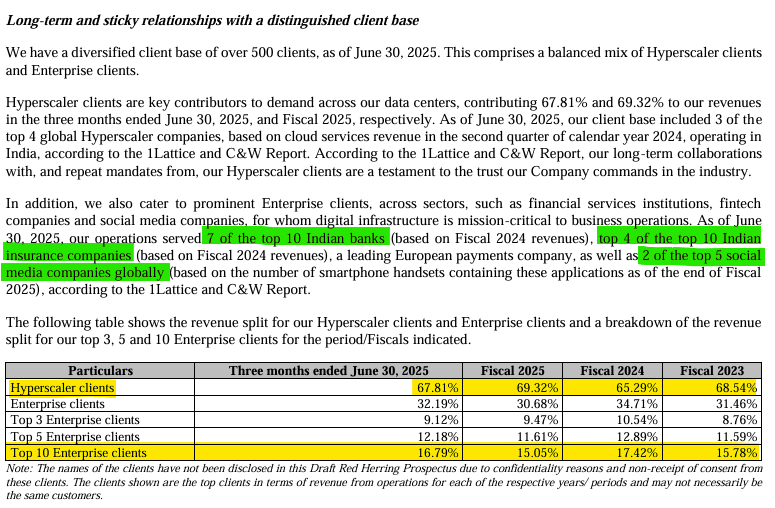

(3) Who are Sify’s top customers?

- While Sify has ~500 customers, there are probably 10-odd customers who contribute > 50% of the revenue.

- Hyperscalers are ~67% of revenue & Enterprise clients are ~33% of revenue; this has remained consistent in the past 36 months

- Interestingly, the consistency remains despite Sify doubling from 92MW capacity in FY23 to 188MW capacity in H2 FY26

- This data is VERY instructive: High customer concentration BUT balanced with stickiness over time & ACV growth from existing customers.

TL;DR while Sify has doubled capacity, its customers have also at least doubled their utilization (and therefore spending) at Sify 🤯

From a cashflow perspective, customers pay in arrears each month or quarter and typically commit to a 3 to 5 year lock-in (!!)

Btw, this is inherent in the business - Sify runs colocation DCs - in the Enterprise DC business; operators rent 100% of capacity from a single DC to a client

- While Sify has ~500 customers, there are probably 10-odd customers who contribute > 50% of the revenue.

- Hyperscalers are ~67% of revenue & Enterprise clients are ~33% of revenue; this has remained consistent in the past 36 months

- Interestingly, the consistency remains despite Sify doubling from 92MW capacity in FY23 to 188MW capacity in H2 FY26

- This data is VERY instructive: High customer concentration BUT balanced with stickiness over time & ACV growth from existing customers.

TL;DR while Sify has doubled capacity, its customers have also at least doubled their utilization (and therefore spending) at Sify 🤯

From a cashflow perspective, customers pay in arrears each month or quarter and typically commit to a 3 to 5 year lock-in (!!)

Btw, this is inherent in the business - Sify runs colocation DCs - in the Enterprise DC business; operators rent 100% of capacity from a single DC to a client

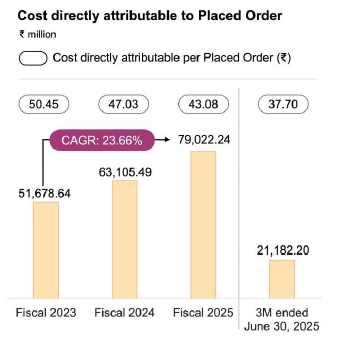

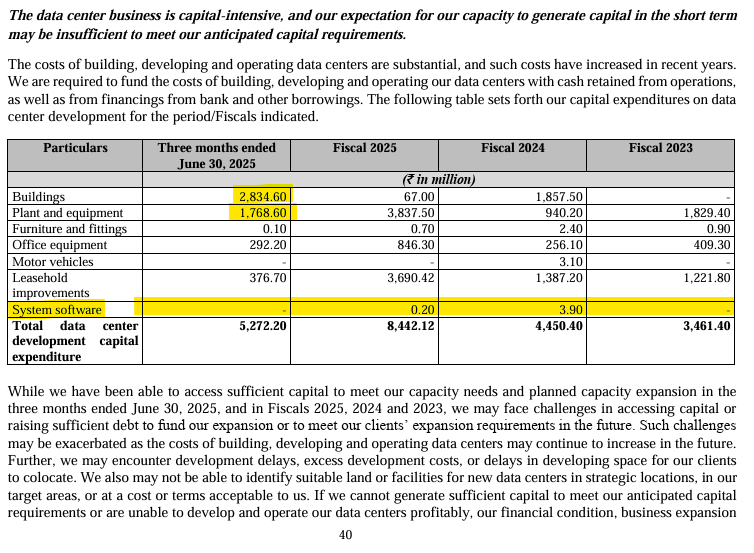

(4) Guess why Sify does NOT spend on software & systems as part of CAPEX?

- There are 4 types of DCs - Colocation, Cloud, Enterprise & Edge (for more; check below)

- The simple answer is: Sify operates co-location DCs i.e. it rents rack space primarily to hyperscalers (global cloud providers)

- Sify only provides the site, shell, electrical wiring & power inputs to allow its hyperscaler customers to plug & play their own servers & software

- Therefore, you can see that the CAPEX from Sify is primarily Building (i.e. land parcel & site) and Plant & Equipment (”MEP” in industry parlance)

💡Some industry context: CAPEX per colocation 1 MW is ~₹46.5 crore v/s ₹138 crore for a cloud 1 MW - the entire cost delta comes down to servers & software (source: JM Financial)

Therefore, if you think CAPEX incurred by Sify looks small - it is because nearly X2 Sify’s CAPEX is incurred by its own customers to set up the servers etc.

PS: I had explained the types of DCs in my prev. thread on the topic here: x.com/Rahul_J_Mathur…

- There are 4 types of DCs - Colocation, Cloud, Enterprise & Edge (for more; check below)

- The simple answer is: Sify operates co-location DCs i.e. it rents rack space primarily to hyperscalers (global cloud providers)

- Sify only provides the site, shell, electrical wiring & power inputs to allow its hyperscaler customers to plug & play their own servers & software

- Therefore, you can see that the CAPEX from Sify is primarily Building (i.e. land parcel & site) and Plant & Equipment (”MEP” in industry parlance)

💡Some industry context: CAPEX per colocation 1 MW is ~₹46.5 crore v/s ₹138 crore for a cloud 1 MW - the entire cost delta comes down to servers & software (source: JM Financial)

Therefore, if you think CAPEX incurred by Sify looks small - it is because nearly X2 Sify’s CAPEX is incurred by its own customers to set up the servers etc.

PS: I had explained the types of DCs in my prev. thread on the topic here: x.com/Rahul_J_Mathur…

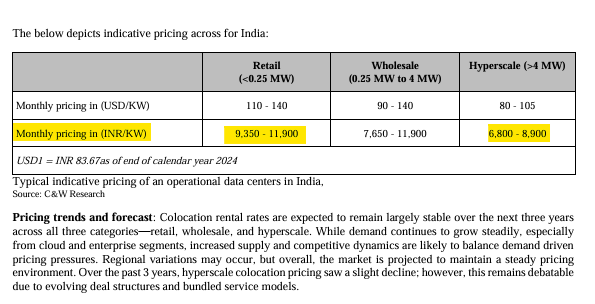

(5) How much does Sify charge?

Colocation DC pricing is always expressed in kW per month

- Sify charges anywhere from ~₹6,800 to ₹11,900 per kW per month; this is within the industry avg of ~₹7,700 per kW per month which JM Financial estimated in March ‘25

- The typical multi-year contract has a ~2% to 4% p.a. escalation clause (because its own cost base i.e. rent also escalates on a similar ~3% basis)

PS: Sify’s top 3 Enterprise customers spend ~ ₹140 crore per annum and utilize ~15 MW of power per month - this is equivalent to running ~10,000 ACs for 8 hours per day - eyewatering figure but nothing in comparison to Stargate and other projects in USA.

Colocation DC pricing is always expressed in kW per month

- Sify charges anywhere from ~₹6,800 to ₹11,900 per kW per month; this is within the industry avg of ~₹7,700 per kW per month which JM Financial estimated in March ‘25

- The typical multi-year contract has a ~2% to 4% p.a. escalation clause (because its own cost base i.e. rent also escalates on a similar ~3% basis)

PS: Sify’s top 3 Enterprise customers spend ~ ₹140 crore per annum and utilize ~15 MW of power per month - this is equivalent to running ~10,000 ACs for 8 hours per day - eyewatering figure but nothing in comparison to Stargate and other projects in USA.

I would highly recommend reading the DRHP - especially the macro POV sections which explain the DC business in detail.

I’ve also written a short 101 on India’s DC industry - linked in Point (4) above; do check that out too if you found this interesting / if you had Qs.

You can also pair reading this DHRP with my prev. thread or with with JM Financial’s DC 101 report (March 2025) and Kotak MF’s DC report (Sept 2025) - both available on the Internet for free 😊

Factories were the mainstay of the industrial revolution - DCs are the mainstay of the digital revolution. Seeing how hyperscalers have committed to 3GW in India this year already - I think we’ll blow past the 5 GW target (colocation & cloud) easily!

➡️ Sify’s DRHP can be found here: sifyinfinitspaces.com/ipo/

Discl: Shared for informational purposes only. DYOR. This post is not an endorsement or paid promotion. DYOR. This is part of my own research to understand the DC space in India for investment purposes (will also record 2 Breakdown videos later this year on the topic)

I’ve also written a short 101 on India’s DC industry - linked in Point (4) above; do check that out too if you found this interesting / if you had Qs.

You can also pair reading this DHRP with my prev. thread or with with JM Financial’s DC 101 report (March 2025) and Kotak MF’s DC report (Sept 2025) - both available on the Internet for free 😊

Factories were the mainstay of the industrial revolution - DCs are the mainstay of the digital revolution. Seeing how hyperscalers have committed to 3GW in India this year already - I think we’ll blow past the 5 GW target (colocation & cloud) easily!

➡️ Sify’s DRHP can be found here: sifyinfinitspaces.com/ipo/

Discl: Shared for informational purposes only. DYOR. This post is not an endorsement or paid promotion. DYOR. This is part of my own research to understand the DC space in India for investment purposes (will also record 2 Breakdown videos later this year on the topic)

• • •

Missing some Tweet in this thread? You can try to

force a refresh