🧵 “THE €1.50 ILLUSION – HOW THE SYSTEM HIDES SILVER’S TRUE VALUE” 🥈

1️⃣

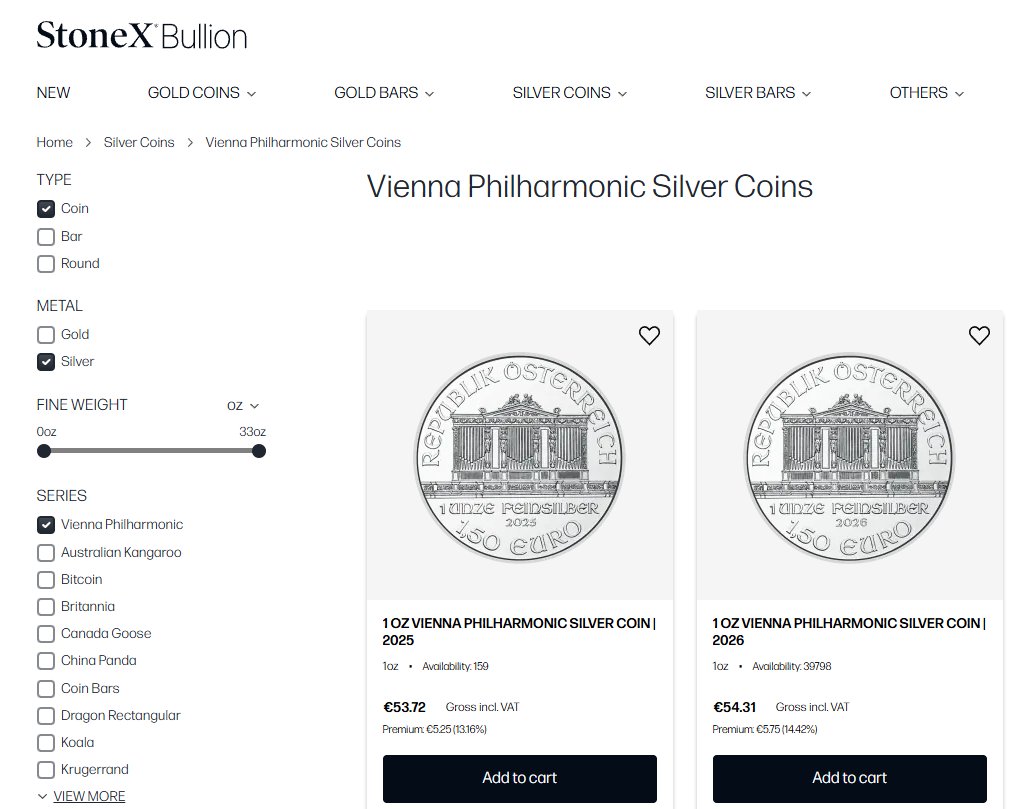

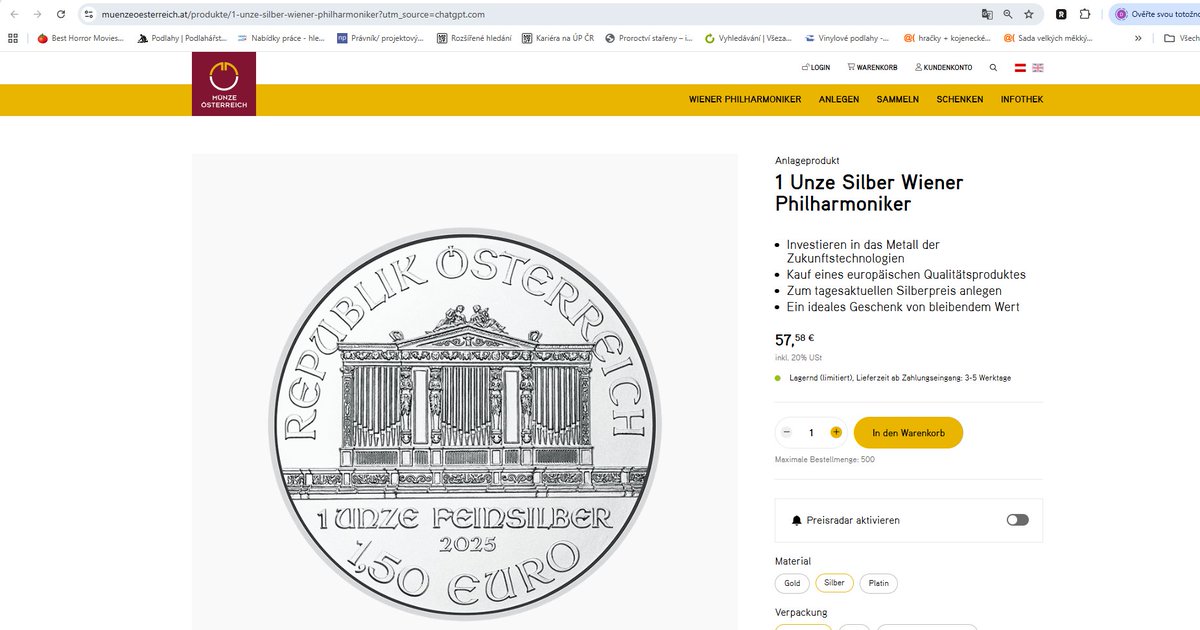

Take a close look at your Austrian Silver Philharmonic.

See that inscription? “1,50 Euro.”

That’s not a typo.

It’s a psychological trick.

1️⃣

Take a close look at your Austrian Silver Philharmonic.

See that inscription? “1,50 Euro.”

That’s not a typo.

It’s a psychological trick.

2️⃣

The face value is €1.50.

The real price today? Around €55–60 across Europe.

That’s a 40× difference.

And most people never question why.

The face value is €1.50.

The real price today? Around €55–60 across Europe.

That’s a 40× difference.

And most people never question why.

3️⃣

This is how the system hides real money in plain sight.

They mint silver as “legal tender,” then assign it a joke value so small it looks irrelevant.

This is how the system hides real money in plain sight.

They mint silver as “legal tender,” then assign it a joke value so small it looks irrelevant.

4️⃣

To the untrained eye, it’s “just a coin.”

To the educated stacker, it’s a quiet act of rebellion.

You’re holding something that can’t be printed.

To the untrained eye, it’s “just a coin.”

To the educated stacker, it’s a quiet act of rebellion.

You’re holding something that can’t be printed.

5️⃣

Even customs officers often treat these as coins,

not bullion — because legally, that’s what they are.

In some cases, they’re even taxed differently.

It’s a legal gray zone… one that works in your favor.

Even customs officers often treat these as coins,

not bullion — because legally, that’s what they are.

In some cases, they’re even taxed differently.

It’s a legal gray zone… one that works in your favor.

6️⃣

So let’s get this straight:

The state prints fiat out of thin air.

Then stamps €1.50 on an ounce of real money —

and calls it “equal value.” 🤡

So let’s get this straight:

The state prints fiat out of thin air.

Then stamps €1.50 on an ounce of real money —

and calls it “equal value.” 🤡

7️⃣

Try paying with that €1.50 coin in a shop.

You’ll be laughed out the door.

But melt it down — and you’ve got over €50 of pure value.

Welcome to the illusion economy.

Try paying with that €1.50 coin in a shop.

You’ll be laughed out the door.

But melt it down — and you’ve got over €50 of pure value.

Welcome to the illusion economy.

8️⃣

This isn’t a design choice.

It’s narrative control.

As long as people think “silver = €1.50,”

they’ll never realize what real money looks like.

This isn’t a design choice.

It’s narrative control.

As long as people think “silver = €1.50,”

they’ll never realize what real money looks like.

9️⃣

History remembers truth.

Laws remember control.

Stackers remember value. 🥈

#Silver #SilverStackers #SilverSqueeze #StackerLogic #SoundMoney #MonetaryIllusion

History remembers truth.

Laws remember control.

Stackers remember value. 🥈

#Silver #SilverStackers #SilverSqueeze #StackerLogic #SoundMoney #MonetaryIllusion

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh