AI growth is exploding:

The US now has 5,426 data centers, more than ALL other major countries COMBINED.

And, there are $40 BILLION worth of US data centers under construction, up +400% since 2022.

This will soon reshape the global economy.

What's next? Let us explain.

The US now has 5,426 data centers, more than ALL other major countries COMBINED.

And, there are $40 BILLION worth of US data centers under construction, up +400% since 2022.

This will soon reshape the global economy.

What's next? Let us explain.

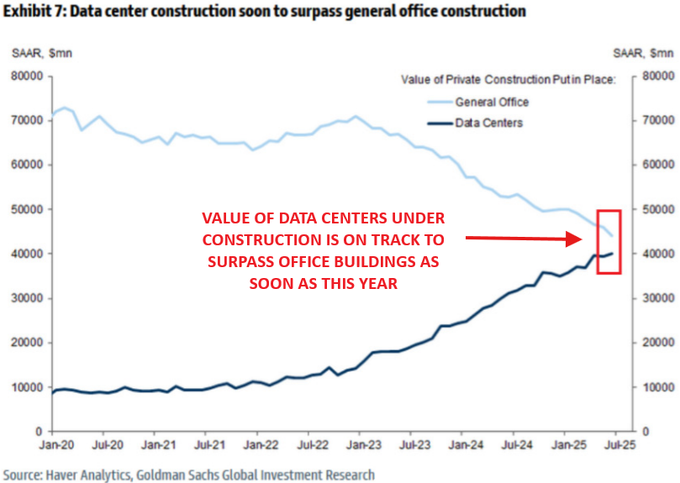

The magnitude of the data center boom became apparent in early-2024.

For the first time in history, the value of US data centers under construction will soon EXCEED office buildings.

Just 3 years ago, data centers were 1/7 the size of offices.

This is a modern-day gold rush.

For the first time in history, the value of US data centers under construction will soon EXCEED office buildings.

Just 3 years ago, data centers were 1/7 the size of offices.

This is a modern-day gold rush.

Take a look at Nov. 2022, when ChatGPT launched.

Since then, data centers under construction in the US have surged from $12 billion to $40 billion.

The craziest part is energy usage projections show we are STILL early.

This has both upstream and downstream effects.

Since then, data centers under construction in the US have surged from $12 billion to $40 billion.

The craziest part is energy usage projections show we are STILL early.

This has both upstream and downstream effects.

By 2030, US data center energy energy consumption will account for ~8.1% of US power demand.

To put this into perspective, it was 3.9% in 2023.

Morgan Stanley predicts a 36GW power shortfall in the US due to data center buildout over the next 3 years.

We need more power.

To put this into perspective, it was 3.9% in 2023.

Morgan Stanley predicts a 36GW power shortfall in the US due to data center buildout over the next 3 years.

We need more power.

But, the number of data centers can be deceiving.

China is building MUCH larger data centers, hence why they have just ~449.

Power consumption is similar, with the US at 14GW and China at 12GW.

Energy usage per person in China is the SAME as the EU, up ~350% since 2000.

China is building MUCH larger data centers, hence why they have just ~449.

Power consumption is similar, with the US at 14GW and China at 12GW.

Energy usage per person in China is the SAME as the EU, up ~350% since 2000.

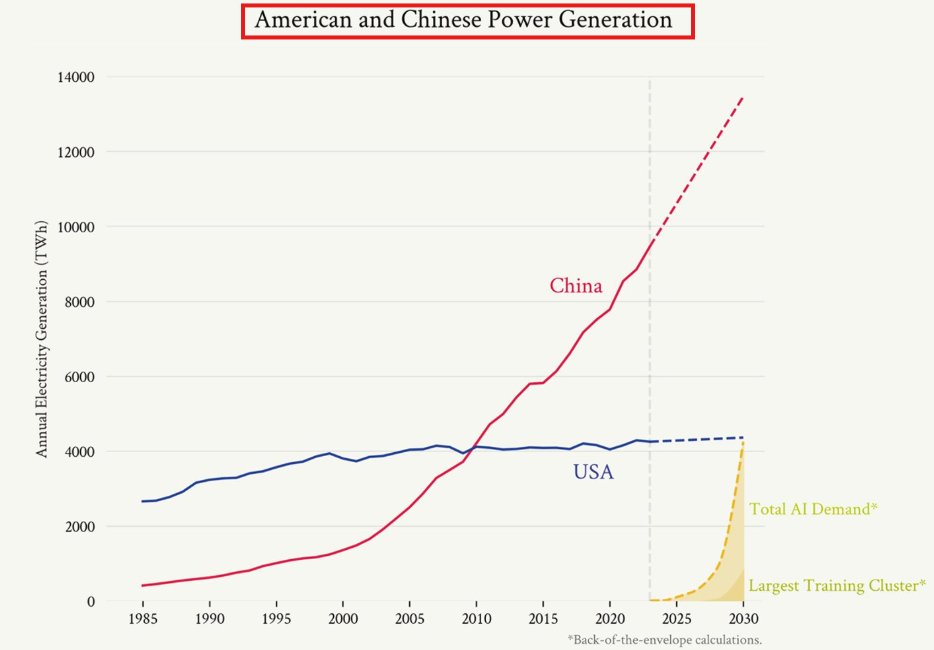

And, this is why we continue to reiterate the message:

Power will soon become the most valuable commodity in the world.

Governments will join the AI arms race and alternative sources of energy are needed.

As seen below, China is WAY ahead of the US on power generation.

Power will soon become the most valuable commodity in the world.

Governments will join the AI arms race and alternative sources of energy are needed.

As seen below, China is WAY ahead of the US on power generation.

We are already seeing the economic effects of this shift:

Since ChatGPT was released in November 2022, electricity prices in the US are up +23%.

Since 2020, electricity prices are up +40%, far outpacing the overall US inflation rate.

Demand is simply higher than supply.

Since ChatGPT was released in November 2022, electricity prices in the US are up +23%.

Since 2020, electricity prices are up +40%, far outpacing the overall US inflation rate.

Demand is simply higher than supply.

So, how will we generate all of this power?

Currently, nuclear power is believed to be the most "promising" solution.

Unlike solar or wind, nuclear plants run 24/7, matching AI’s constant energy draw.

It's also one of the most cost-effective sources of energy, at $71/MWh.

Currently, nuclear power is believed to be the most "promising" solution.

Unlike solar or wind, nuclear plants run 24/7, matching AI’s constant energy draw.

It's also one of the most cost-effective sources of energy, at $71/MWh.

But, we have a major problem.

Nuclear power plants take a long time to build, putting them 10+ years away in the US.

The US has ZERO large nuclear reactors under construction, compared to 29 in China.

The solver of this issue will become one of the world's largest companies.

Nuclear power plants take a long time to build, putting them 10+ years away in the US.

The US has ZERO large nuclear reactors under construction, compared to 29 in China.

The solver of this issue will become one of the world's largest companies.

We are often asked, "what's the next big thing?"

Everyone is focused on chip performance and advancing AI models.

Alphabet, Amazon, Meta, Microsoft, and OpenAI alone have announced $800 BILLION in commitments for new data centers in 2025.

The next big "thing" MUST be power.

Everyone is focused on chip performance and advancing AI models.

Alphabet, Amazon, Meta, Microsoft, and OpenAI alone have announced $800 BILLION in commitments for new data centers in 2025.

The next big "thing" MUST be power.

The rate of economic change is only accelerating with the rise of AI.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

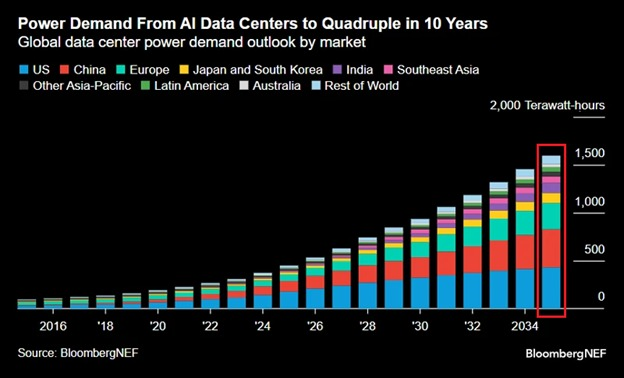

Lastly, without FAR MORE electricity, the AI Revolution simply cannot happen.

AI data centers ALONE are set to consume 1,600 TWh of power by 2035, or ~4.4% of global supply.

This next big "thing" is power.

Follow us @KobeissiLetter for real time analysis as this develops.

AI data centers ALONE are set to consume 1,600 TWh of power by 2035, or ~4.4% of global supply.

This next big "thing" is power.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh