🧵 Thread: China’s Silver Vaults Are Draining Fast — and No One’s Talking About It

Except few - THANKS TO @oriental_ghost

Except few - THANKS TO @oriental_ghost

https://twitter.com/oriental_ghost/status/1982716120009490543

1️⃣Shanghai’s silver vaults are bleeding metal. Both the Shanghai Gold Exchange (SGE) and the Shanghai Futures Exchange (SHFE) are reporting steady outflows of physical silver since mid-2025.

This isn’t a rumor — it’s visible in the data.

This isn’t a rumor — it’s visible in the data.

2️⃣

Earlier this year, SGE inventories fell to ~937 tons, the lowest in 8 months (verified April 2025).

Now new reports suggest the vaults may have dropped below 1,000 T for the first time ever.

That’s not noise.

That’s supply stress.

Earlier this year, SGE inventories fell to ~937 tons, the lowest in 8 months (verified April 2025).

Now new reports suggest the vaults may have dropped below 1,000 T for the first time ever.

That’s not noise.

That’s supply stress.

3️⃣

According to trader Bai Xiaojun, SHFE vaults lost over 145 tons of silver in just one week.

While the exact figures await official confirmation, the trend is crystal clear:

👉 physical silver is leaving the Chinese system faster than it enters.

According to trader Bai Xiaojun, SHFE vaults lost over 145 tons of silver in just one week.

While the exact figures await official confirmation, the trend is crystal clear:

👉 physical silver is leaving the Chinese system faster than it enters.

4️⃣

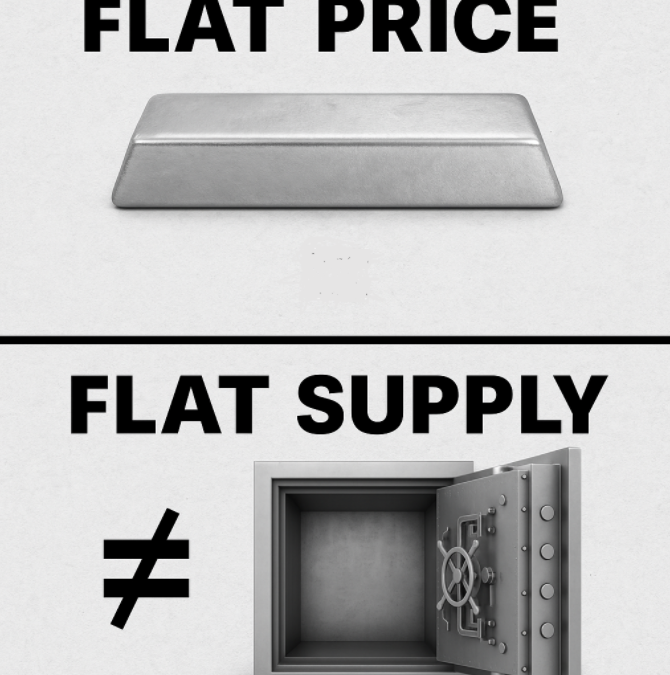

Price? Flat.

Inventories? Collapsing.

That’s what manipulation looks like — keeping paper prices stable while physical drains into private hands.

Price? Flat.

Inventories? Collapsing.

That’s what manipulation looks like — keeping paper prices stable while physical drains into private hands.

5️⃣

China is the world’s largest industrial silver consumer:

solar panel production ☀️

electronics ⚙️

medical tech 🧬

When these sectors absorb metal, it doesn’t come back.

It’s not recycled fast enough.

China is the world’s largest industrial silver consumer:

solar panel production ☀️

electronics ⚙️

medical tech 🧬

When these sectors absorb metal, it doesn’t come back.

It’s not recycled fast enough.

6️⃣

SHFE & SGE are both deliverable markets.

That means real silver must exist behind those contracts.

Once it’s gone, paper promises can’t hide the shortage.

SHFE & SGE are both deliverable markets.

That means real silver must exist behind those contracts.

Once it’s gone, paper promises can’t hide the shortage.

7️⃣

If China’s vaults truly fall under 1,000 tons, it’s not just a headline — it’s a signal that global inventories are tightening across all exchanges.

London, New York, Shanghai — same story, different vault.

If China’s vaults truly fall under 1,000 tons, it’s not just a headline — it’s a signal that global inventories are tightening across all exchanges.

London, New York, Shanghai — same story, different vault.

8️⃣

Stackers already know what this means:

When the East stops selling and starts hoarding,

the West discovers what “supply shock” really feels like.

Stackers already know what this means:

When the East stops selling and starts hoarding,

the West discovers what “supply shock” really feels like.

9️⃣

Price suppression only works until delivery fails.

When that happens — the premium gap between paper and physical will explode.

Price suppression only works until delivery fails.

When that happens — the premium gap between paper and physical will explode.

🔟

Stay calm. Stack smart.

The vaults are telling you what the charts won’t.

#SilverSqueeze 🥈 #StackerLogic #China #SilverMarket #PhysicalSilver

Stay calm. Stack smart.

The vaults are telling you what the charts won’t.

#SilverSqueeze 🥈 #StackerLogic #China #SilverMarket #PhysicalSilver

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh