One of the largest FinTechs in the world @RobinhoodApp is spending ETH to deploy stocks on @arbitrum, and you're bearish on Ethereum?

10k+ transactions, only ~$130 of fees.

Let's dive into the power of building on crypto rails.

(🔍/9)

10k+ transactions, only ~$130 of fees.

Let's dive into the power of building on crypto rails.

(🔍/9)

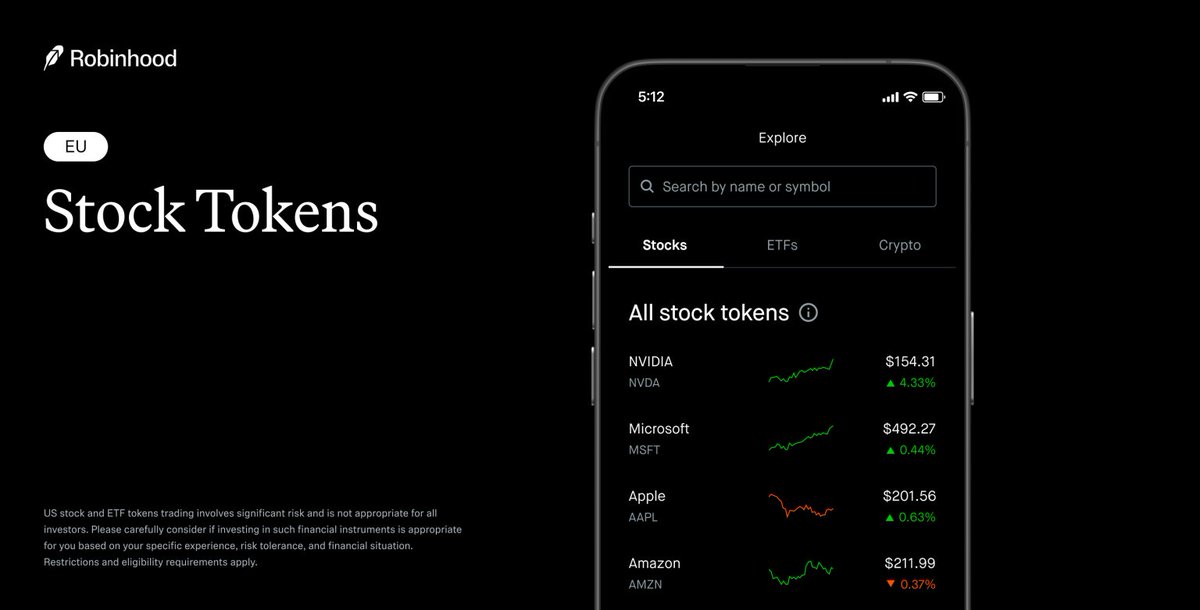

1/ What are Robinhood Stock Tokens?

Stock Tokens are tokenized contracts that follow the price of their underlying asset, recorded on a blockchain. The benefits of stock tokens include:

• Expanding US stocks and ETFs to EU investors

• Only 0.1% FX fee on each order with no additional fees from Robinhood

• Start with just €1

• 24-hour market access from Monday to Friday

• Robinhood Stock Tokens are offered under MiFID II as derivatives. The underlying assets are held securely by a US-licensed institution.

Stock Tokens are tokenized contracts that follow the price of their underlying asset, recorded on a blockchain. The benefits of stock tokens include:

• Expanding US stocks and ETFs to EU investors

• Only 0.1% FX fee on each order with no additional fees from Robinhood

• Start with just €1

• 24-hour market access from Monday to Friday

• Robinhood Stock Tokens are offered under MiFID II as derivatives. The underlying assets are held securely by a US-licensed institution.

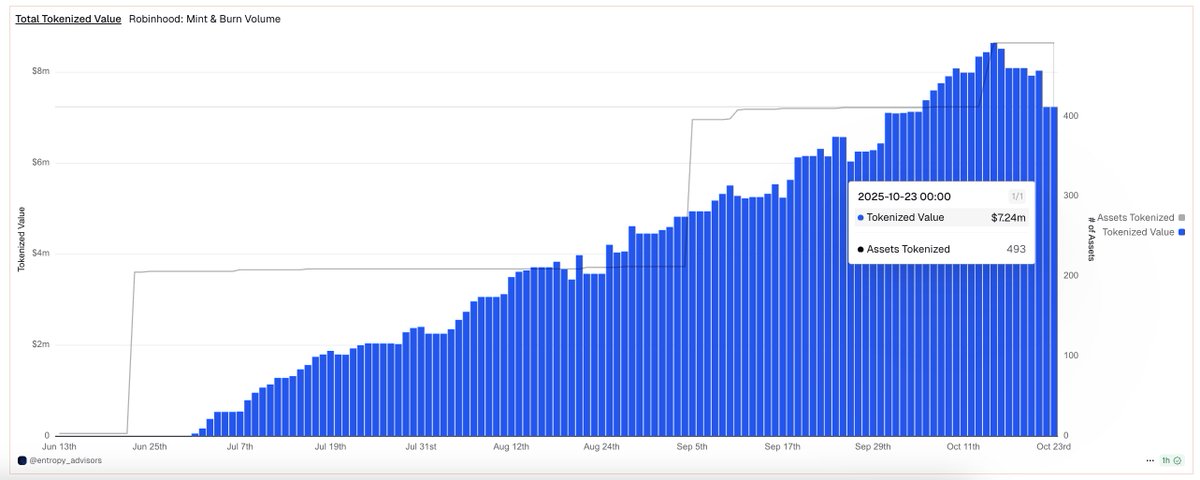

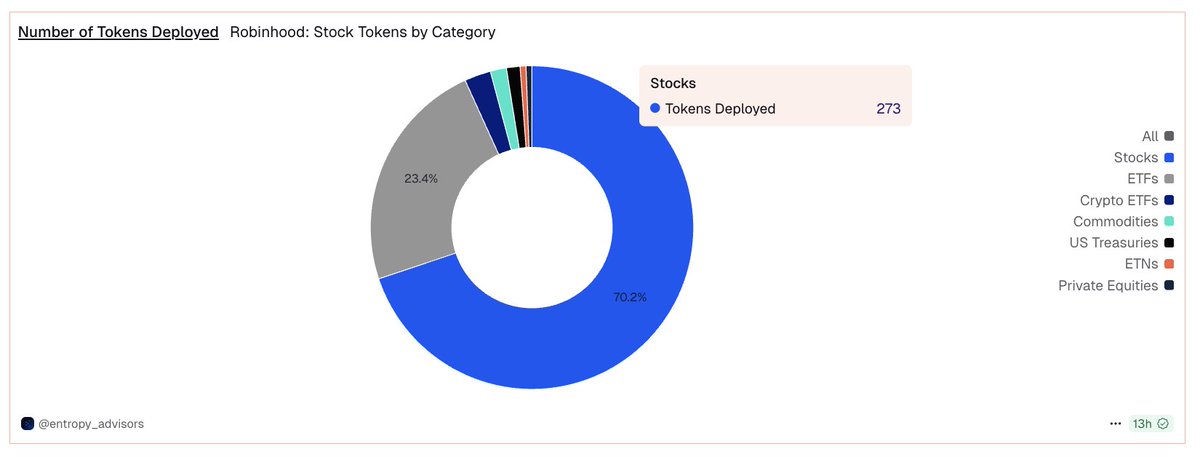

2/ Close to 500 Stocks, ETFs, and Commodities have been tokenized on Arbitrum.

Thanks to tokenization, Robinhood EU users can now access TSLA, VOO, HOOD, BMNR, QQQ, etc. via Robinhood Stock Tokens.

Thanks to tokenization, Robinhood EU users can now access TSLA, VOO, HOOD, BMNR, QQQ, etc. via Robinhood Stock Tokens.

3/ The most popular types of assets for tokenization are stocks (70%) and ETFs (23.4%).

Top Tokenized Stocks & ETFs by Tokenized Value:

1. Alphabet Class A: GOOGL ($769k)

2. BitMine: BMNR ($413k)

3. Vanguard S&P 500 ETF: VOO ($383k)

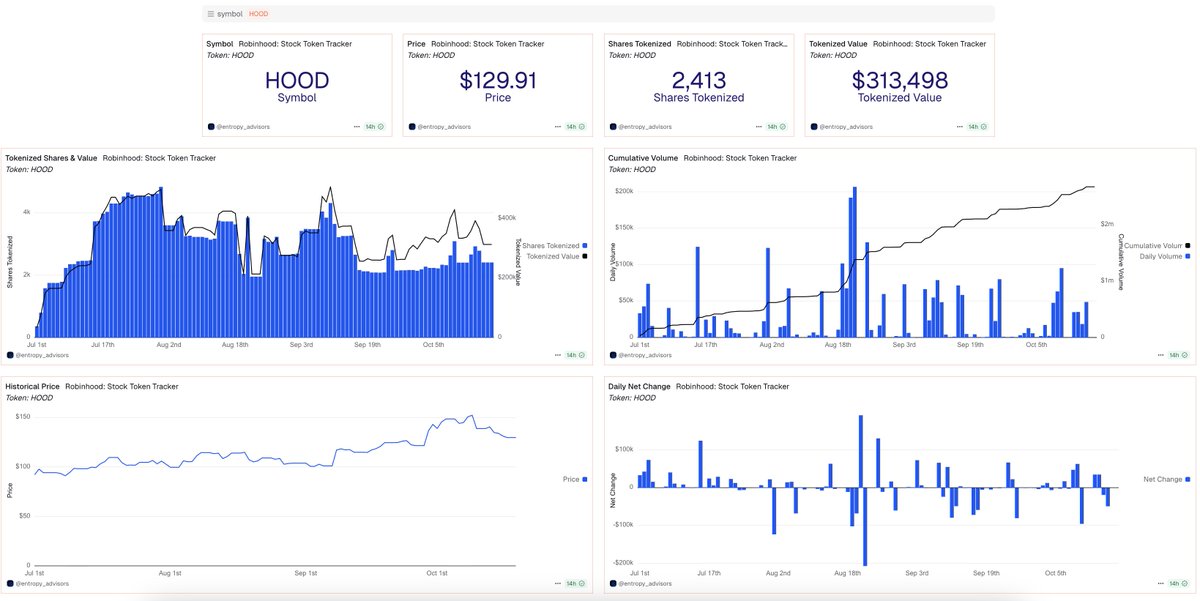

4. Robinhood: HOOD ($313k)

5. Tesla: TSLA ($278k)

Top Tokenized Stocks & ETFs by Tokenized Value:

1. Alphabet Class A: GOOGL ($769k)

2. BitMine: BMNR ($413k)

3. Vanguard S&P 500 ETF: VOO ($383k)

4. Robinhood: HOOD ($313k)

5. Tesla: TSLA ($278k)

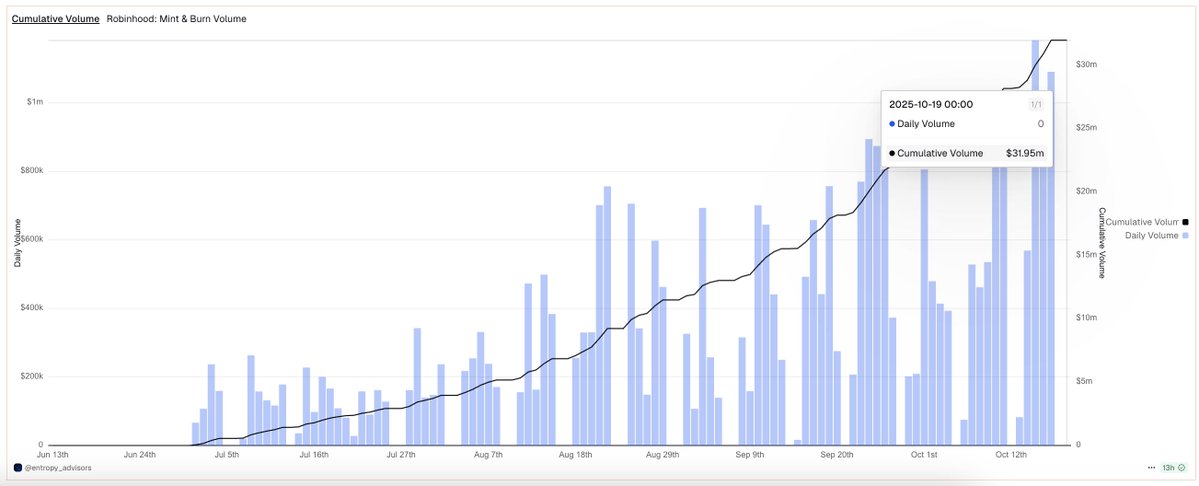

4/ Since launch, Robinhood Stock Tokens have generated $32M in Minting and Burning Volume.

It is important to note that the mint and burn volume does not equal the trading volume. Trading activities of the stock tokens happen off-chain within Robinhood, for now.

It is important to note that the mint and burn volume does not equal the trading volume. Trading activities of the stock tokens happen off-chain within Robinhood, for now.

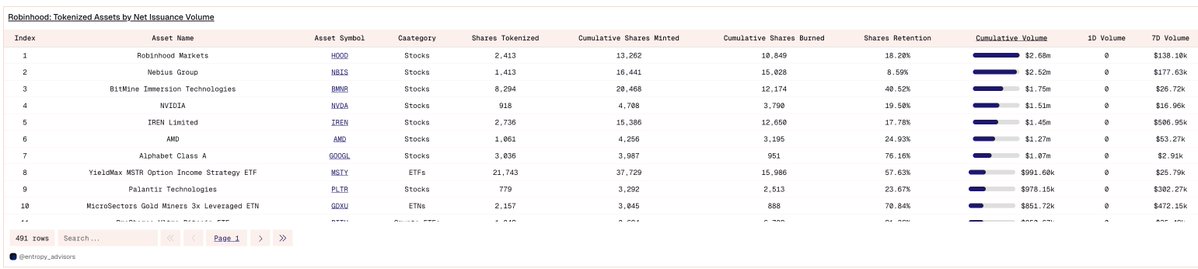

5/ The token with the highest mint and burn volume is Robinhood's own stock, HOOD, with a volume of $2.6M.

Most tokens with the highest cumulative mint and burn volume are stocks. Besides HOOD, other tokens in the top 10 by mint & burn volume include NBIS, BMNR, NVDA, IREN, and AMD.

Most tokens with the highest cumulative mint and burn volume are stocks. Besides HOOD, other tokens in the top 10 by mint & burn volume include NBIS, BMNR, NVDA, IREN, and AMD.

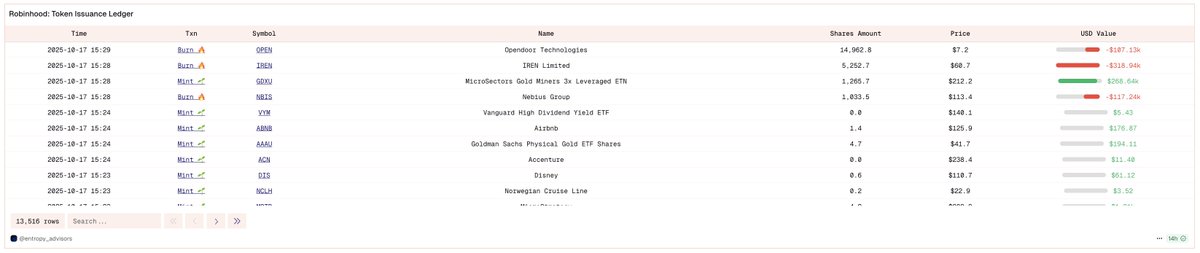

6/ With gold prices surging to a record high of $4,200, the GDXU, a Gold 3X leveraged ETN stock token, recorded a minting volume of $268k on October 17.

Users of the dashboard can leverage this table to navigate the historical mints and burns of all the Robinhood Stock Tokens.

Users of the dashboard can leverage this table to navigate the historical mints and burns of all the Robinhood Stock Tokens.

7/ Users can explore a variety of stock tokens, including stocks, ETFs, ETNs, private equities, and crypto ETFs, around 500 tokens all in one place.

You can access the following data for the stock tokens:

• Tokenized shares and their value

• Historical price

• Cumulative volume

• Daily net change

You can access the following data for the stock tokens:

• Tokenized shares and their value

• Historical price

• Cumulative volume

• Daily net change

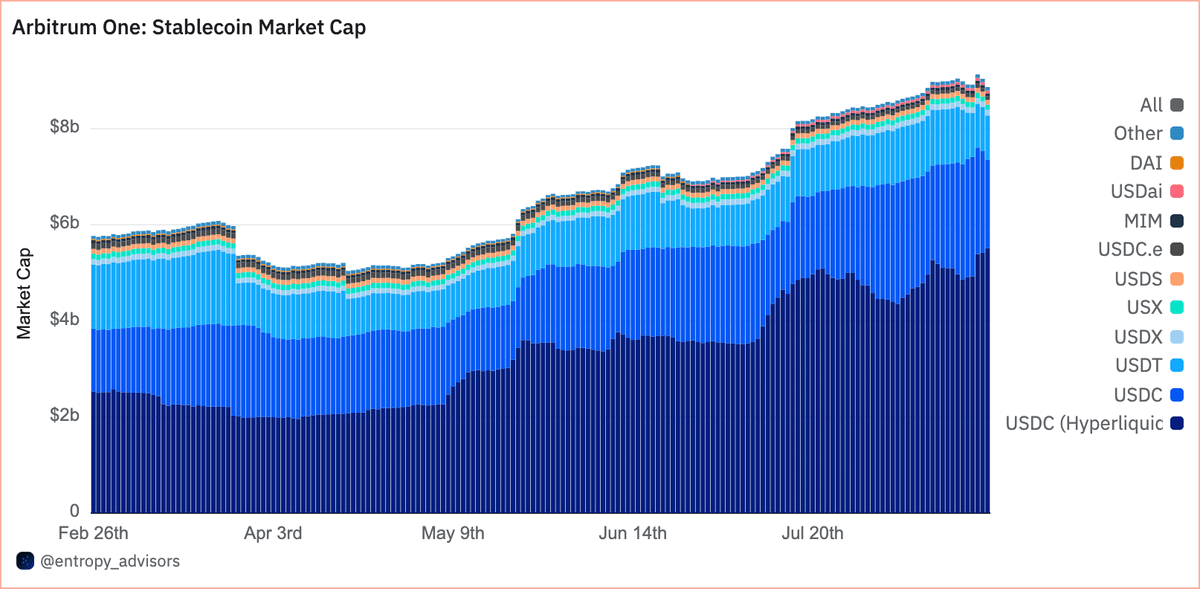

8/ Why is Arbitrum the place for Tokenization?

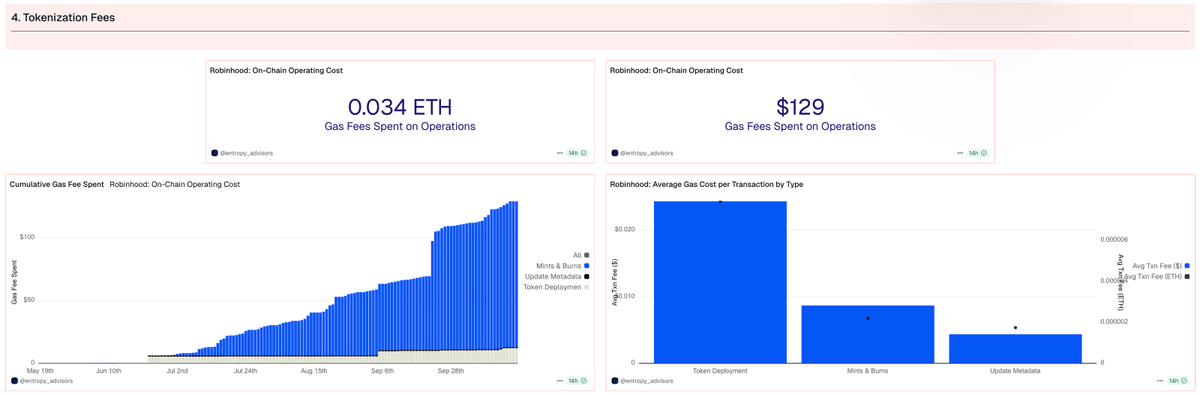

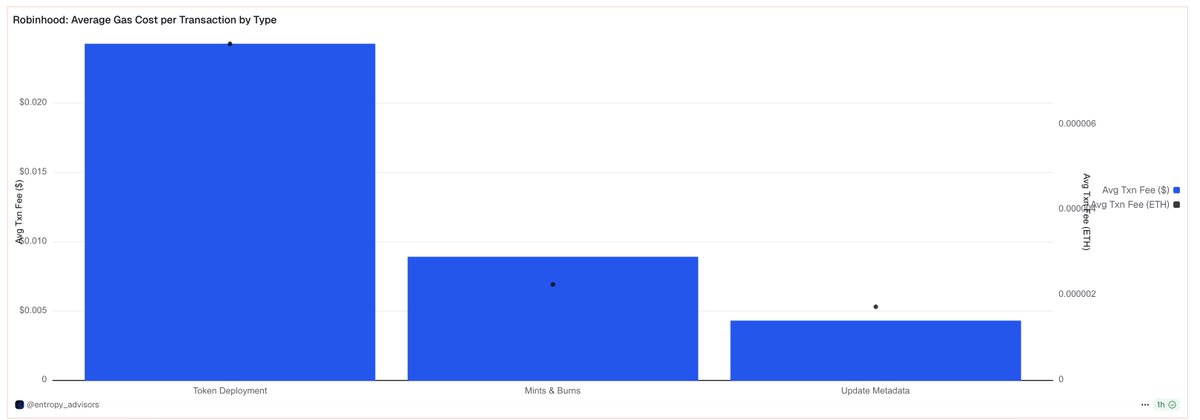

Despite tokenizing close to 500 stock tokens on Arbitrum, Robinhood only spent ~$129 in gas fees on on-chain operations.

Most fees have been spent on token mints and burns. On average, it only costs $0.0087 for every mint and burn transaction.

Despite tokenizing close to 500 stock tokens on Arbitrum, Robinhood only spent ~$129 in gas fees on on-chain operations.

Most fees have been spent on token mints and burns. On average, it only costs $0.0087 for every mint and burn transaction.

9/ Robinhood's ambition for tokenization extends beyond Stock Tokens. The Robinhood Chain is in development, utilizing Arbitrum's Orbit Stack. This will serve as a permissionless layer-2 on Ethereum, optimized for tokenized assets.

Stay Tuned!

Stay Tuned!

We hope you enjoy the data and analysis! Should you have more questions, feel free to reach out to @tomwanhh.

Access the Full dashboard with the link below:

dune.com/entropy_adviso…

Access the Full dashboard with the link below:

dune.com/entropy_adviso…

• • •

Missing some Tweet in this thread? You can try to

force a refresh