How to get URL link on X (Twitter) App

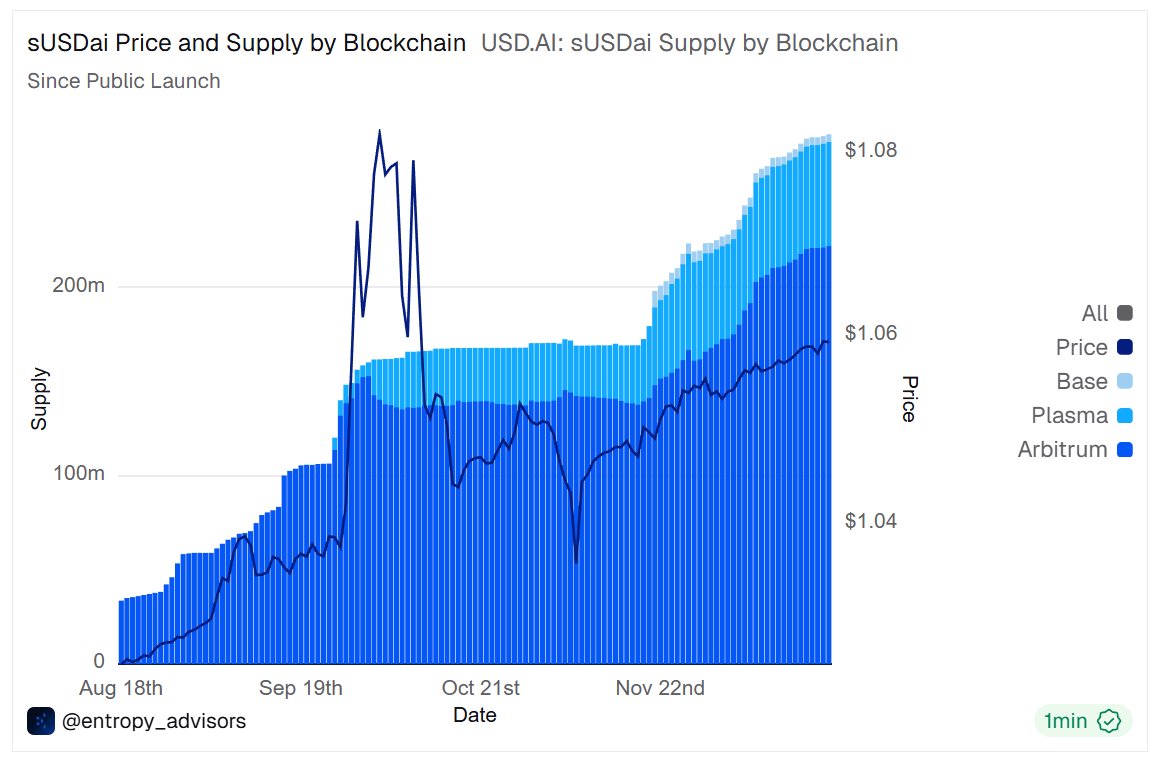

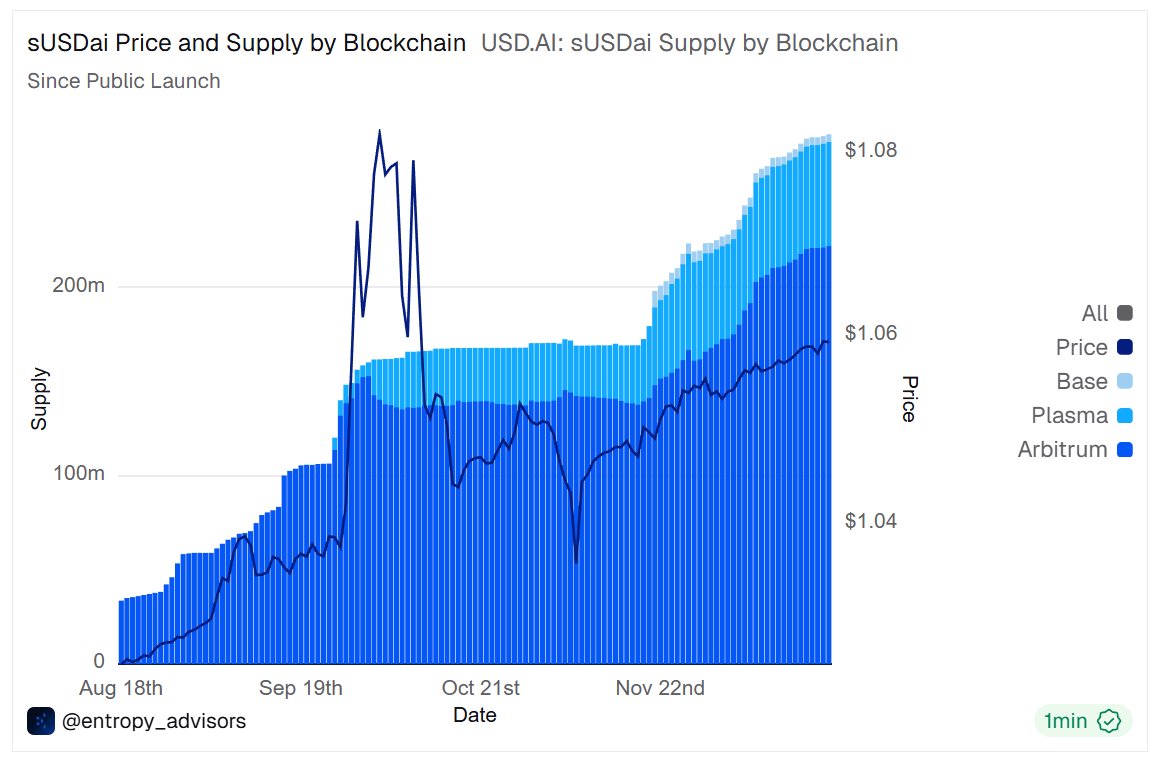

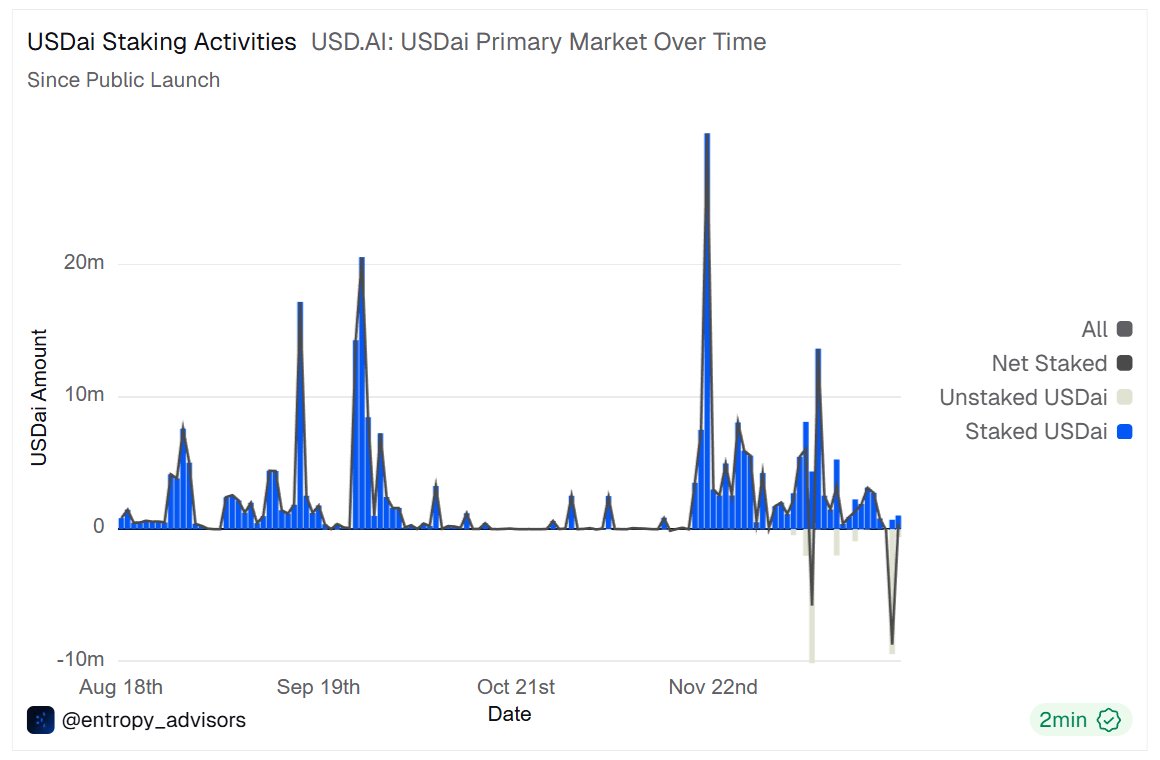

1/ Staking activity surged following the addition of Base and a $250M cap increase for USDai, announced at Devconnect in late November.

1/ Staking activity surged following the addition of Base and a $250M cap increase for USDai, announced at Devconnect in late November.

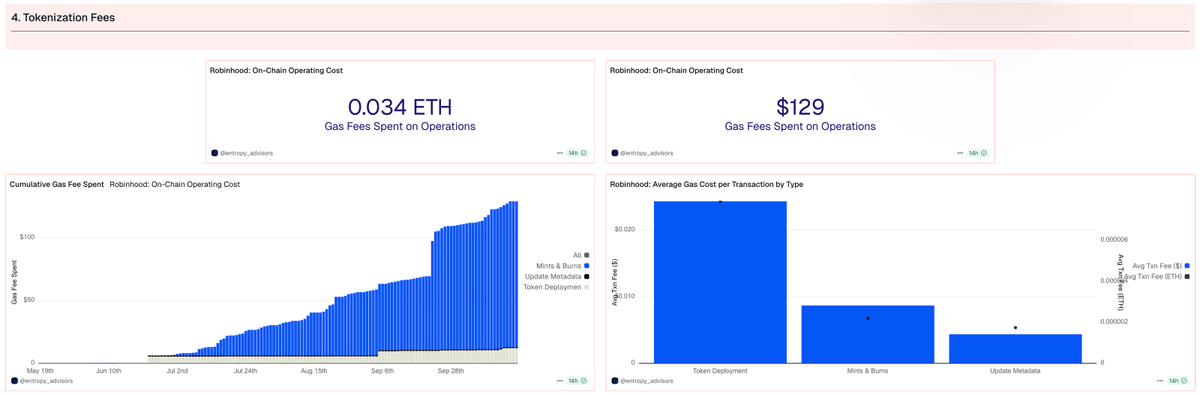

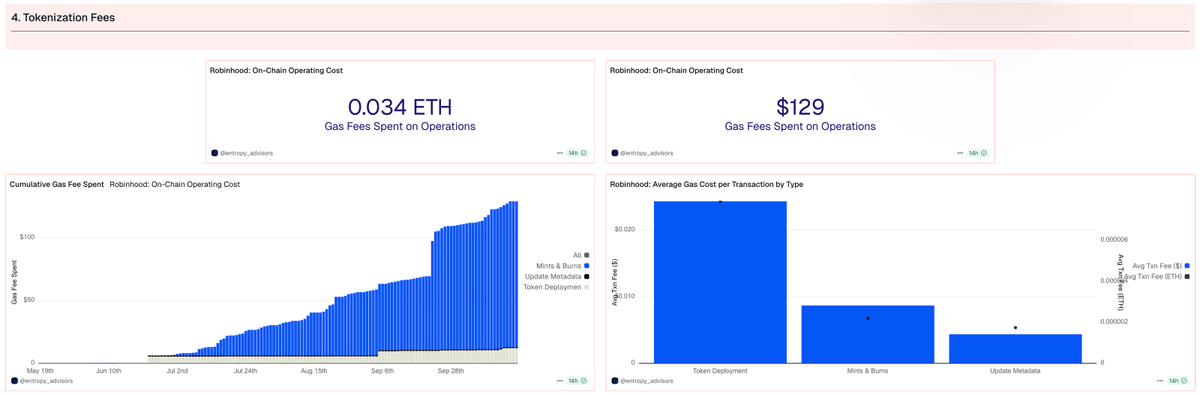

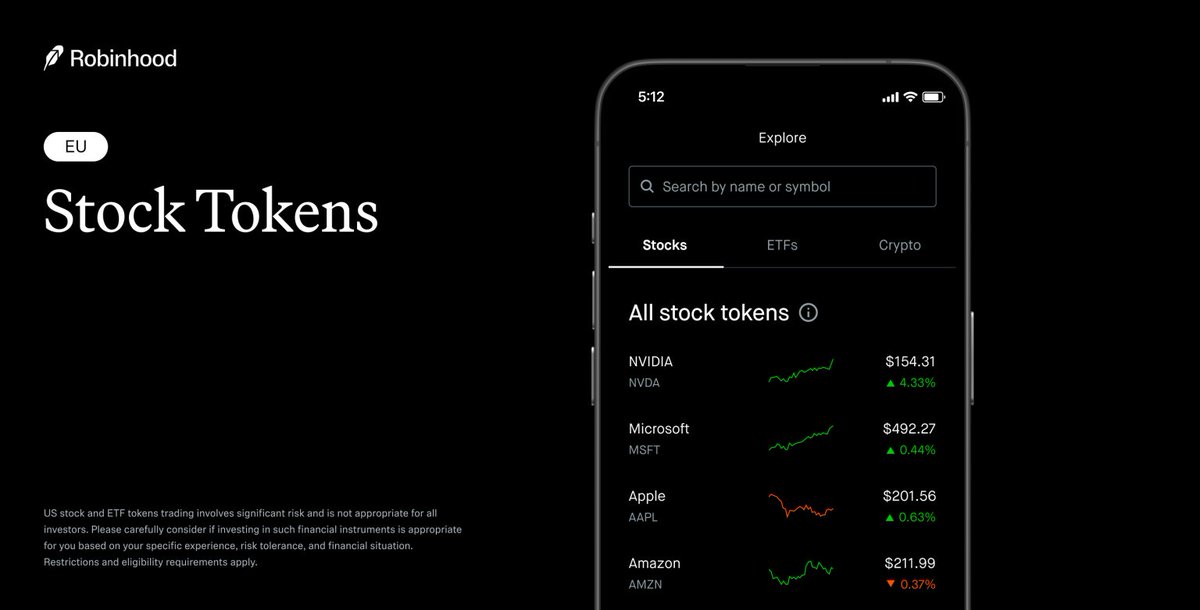

1/ What are Robinhood Stock Tokens?

1/ What are Robinhood Stock Tokens?

@Dune 1/ The first of three sections is Total Assets.

@Dune 1/ The first of three sections is Total Assets.

@Dune 1/ How does governance work in Arbitrum DAO?

@Dune 1/ How does governance work in Arbitrum DAO?

1/ Why is a fee switch needed?

1/ Why is a fee switch needed?

1/ The saga started when Security researcher Tay highlighted that addresses linked to the notorious North Korean hacker group have been interacting with Hyperliquid

1/ The saga started when Security researcher Tay highlighted that addresses linked to the notorious North Korean hacker group have been interacting with Hyperliquidhttps://x.com/tayvano_/status/1870960207842701358